Fill and Sign Alabama Legal Forms

Documents:

2822

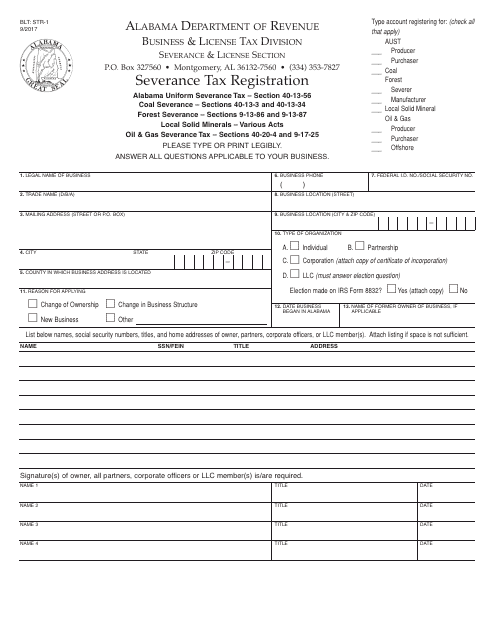

This Form is used for registering for severance tax in the state of Alabama. It is required for individuals and businesses engaged in extracting natural resources such as oil, gas, and minerals.

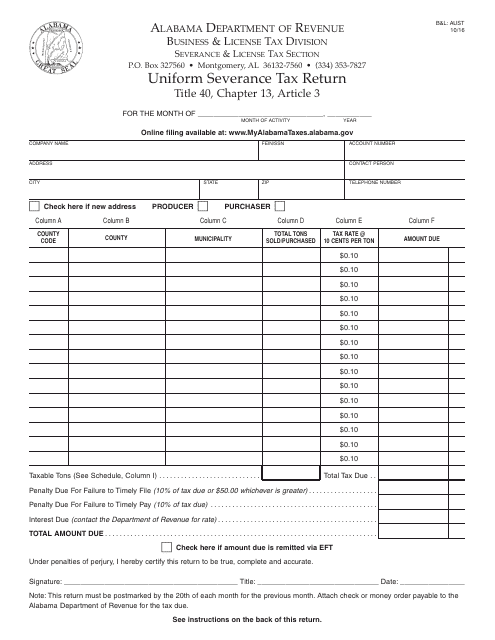

This form is used for filing the uniform severance tax return in the state of Alabama. It is necessary for businesses operating in the state to report and pay their severance taxes using this form.

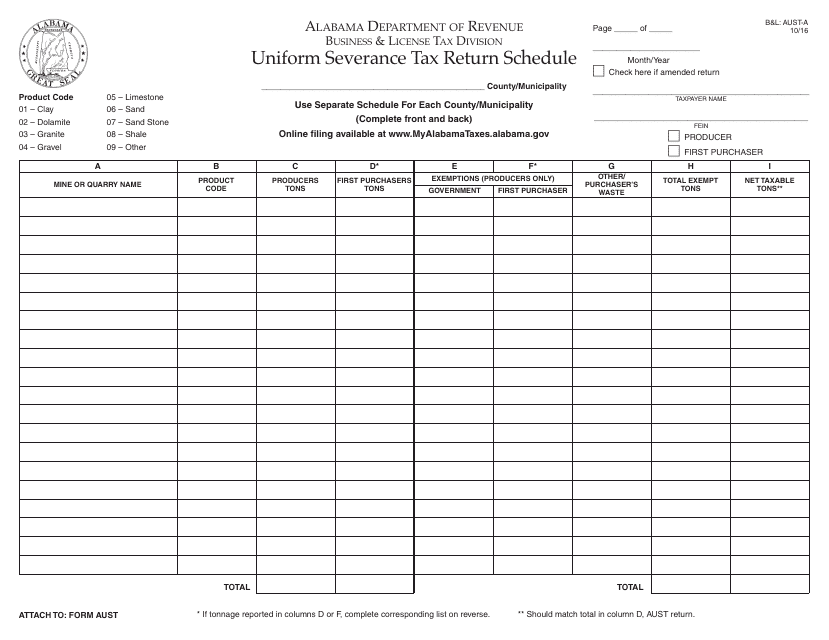

This form is used for reporting and paying the uniform severance tax in the state of Alabama.

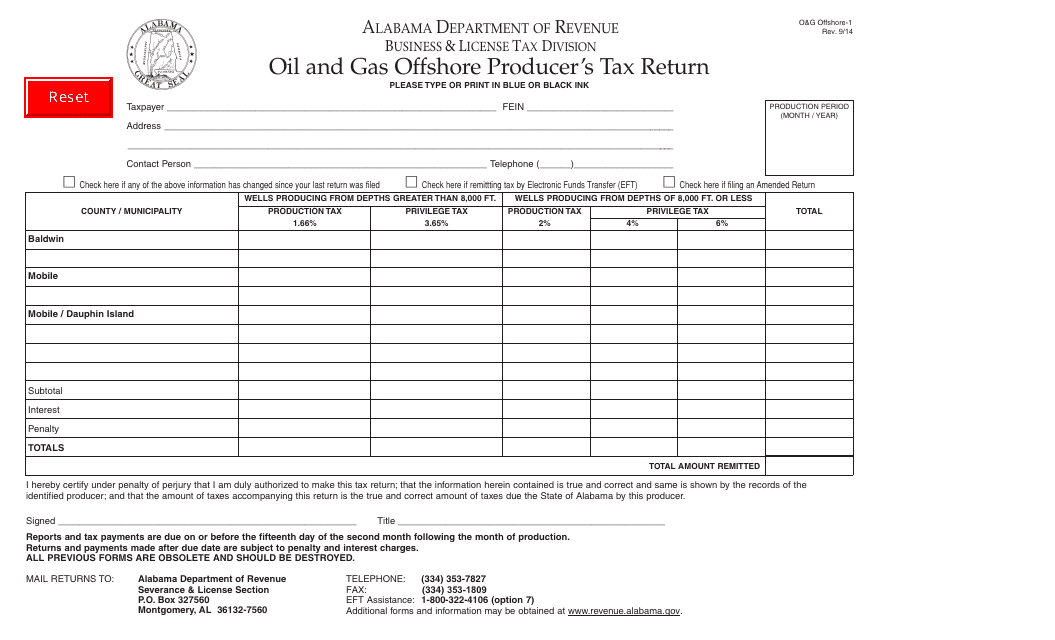

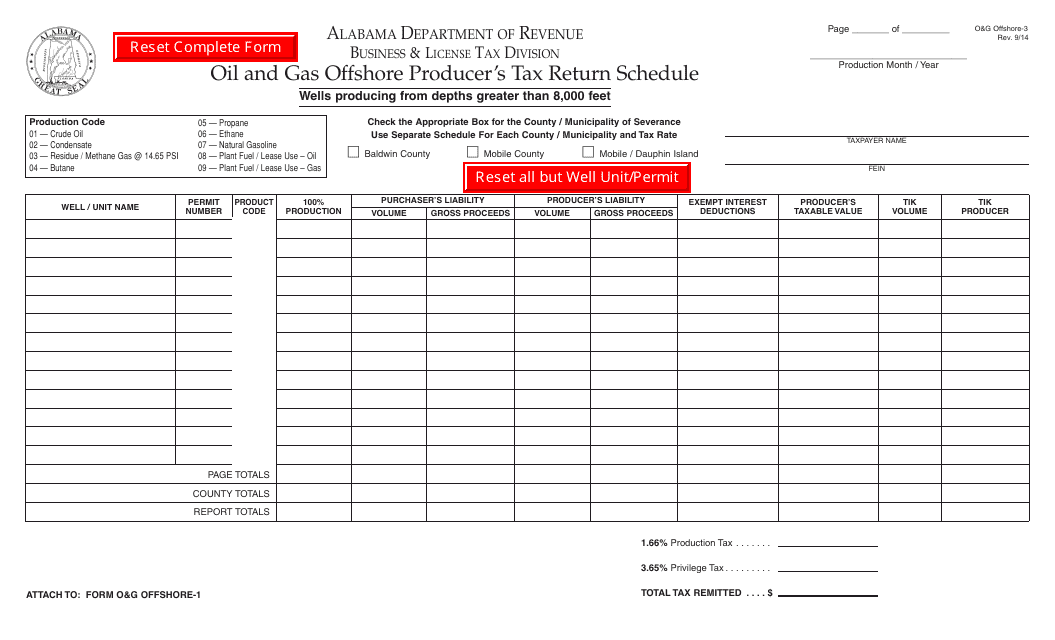

This form is used for filing the oil and gas offshore producer's tax return in Alabama.

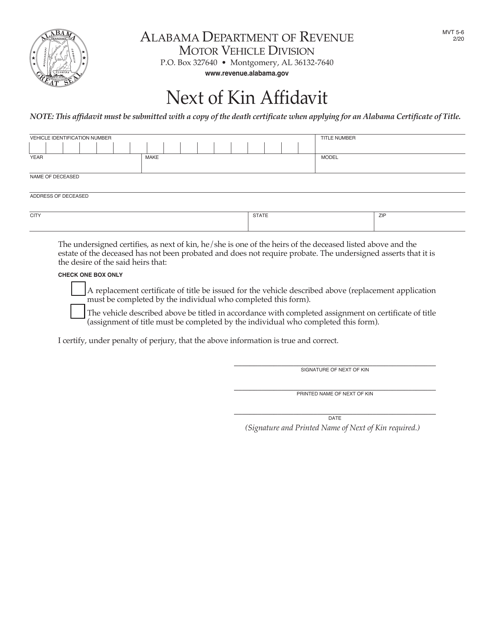

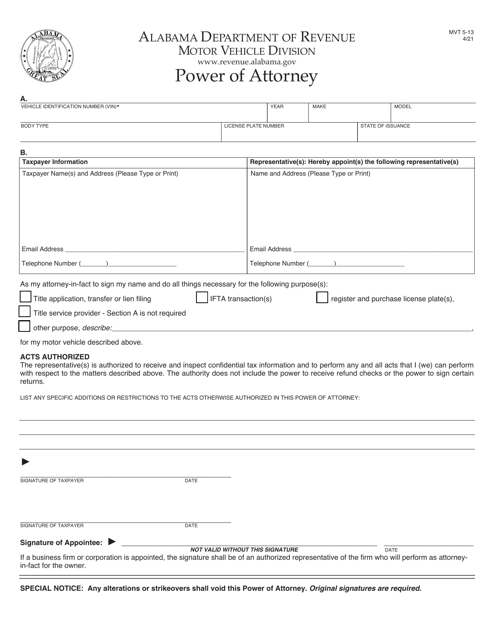

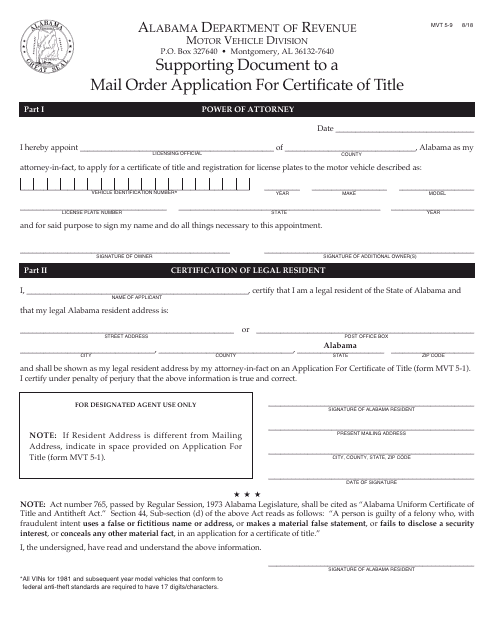

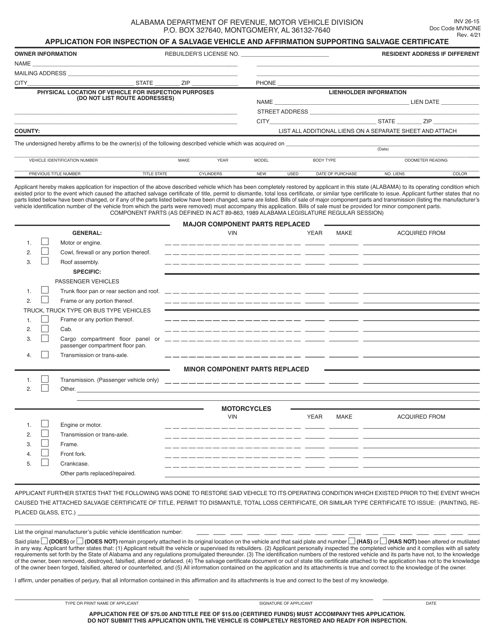

This form is used as a supporting document for a mail order application for a certificate of title in Alabama. It is necessary to complete the application process.

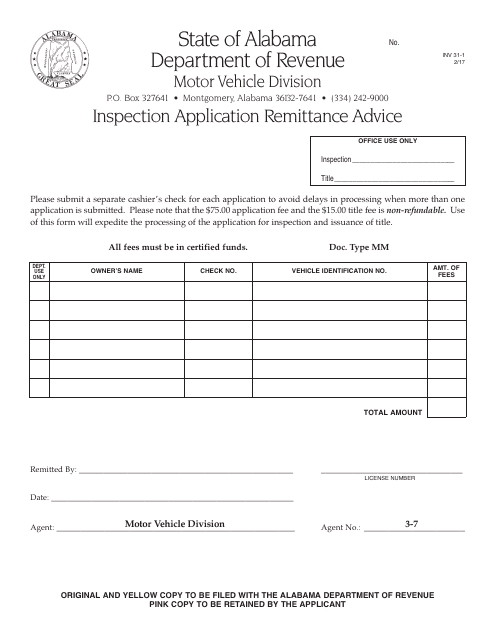

This form is used for submitting an inspection application and remittance advice in the state of Alabama. It is a required document for those seeking to schedule an inspection and provide payment for the service.

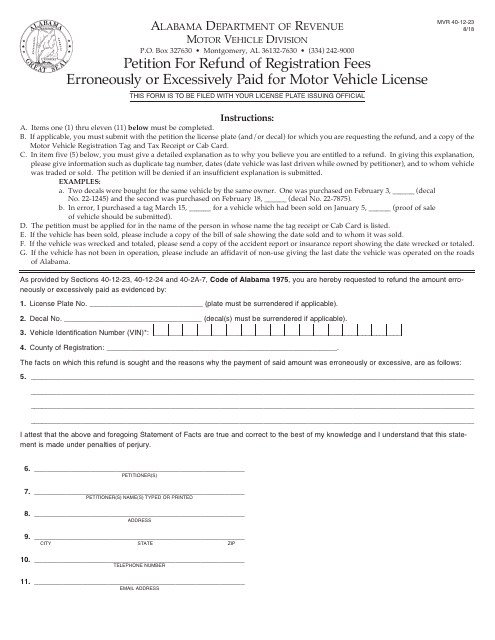

This form is used for requesting a refund of registration fees paid in error or in excess for a motor vehicle license in Alabama.

This form is used for reporting and paying taxes by oil and gas producers operating offshore in Alabama. It is specifically for the O&G OFFSHORE-3 schedule of the Oil and Gas Offshore Producer's Tax Return.

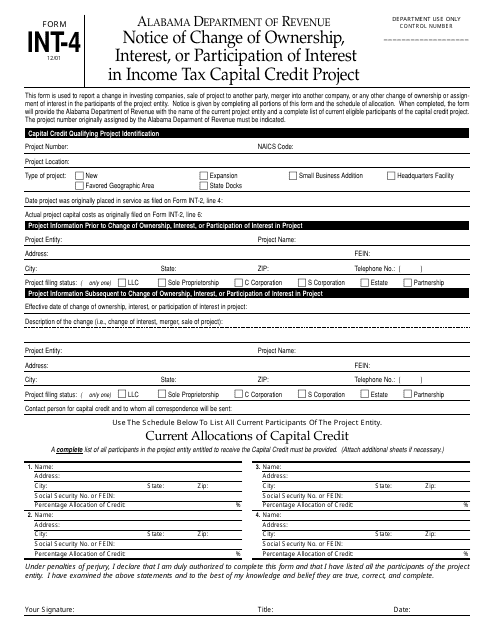

This form is used for informing the Alabama Department of Revenue about any change in ownership, interest, or participation of interest in an income tax capital credit project in Alabama.

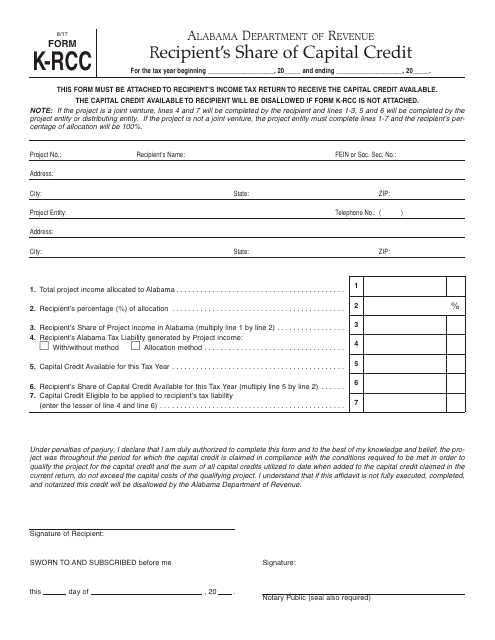

This Form is used for Alabama residents to report their share of capital credit as a recipient.

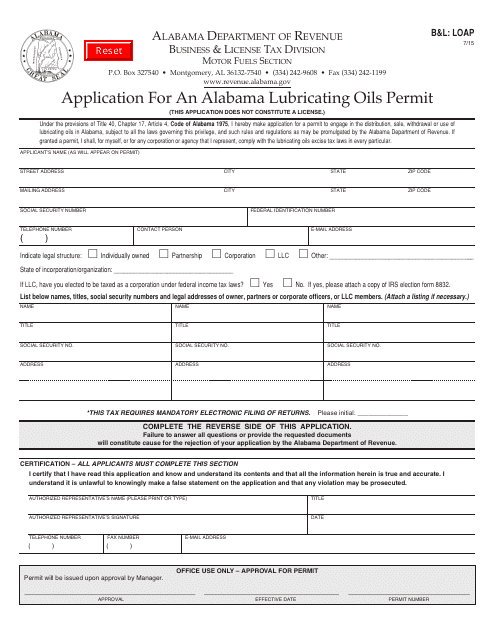

This Form is used for applying for a Lubricating Oils Permit in the state of Alabama.

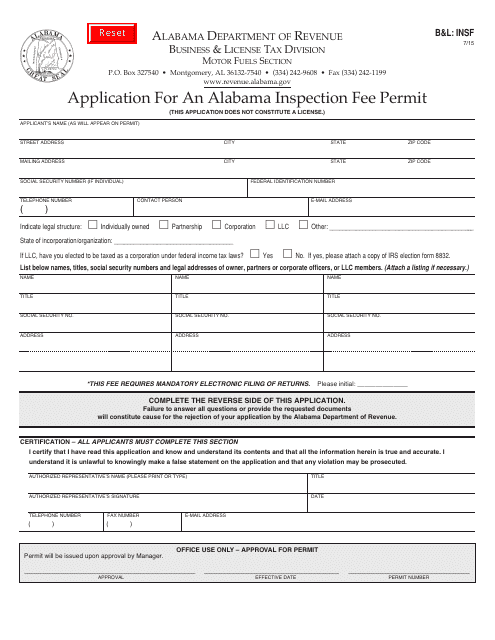

This document is used for applying for an Alabama Inspection Fee Permit in Alabama.

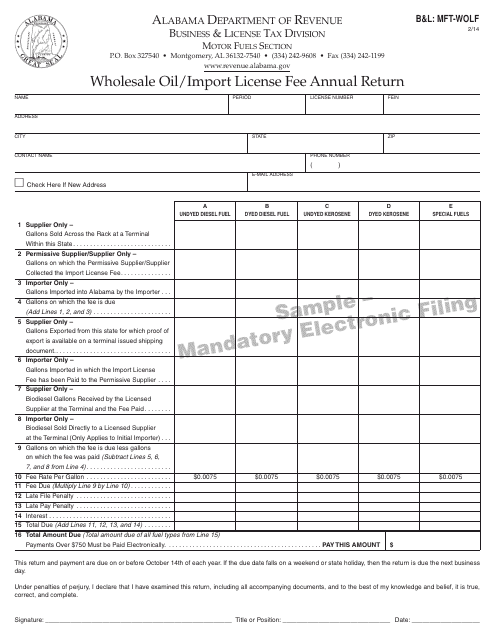

This form is used for filing the annual return and paying the license fee for wholesale oil/import in Alabama.

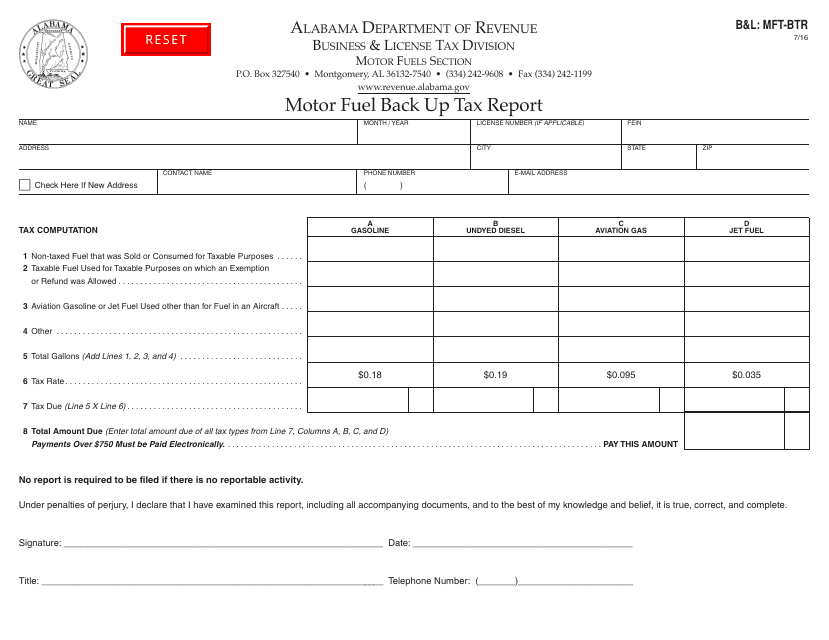

This form is used for reporting and calculating the motor fuel back up tax in Alabama. It is specifically designed for businesses in the motor fuel industry.

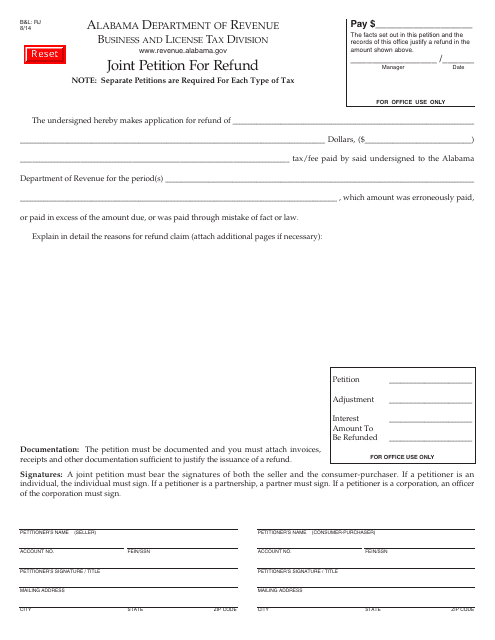

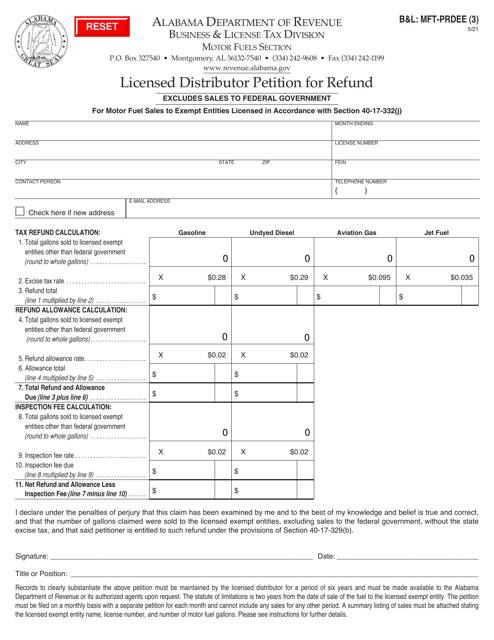

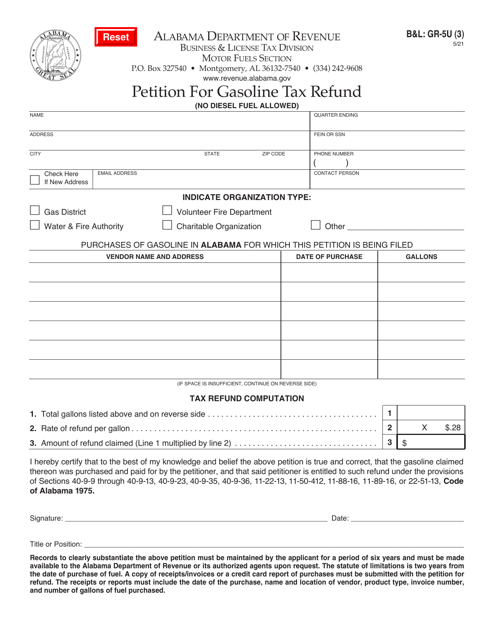

This form is used for submitting a joint petition for a refund in the state of Alabama. It is specific to residents of Alabama who are seeking a refund, and it must be completed and submitted according to the instructions provided.

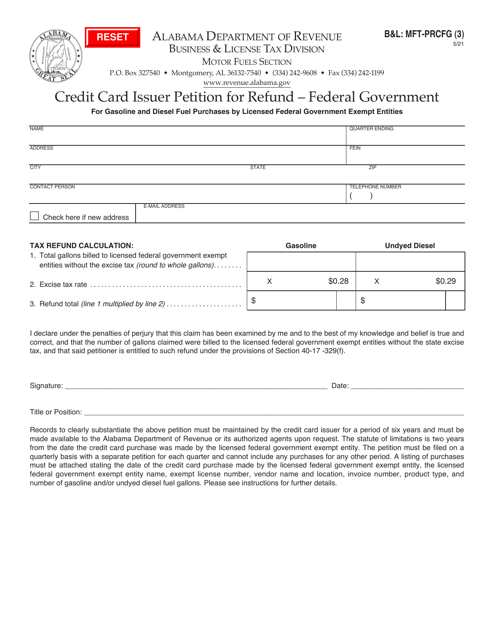

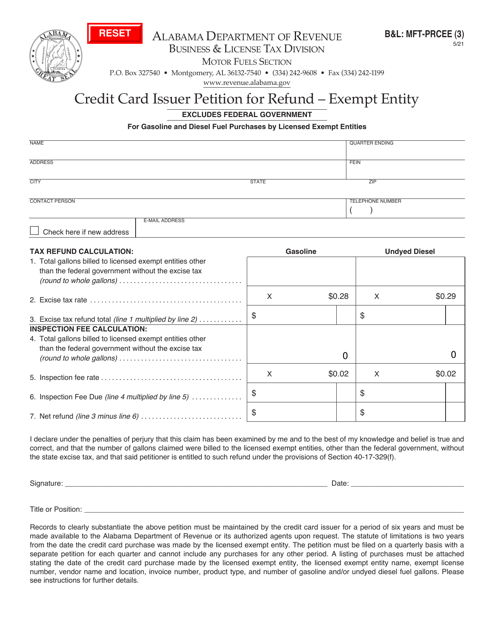

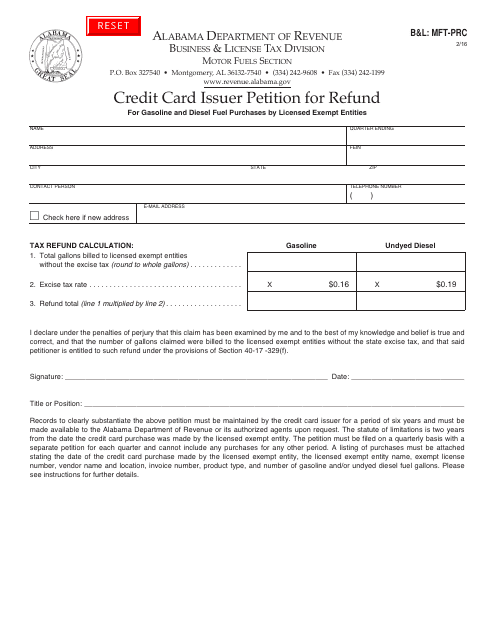

This Form is used for requesting a refund from a credit card issuer in Alabama for a B&L issued card.

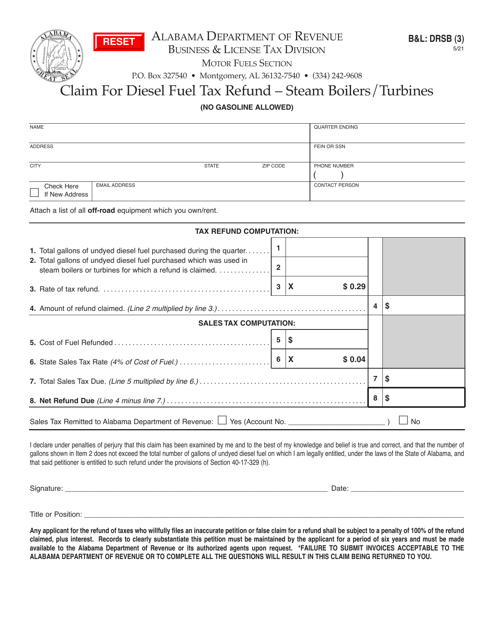

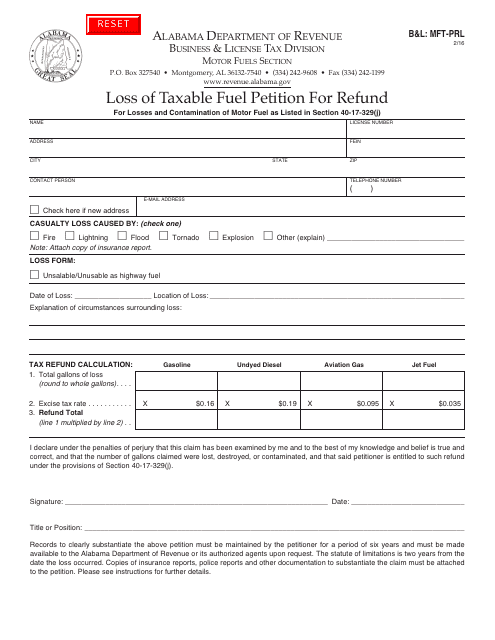

This Form is used for filing a petition for refund of taxable fuel lost in Alabama. It is specifically for taxpayers who have experienced a loss of taxable fuel and are seeking a refund.

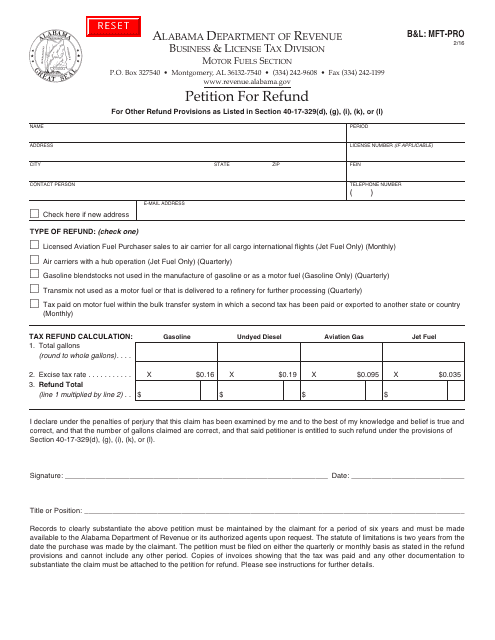

This form is used for filing a petition for refund in Alabama for the MFT-PRO tax.

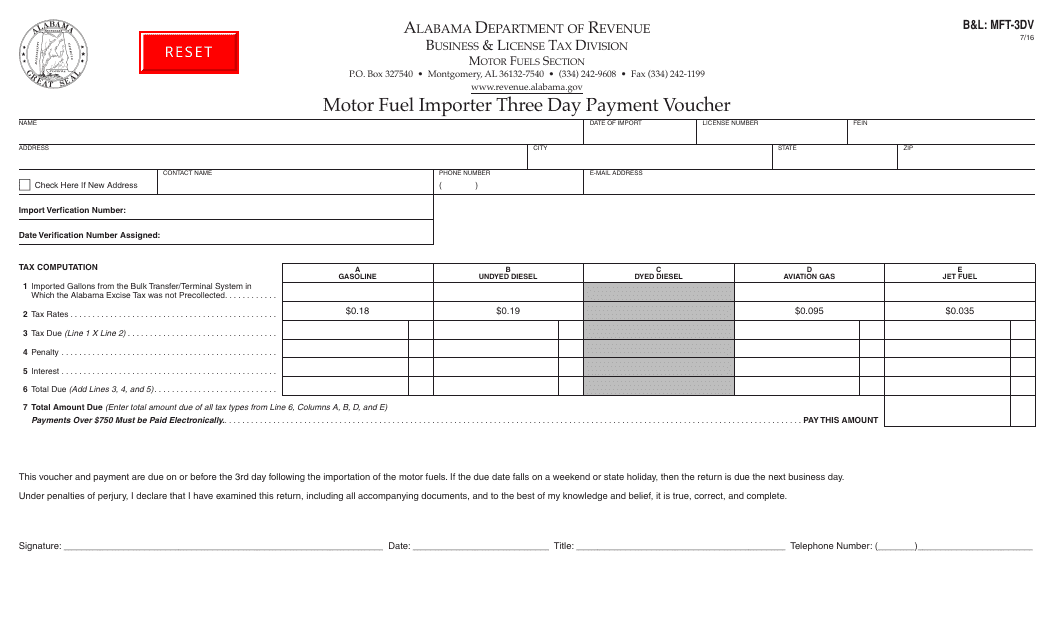

This form is used for motor fuel importers in Alabama to make a three-day payment.