Fill and Sign Florida Legal Forms

Documents:

6039

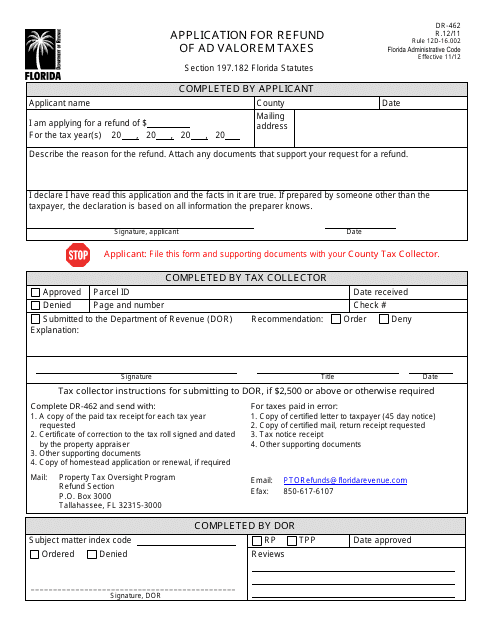

This Form is used for applying for a refund of ad valorem taxes in the state of Florida.

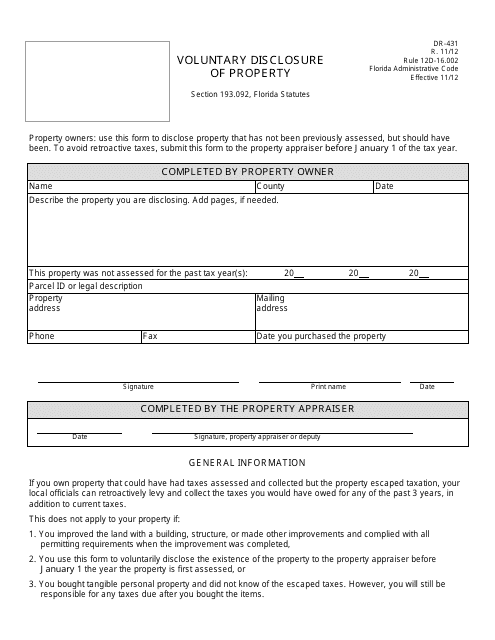

This form is used for voluntary disclosure of property in the state of Florida. It allows individuals to disclose any previously unreported property to the state and avoid potential penalties or legal consequences.

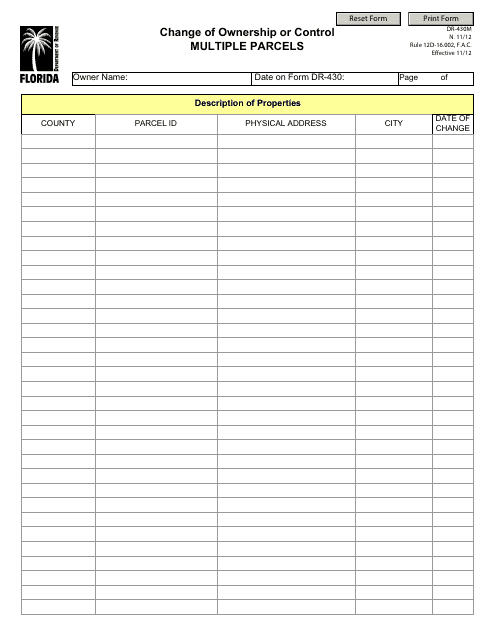

This form is used for reporting a change in ownership or control of multiple parcels in Florida.

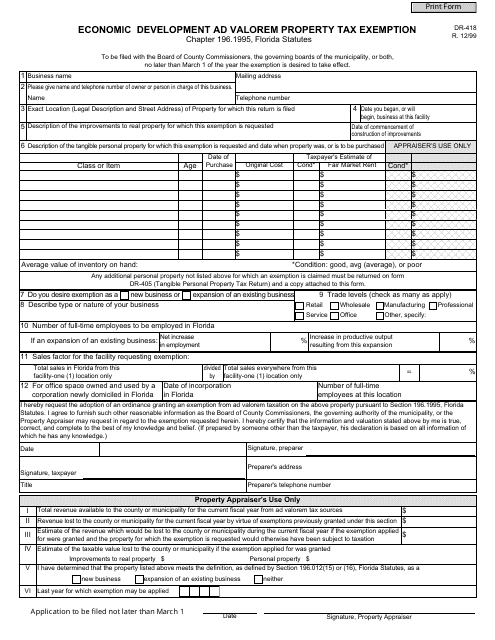

This form is used for applying for an economic development ad valorem property tax exemption in the state of Florida.

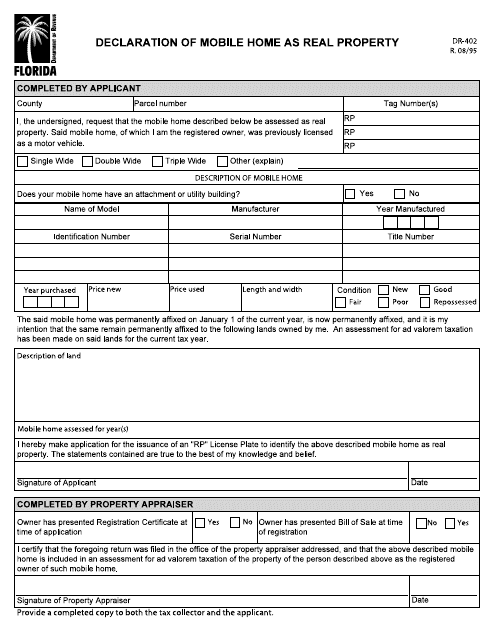

This Form is used for declaring a mobile home as real property in the state of Florida. It is important for mobile home owners to complete this form in order to establish legal ownership and property value.

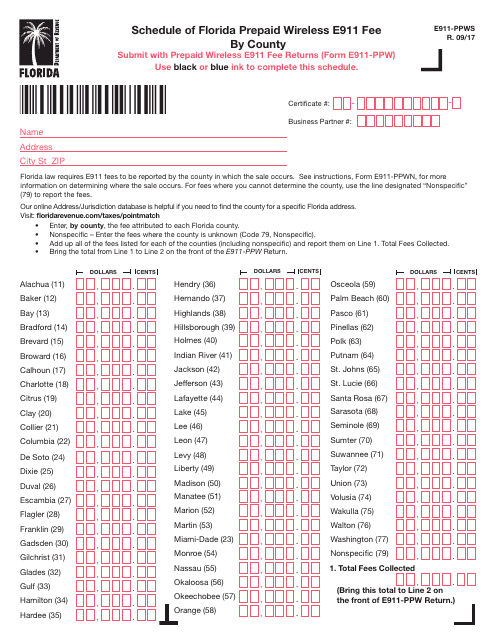

This Form is used for viewing the schedule of Florida Prepaid Wireless E911 Fee by County in Florida.

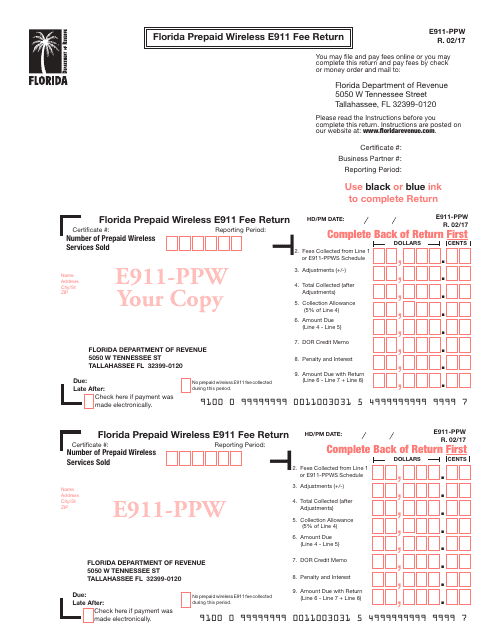

This form is used for submitting the prepaid wireless E911 fee return in the state of Florida.

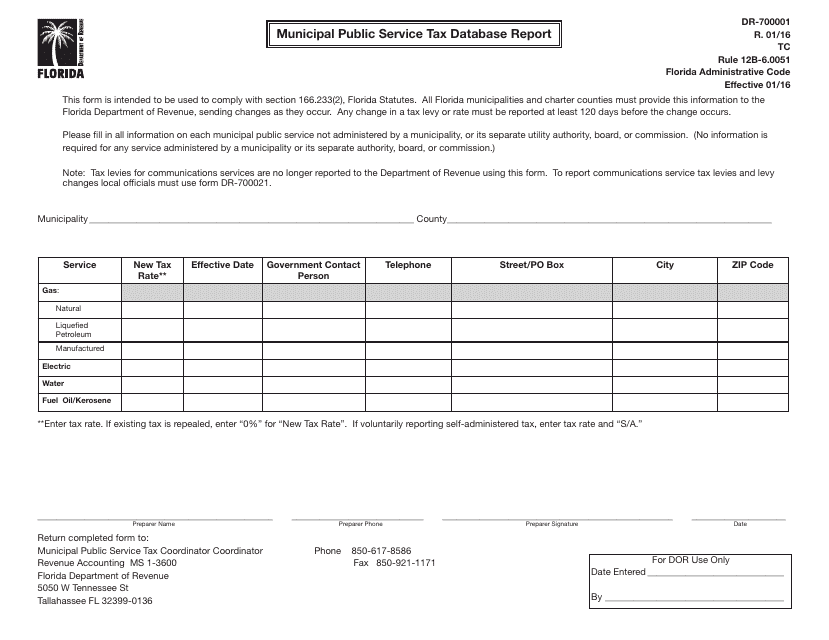

This form is used for generating a report on the municipal public service tax database in Florida. It helps gather information about taxes related to public services provided by municipalities in the state.

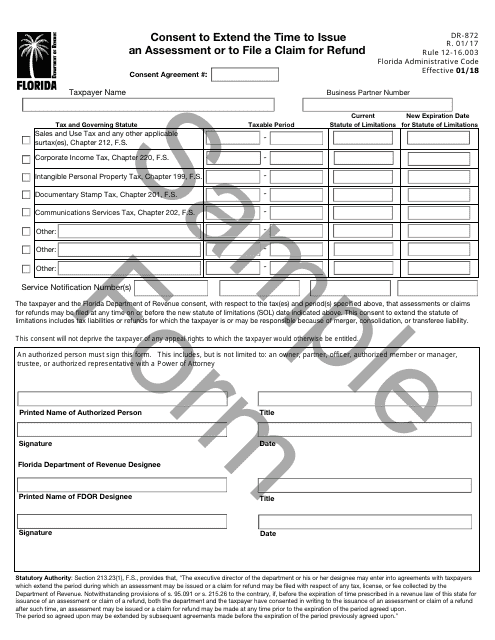

This form is used for consenting to extend the time to issue an assessment or to file a claim for refund in the state of Florida.

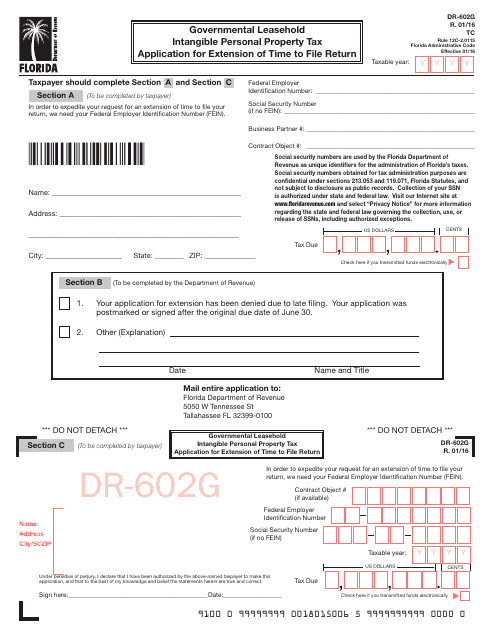

This form is used for requesting an extension of time to file a return for the Governmental Leasehold Intangible Personal Property Tax in Florida.

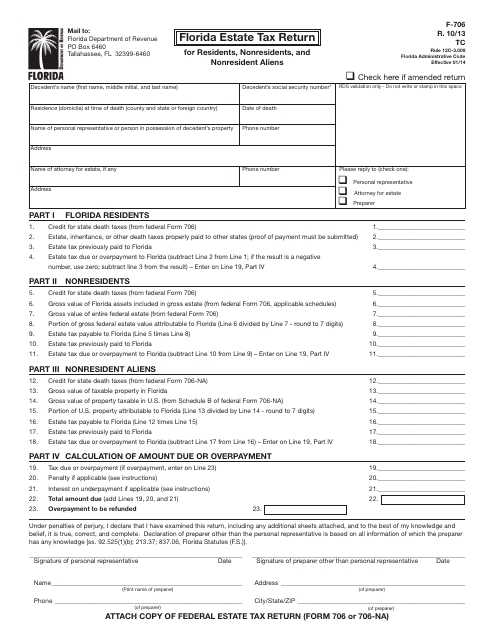

This form is used for filing estate tax returns in Florida by residents, nonresidents, and nonresident aliens.

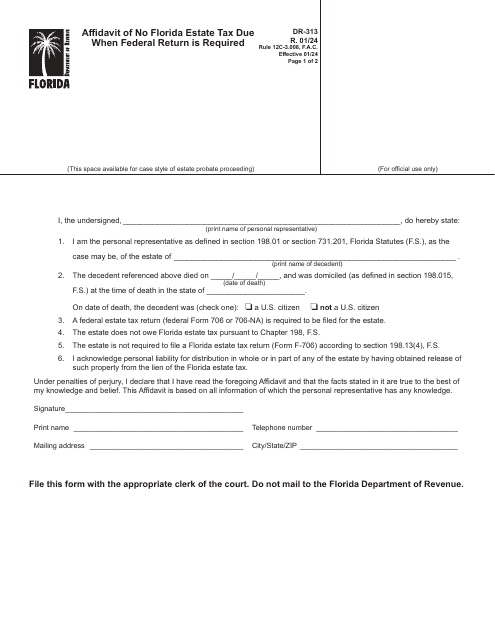

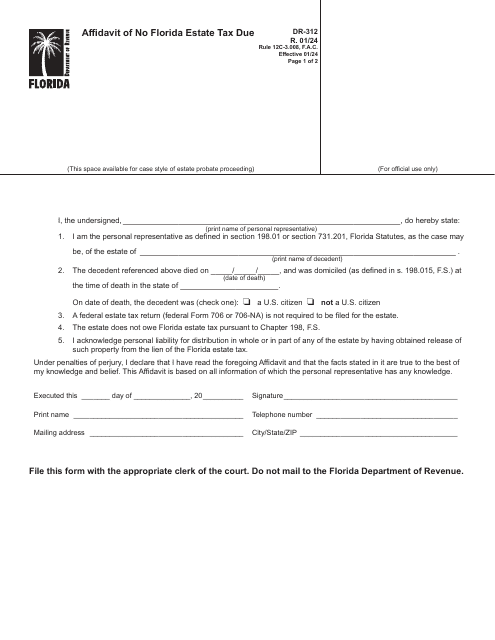

This form is a Florida legal document completed for the estates of decedents who died on or after January 1, 2005, if the estate does not require the filing of a federal estate tax return.

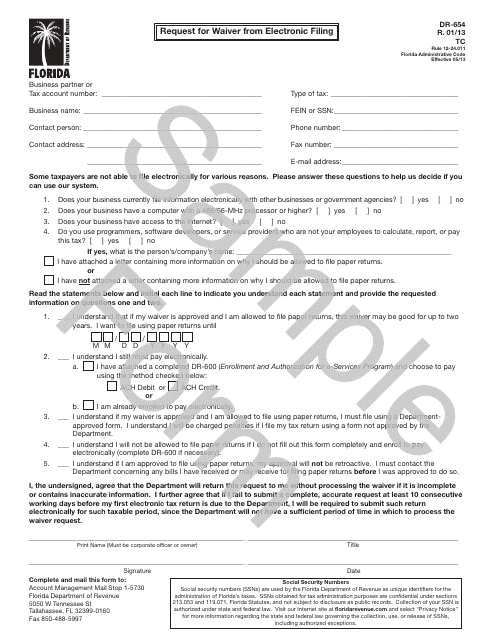

This form is used for requesting a waiver from electronic filing in the state of Florida.

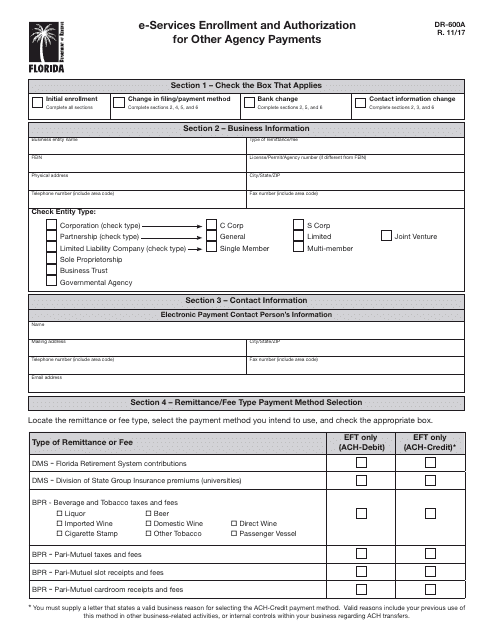

This form is used for enrolling in and authorizing e-services for making payments to other agencies in the state of Florida.

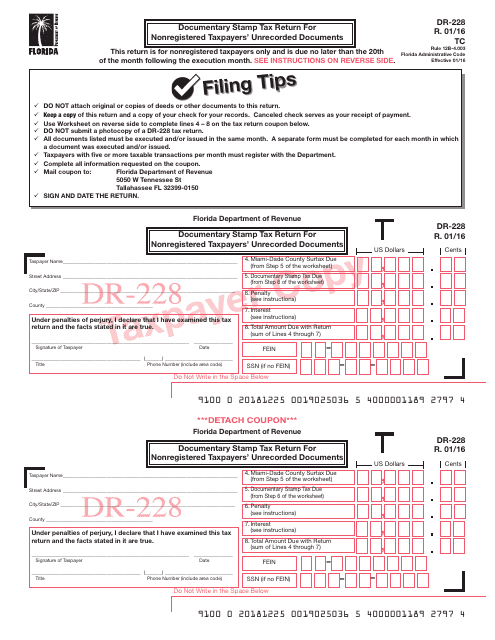

Form DR-228 Documentary Stamp Tax Return for Nonregistered Taxpayers' Unrecorded Documents - Florida

This form is used for nonregistered taxpayers in Florida to report and pay documentary stamp tax on unrecorded documents.

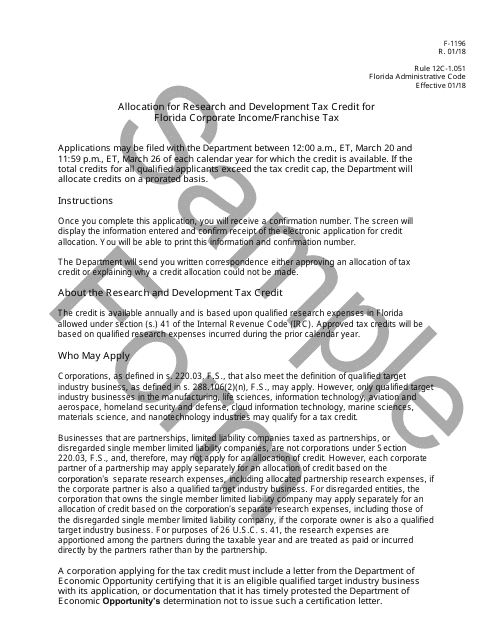

This form is used for allocating the research and development tax credit for Florida corporate income/franchise tax in the state of Florida.

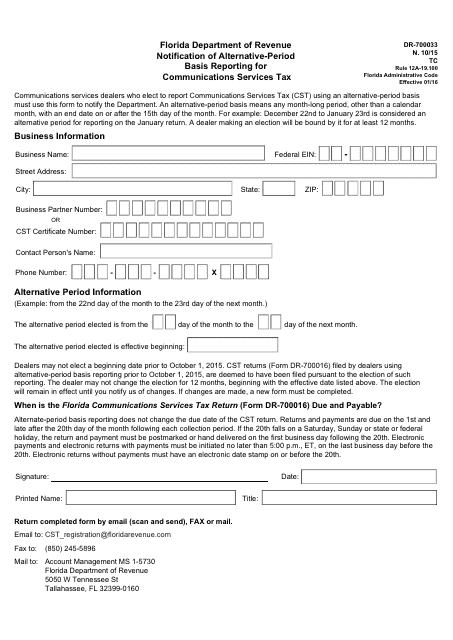

This form is used for notifying the Florida Department of Revenue about alternative-period basis reporting for communications services tax.

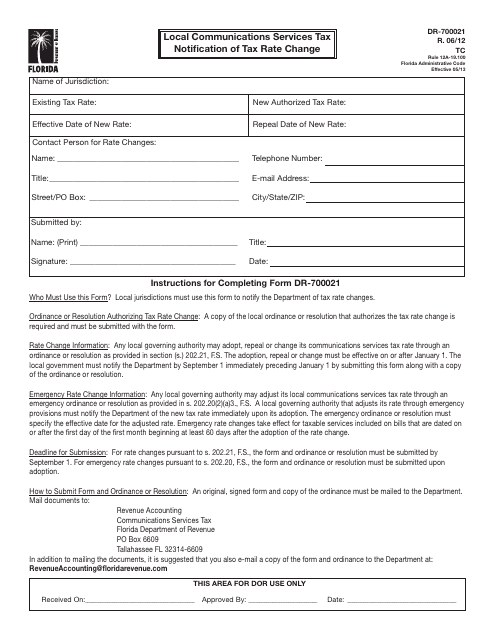

This document is used for notifying residents of Florida about a change in the tax rate for local communication services.

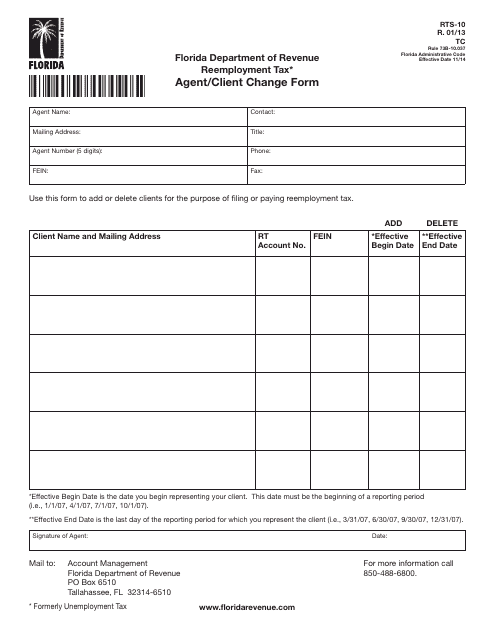

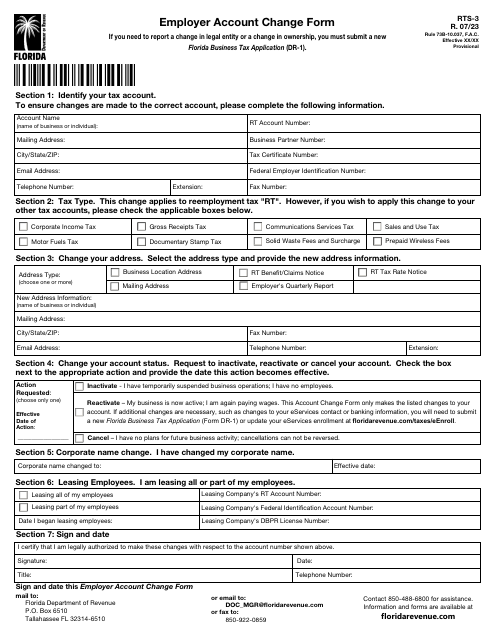

This Form is used for changing a Reemployment Tax Agent or Client in Florida.

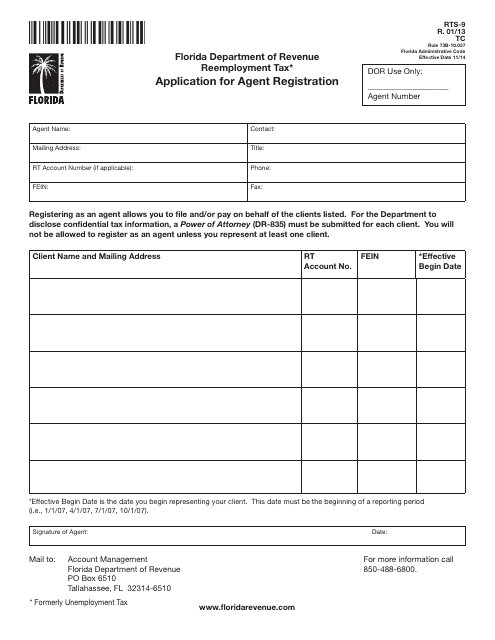

This form is used for agent registration for reemployment tax in Florida.

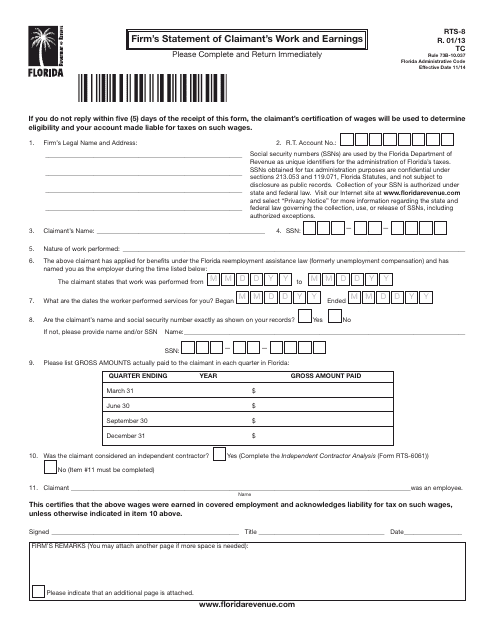

This Form is used for filing a statement of claimant's work and earnings by a firm in Florida.

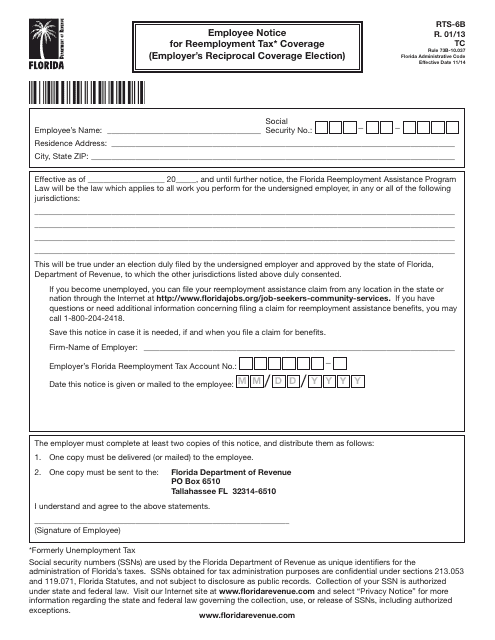

This form is used for informing employees about reemployment tax coverage and the employer's reciprocal coverage election in the state of Florida.

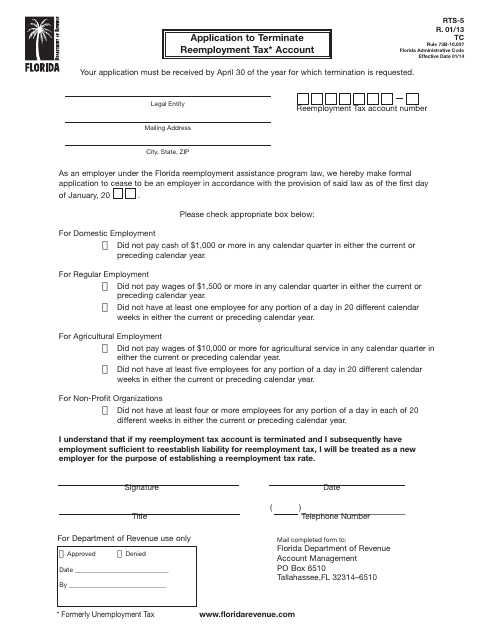

This form is used for terminating a reemployment tax account in the state of Florida.

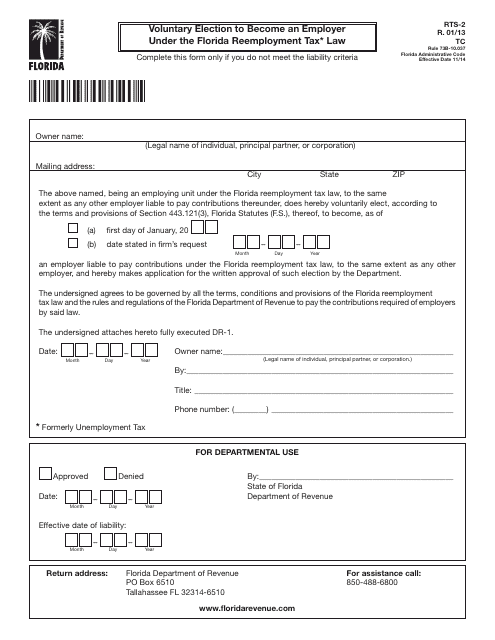

Form RTS-2 Voluntary Election to Become an Employer Under the Florida Reemployment Tax Law - Florida

This form is used for employers in Florida to voluntarily elect to become subject to the Florida Reemployment Tax Law.

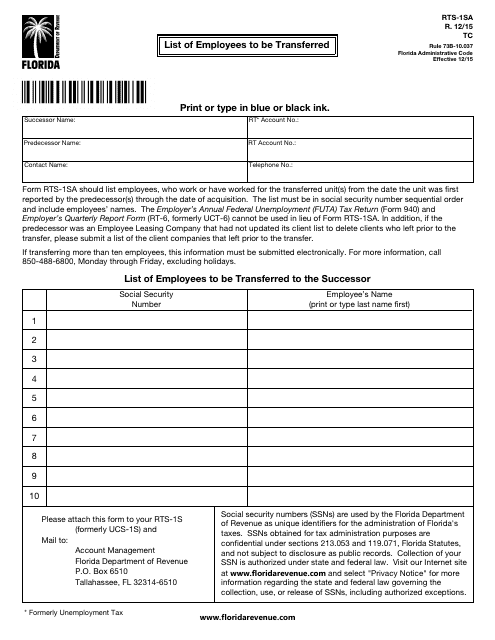

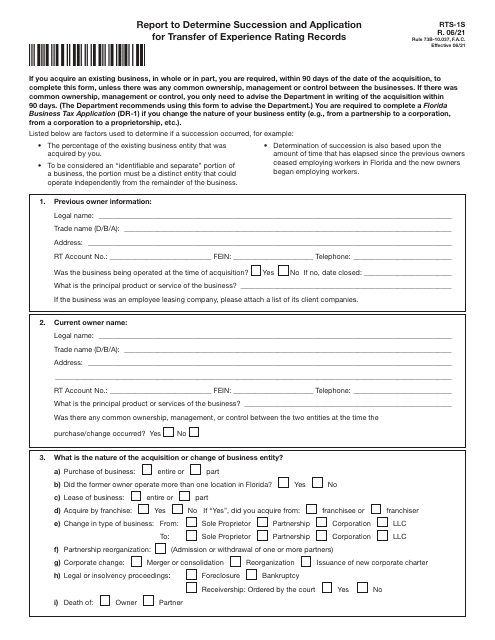

This Form is used for listing employees who are to be transferred in the state of Florida.

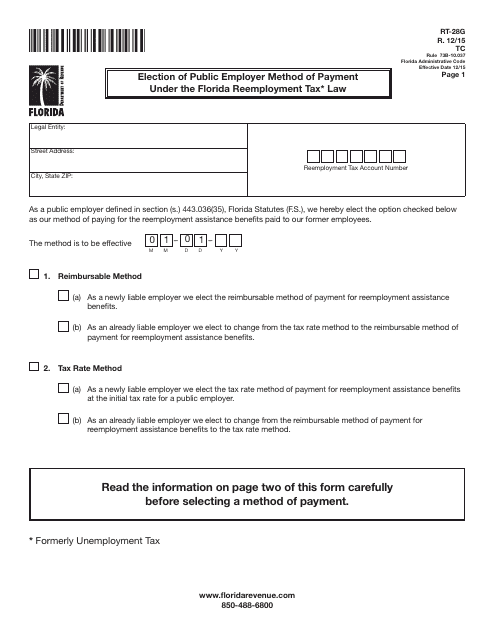

This form is used for employers in Florida to elect their method of payment for reemployment tax under the Florida Reemployment Tax Law.

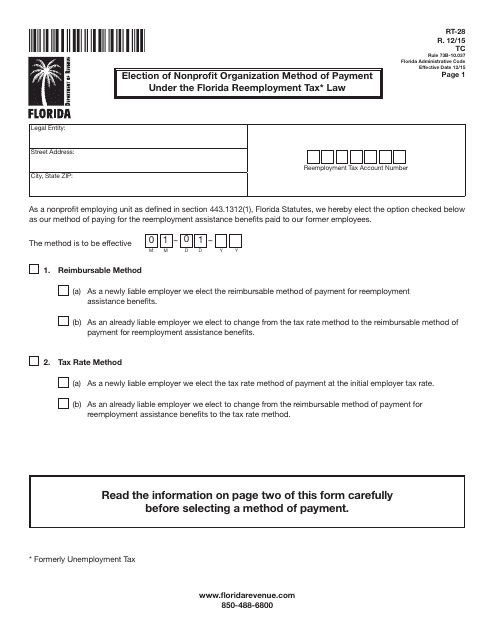

This Form is used for nonprofit organizations in Florida to choose a payment method for reemployment taxes under the Florida Reemployment Tax Law.

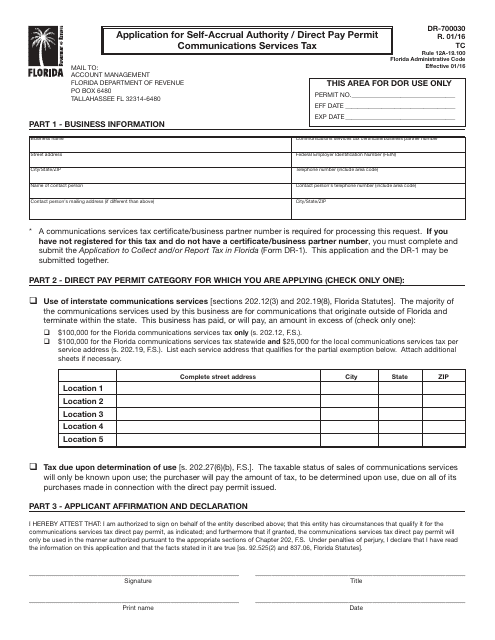

This form is used for applying for self-accrual authority or direct pay permit for the communications services tax in Florida.