Fill and Sign Arizona Legal Forms

Documents:

5891

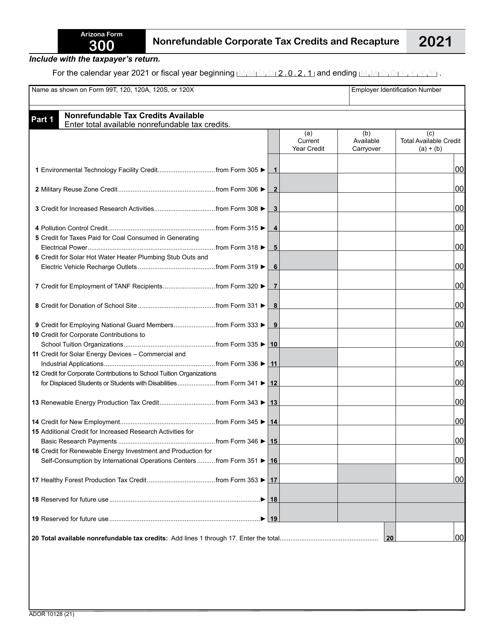

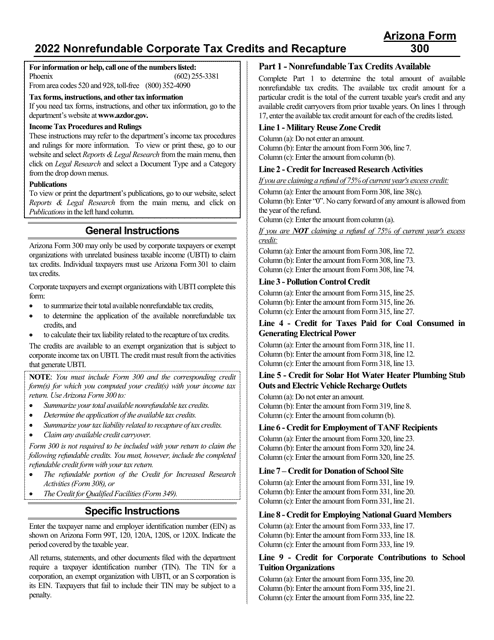

This document is used for claiming and recapturing nonrefundable corporate tax credits in Arizona.

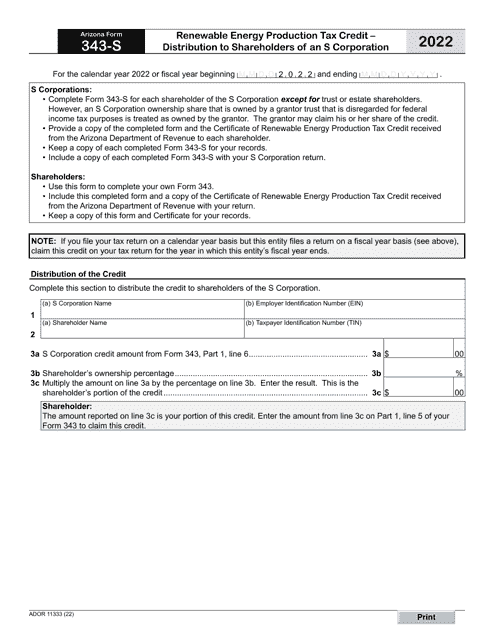

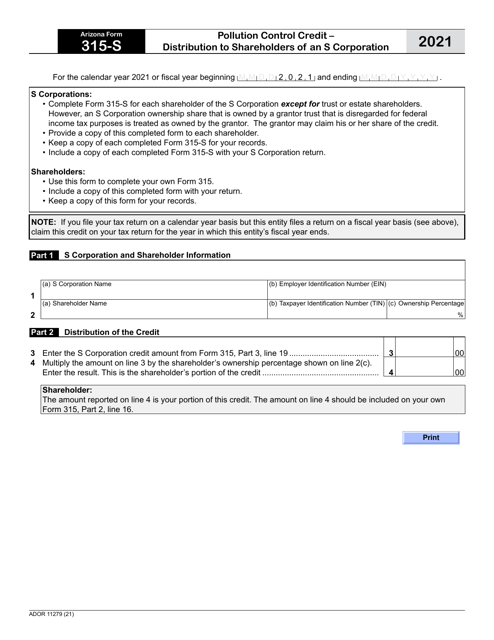

This form is used for reporting and distributing pollution control credits to shareholders of an S Corporation in Arizona. It helps allocate the credits among the shareholders based on their ownership percentage.

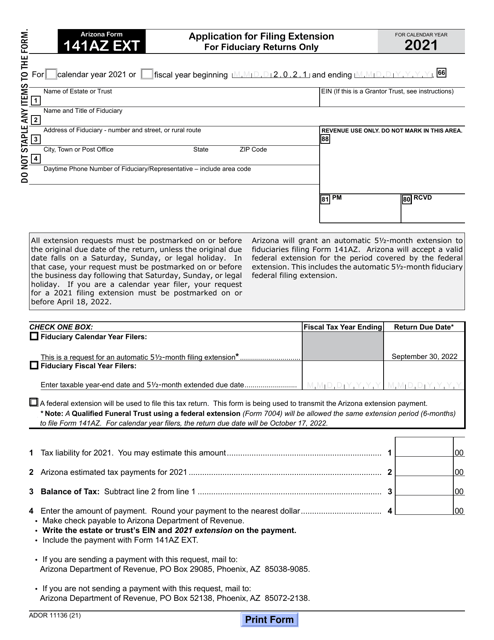

This document is a form used in Arizona to apply for a filing extension specifically for fiduciary returns.

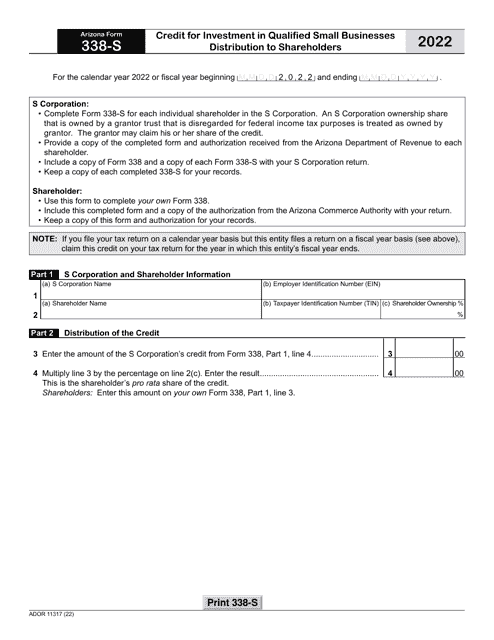

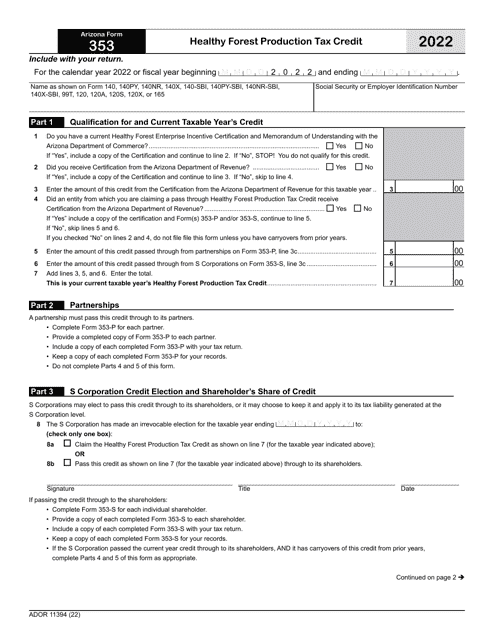

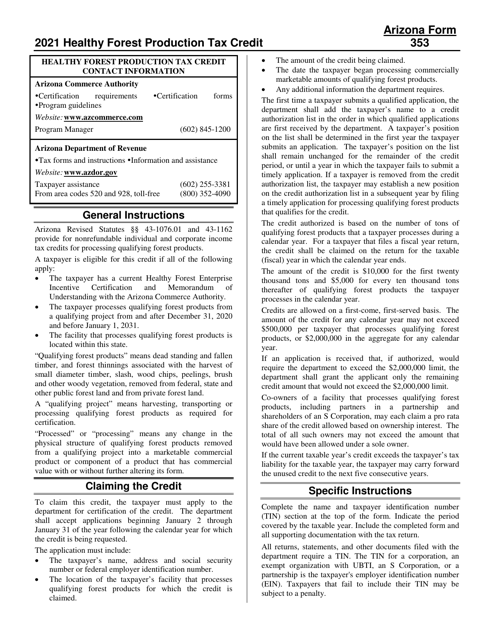

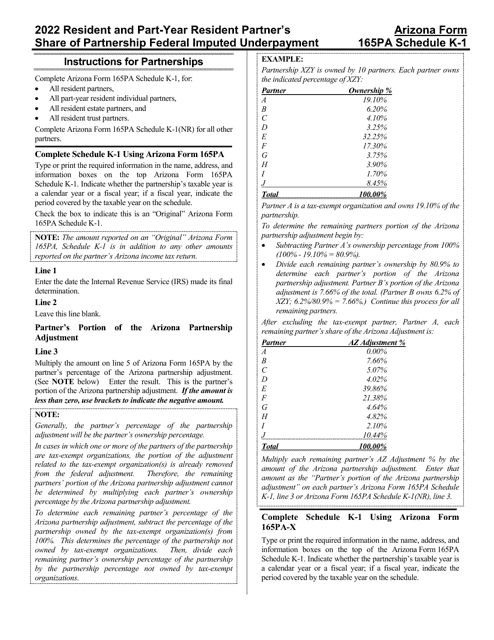

This document provides instructions for filling out various forms related to tax reporting in Arizona. It includes information for Form 353, ADOR11394, Form 353-P, ADOR111395, and Form 353-S, ADOR111396. The instructions will help individuals and businesses accurately complete these forms and fulfill their tax obligations in Arizona.

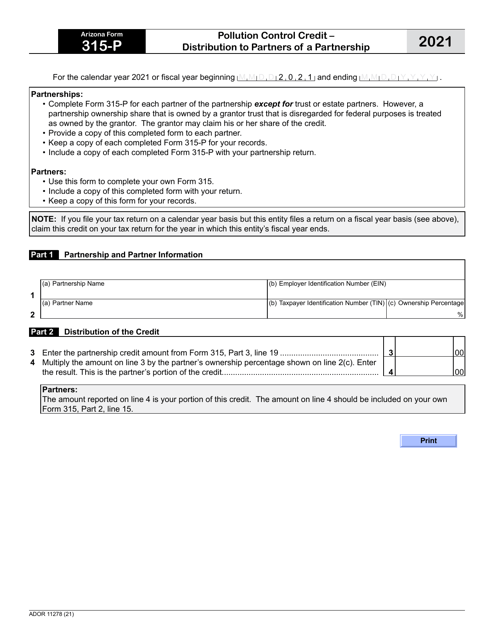

This Form is used for distributing pollution control credits to partners of a partnership in Arizona.

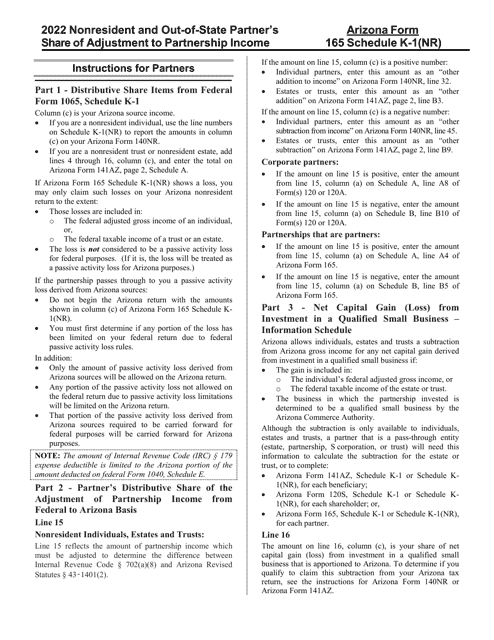

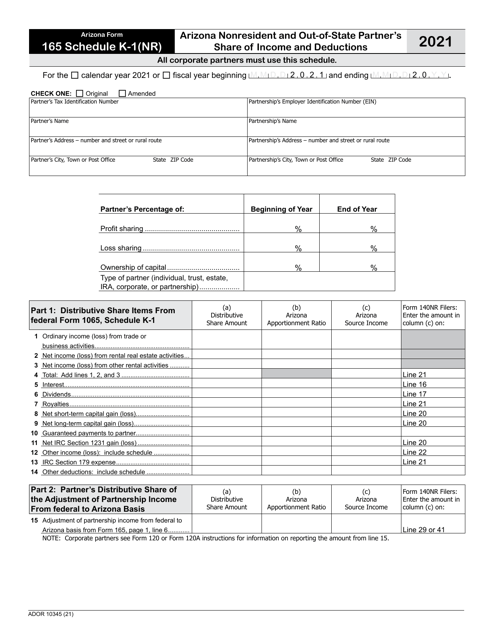

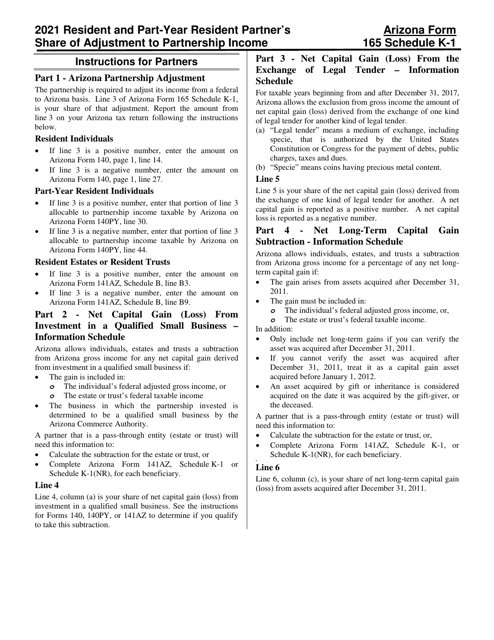

This document is used for reporting the nonresident and out-of-state partner's share of income and deductions for tax purposes in Arizona.

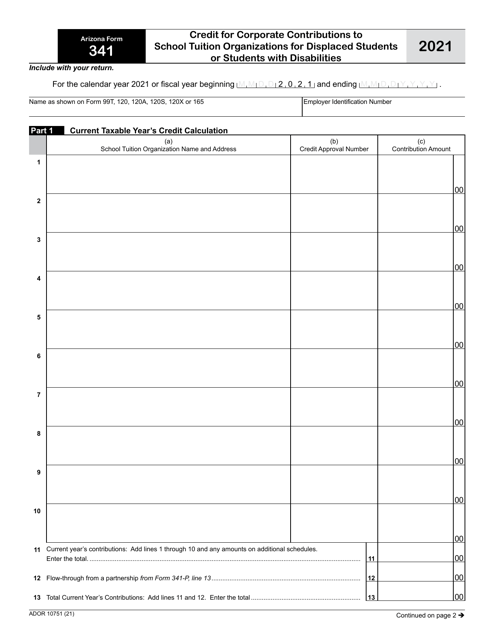

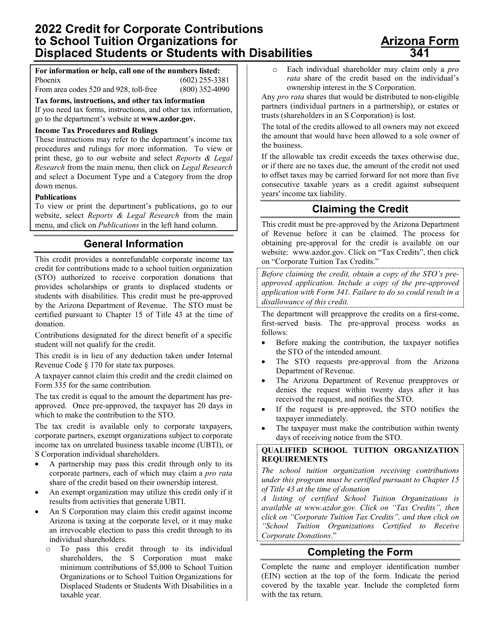

This Form is used for claiming a credit for corporate contributions to school tuition organizations in Arizona, specifically for displaced students or students with disabilities.

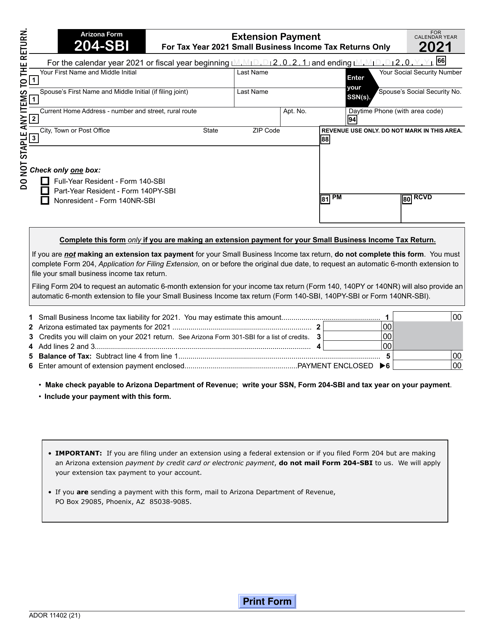

This form is used for making extension payments for small business income tax returns in Arizona.

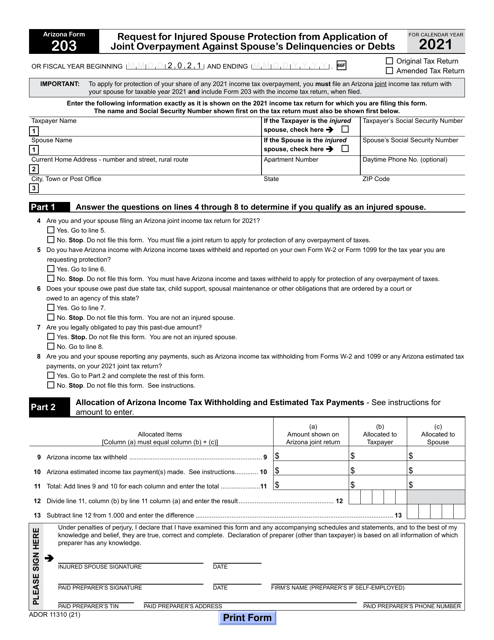

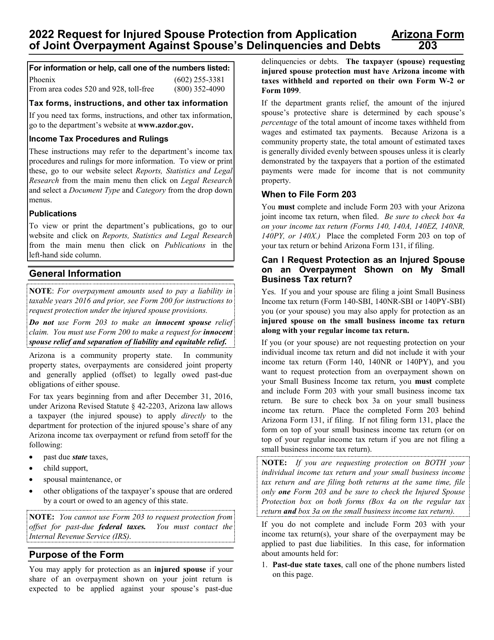

This form is used for requesting protection for an injured spouse from the application of joint overpayment against their spouse's delinquencies or debts in the state of Arizona.

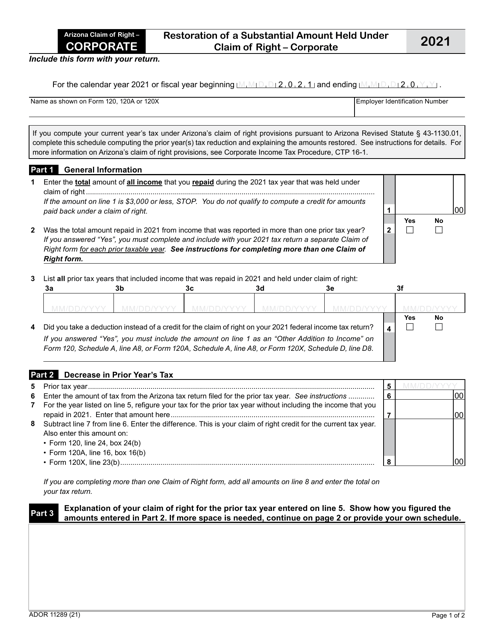

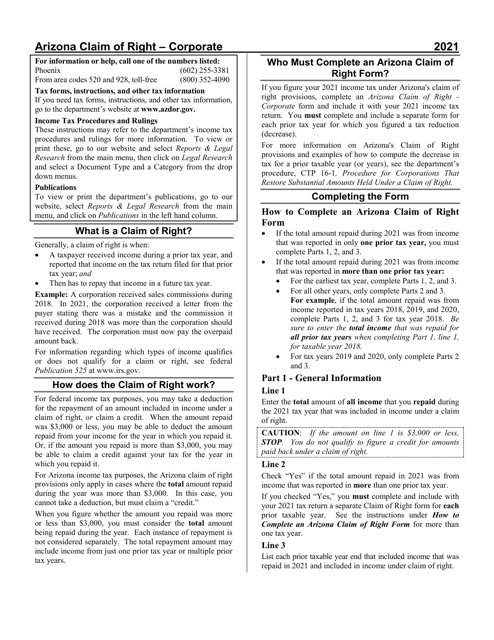

This Form is used for the restoration of a substantial amount held under claim of right for corporate entities in the state of Arizona.

This document is used for filing a request to restore a substantial amount held under a claim of right for a corporate entity in the state of Arizona. It provides instructions on how to complete the form ADOR11289.

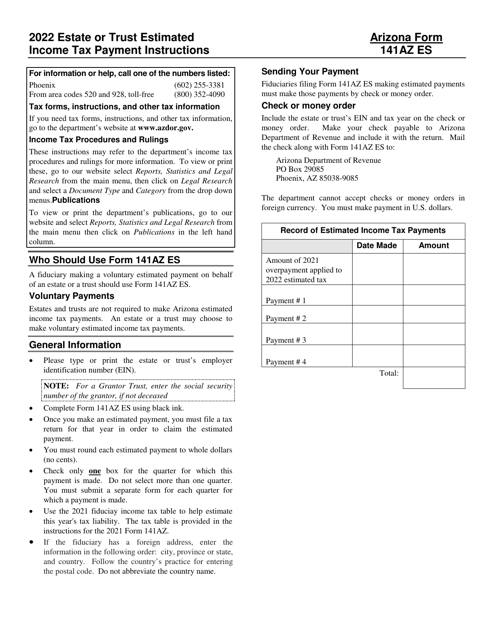

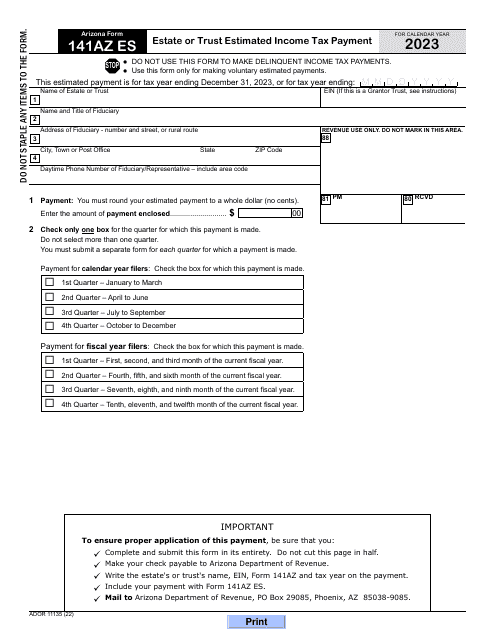

This Form is used for making estimated income tax payments for estates or trusts in Arizona.

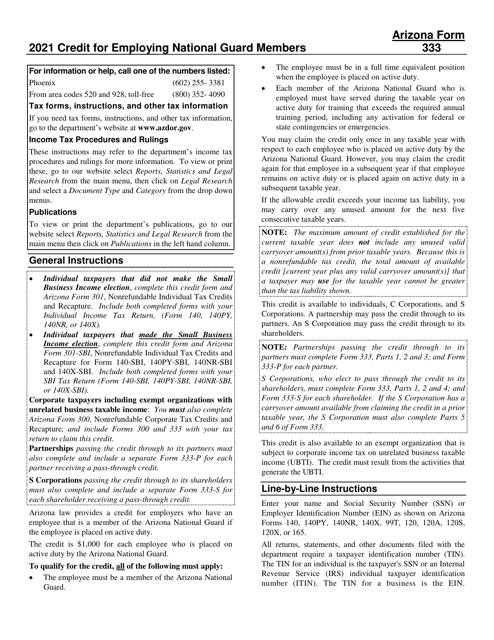

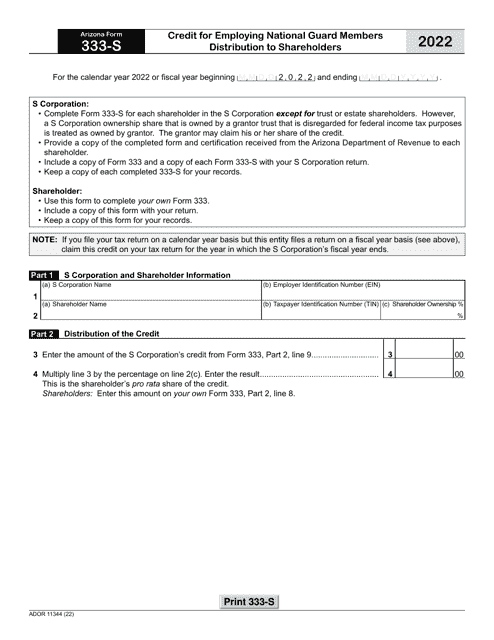

This Form is used for filing tax returns in the state of Arizona. It includes various versions such as Arizona Form 333, ADOR10714, Arizona Form 333-P, ADOR11343, Arizona Form 333-S, and ADOR11344.

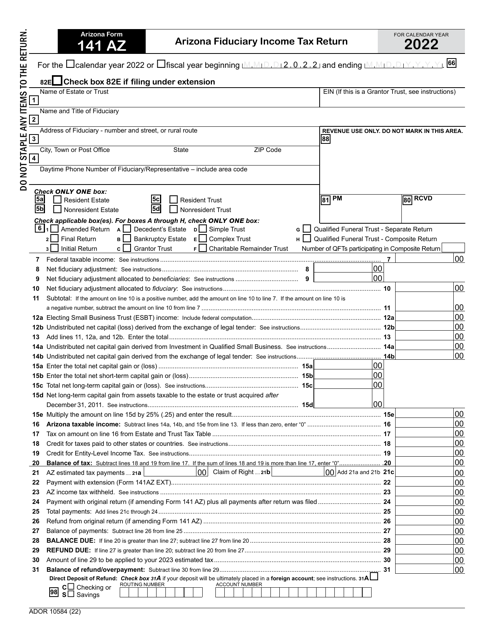

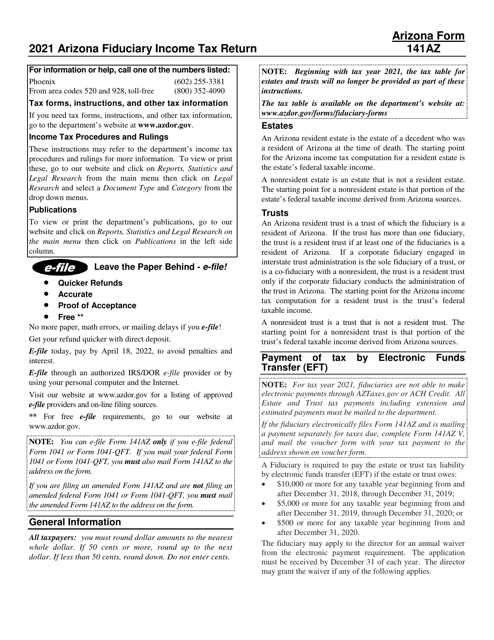

This Form is used for filing Arizona Fiduciary Income Tax Return for residents of Arizona who have a fiduciary relationship with an estate or trust.