Fill and Sign Utah Legal Forms

Documents:

2266

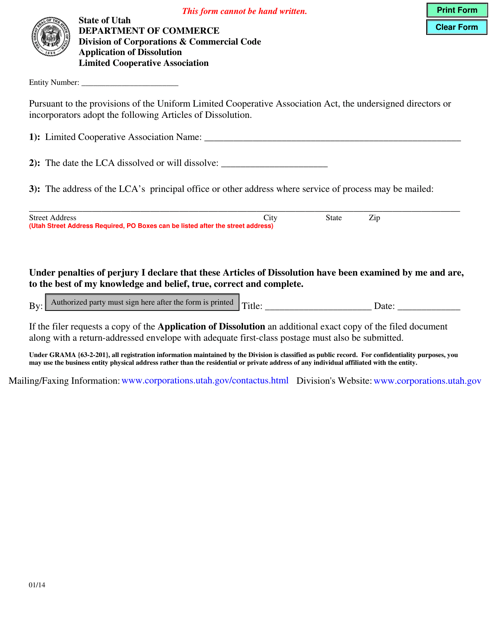

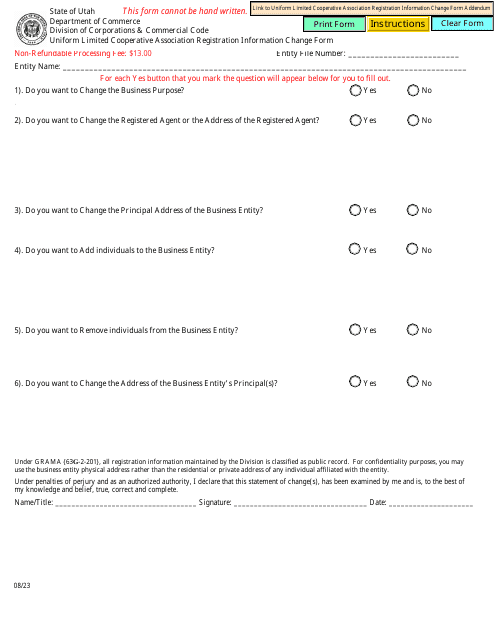

This type of document is used for applying for the dissolution of a limited cooperative association in the state of Utah.

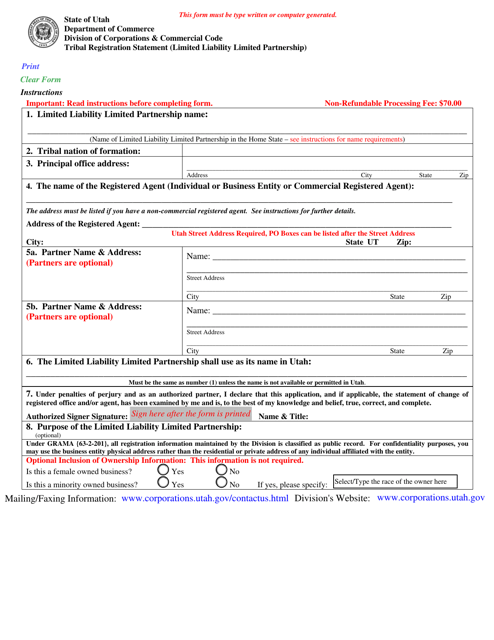

This document is for registering a limited liability limited partnership with tribal affiliation in the state of Utah.

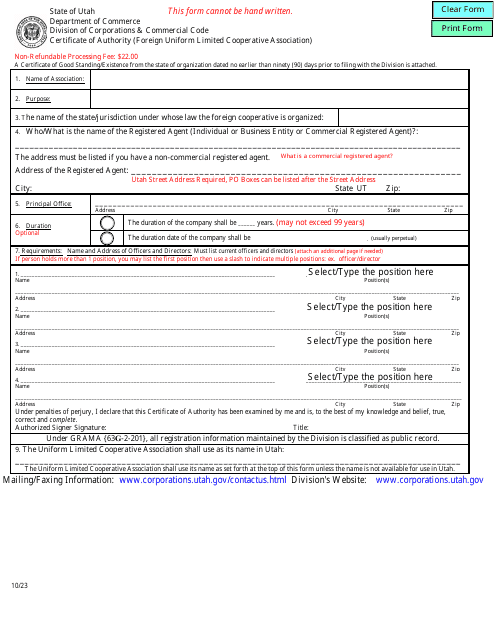

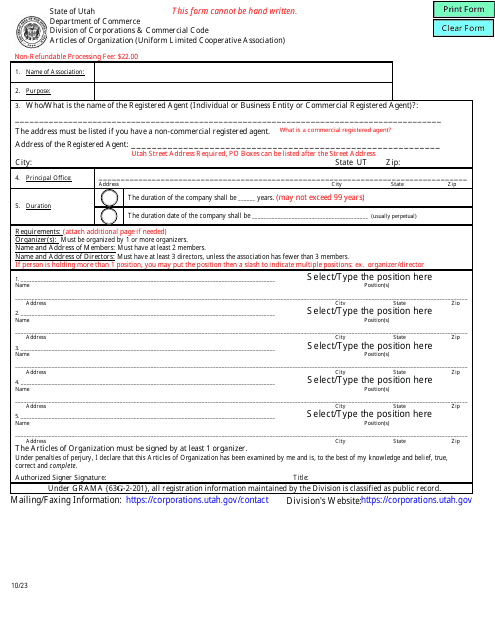

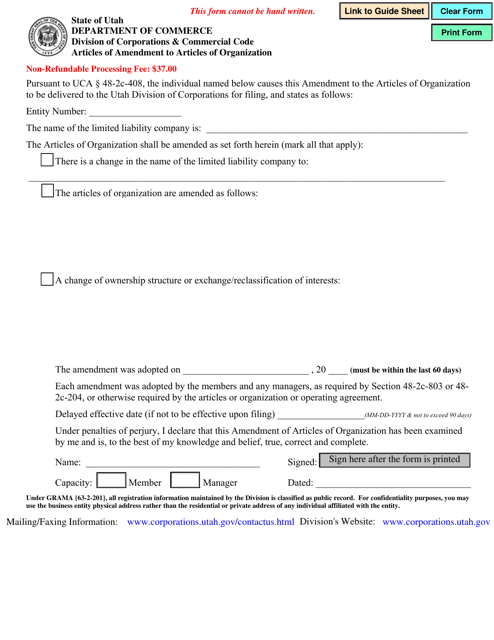

This document allows for making changes or alterations to the Articles of Organization of a company registered in the state of Utah. It is used to update important information such as the company's name, address, or the members or managers of the company.

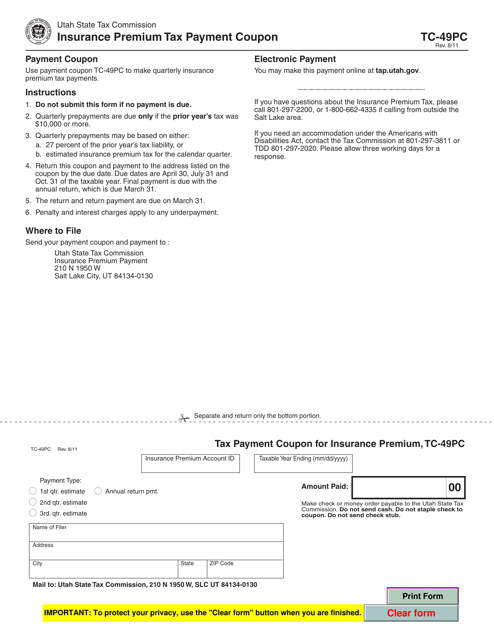

This form is used for making insurance premium tax payments in Utah. It is called TC-49PC Insurance Premium Tax Payment Coupon.

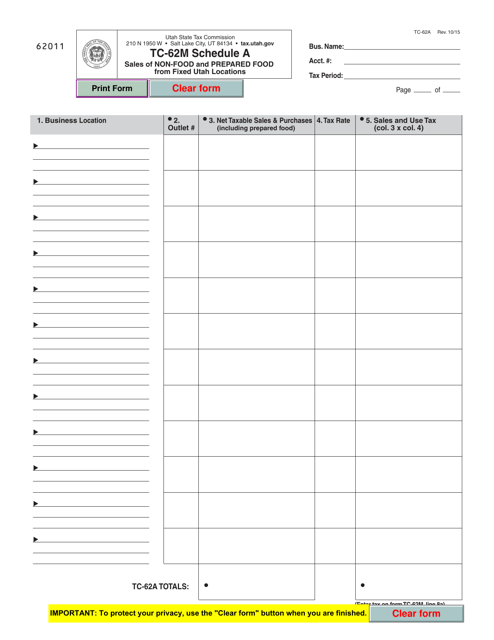

Form TC-62M (TC-62A) Schedule A Sales of Non-food and Prepared Food From Fixed Utah Locations - Utah

This form is used for reporting the sales of non-food and prepared food from fixed locations in Utah. It is specifically for businesses in Utah that sell non-food and prepared food items.

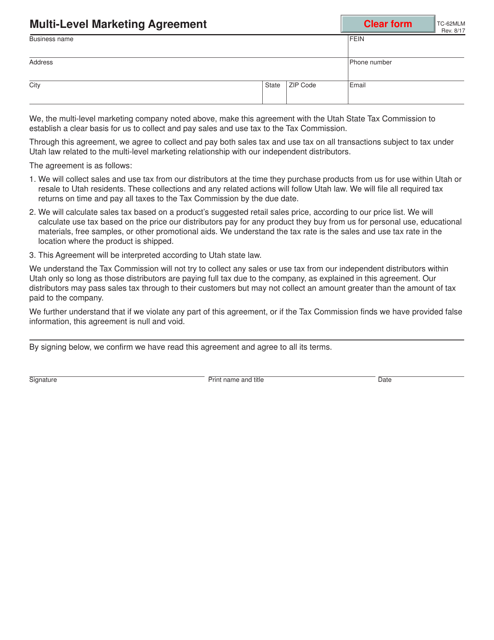

This form is used for creating a multi-level marketing agreement in Utah.

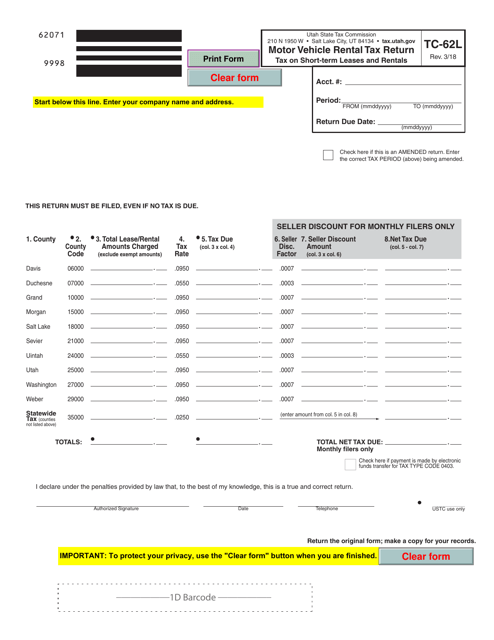

This form is used for reporting and paying the motor vehicle rental tax in Utah. It is submitted by rental companies to the Utah State Tax Commission.

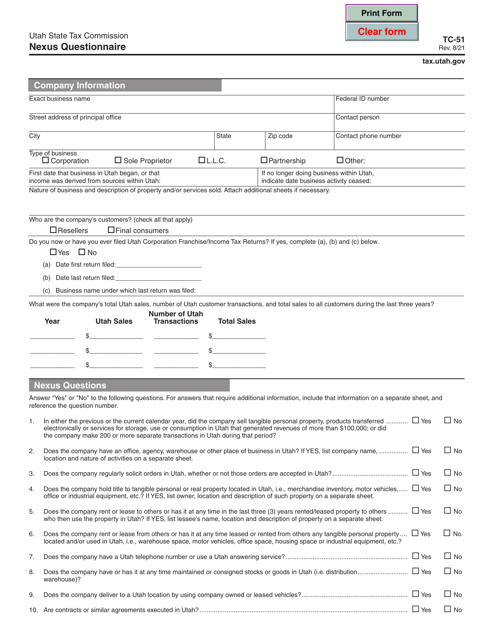

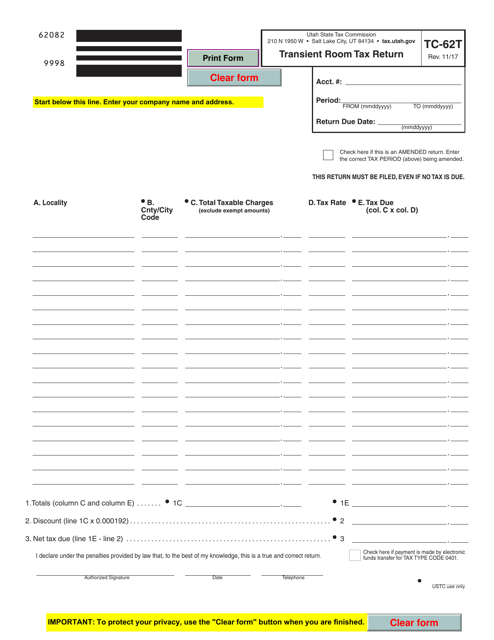

This Form is used for reporting and submitting transient room tax in the state of Utah.

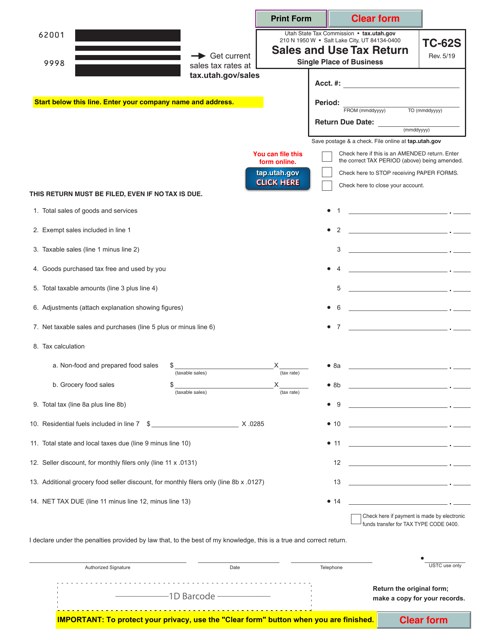

This form is used for reporting and paying sales and use taxes for single places of business in Utah.

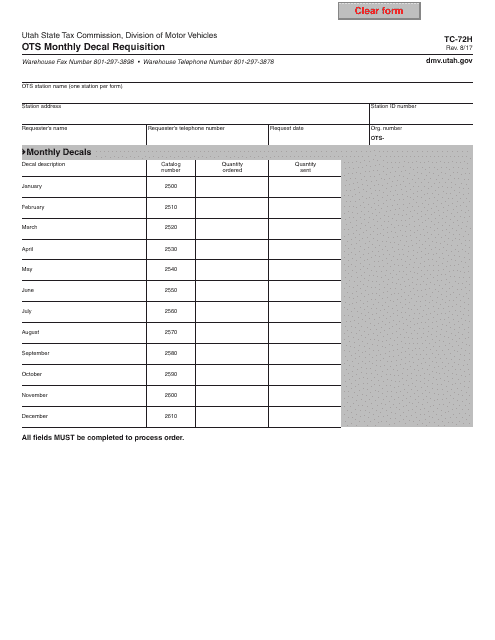

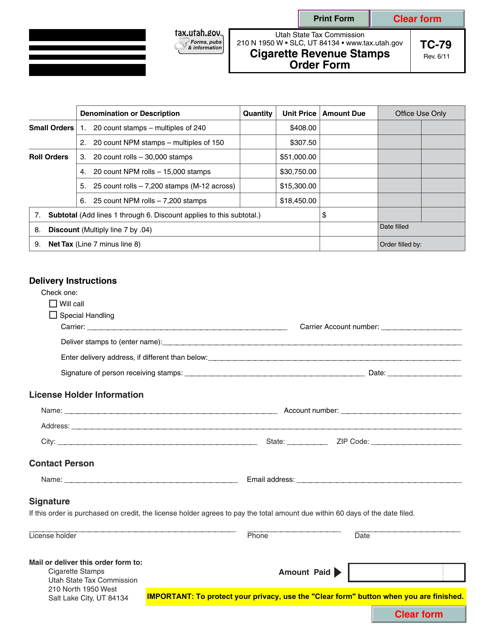

This form is used for ordering cigarette revenue stamps in Utah.

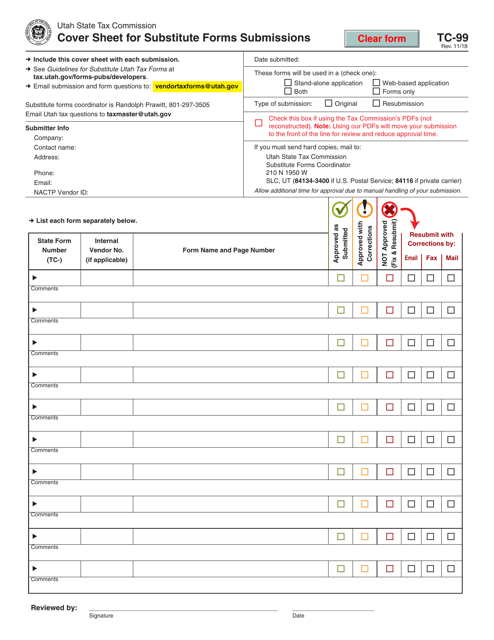

This form is used for submitting substitute forms in Utah and serves as a cover sheet for the submission.

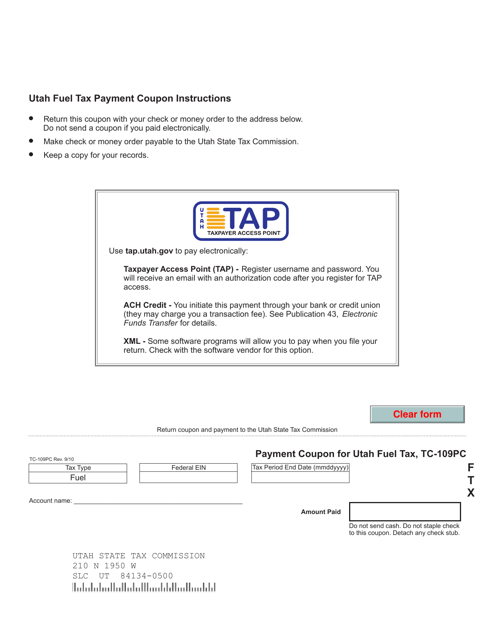

This form is used for submitting the payment coupon for Utah fuel tax in Utah.

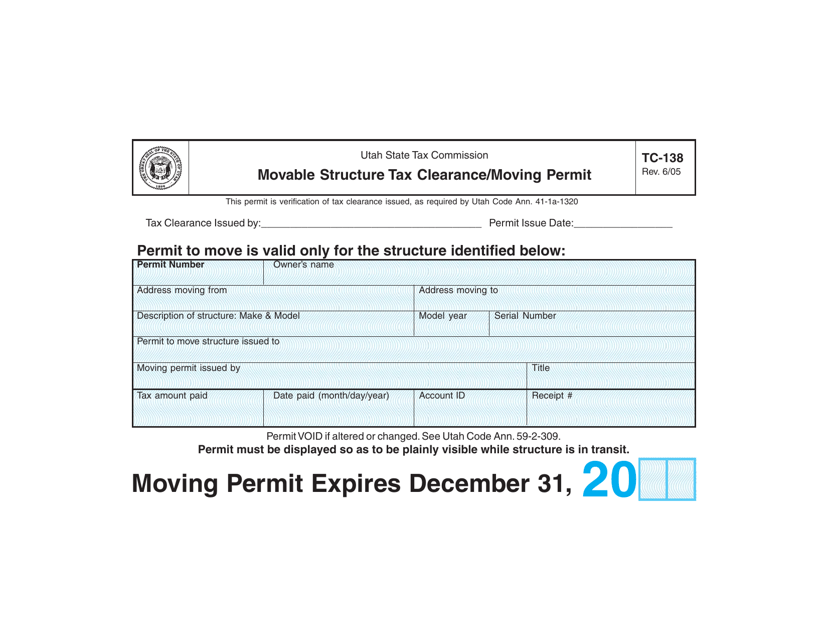

This form is used for obtaining a tax clearance and moving permit for movable structures in Utah.

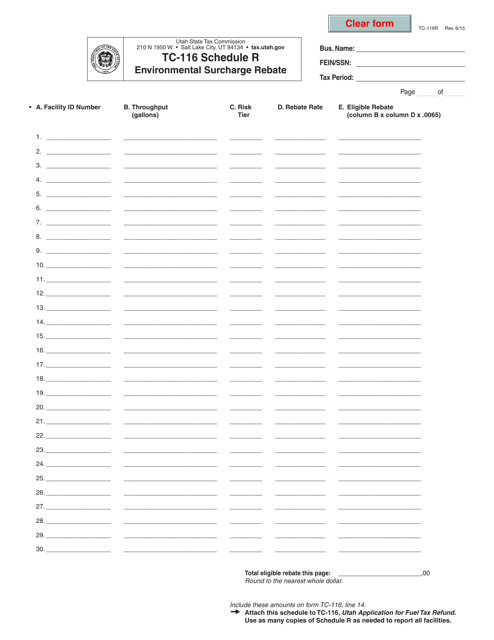

This form is used for requesting a rebate on environmental surcharges paid in Utah.

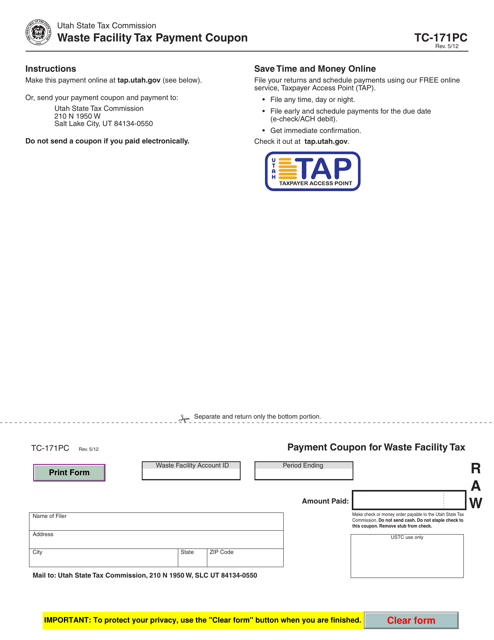

This form is used for making tax payments for waste facilities in Utah.

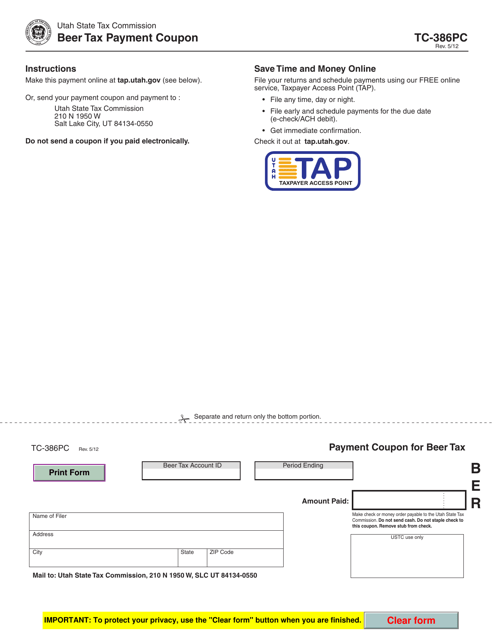

This form is used for making beer tax payments in Utah.

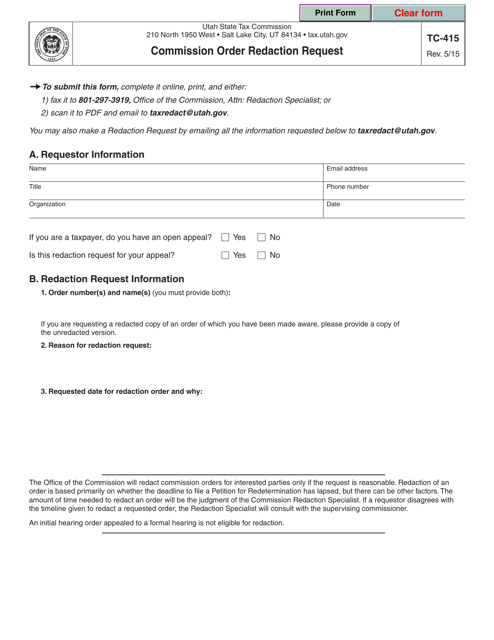

This form is used for requesting the redaction of commission orders in Utah.

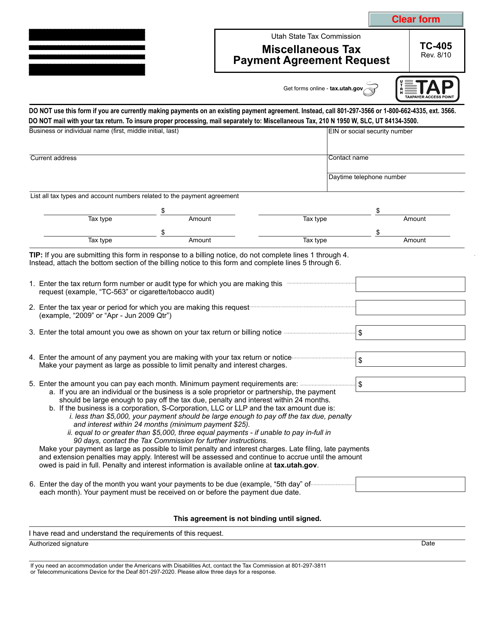

This Form is used for taxpayers in Utah to request a miscellaneous tax payment agreement.

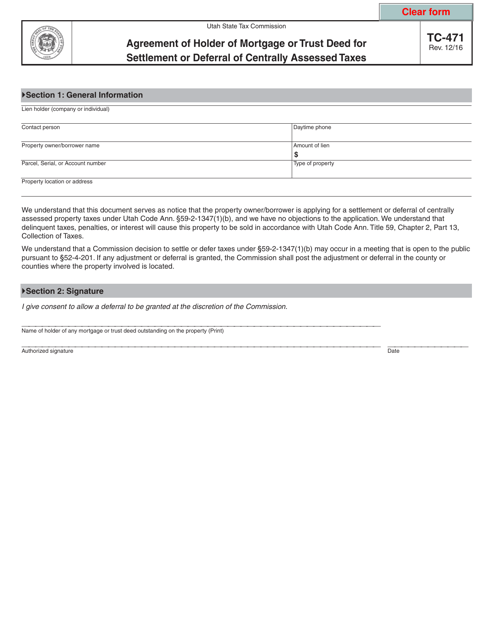

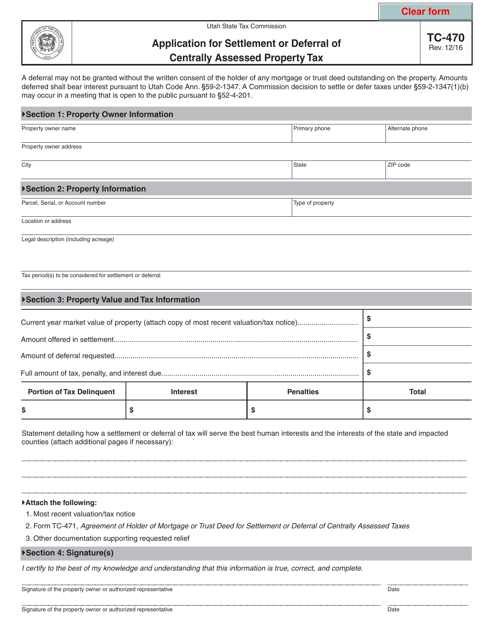

This type of document is used for making an agreement between the holder of a mortgage or trust deed and the taxpayer in Utah to settle or defer centrally assessed taxes.

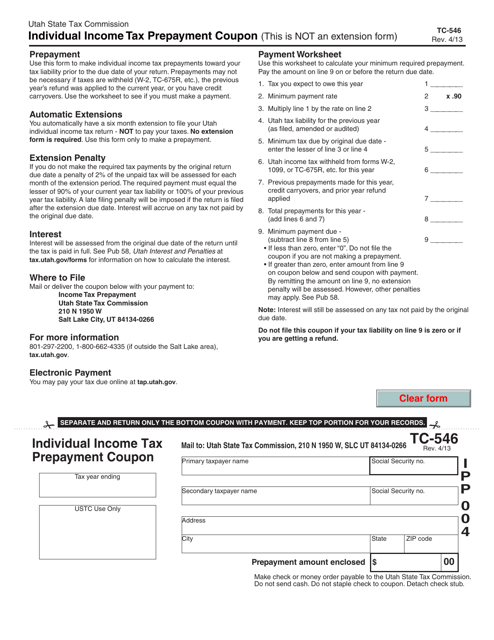

This Form is used for making prepayments of individual income taxes specifically for residents of Utah. It serves as a coupon to submit with your payment to ensure proper allocation.

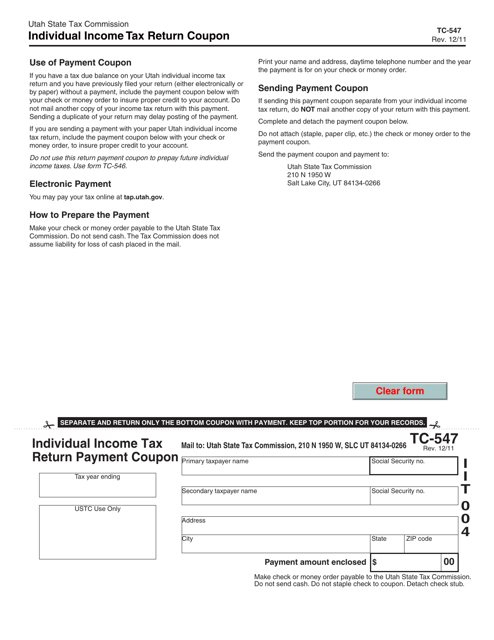

This form is used for making individual income tax payments in Utah. It is known as Form TC-547 Individual Income Tax Return Payment Coupon.

This form is used for applying for settlement or deferral of centrally assessed property tax in the state of Utah.

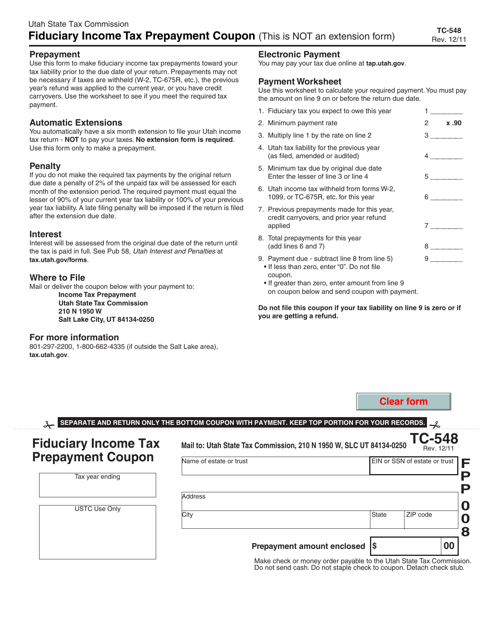

This form is used for making prepayments of fiduciary income tax in Utah.

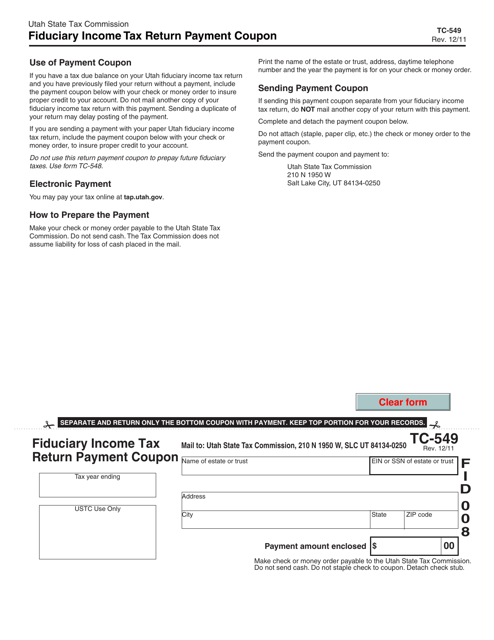

This document is used for making payments for the Utah Fiduciary Income Tax Return.

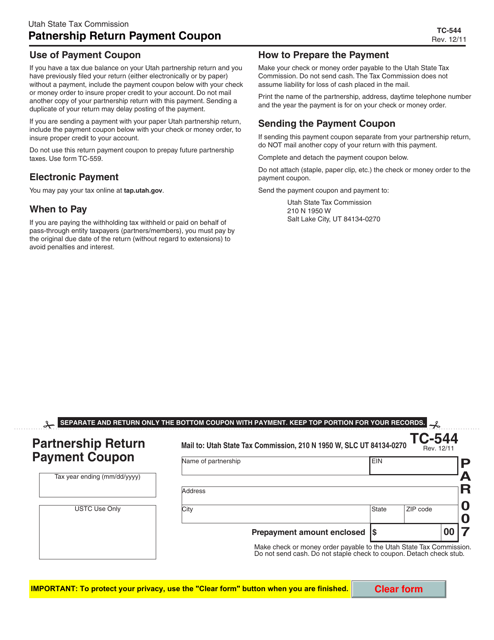

This form is used for making payments for partnership tax returns in Utah.