Fill and Sign Utah Legal Forms

Documents:

2266

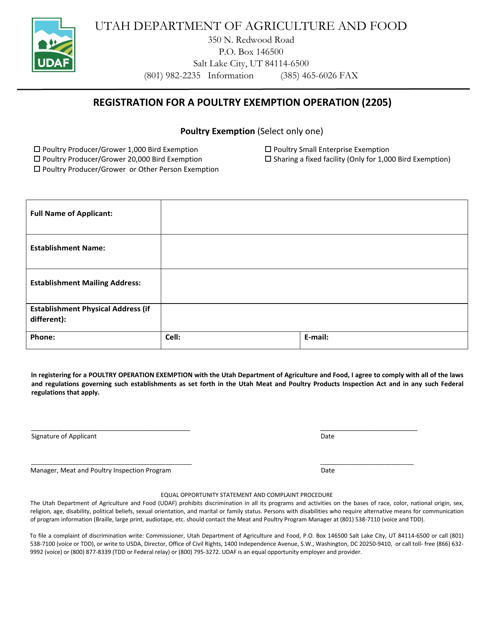

This Form is used for registering a poultry exemption operation in Utah.

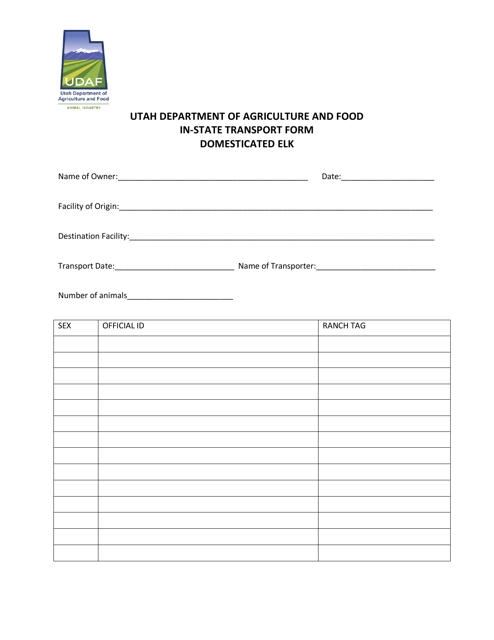

This document is used for transporting domesticated elk within the state of Utah.

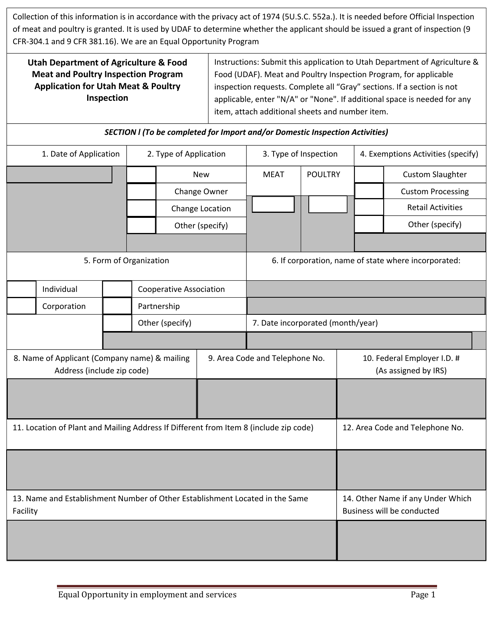

This document is an application form for Utah Meat and Poultry Inspection. It is used by individuals or businesses involved in the meat and poultry industry in Utah to apply for inspection services.

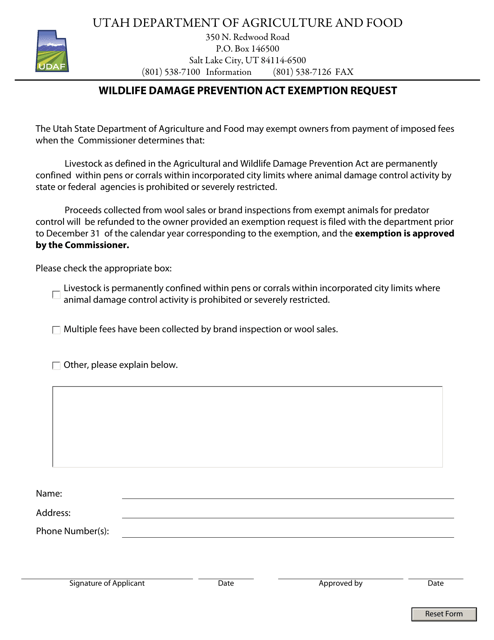

This document is used to request an exemption under the Wildlife Damage Prevention Act in the state of Utah.

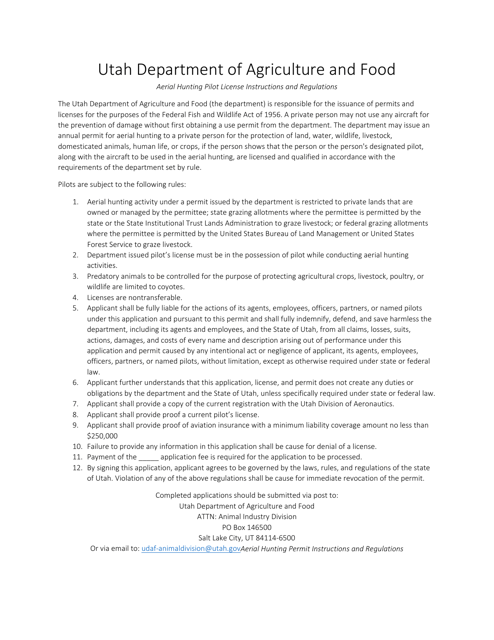

This document is used for applying for an Aerial Hunting License in the state of Utah. It is specifically designed for pilots who wish to participate in aerial hunting activities.

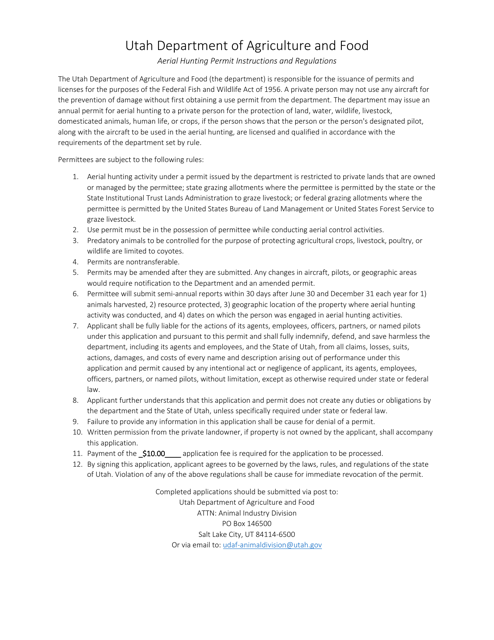

This document allows individuals in Utah to obtain a permit for participating in aerial hunting activities. It outlines the necessary requirements and regulations for aerial hunting in the state.

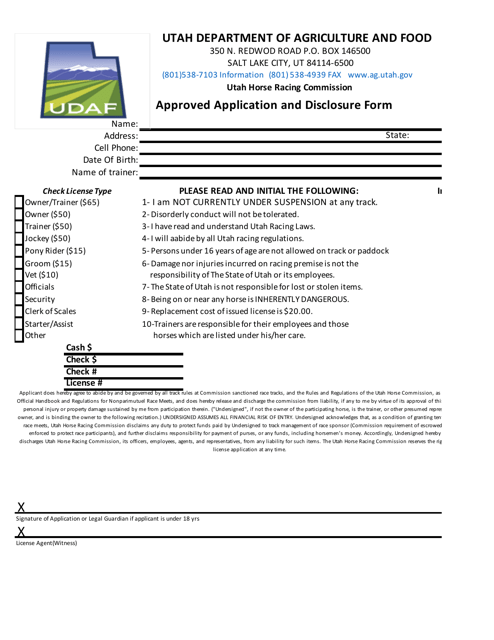

This Form is used for the approval of applications and the disclosure of information in the state of Utah.

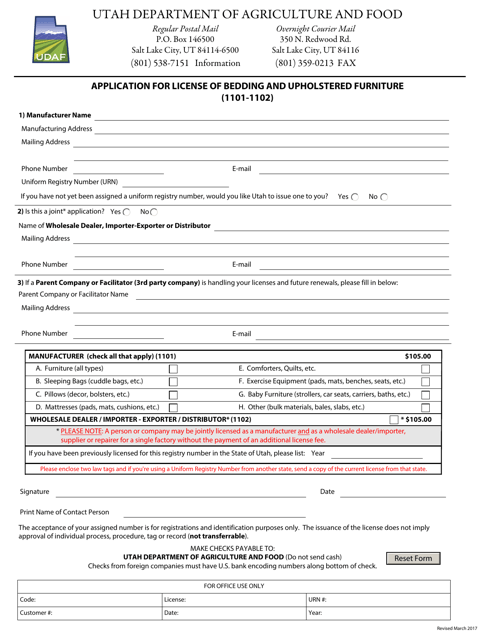

This document is for individuals who want to apply for a license to sell bedding and upholstered furniture in the state of Utah.

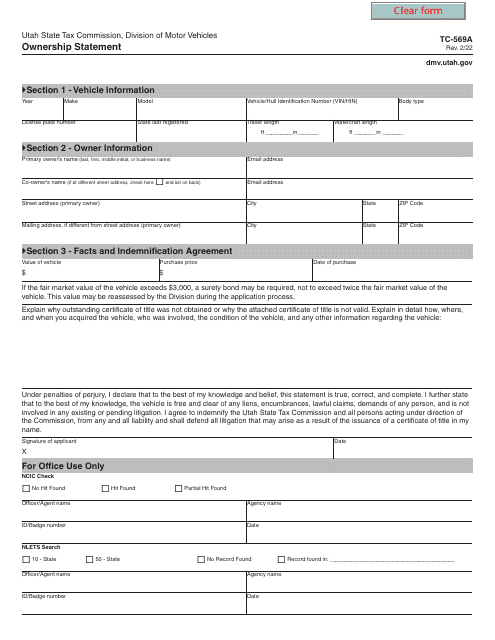

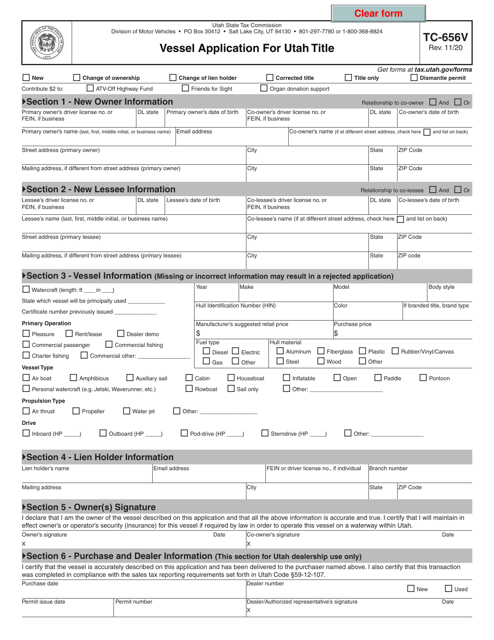

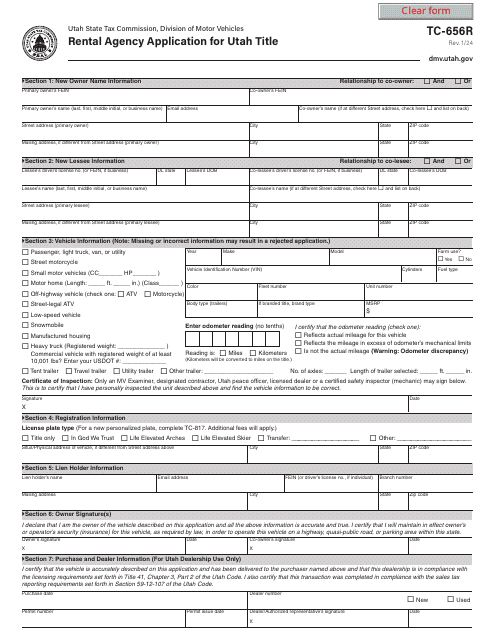

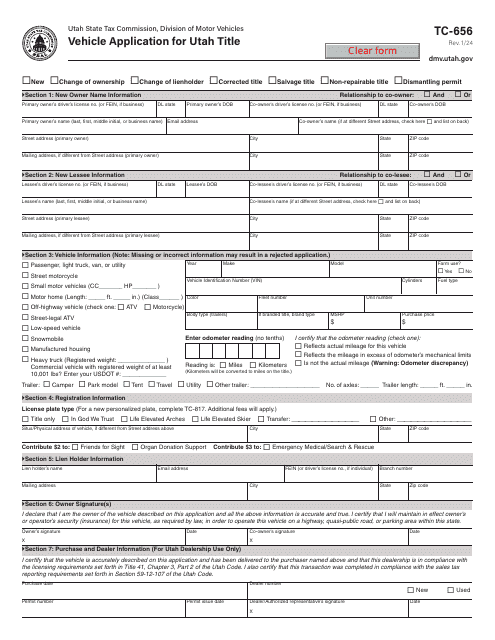

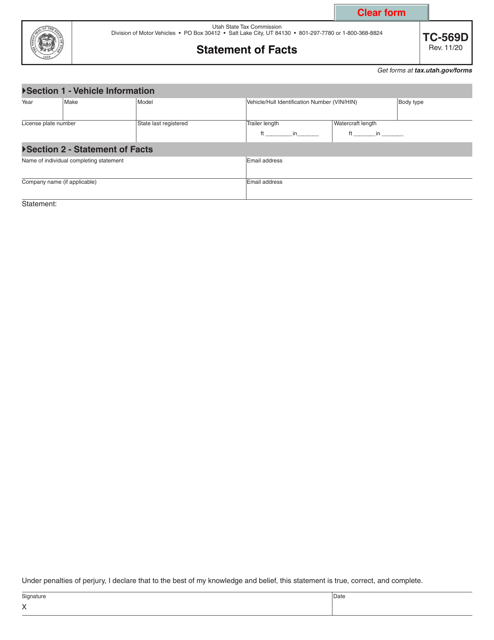

Utah vehicle owners may use this form to apply for a title, change information on an existing title, or request a permit to dismantle a vehicle.

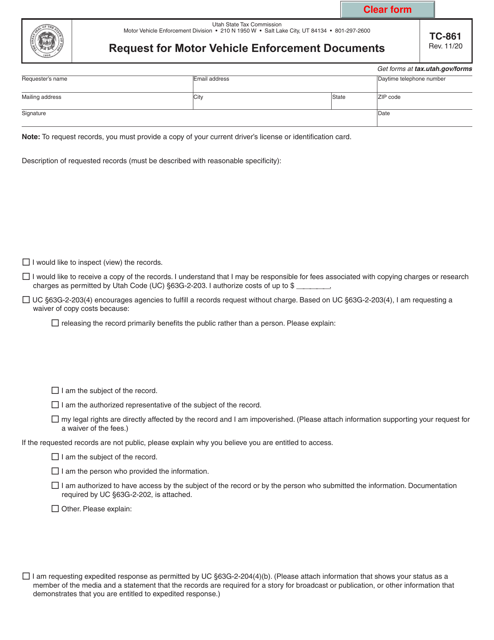

This form is used for requesting motor vehicle enforcement documents in Utah.

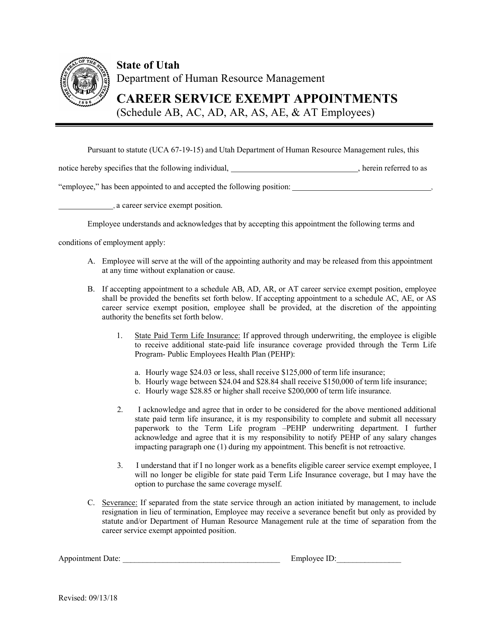

This document is for Career Service Exempt Appointments in Utah. It includes schedules AB, AC, AD, AR, AS, AE, and AT employees.

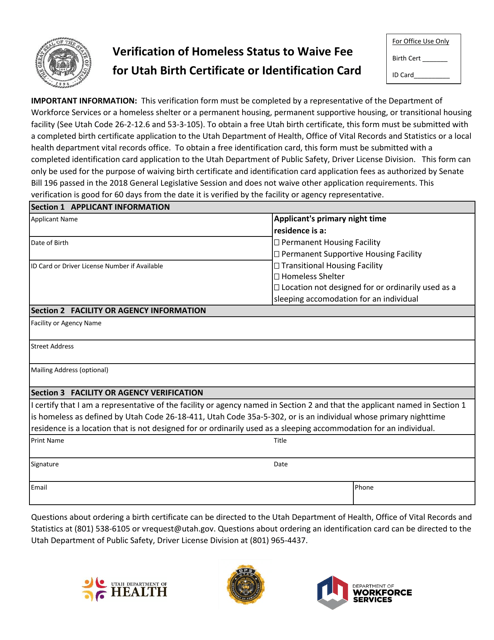

This Form is used for verifying homeless status to waive fee for obtaining a Utah birth certificate or identification card.

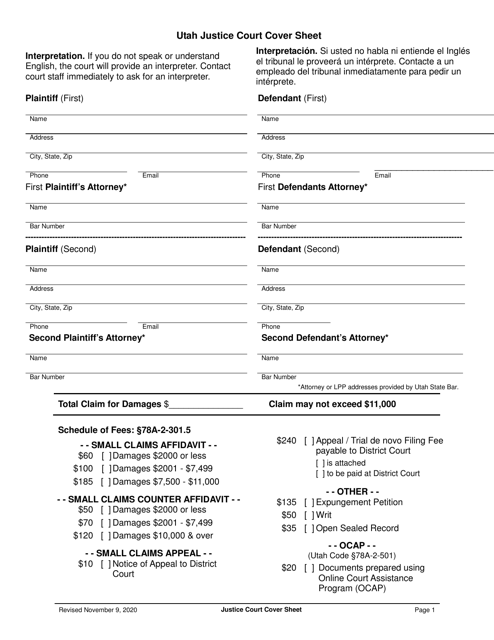

This document is a cover sheet used in the Utah Justice Court. It is available in both English and Spanish.

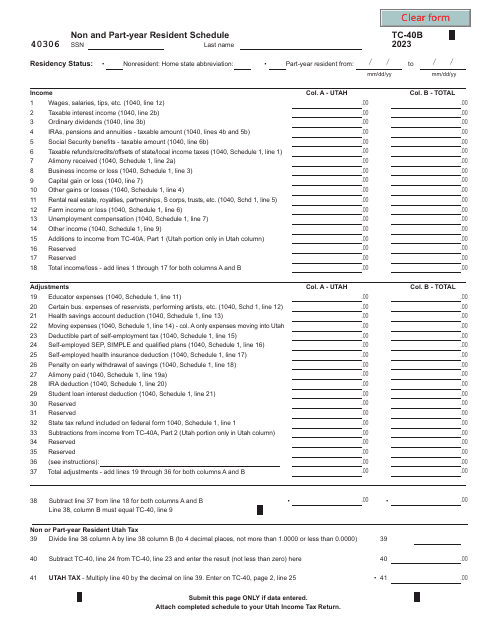

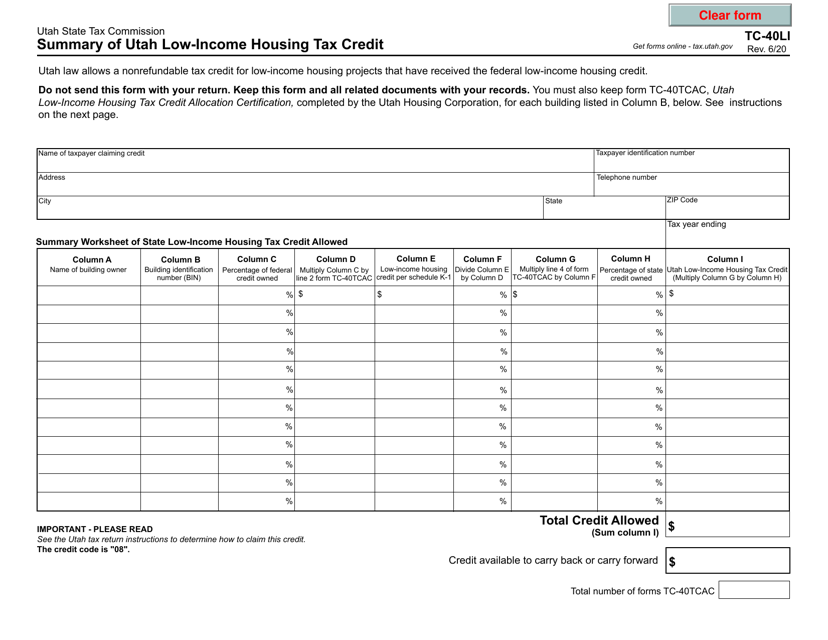

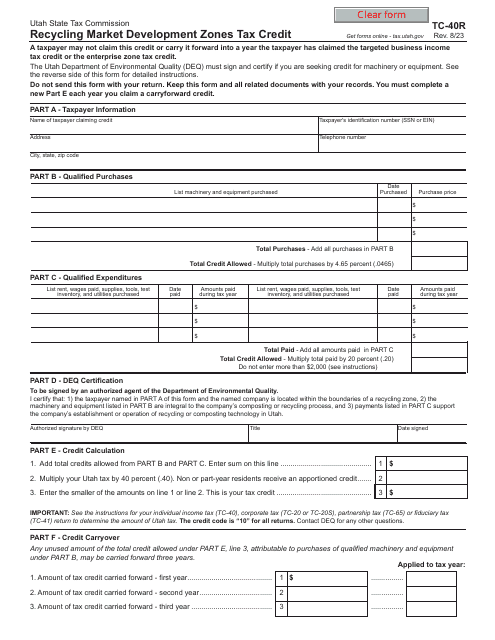

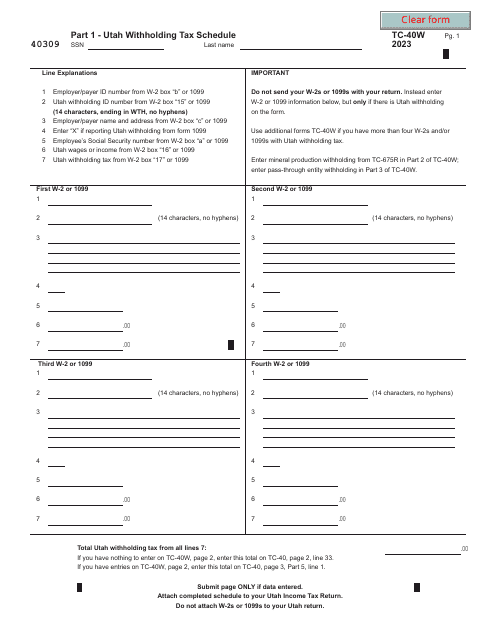

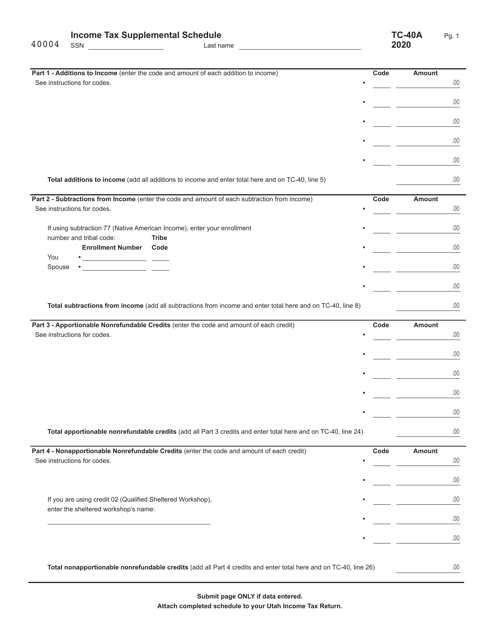

This form is used for reporting supplemental income tax information on the TC-40 Income Tax Return in the state of Utah.

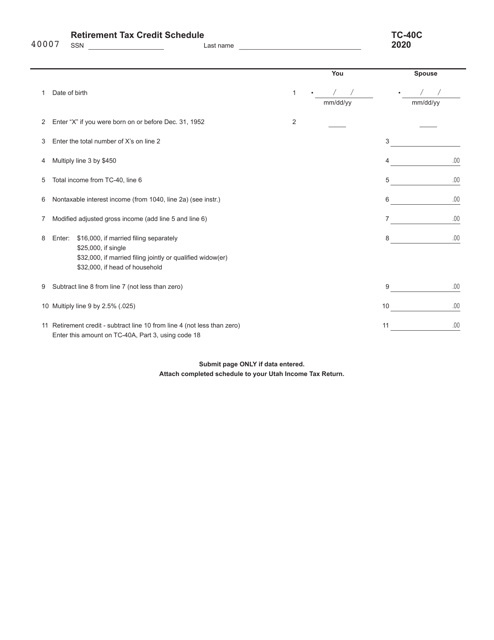

This form is used for reporting retirement tax credit in Utah. It is necessary for taxpayers to claim and calculate the credit accurately.

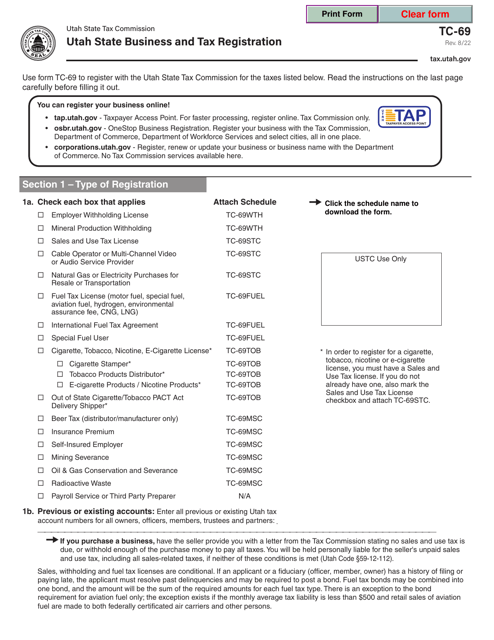

This Form is used for completing various schedules related to business activities in the state of Utah. These schedules cover topics such as income, deductions, credits, and tax liability.