Md Tax Forms and Templates

Md Tax Forms are used for reporting and filing state income taxes in the state of Maryland. These forms are required to report various types of income, deductions, credits, and other details that determine an individual's or business's tax liability to the state. Residents and businesses in Maryland need to file these tax forms annually to comply with the state's tax regulations and pay their state income taxes.

Documents:

17

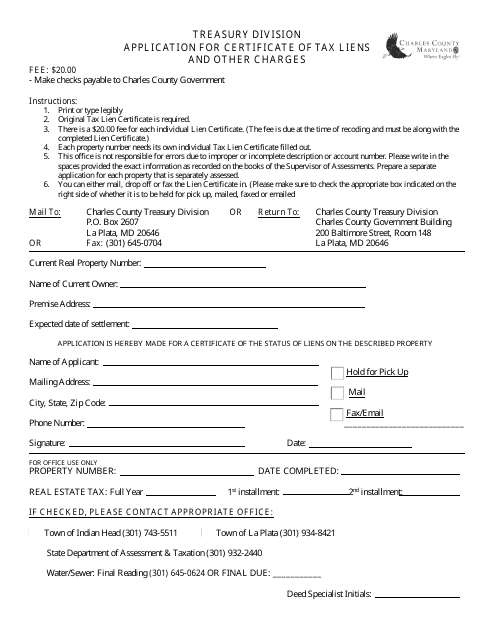

This document is used for applying for a certificate of tax liens and other charges in Charles County, Maryland. It is necessary for individuals or businesses who owe unpaid taxes or other outstanding charges to the county. The certificate serves as proof of the outstanding debts and is often required in real estate transactions or loan applications.

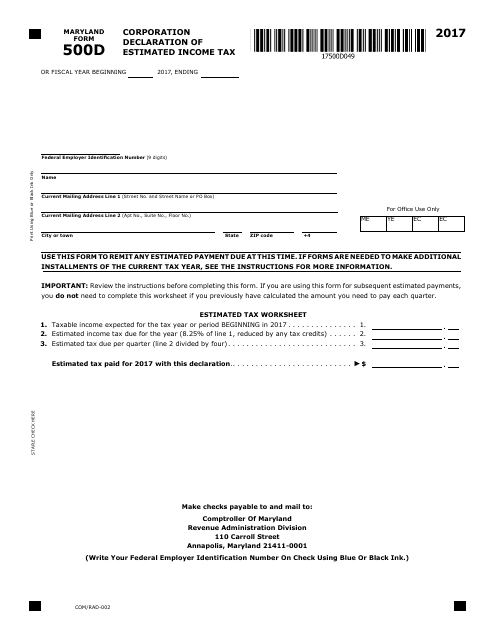

This form is used for Maryland corporations to declare their estimated income tax for the year.

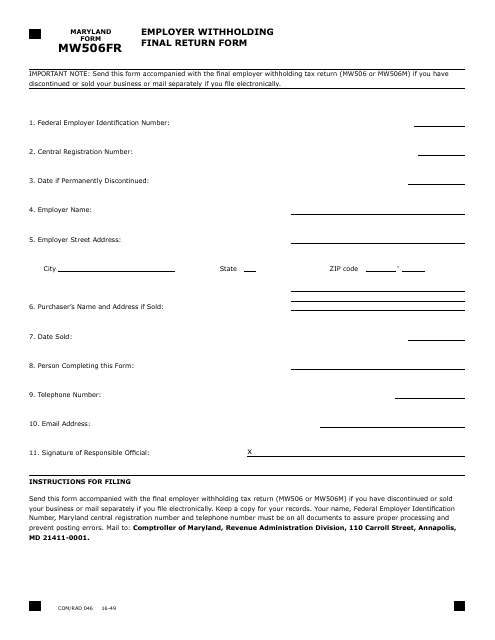

This form is used for filing the final employer withholding return for businesses in the state of Maryland. It is specifically for employers to report and remit any final withholdings from employee wages.

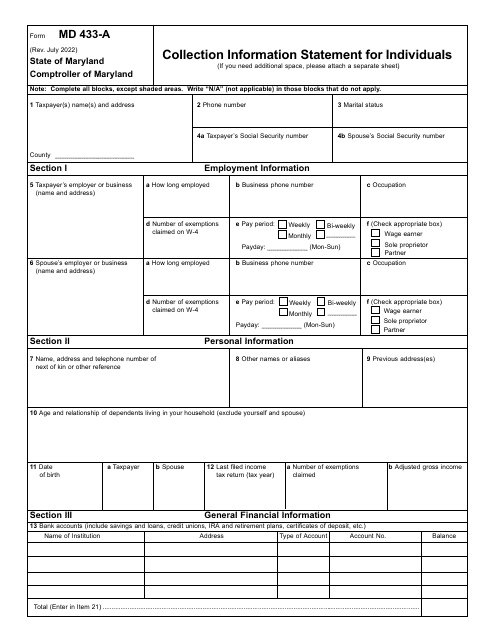

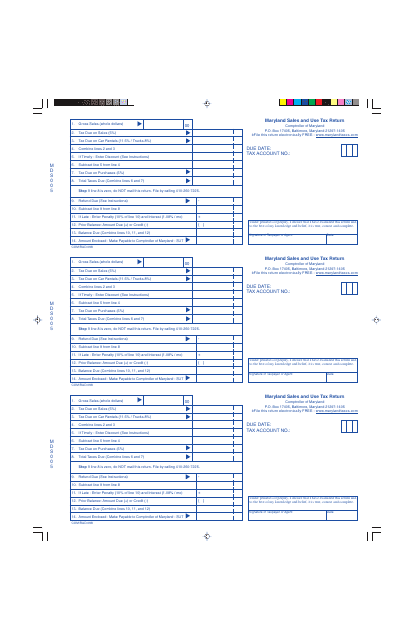

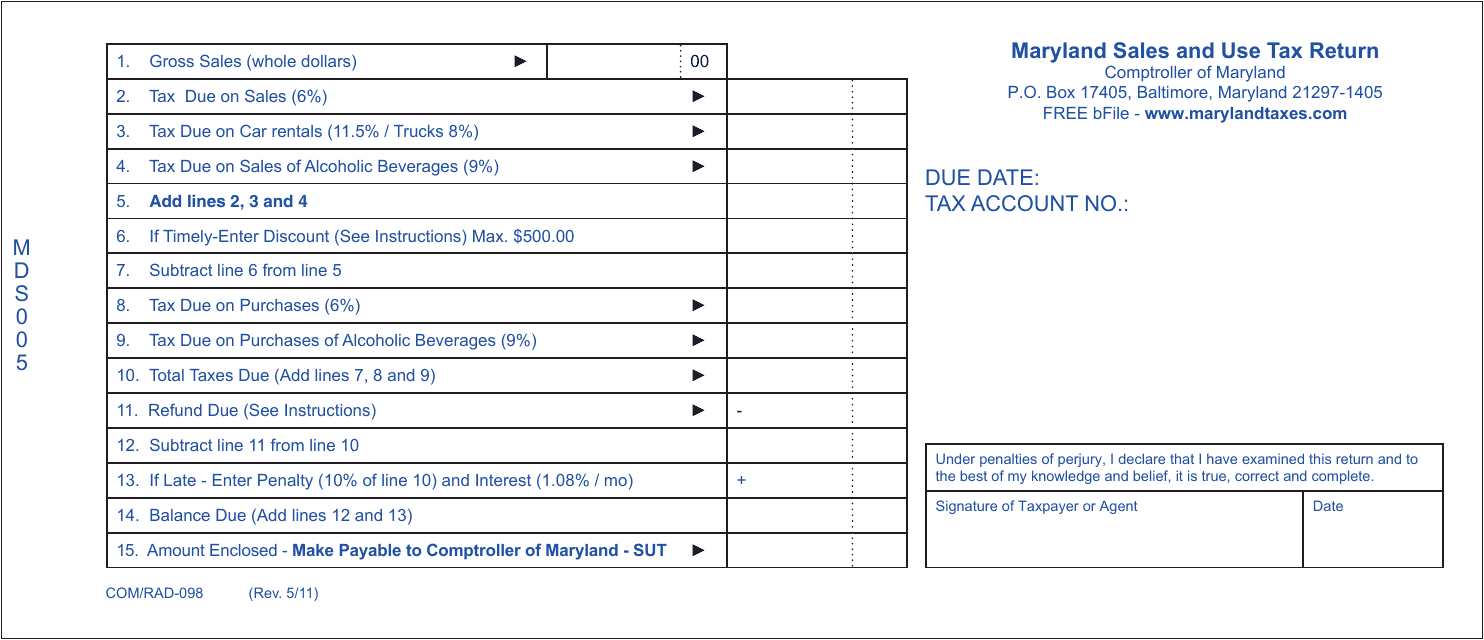

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

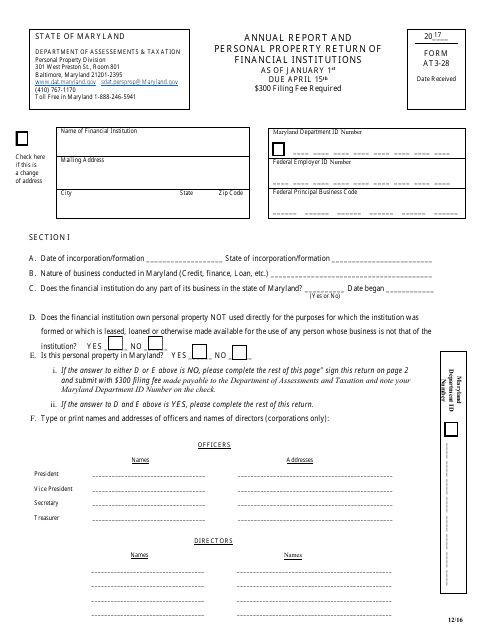

This Form is used for financial institutions in Maryland to file their annual report and personal property return.

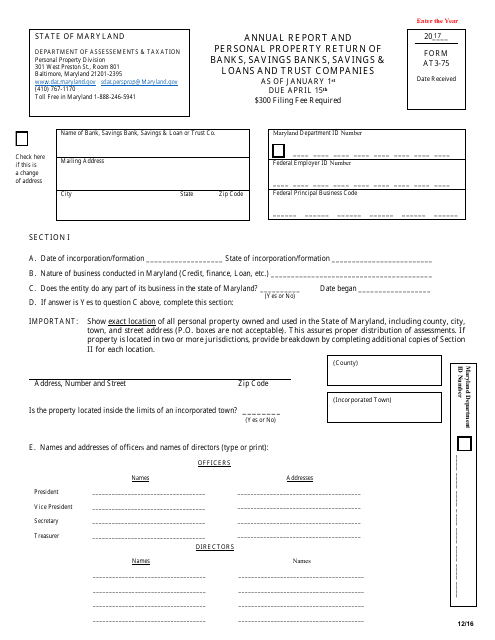

This Form is used for banks, savings banks, savings & loans and trust companies in Maryland to file their annual report and personal property return.

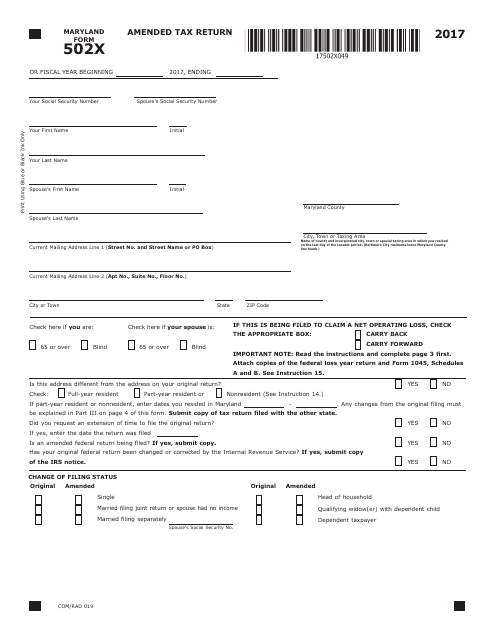

This form is used for filing an amended tax return in the state of Maryland.

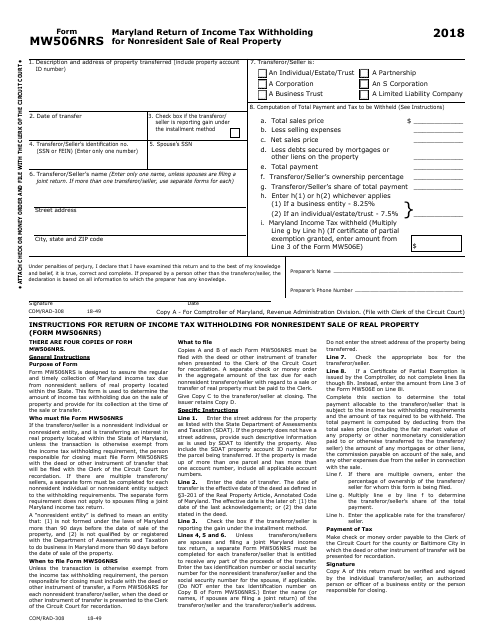

This form is used for reporting income tax withholding on the sale of real property in Maryland by nonresidents.

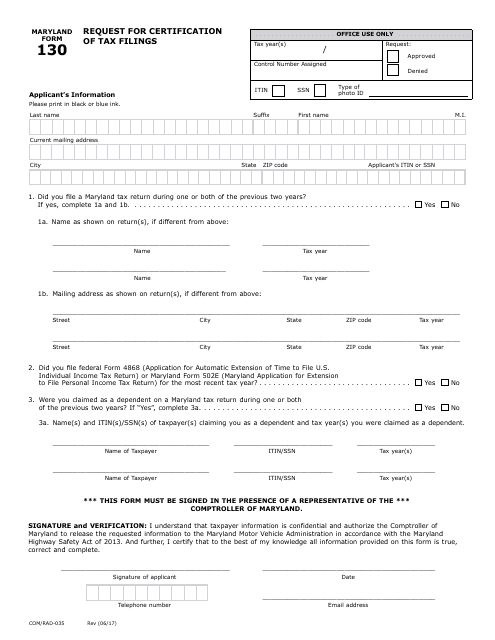

This form is used for requesting certification of tax filings in the state of Maryland.

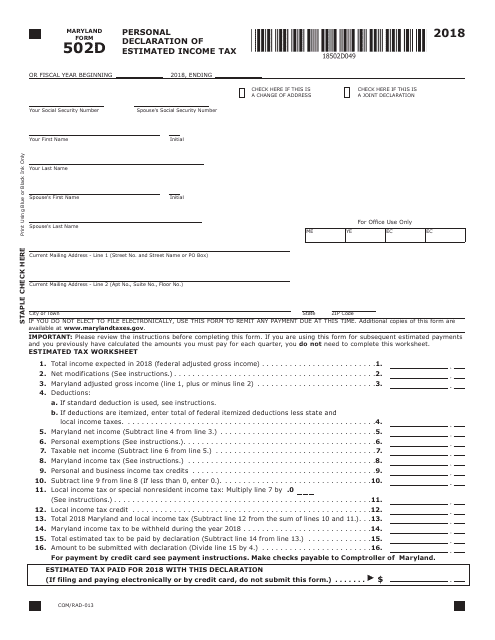

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

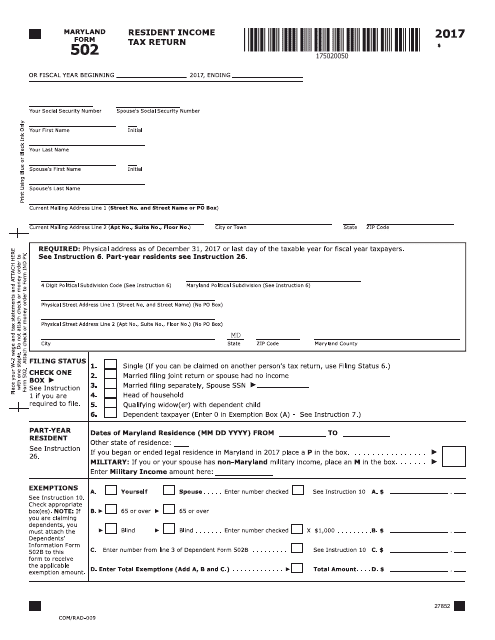

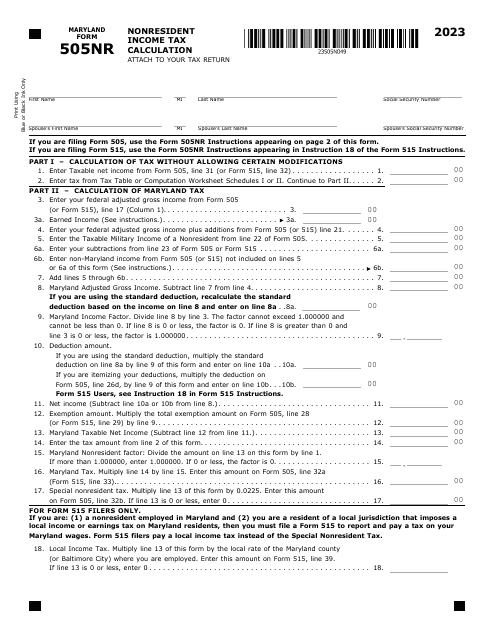

This tax form is used for Maryland residents to report their income and calculate state taxes owed or refunds.

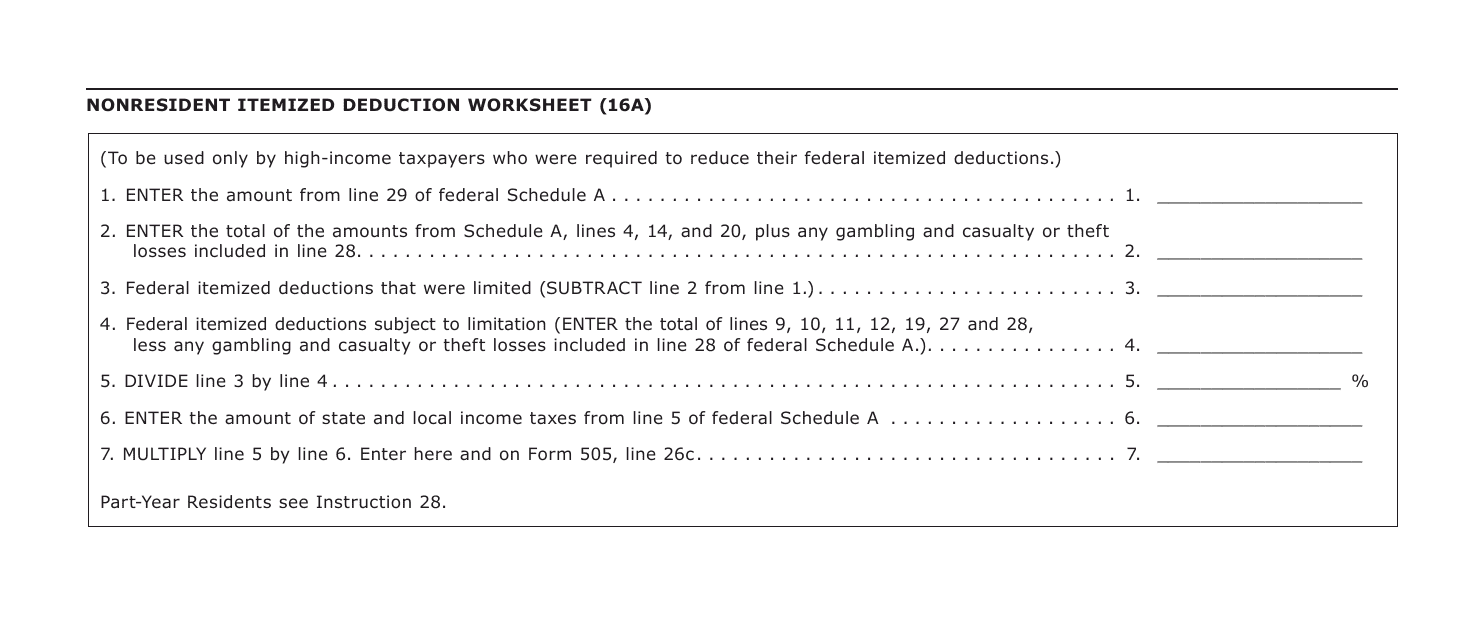

This form is used for calculating nonresident itemized deductions for Maryland state taxes.

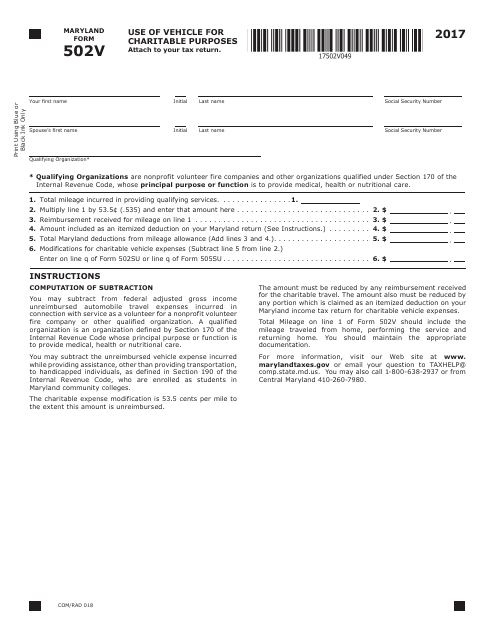

This form is used for reporting the use of a vehicle for charitable purposes in Maryland.

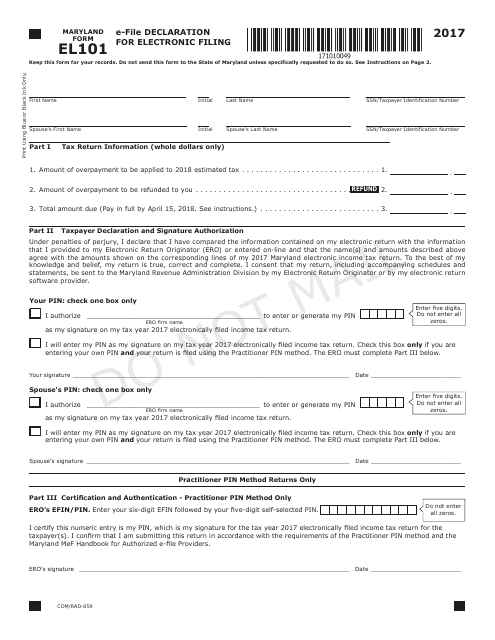

This form is used for declaring electronic filing in the state of Maryland. It is specifically for individuals who want to e-file their tax returns.