Georgia Tax Forms and Templates

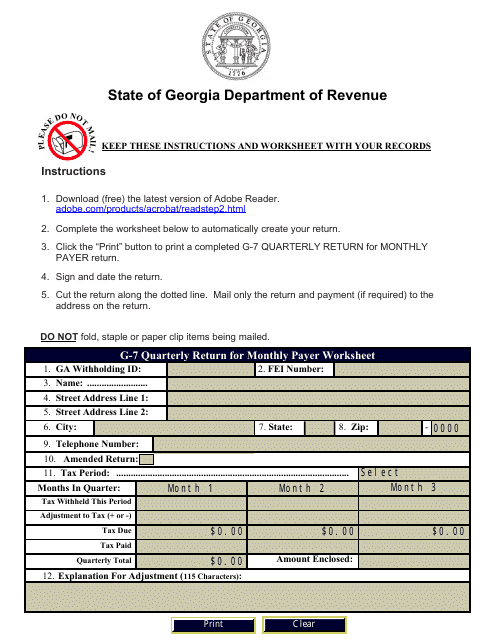

Georgia Tax Forms are used by individuals and businesses in the state of Georgia to report their income, calculate their tax liability, and fulfill their tax obligations to the Georgia Department of Revenue. These forms cover a wide range of taxes, including income tax, sales tax, property tax, and others. By completing and submitting the appropriate tax forms, taxpayers provide the necessary information for the state to determine their tax liability and ensure compliance with Georgia tax laws.

Documents:

11

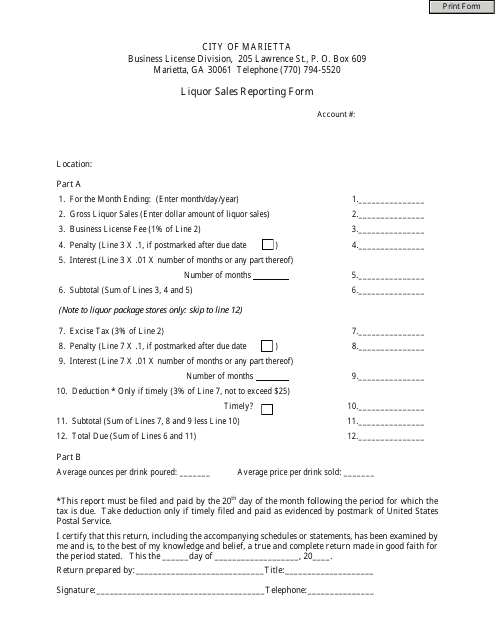

This Form is used for reporting liquor sales in the City of Marietta, Georgia, United States. It is required by the city to track and monitor liquor sales within its jurisdiction.

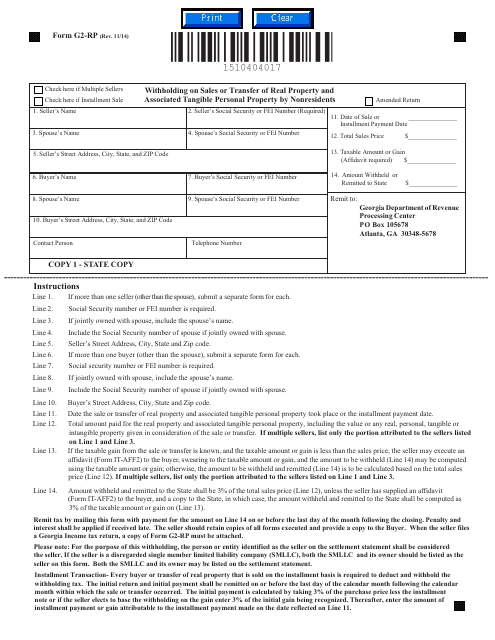

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.

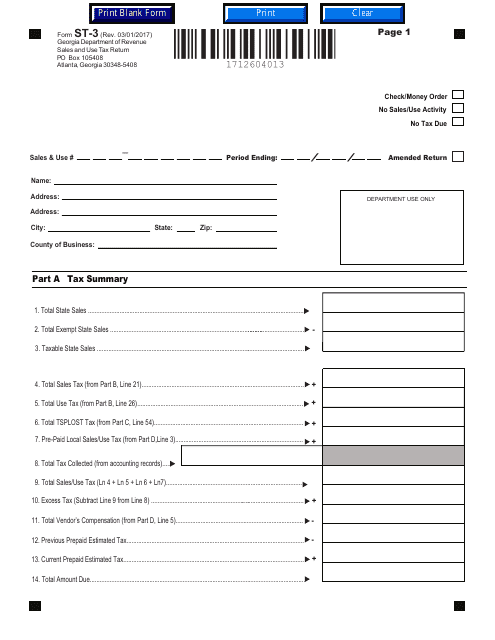

Georgia-registered organizations may use this form to report the sales and use tax they owe in the state of Georgia.

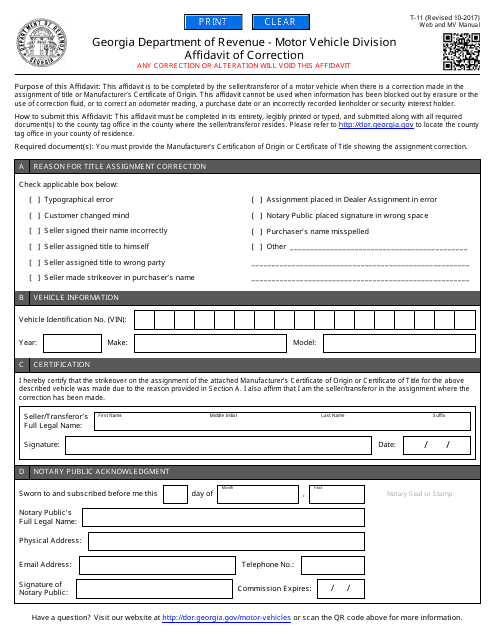

This form is used for correcting errors on a title or registration document in the state of Georgia, United States.

This is a legal document needed to gain tax exemption for the purpose of product resale in the state of Georgia.

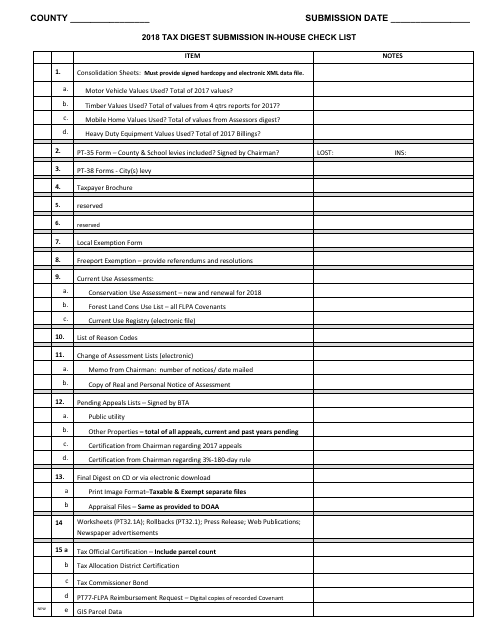

This checklist is used for submitting the tax digest in-house in the state of Georgia, United States. It provides a comprehensive list of items to be reviewed and included when submitting the tax digest.

This form is used for reporting tangible personal property for taxation purposes in the state of Georgia, United States.