Alabama Tax Forms and Templates

Alabama tax forms are used by individuals and businesses in the state of Alabama to report their income, calculate their tax liability, and claim any applicable tax credits or deductions. These forms are necessary for fulfilling the tax obligations imposed by the Alabama Department of Revenue.

Documents:

196

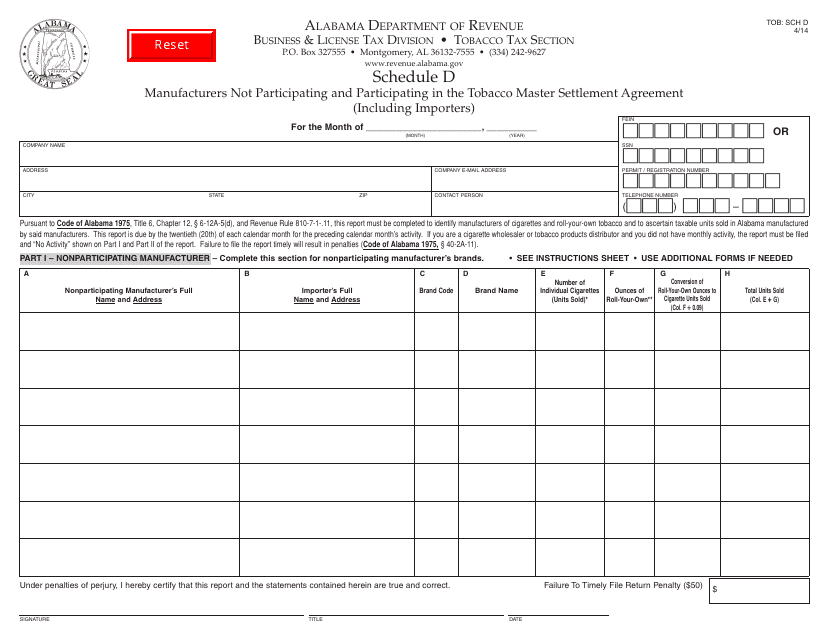

This document identifies manufacturers in Alabama that are not part of the Tobacco Master Settlement Agreement.

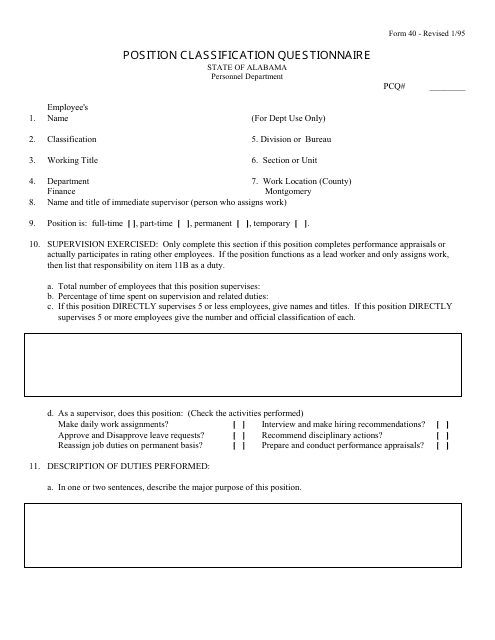

This Form is used for the Position Classification Questionnaire in Alabama.

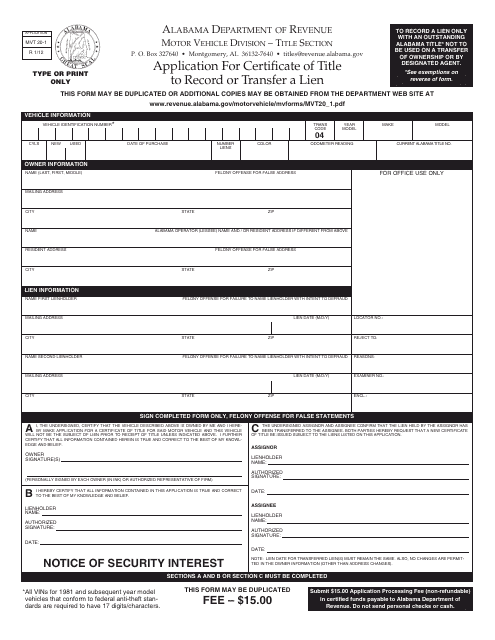

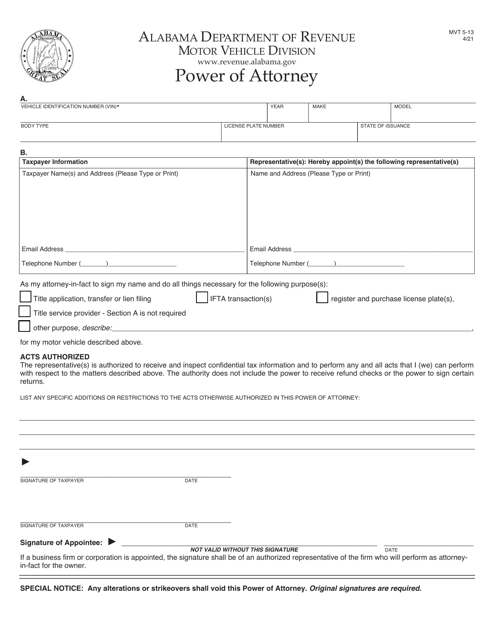

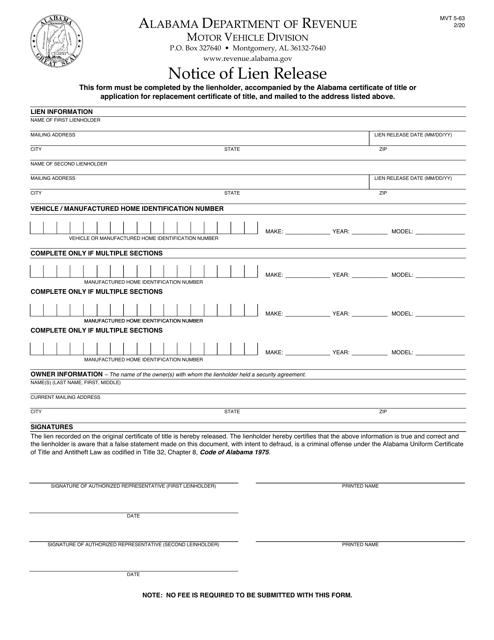

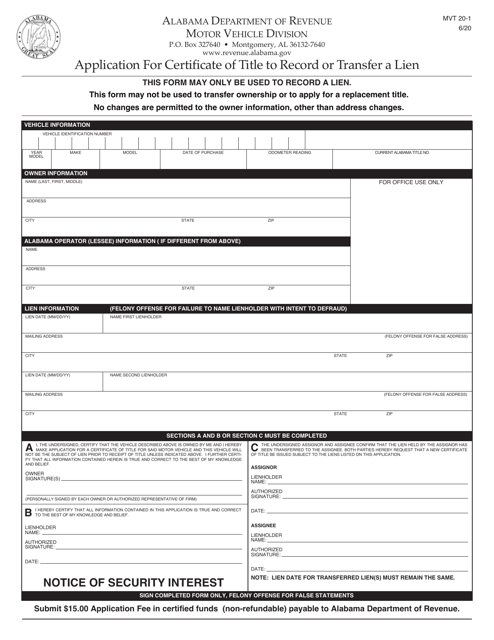

This form is used for applying for a certificate of title in Alabama, in order to record or transfer a lien on a vehicle.

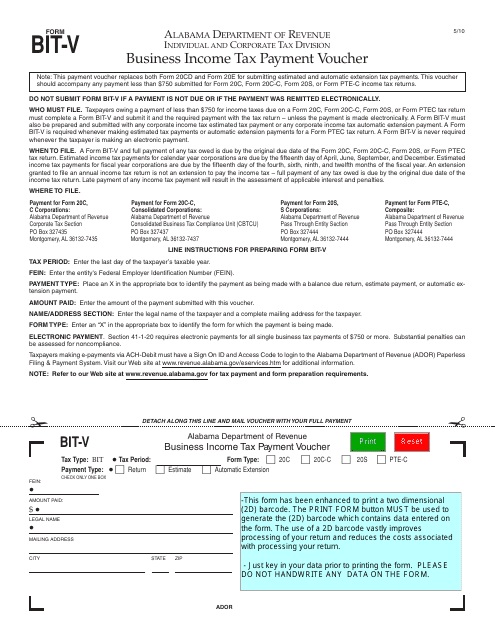

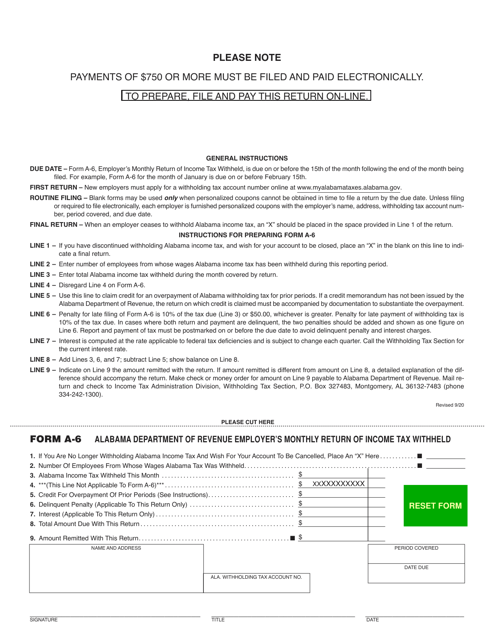

This Form is used for submitting business income tax payment in the state of Alabama.

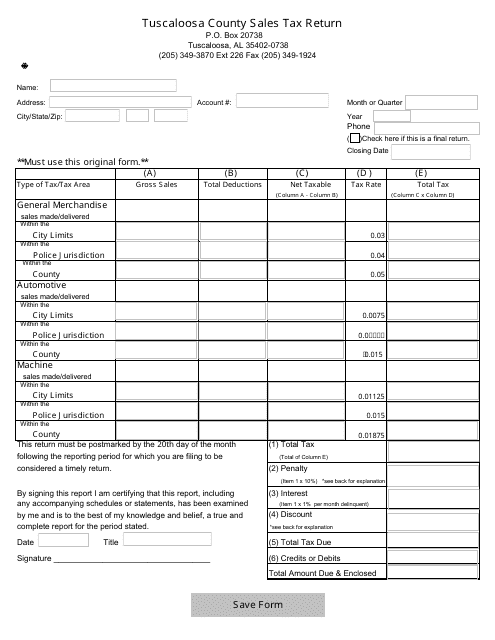

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

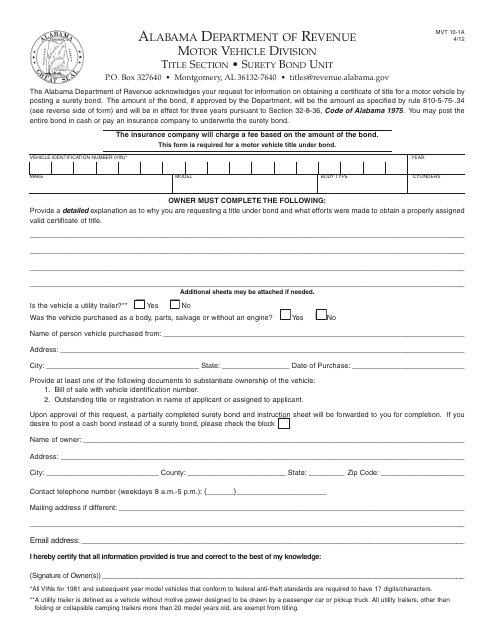

This form is used for requesting a surety bond in Alabama.

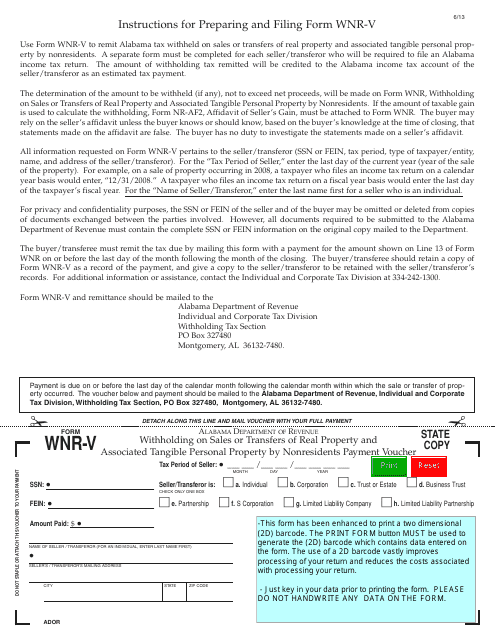

This form is used for making payment vouchers for nonresidents who are withholding on sales or transfers of real property and associated tangible personal property in Alabama.

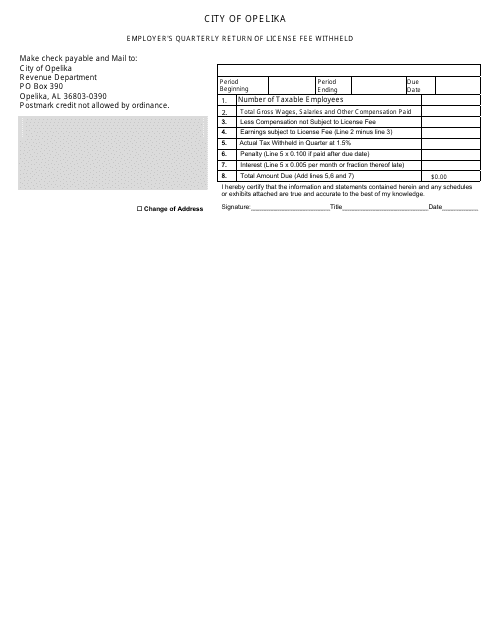

This type of document is used for reporting and submitting the license fees withheld by employers to the City of Opelika, Alabama on a quarterly basis.

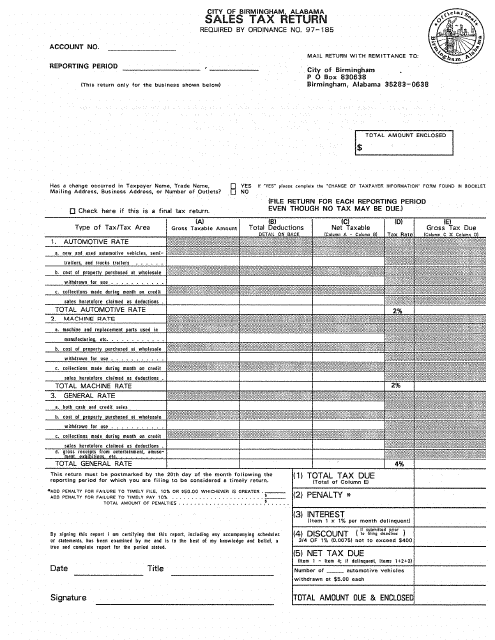

This Form is used for submitting sales tax returns to the City of Birmingham, Alabama.

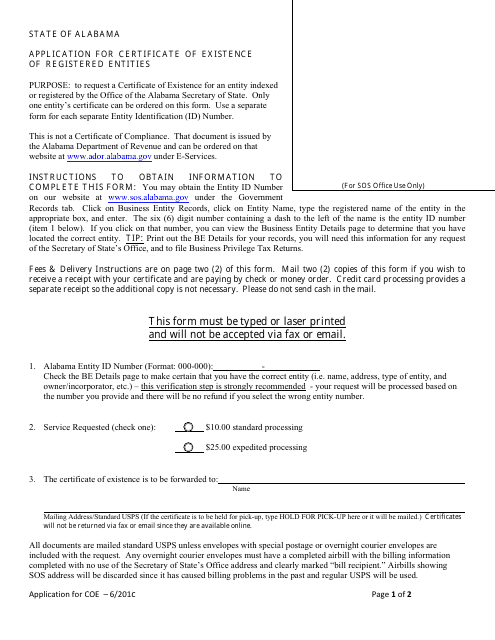

This form is used for requesting a Certificate of Existence for registered entities in Alabama, confirming their legal status.

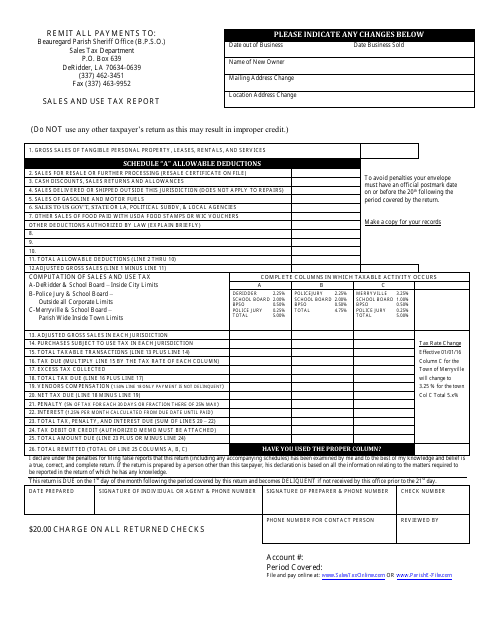

This Form is used for reporting sales and use tax in Beauregard Parish, Louisiana.

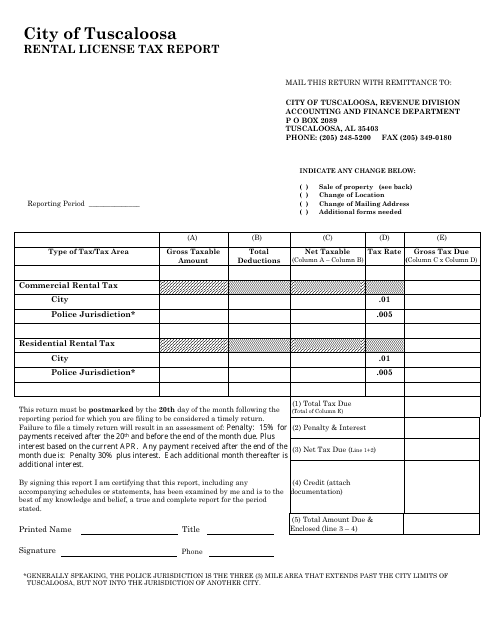

This document is a rental license tax report form specific to the City of Tuscaloosa, Alabama. It is used by rental property owners to report and pay taxes related to their rental income in the city.

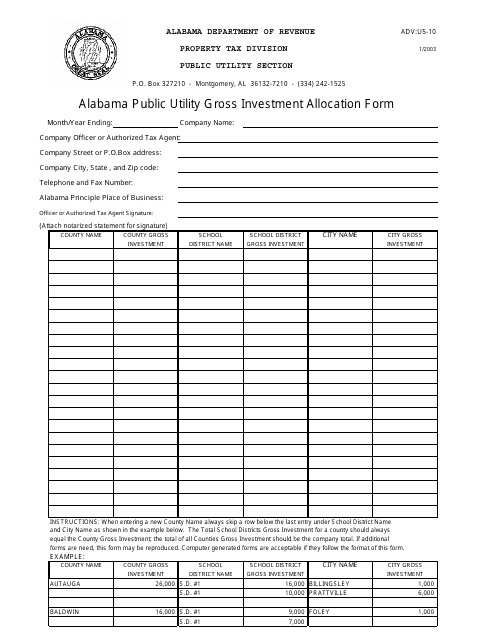

This document is used for the allocation of gross investments in Alabama public utility companies.

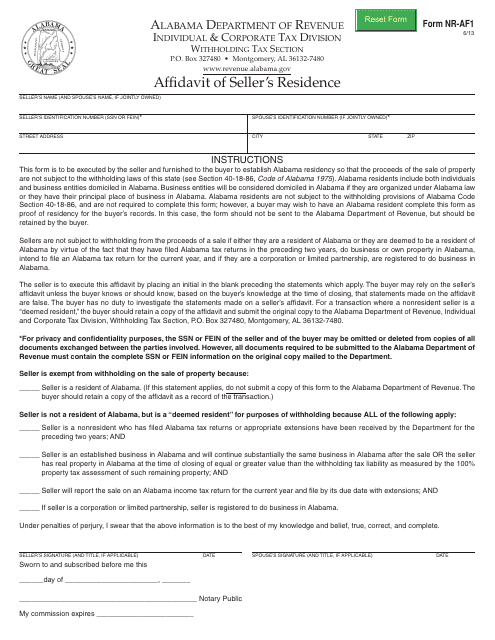

This form is used for sellers in Alabama to provide an affidavit of their residence.

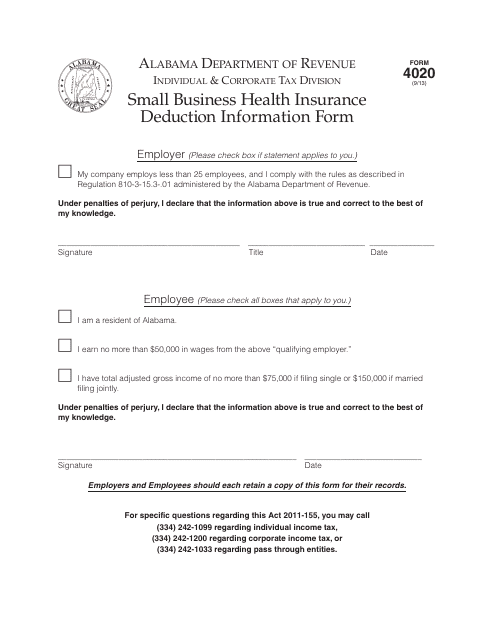

This Form is used for providing information about the small business health insurance deduction in the state of Alabama.

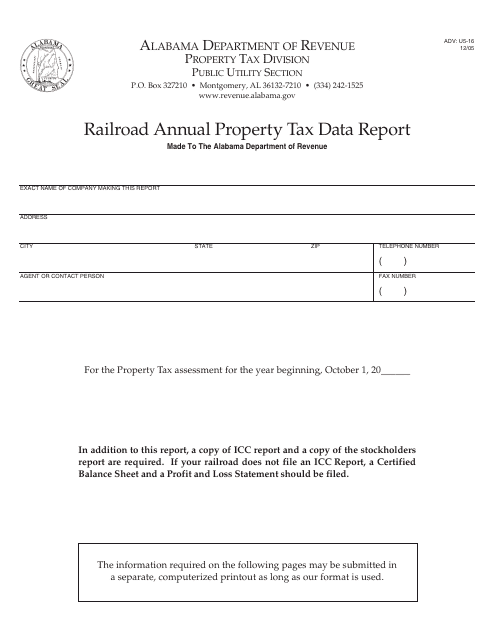

This Form is used for reporting annual property tax data for railroads in Alabama.

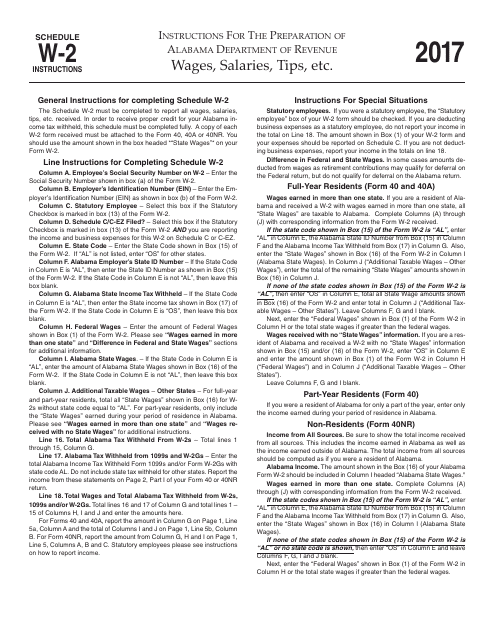

This Form is used for reporting wages, salaries, tips, and other income earned in the state of Alabama. It provides instructions on how to fill out Form W-2 for tax purposes.

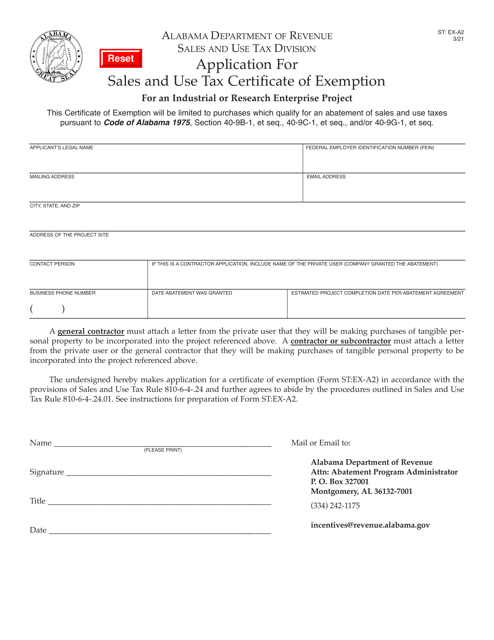

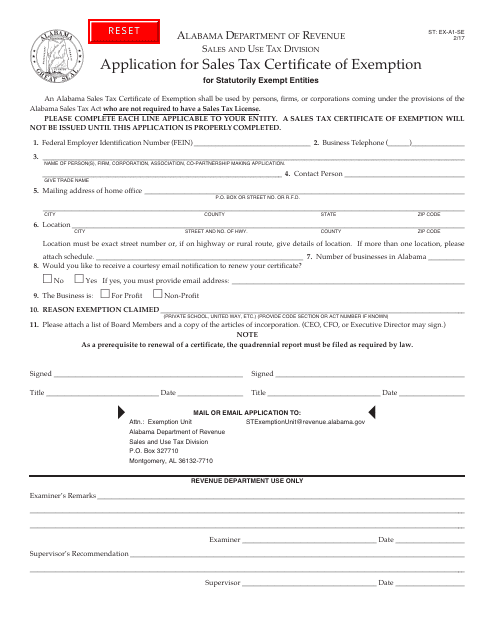

This form is used for applying for a Sales Tax Certificate of Exemption for Statutorily Exempt Entities in Alabama.

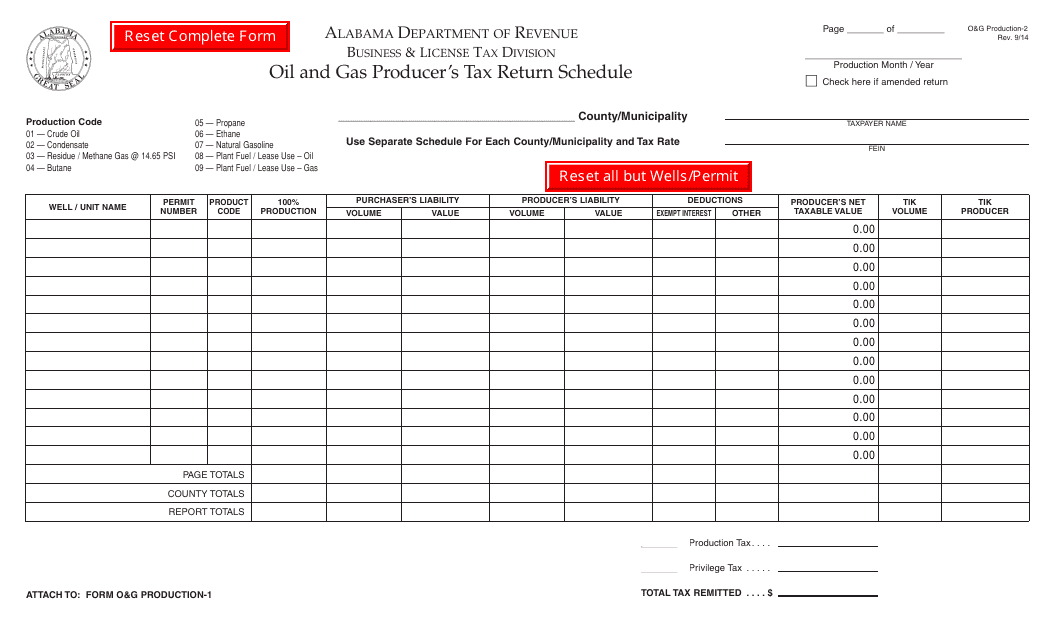

This document is used for filing the Oil and Gas Producer's Tax Return Schedule in the state of Alabama. It is used by individuals or businesses involved in oil and gas production to report their tax liabilities.

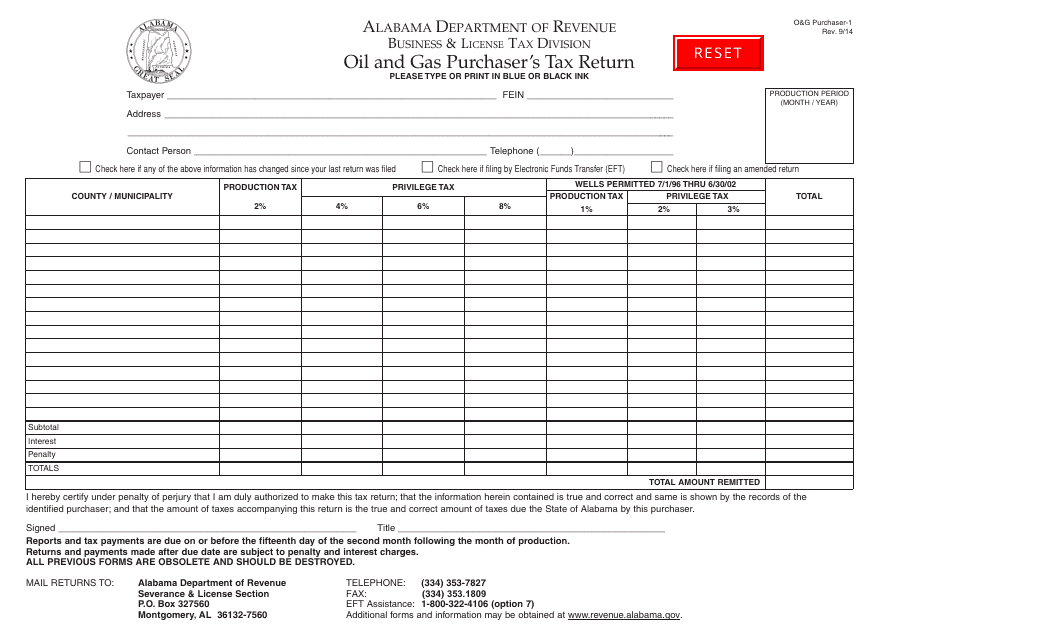

This document is used for submitting tax returns for oil and gas purchasers in Alabama.

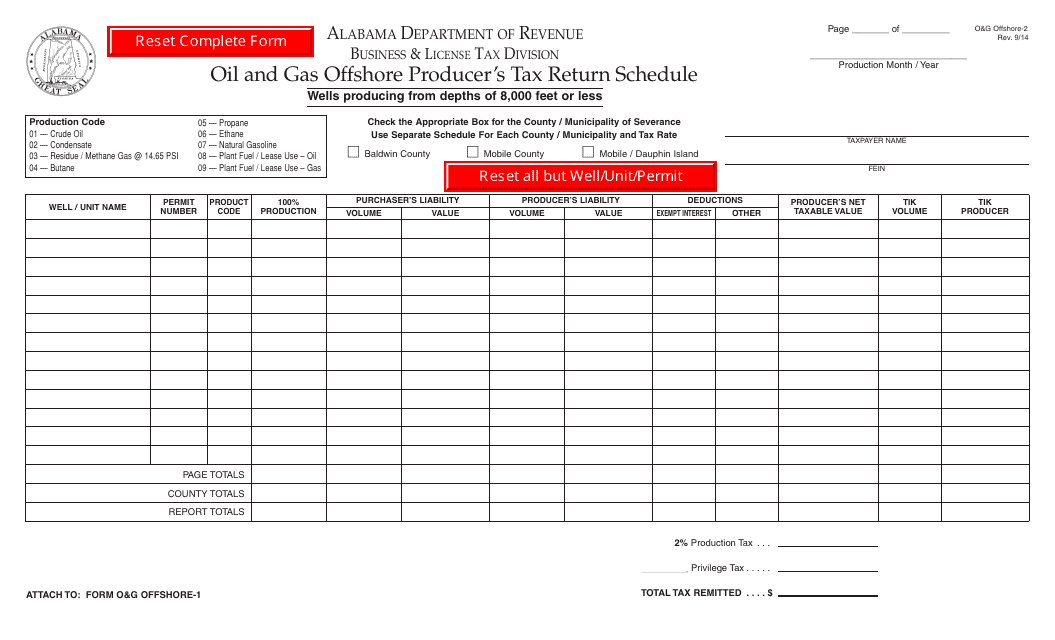

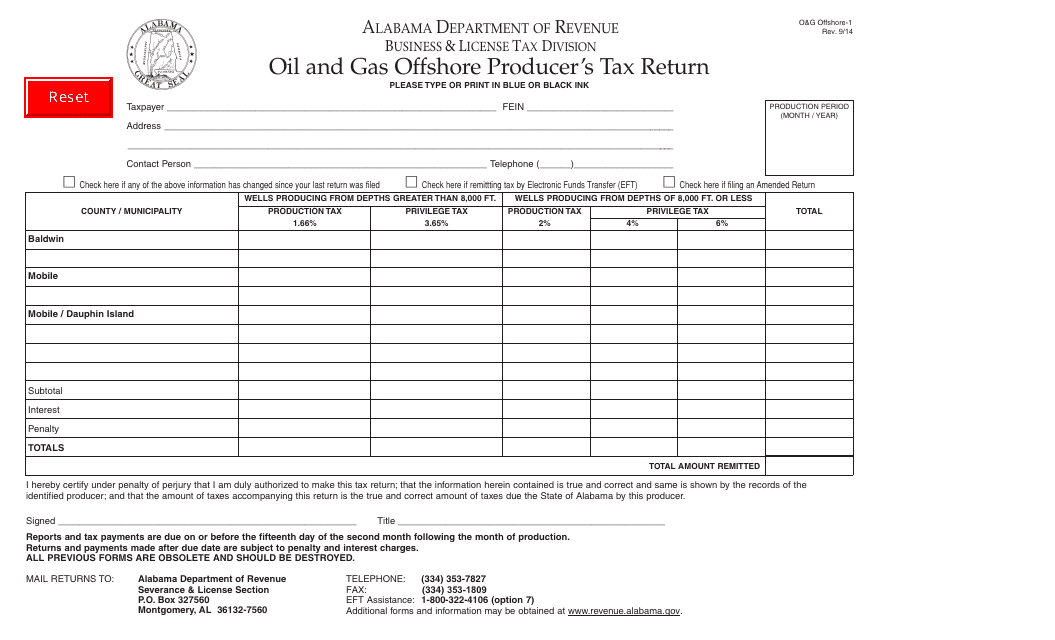

This form is used for reporting and paying the oil and gas offshore producer's tax in Alabama.

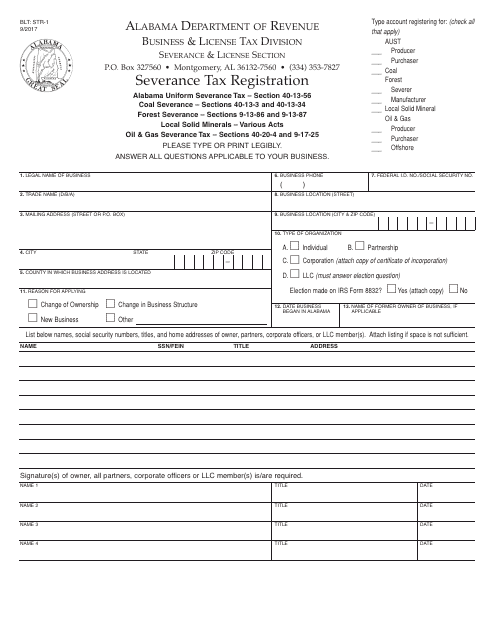

This Form is used for registering for severance tax in the state of Alabama. It is required for individuals and businesses engaged in extracting natural resources such as oil, gas, and minerals.

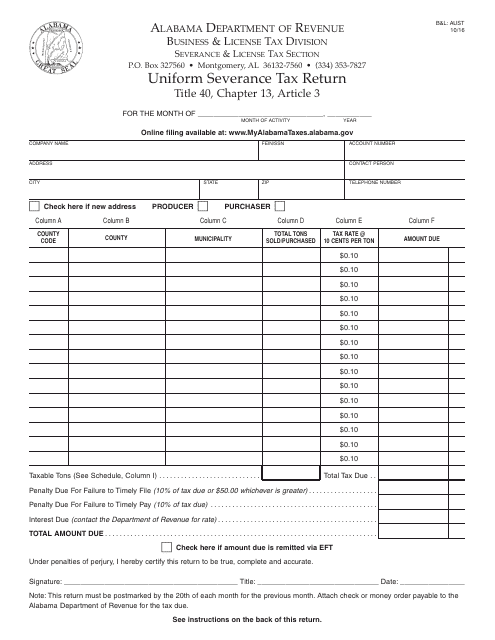

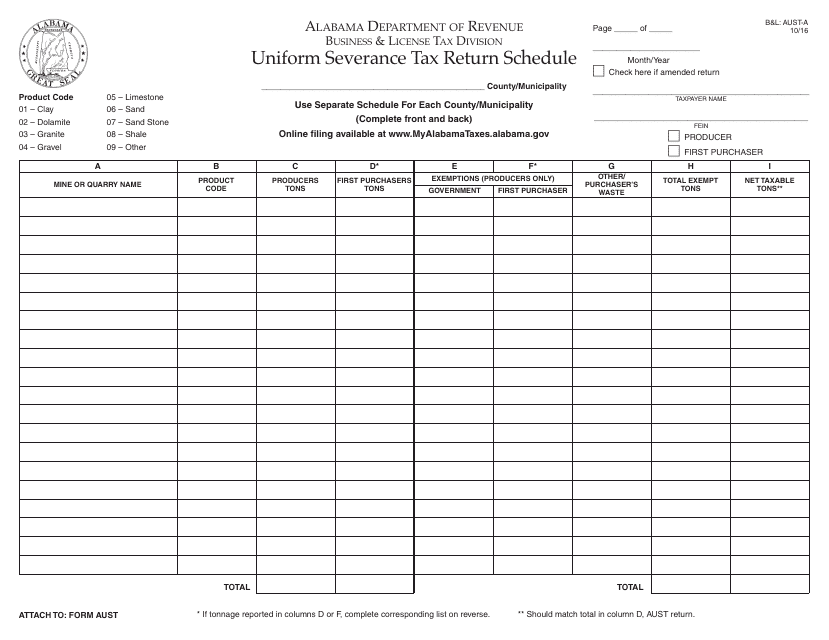

This form is used for filing the uniform severance tax return in the state of Alabama. It is necessary for businesses operating in the state to report and pay their severance taxes using this form.

This form is used for reporting and paying the uniform severance tax in the state of Alabama.

This form is used for filing the oil and gas offshore producer's tax return in Alabama.

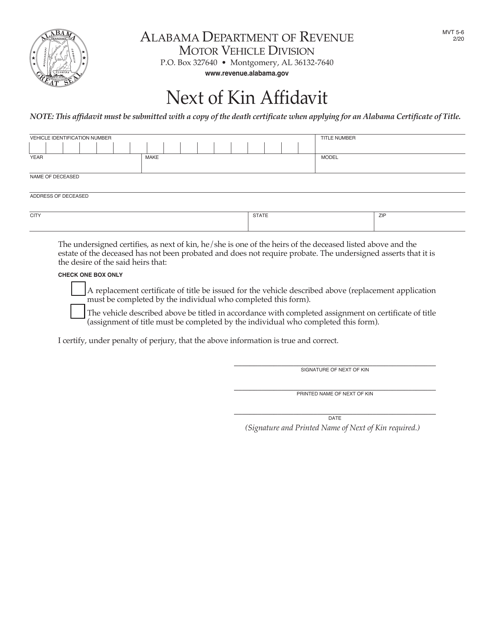

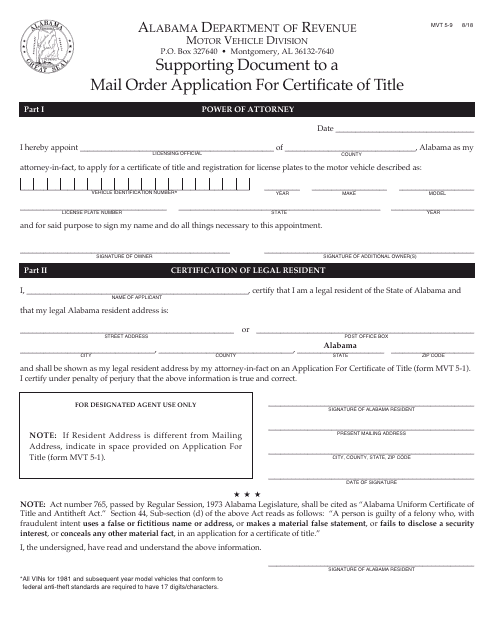

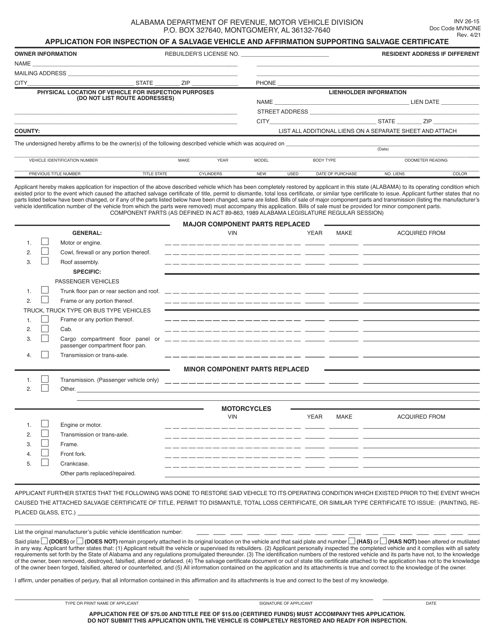

This form is used as a supporting document for a mail order application for a certificate of title in Alabama. It is necessary to complete the application process.

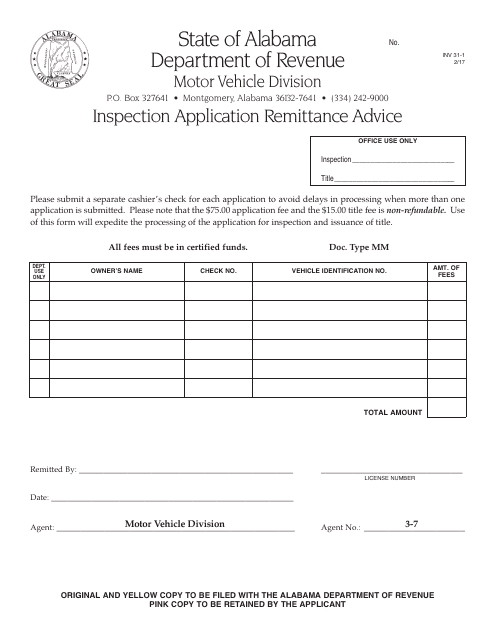

This form is used for submitting an inspection application and remittance advice in the state of Alabama. It is a required document for those seeking to schedule an inspection and provide payment for the service.