Illinois Tax Forms and Templates

Illinois Tax forms are used by individuals and businesses in the state of Illinois to report their income and calculate the amount of tax they owe. These forms are used to accurately calculate and file state taxes with the Illinois Department of Revenue.

Documents:

30

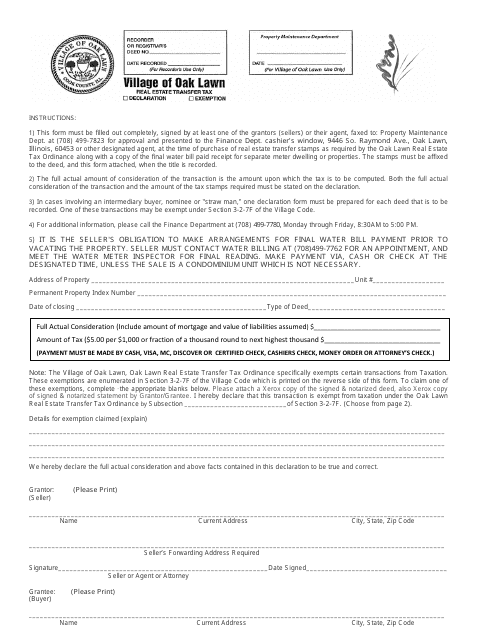

This form is used for reporting and paying the real estate transfer tax in Oak Lawn, Illinois. The tax is levied on the transfer of real property within the city limits.

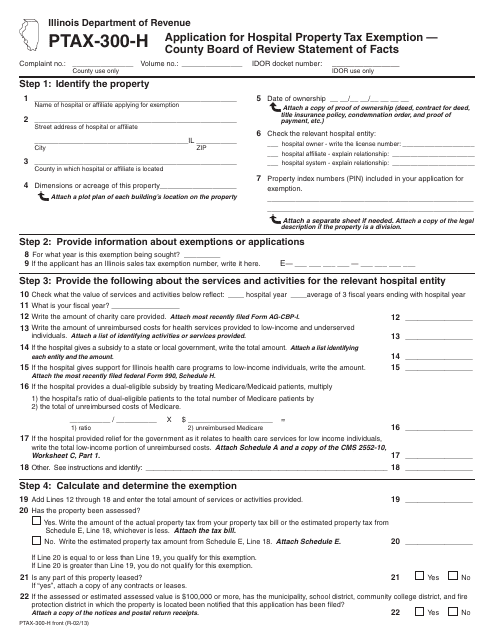

This form is used for applying for hospital property tax exemption in Illinois. It includes a statement of facts that must be submitted to the County Board of Review.

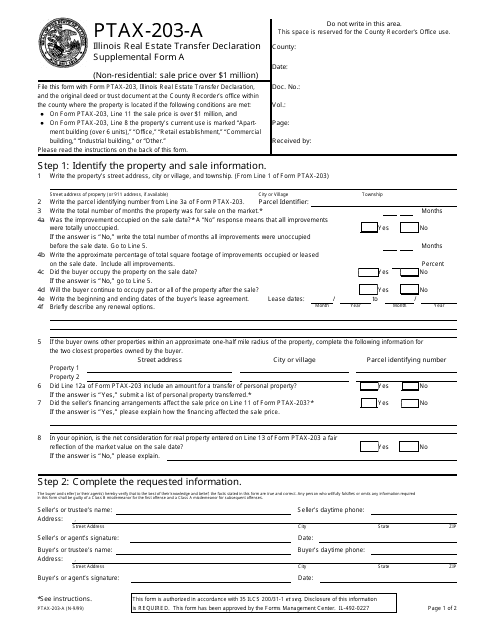

This Form is used for providing additional information for the Real Estate Transfer Declaration in Illinois.

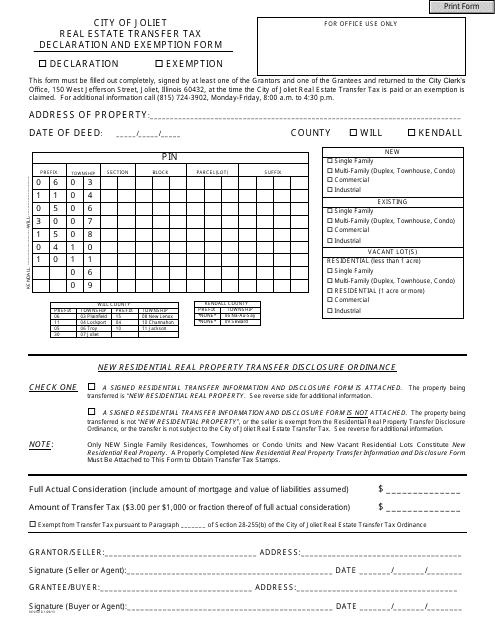

This document is used for declaring and seeking exemptions from real estate transfer taxes in the City of Joliet, Illinois.

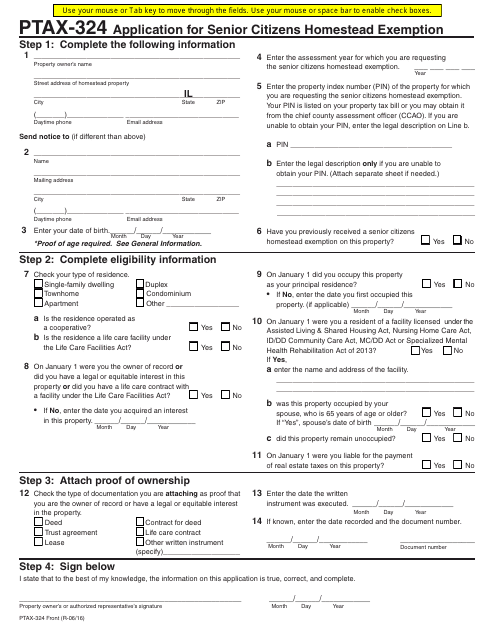

This form is used for applying for the Senior Citizens Homestead Exemption in Illinois.

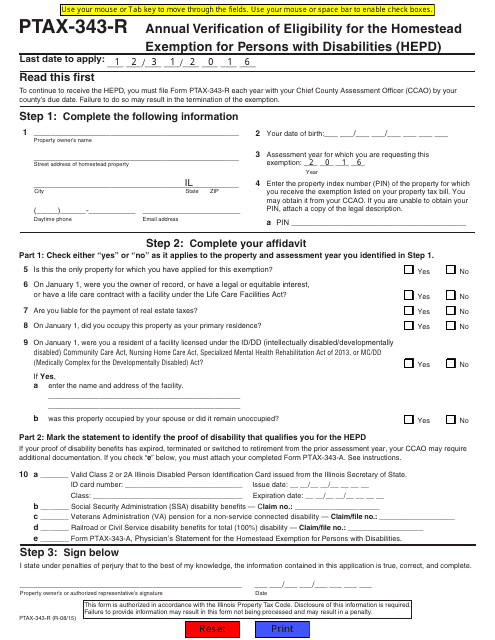

This form is used for annual verification of eligibility for the Homestead Exemption for Persons with Disabilities (HEPD) in Illinois.

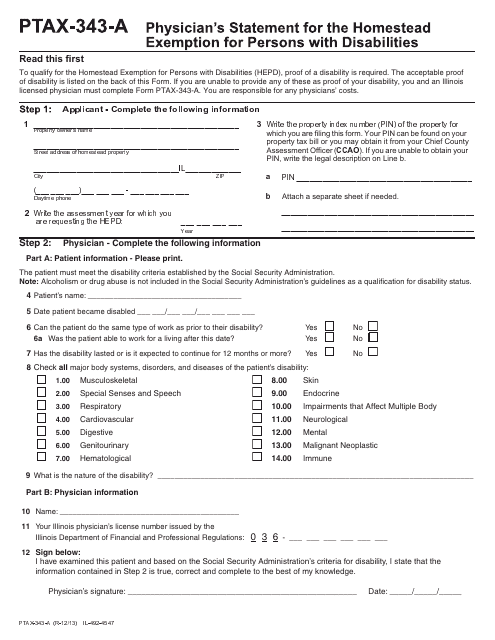

This form is used for applying for a tax exemption for persons with disabilities in the state of Illinois. Physicians need to complete this form to provide supporting medical information.

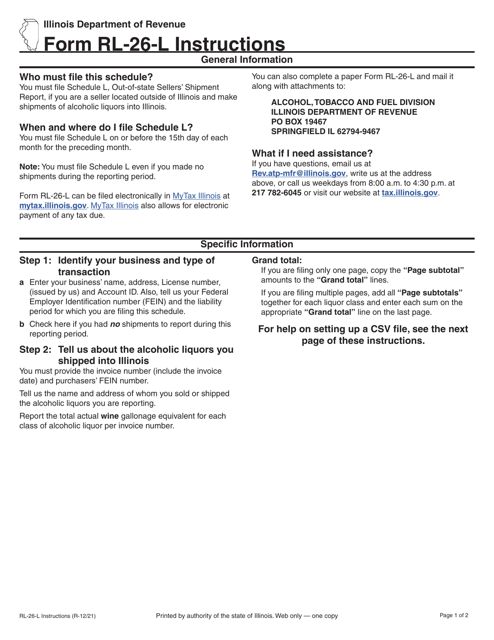

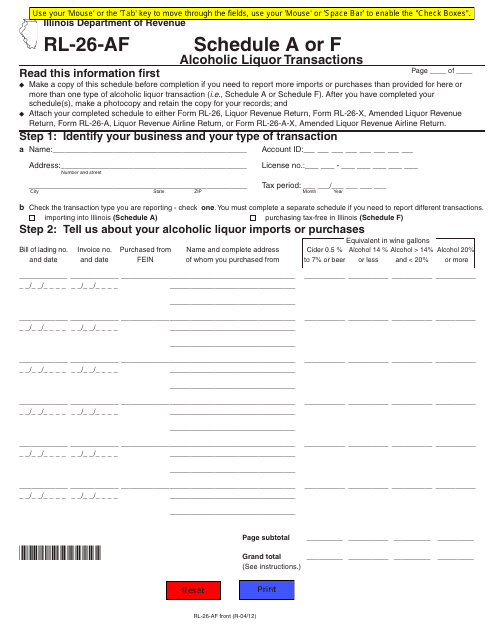

This form is used for reporting alcoholic liquor transactions in Illinois.

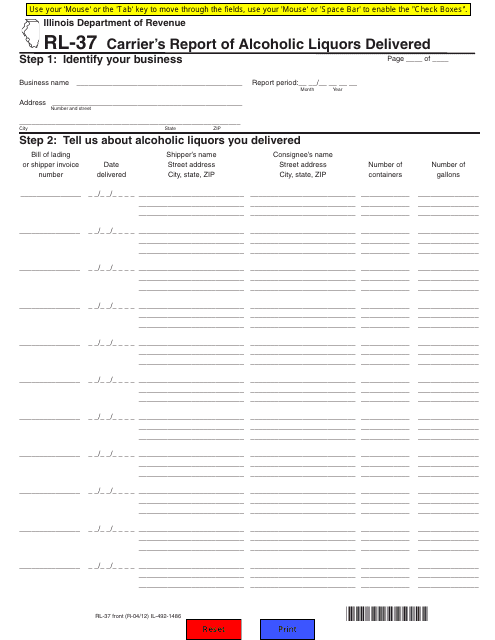

This form is used for Illinois carriers to report the delivery of alcoholic liquors. It is a required document for compliance purposes.

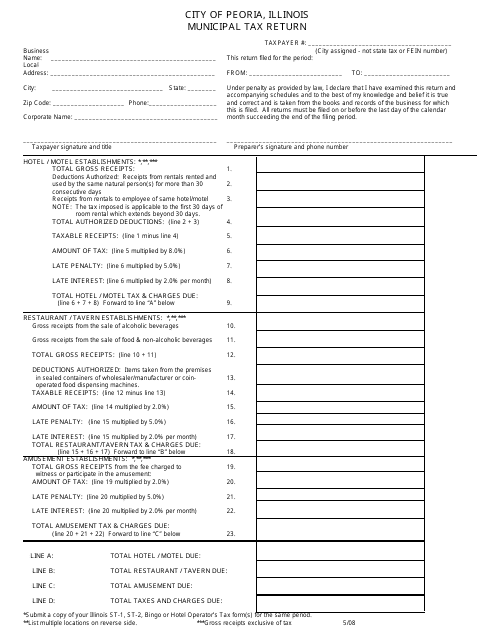

This type of document is used for reporting and filing municipal taxes for residents of Peoria, Illinois.

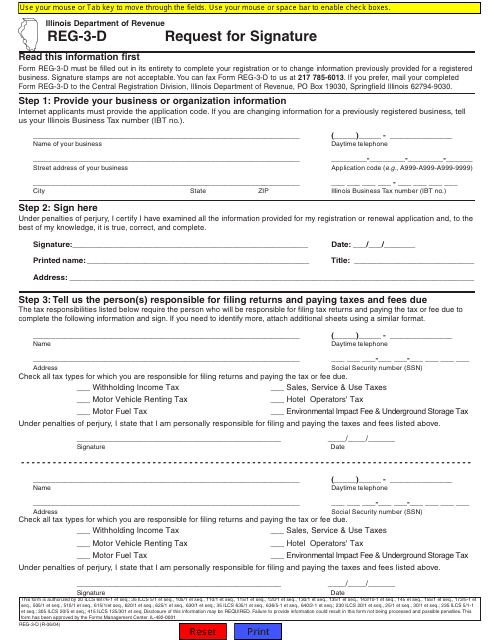

This Form is used for requesting a signature in the state of Illinois.

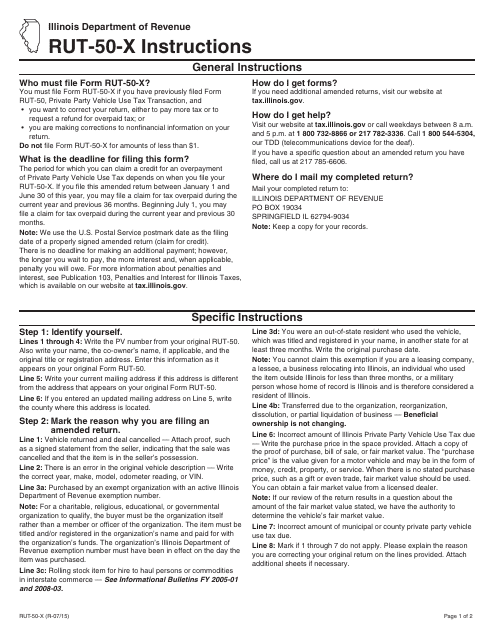

This form is used for amending a private party vehicle use tax transaction in Illinois. It provides instructions on how to properly complete the Form RUT-50-X.

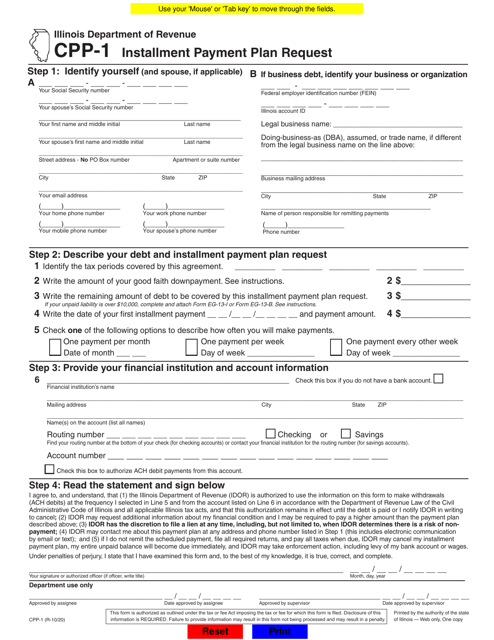

This Illinois form is filled out by taxpayers who have tax delinquencies they cannot pay in full. If you have a financial hardship and would like to sign an installment payment plan with the Department of Revenue, complete a CPP-1 Form.

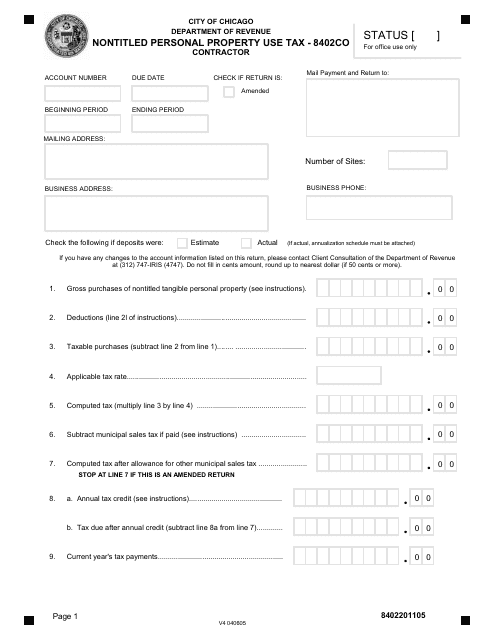

This form is used for reporting and paying the nontitled personal property use tax in the City of Chicago, Illinois.

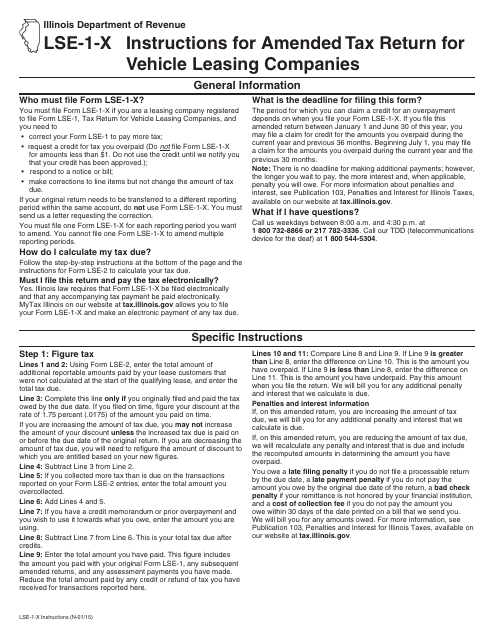

This form is used for filing an amended tax return for vehicle leasing companies in the state of Illinois. It provides instructions on how to complete and submit the Form LSE-1-X to accurately report any changes or corrections to the previously filed tax return.

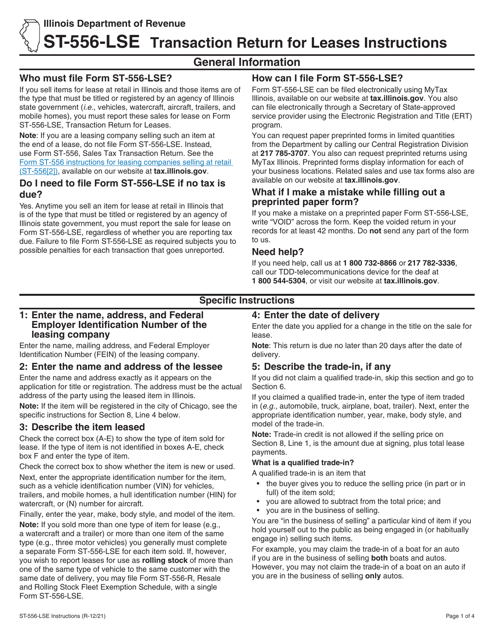

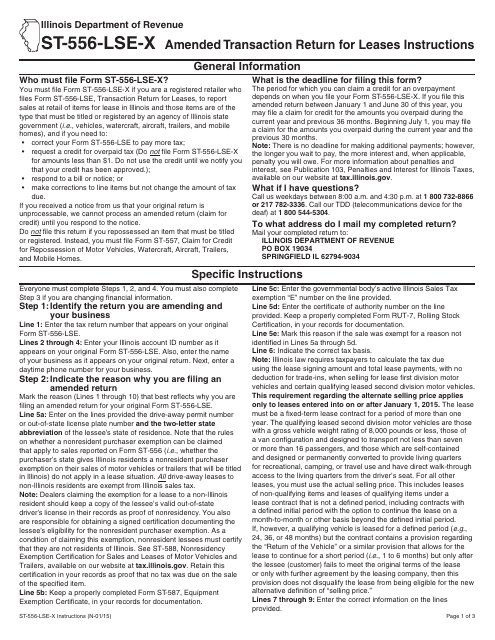

This Form is used for filing an amended transaction return for leases in the state of Illinois. It provides instructions on how to report changes or corrections to previously filed lease transactions.

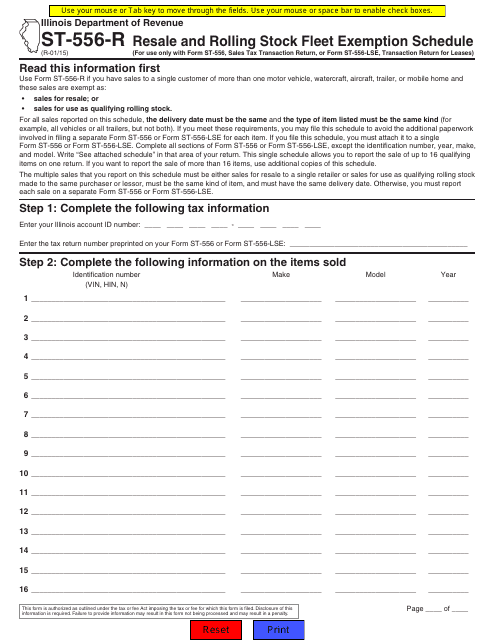

This form is used for reporting the resale and exemption schedule for rolling stock fleets in the state of Illinois.

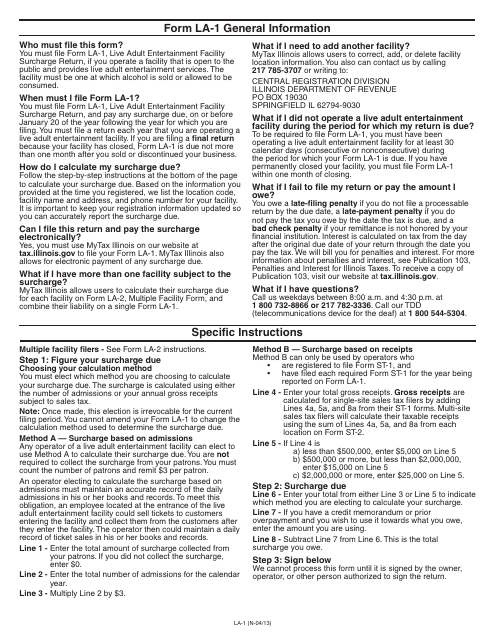

This form is used for reporting and paying the Live Adult Entertainment Facility Surcharge in the state of Illinois.

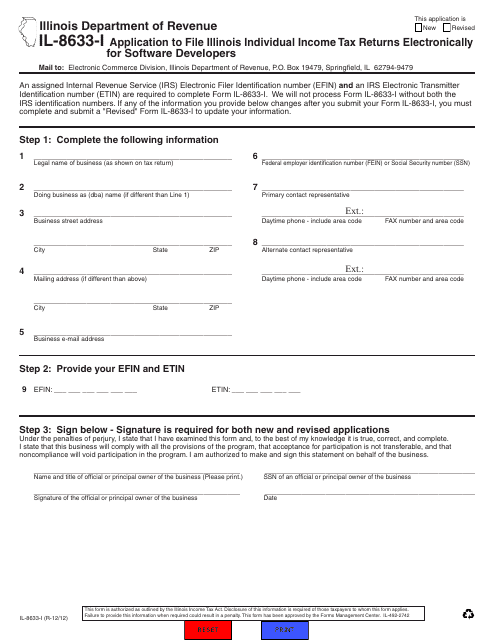

This Form is used for software developers in Illinois to apply for electronic filing of individual income tax returns.

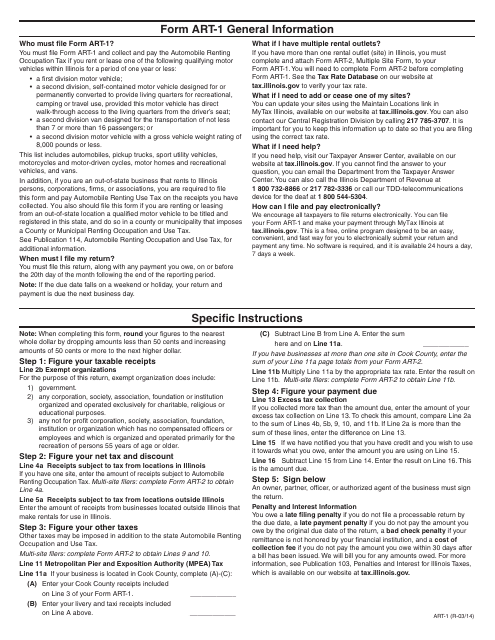

This document is used for filing the Automobile Renting Occupation and Use Tax Return in Illinois. It provides instructions on how to fill out the form and submit the tax return.

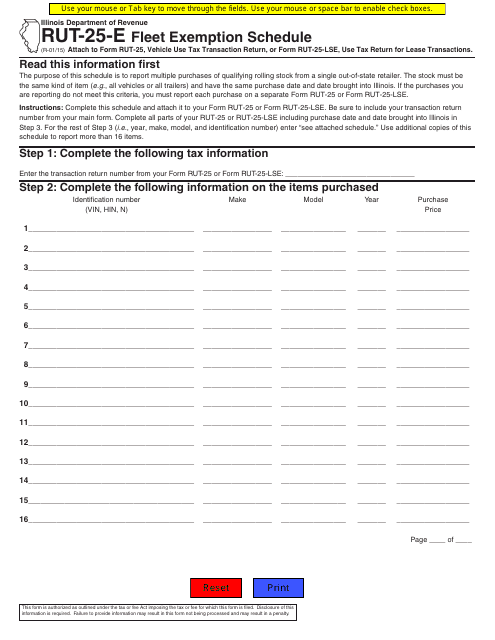

This form is used for fleet exemption schedule in Illinois. It is specifically for Form RUT-25-E.

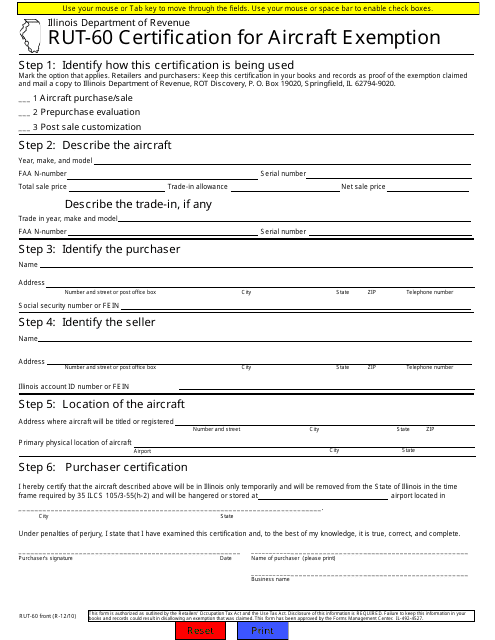

This form is used for aircraft owners in Illinois to certify their eligibility for exemption from certain taxes.

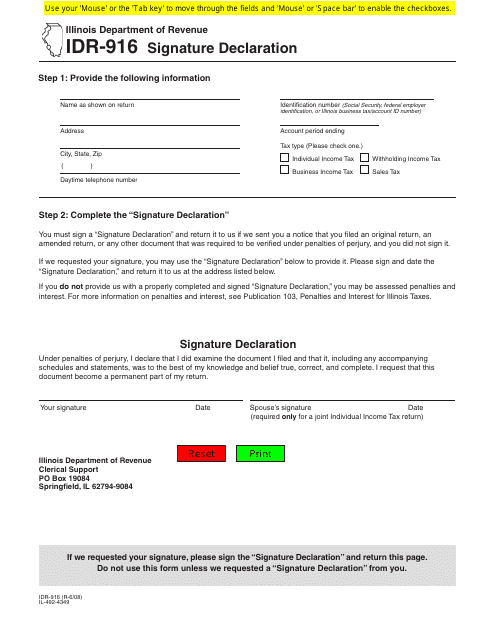

This form is used for declaring signatures in the state of Illinois. It is used to verify the authenticity of a signature on a document or form.

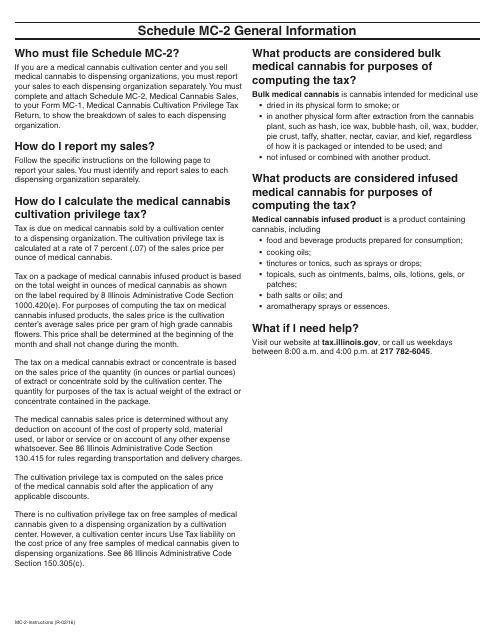

This Form is used for reporting medical cannabis sales in the state of Illinois. It provides instructions for completing Form 962 Schedule MC-2.

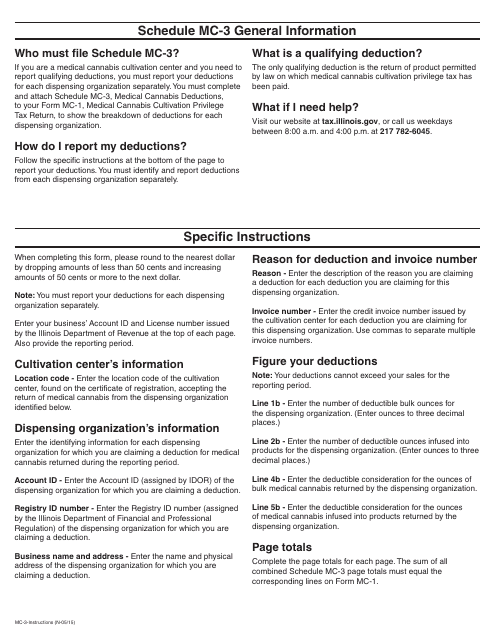

This Form is used for claiming medical cannabis deductions in Illinois on Schedule MC-3. It provides instructions on how to accurately report and calculate deductions related to medical cannabis expenses.

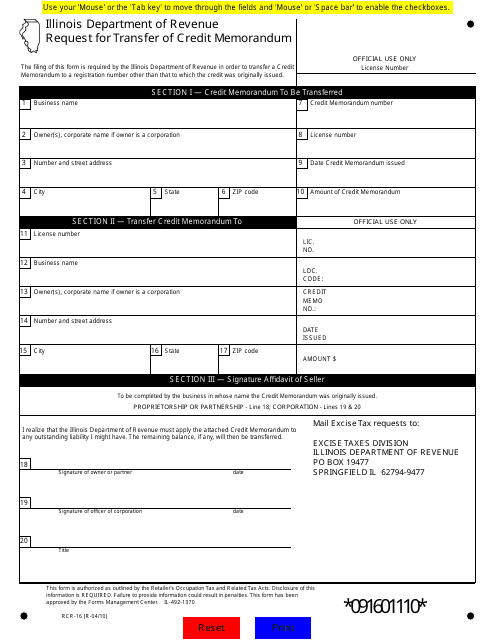

This form is used for making a request to transfer credit memorandums in the state of Illinois.