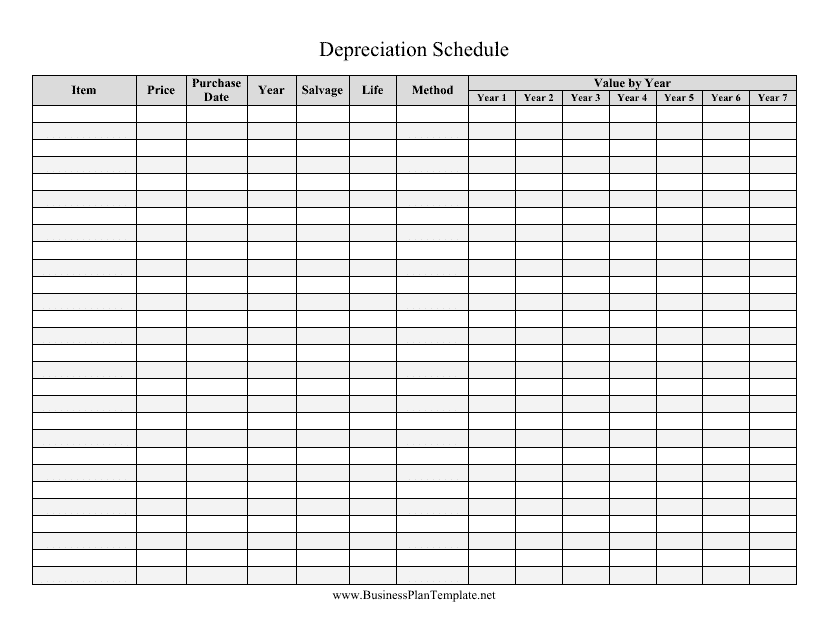

Depreciation Schedule Templates

Depreciation Schedules are used to track the decrease in value of an asset over time. They help businesses determine the annual depreciation expense for an asset, which is important for proper accounting and tax reporting. Depreciation schedules provide a systematic breakdown of the depreciation amount each year, allowing businesses to plan and budget accordingly. This information is used in financial statements and tax returns to accurately represent the value of assets and determine taxable income.

Documents:

15

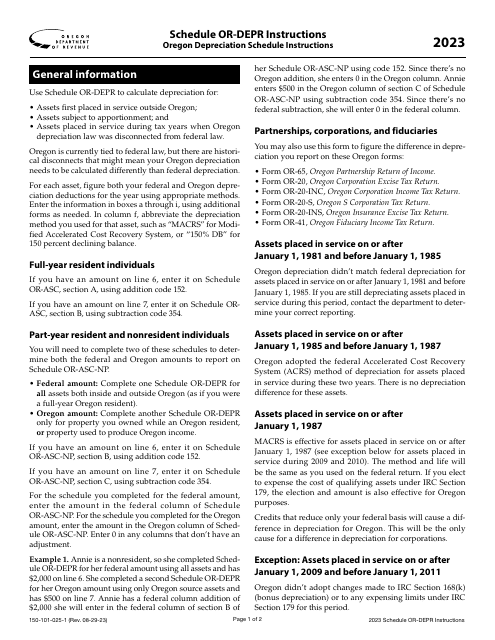

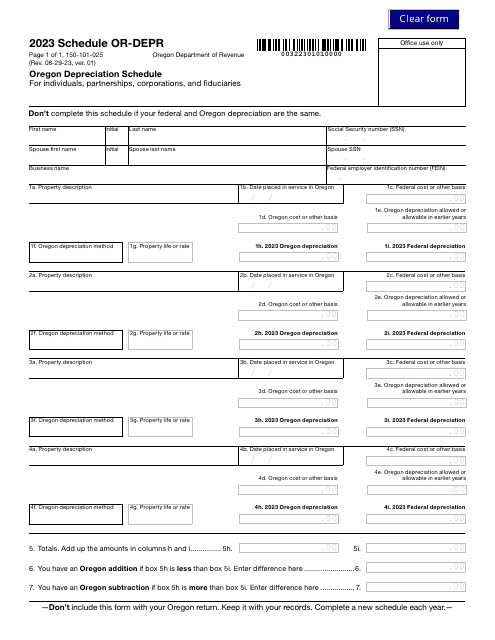

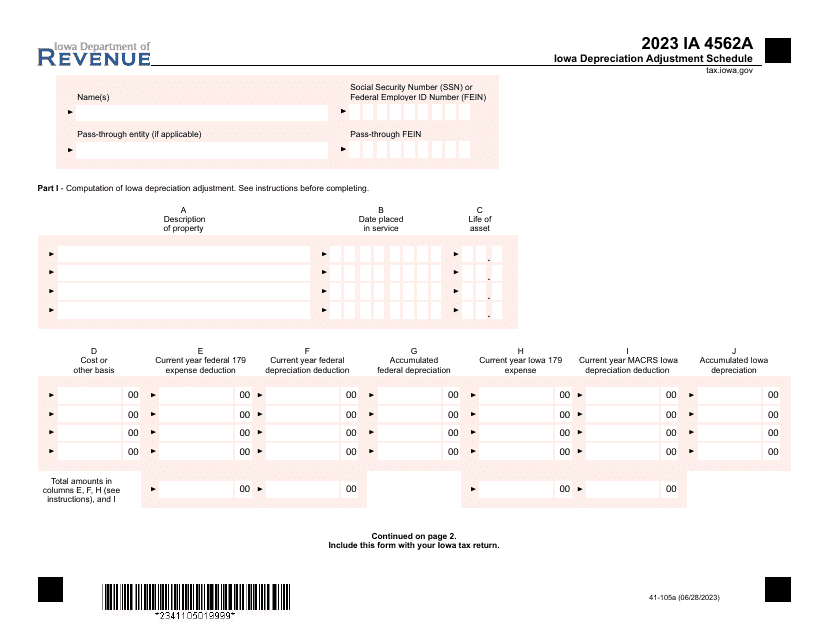

This document provides a template for creating a schedule that determines the depreciation of assets over time. It is useful for businesses to track the decrease in value of their assets for accounting and tax purposes.

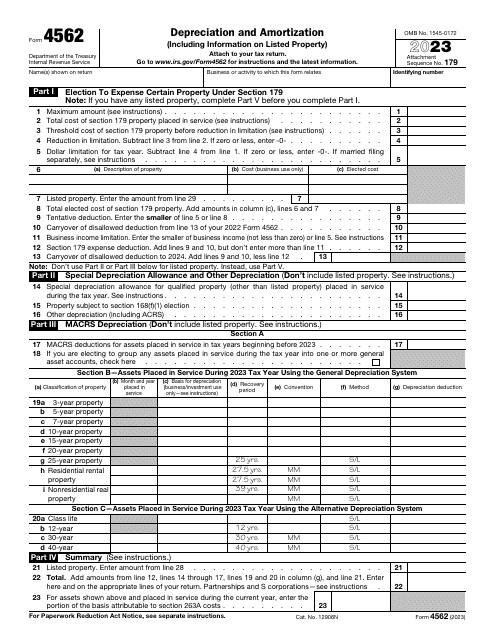

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

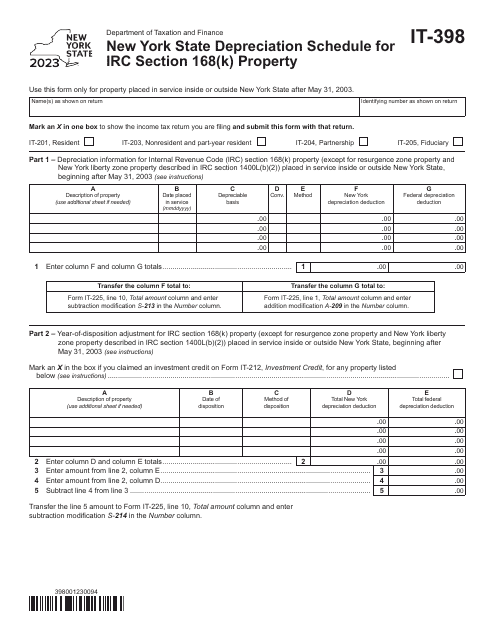

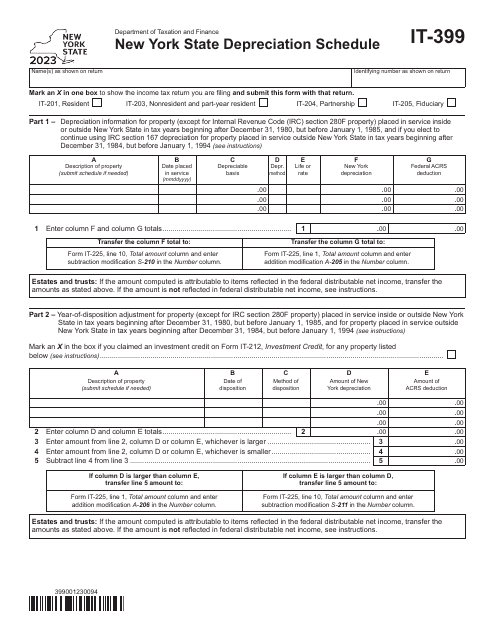

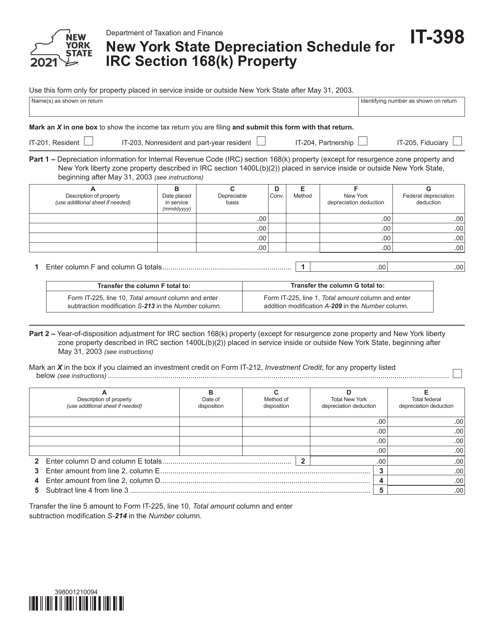

This Form is used for reporting depreciation of IRC Section 168(K) property in New York State. It provides a schedule for calculating and reporting depreciation for tax purposes.