Debt Schedule Templates

Debt Schedule Templates are designed to help individuals or businesses organize and track their debts. These templates typically include sections to list all outstanding debts, such as credit cards, loans, or mortgages, along with important details about each debt, including the interest rate, monthly payment amount, and the remaining balance. By using a Debt Schedule Template, individuals can get a clear overview of their debts, plan their repayment strategies, and stay organized throughout the process.

Documents:

10

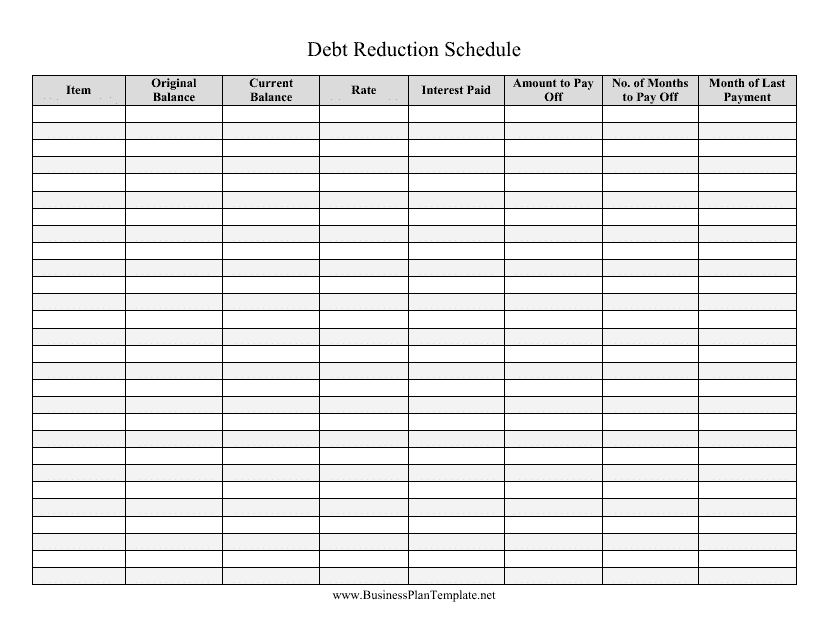

This document is a template that helps in creating a schedule for reducing debt. It can be customized to fit individual financial situations and goals.

This document is a debt snowball spreadsheet designed specifically for military personnel using Dave Ramsey's Financial Peace method. It helps individuals manage and pay off their debts systematically.

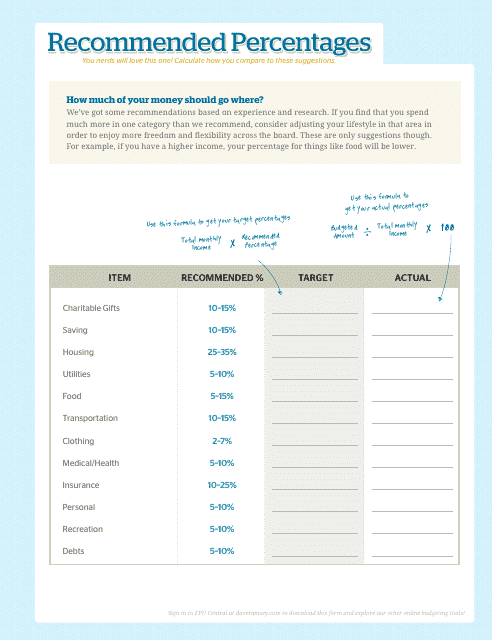

This document is a spreadsheet that helps individuals allocate their spending based on Dave Ramsey's recommended percentages. It provides a breakdown of ideal spending in different categories like housing, transportation, and savings.

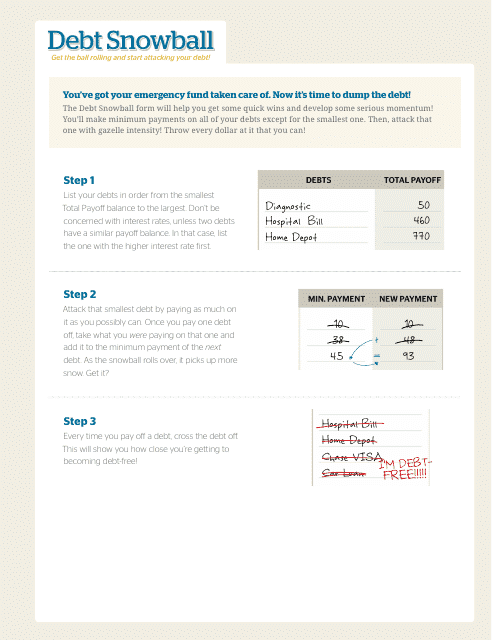

This document is a debt snowball spreadsheet used in Dave Ramsey's Financial Peace University. It helps individuals track and pay off their debts systematically, aiming for financial freedom.

This Excel template is used to organize and track a company's debts. It helps businesses to understand their debt obligations, such as loan repayments and interest payments, over a specified period of time. With this template, businesses can effectively manage their debt and plan for future financial commitments.

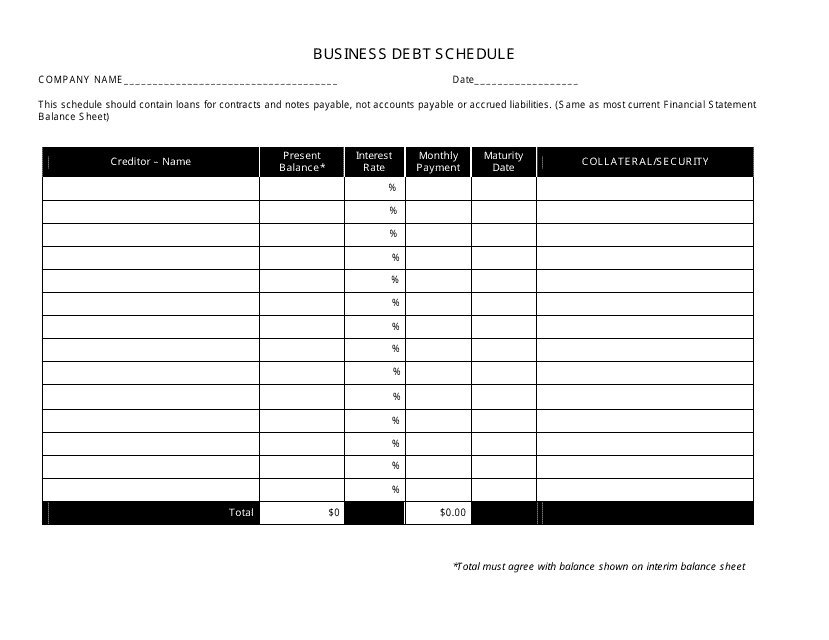

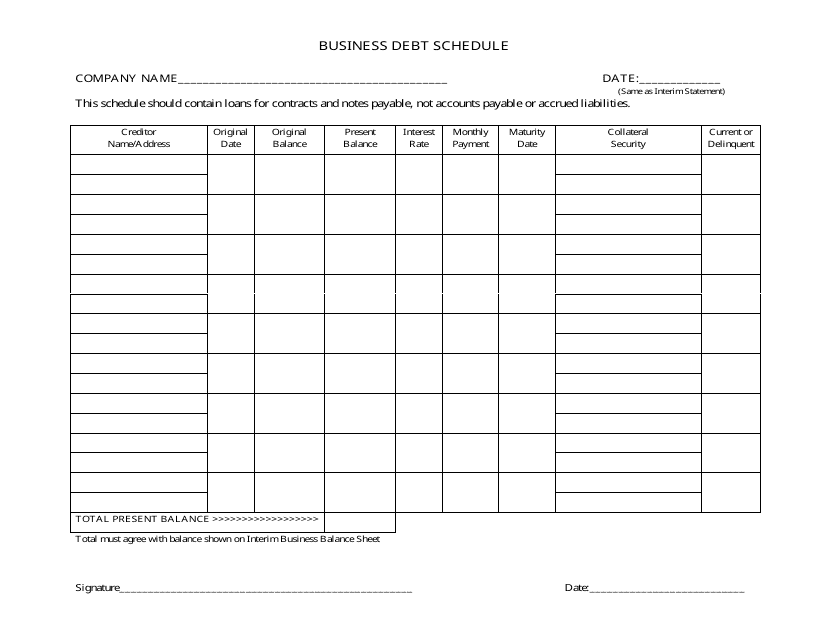

This document provides a template for creating a schedule of business debts. It is designed in a black and white format for easy printing and use.

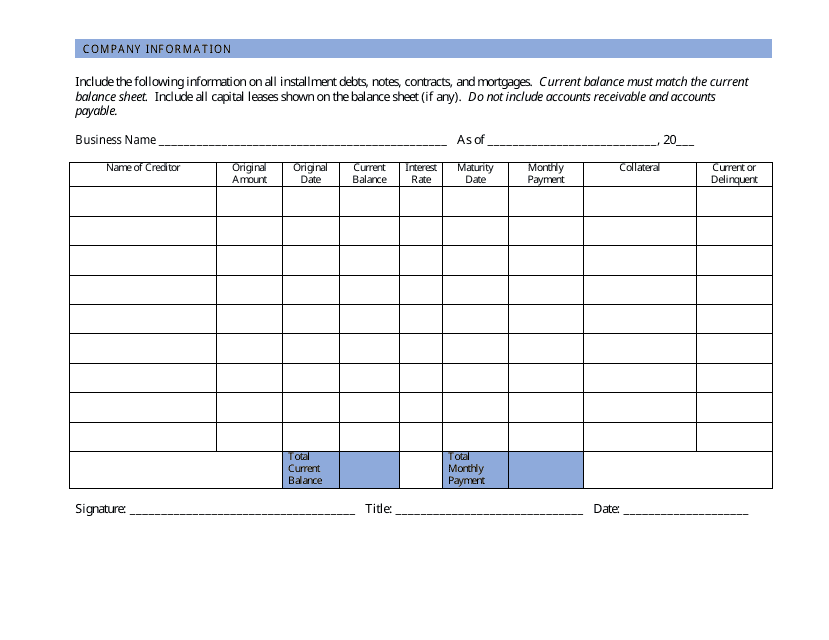

This document is a template that helps businesses organize and track their debt schedule. It provides a varicolored format for easy visualization.

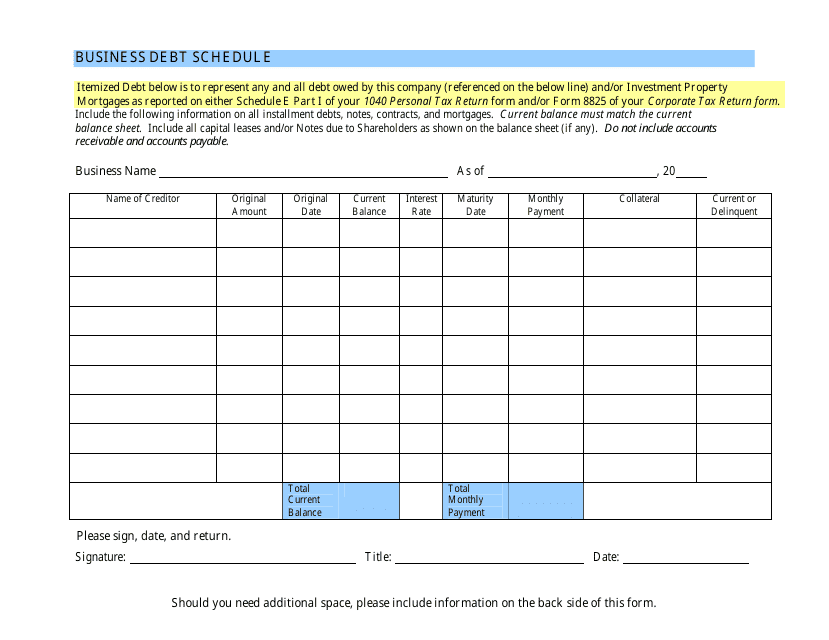

This document helps businesses organize and track their debts. It provides a template for listing the details of each debt, such as the amount owed, interest rate, and repayment terms. By using this template, businesses can better manage their debt obligations and make informed financial decisions.

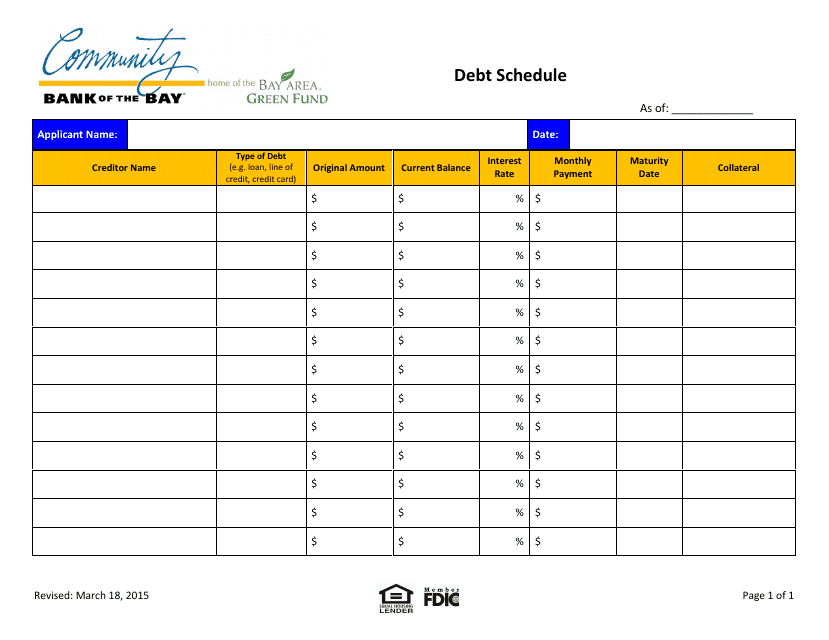

This document is a debt schedule template provided by Community Bank of the Bay. It helps individuals or businesses in organizing their debt repayment schedule.

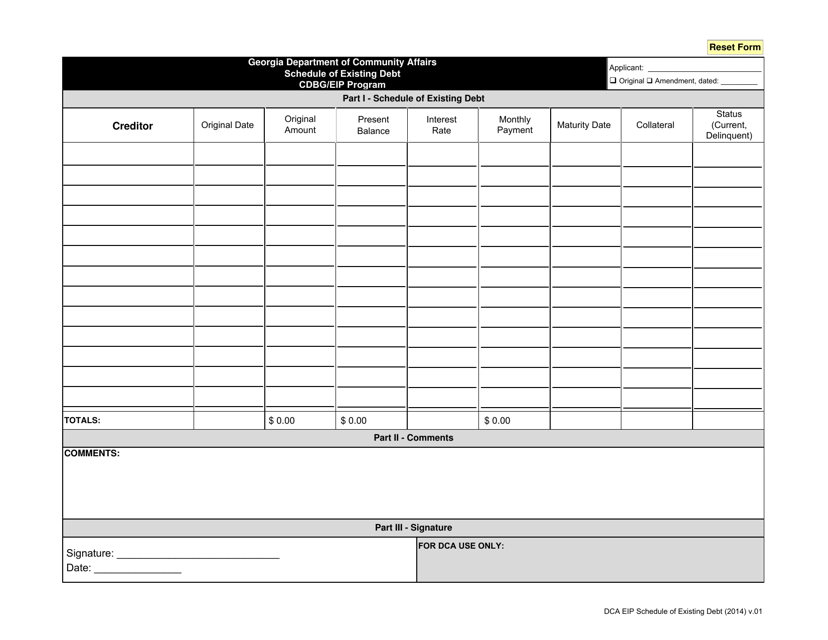

This document provides information about the existing debt schedule for the CDBG/EIP Program in the state of Georgia, United States. It outlines the repayment timelines and amounts owed for the program.