Fill and Sign Oregon Legal Forms

Documents:

5198

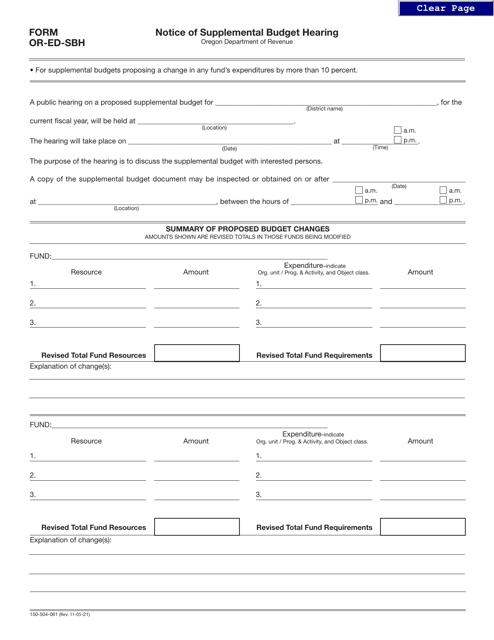

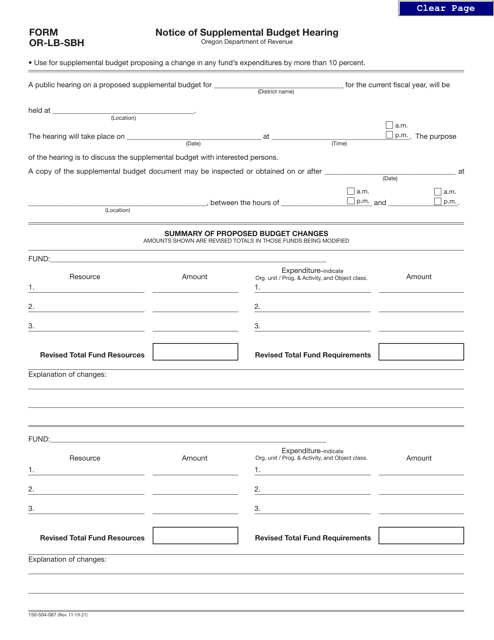

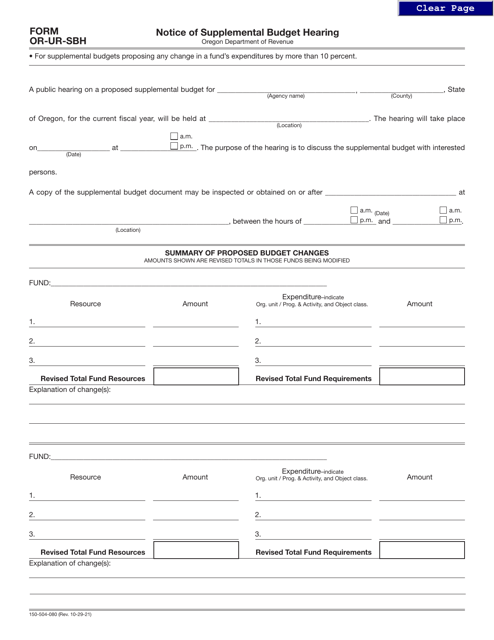

This Form is used for issuing a notice of a supplemental budget hearing in Education Districts as part of the local budget law in Oregon.

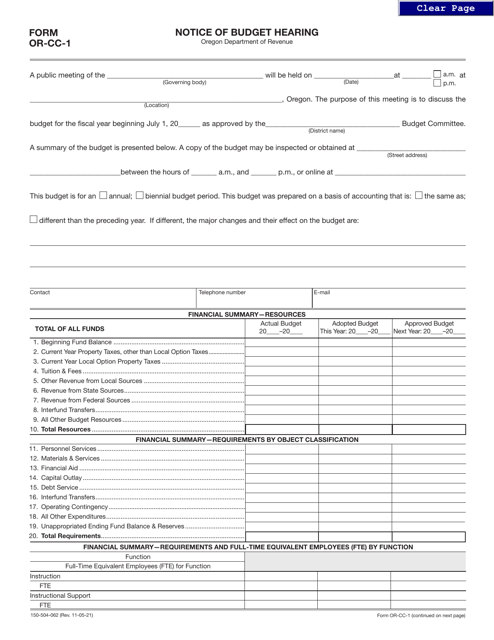

This Form is used for notifying Education Districts in Oregon about a budget hearing under the Local Budget Law.

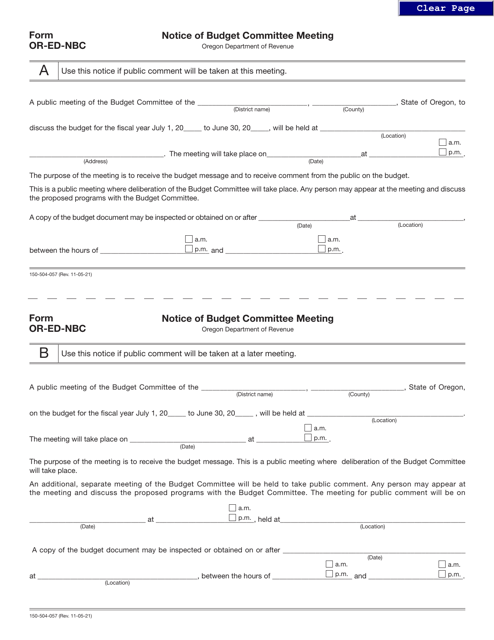

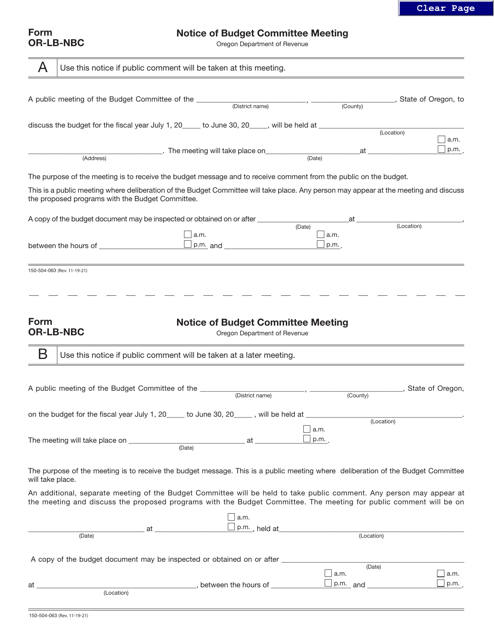

This Form is used for providing notice of a budget committee meeting for education districts in Oregon, in accordance with the Local Budget Law.

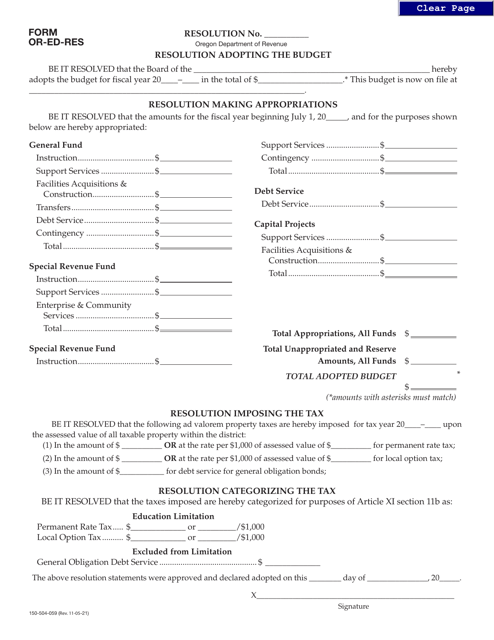

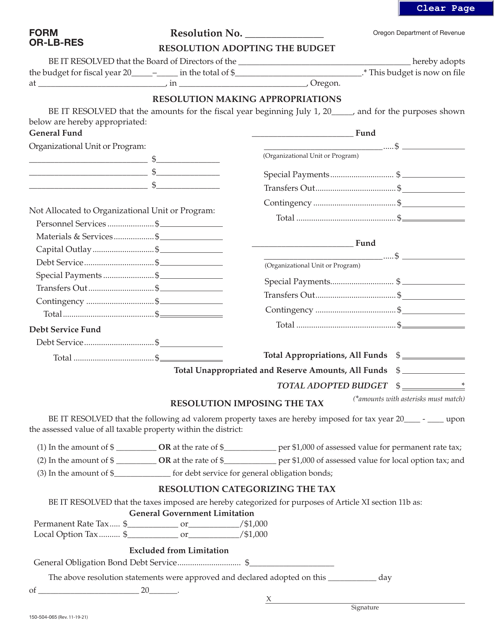

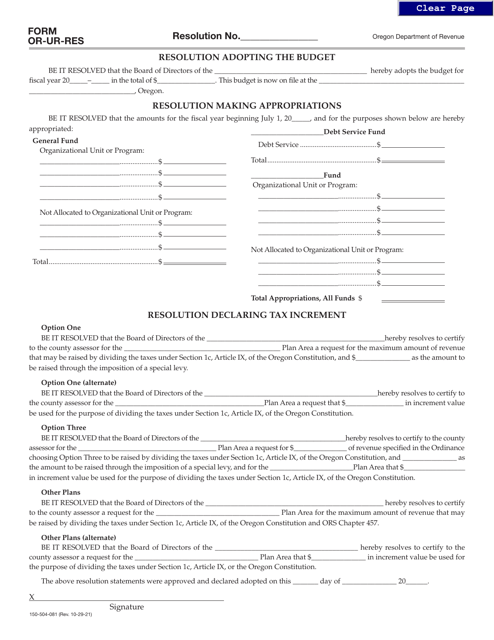

This Form is used for adopting the budget resolution for education districts in Oregon, as per the local budget law.

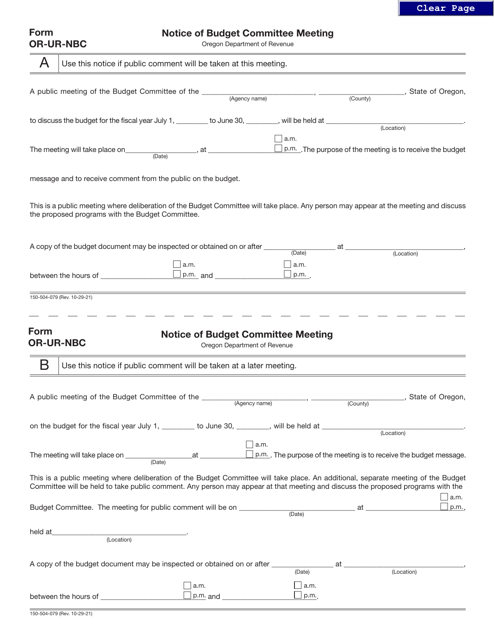

This document is used for giving notice of a budget committee meeting for municipal corporations in Oregon under the Local Budget Law. It is a form that needs to be filled out and submitted to communicate the date, time, and location of the meeting.

This Form is used for filing a Notice of Supplemental Budget Hearing in the state of Oregon.

This Form is used for submitting a Notice of Budget Committee Meeting in Oregon.

This Form is used for adopting the budget for municipal corporations in Oregon in accordance with the Local Budget Law.

This form is used for adopting the budget for urban renewal agencies in accordance with the local budget law in Oregon.

This form is used for providing notice of a supplemental budget hearing for Urban Renewal Agencies in Oregon as required by the Local Budget Law.

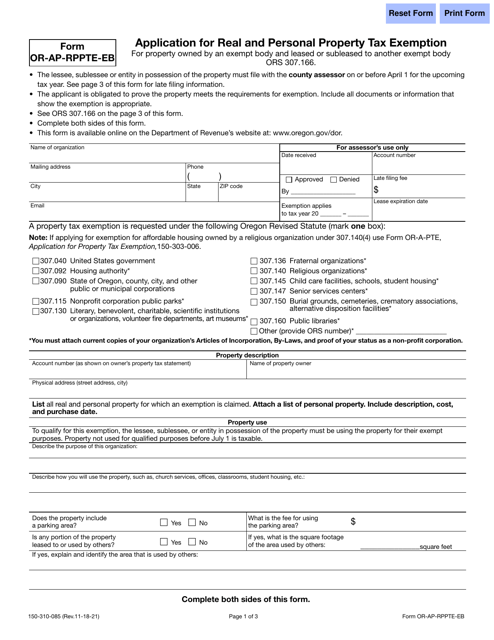

This form is used for applying for a tax exemption on real and personal property in Oregon when the property is owned by an exempt organization and leased or subleased to another exempt organization.

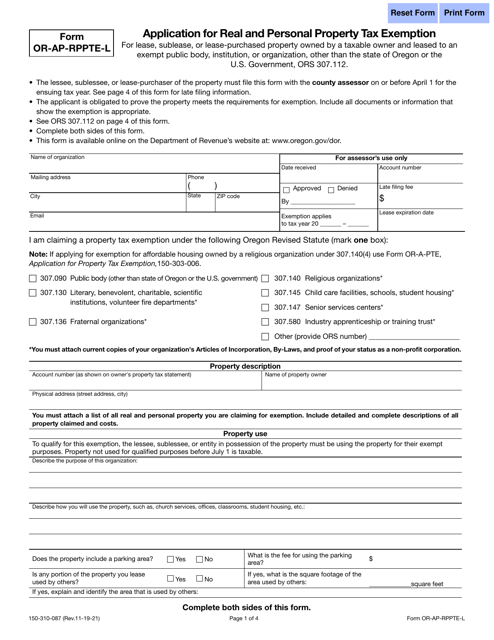

This Form is used for applying for a real and personal property tax exemption in Oregon for lease, sublease, or lease-purchased property owned by a taxable owner and leased to an exempt public body, institution, or organization.

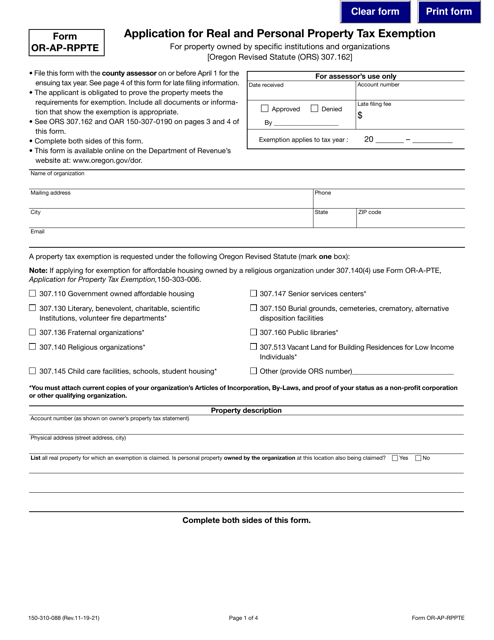

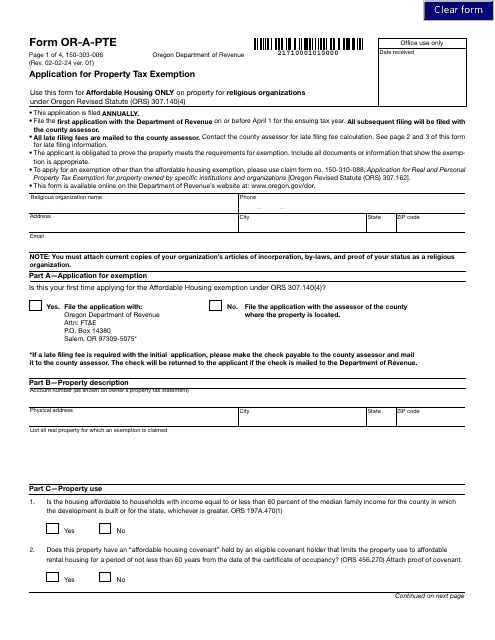

This form is used for applying for a real and personal property tax exemption in the state of Oregon for certain institutions and organizations that own property.

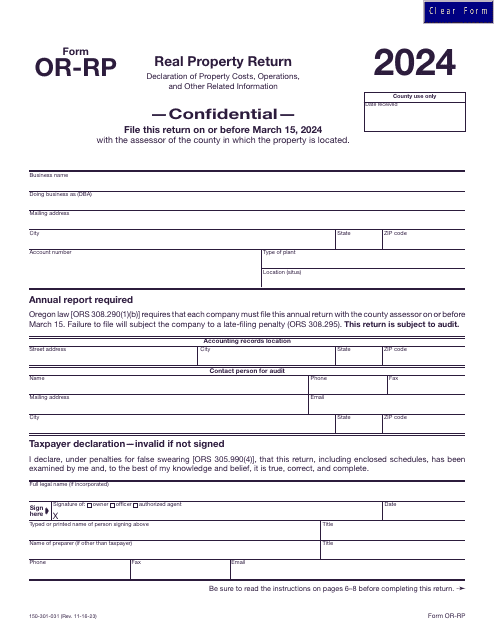

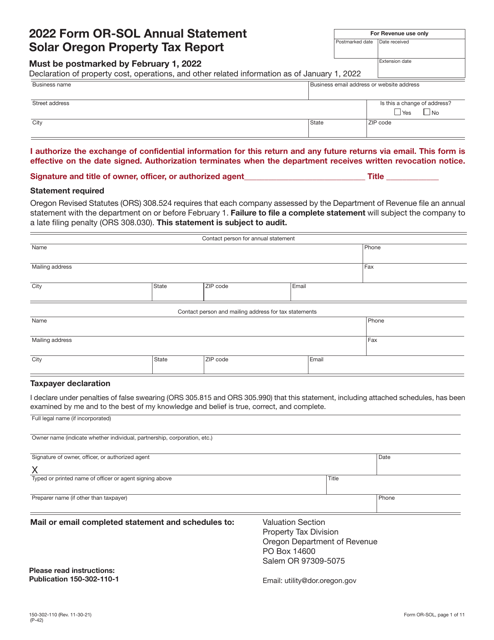

This Form is used for reporting solar properties in Oregon for annual property tax purposes.

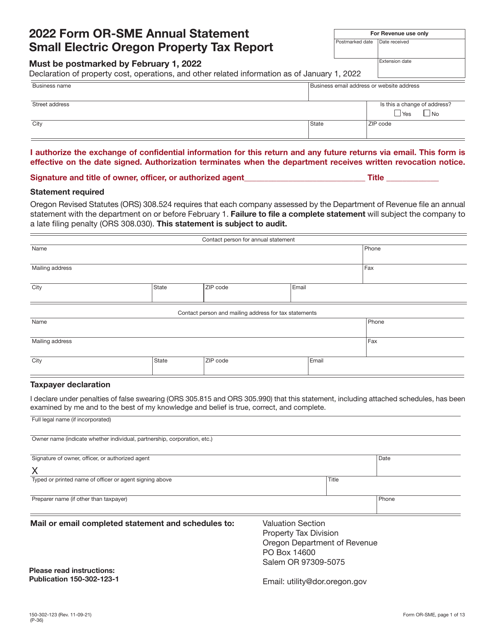

This form is used for filing an annual statement for small electric Oregon property tax report in Oregon.

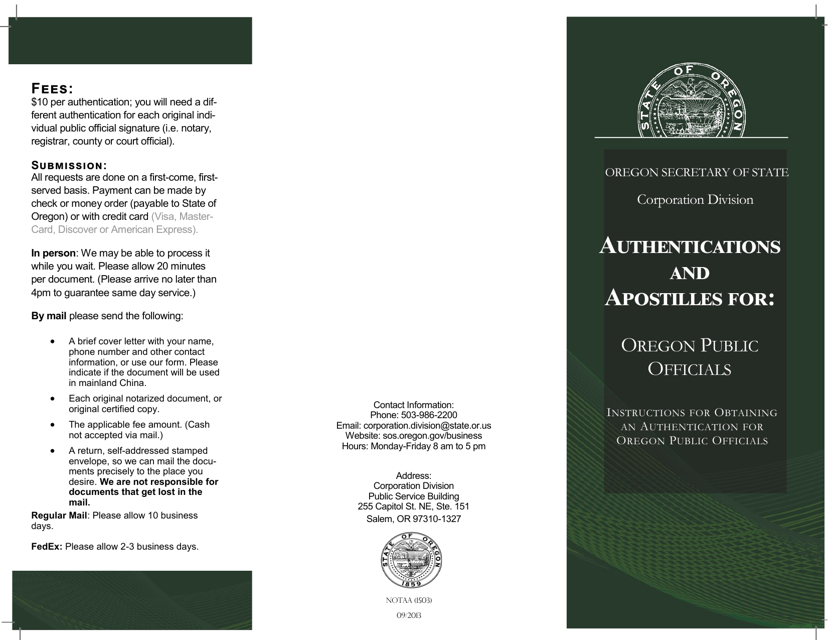

This document provides instructions on how to obtain an authentication for Oregon public officials. It outlines the necessary steps and requirements for this process.

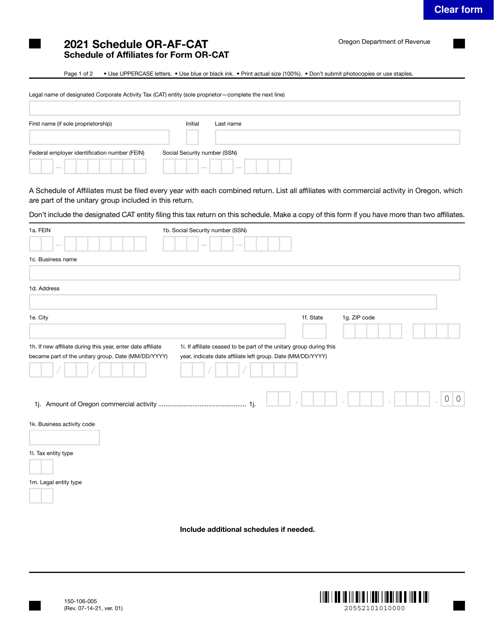

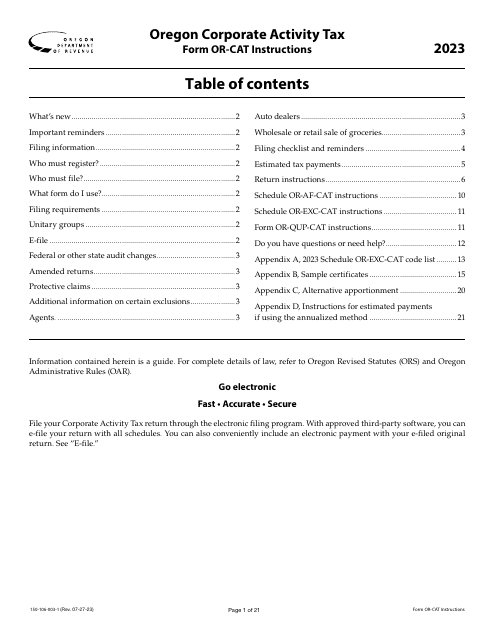

This Form is used for completing the Schedule of Affiliates for Form OR-CAT in Oregon.

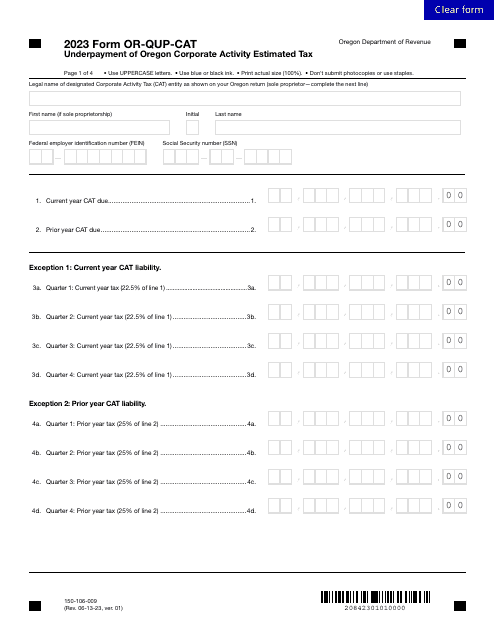

Form OR-QUP-CAT (150-106-009) Underpayment of Oregon Corporate Activity Estimated Tax - Oregon, 2023

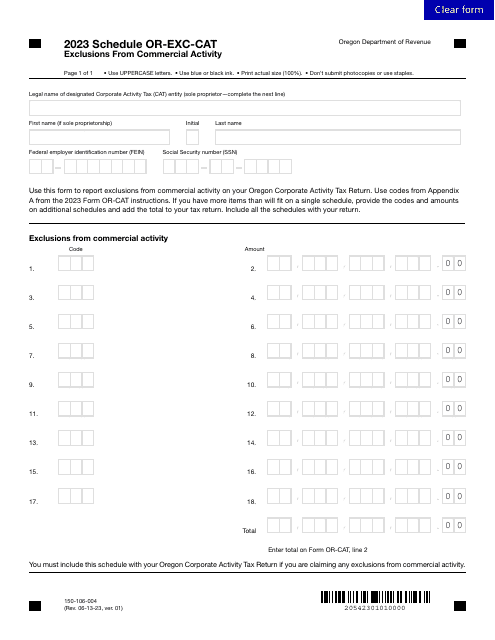

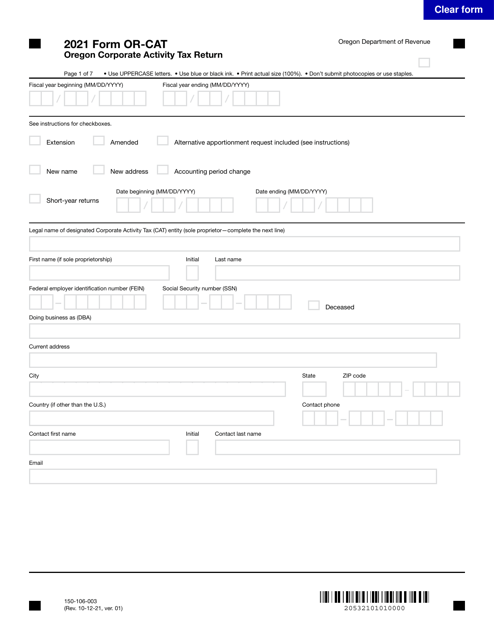

This form is used for filing the Oregon Corporate Activity Tax Return, which is required for businesses operating in Oregon to report their corporate activity tax obligations.

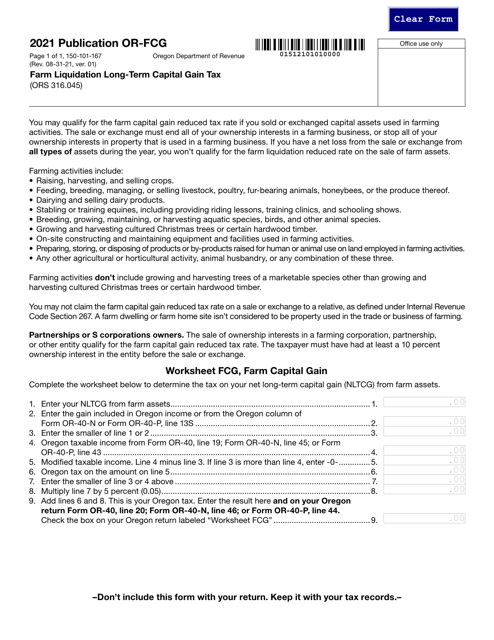

This form is used for calculating the long-term capital gain tax on farm liquidation in Oregon.

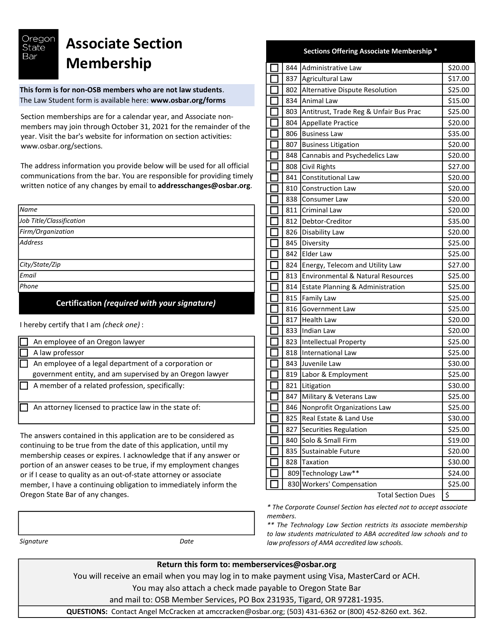

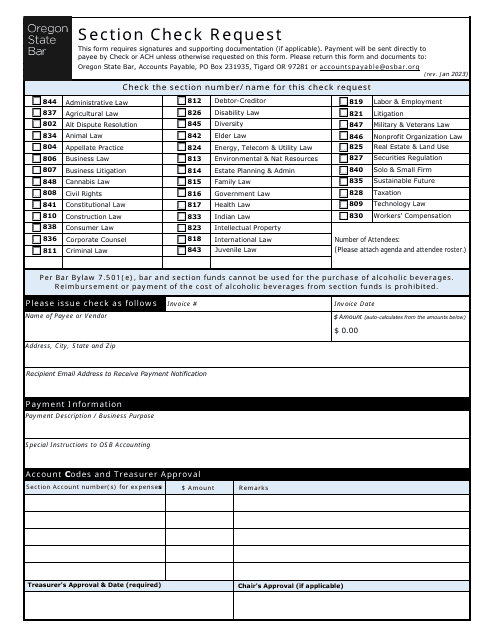

This document is for becoming a member of a specific section in Oregon. It provides information on how to join and the benefits of section membership.

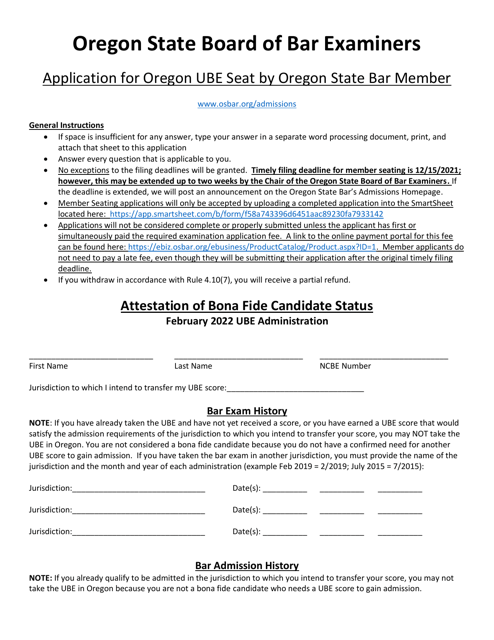

This form is used for applying for a seat in the Oregon Ube (Uniform Bar Exam) by a member of the Oregon State Bar.