Fill and Sign Oregon Legal Forms

Documents:

5198

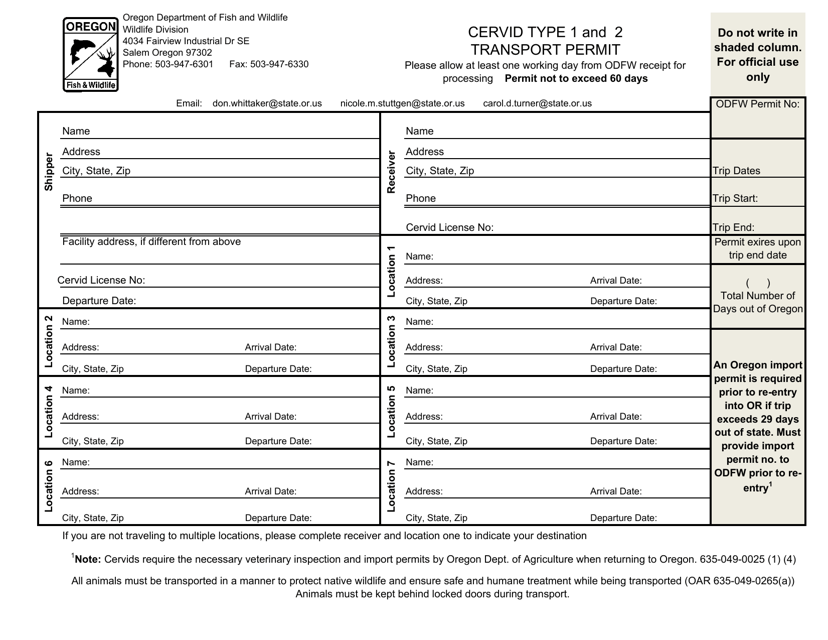

This document is for obtaining a permit to transport cervids (deer species) of Type 1 and 2 in the state of Oregon.

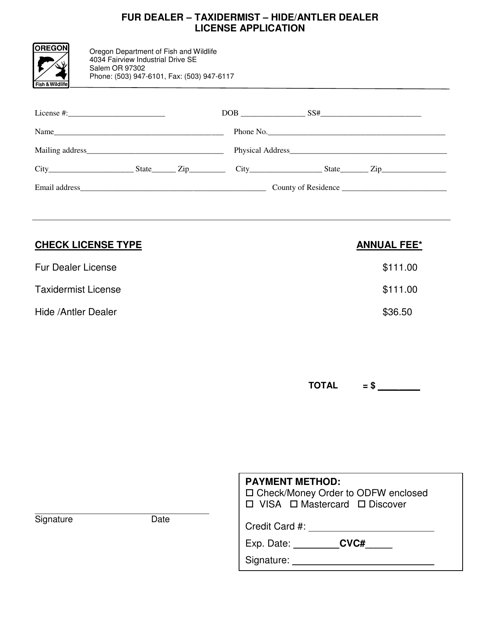

This type of document is an application form to apply for a fur dealer, taxidermist, hide/antler dealer license in the state of Oregon.

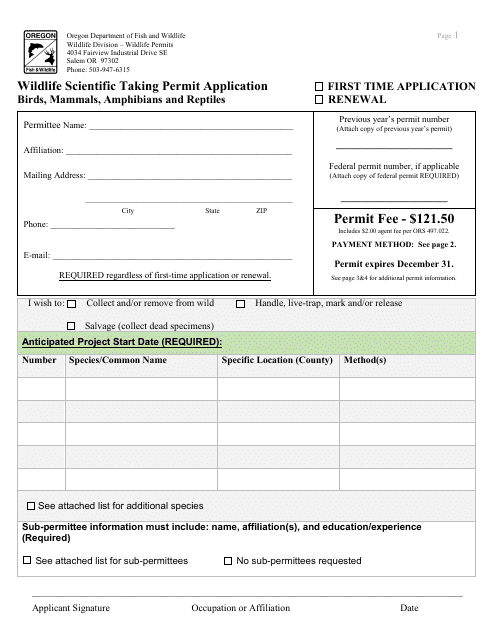

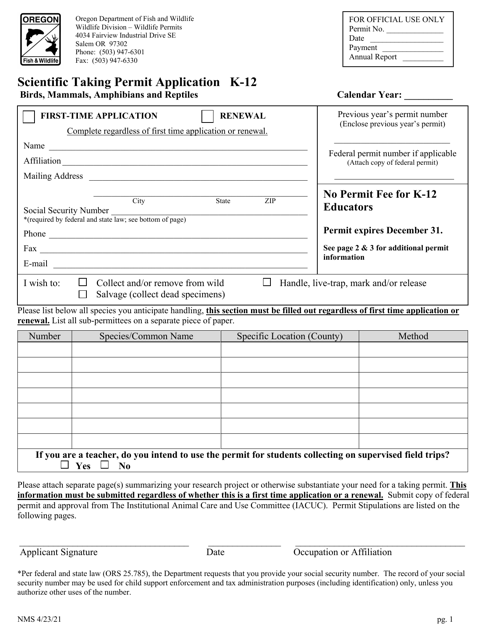

This document is used for applying for a scientific taking permit in Oregon for studying birds, mammals, amphibians, and reptiles.

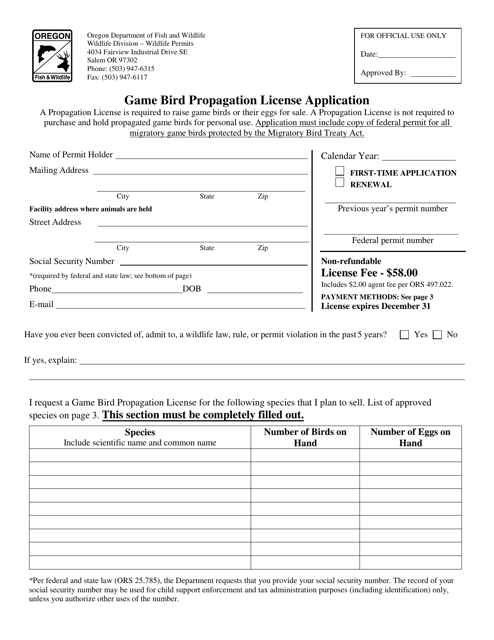

This is a form used to apply for a license to propagate game birds in the state of Oregon.

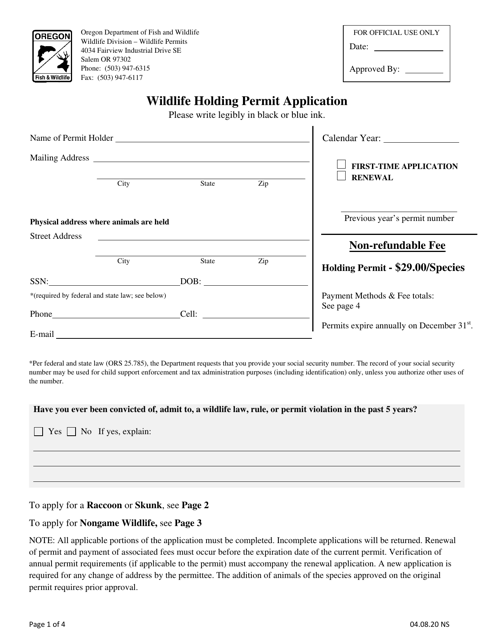

This document is used to apply for a permit to hold wildlife in Oregon. It is required for individuals or organizations looking to keep and care for wild animals legally.

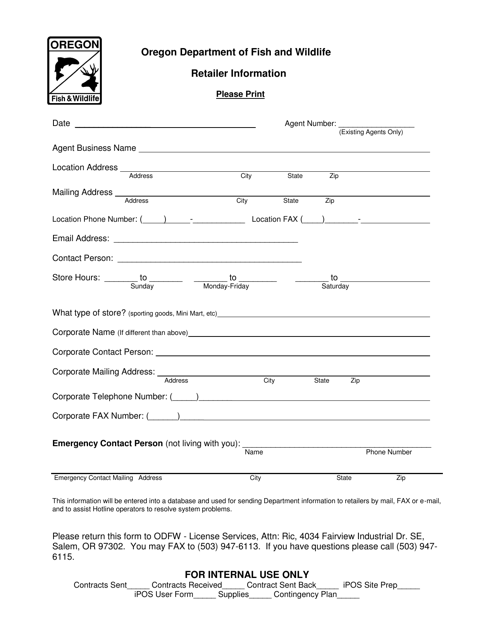

This Form is used for collecting retail information from agents in Oregon. It helps gather data about agents' retail activities in the state.

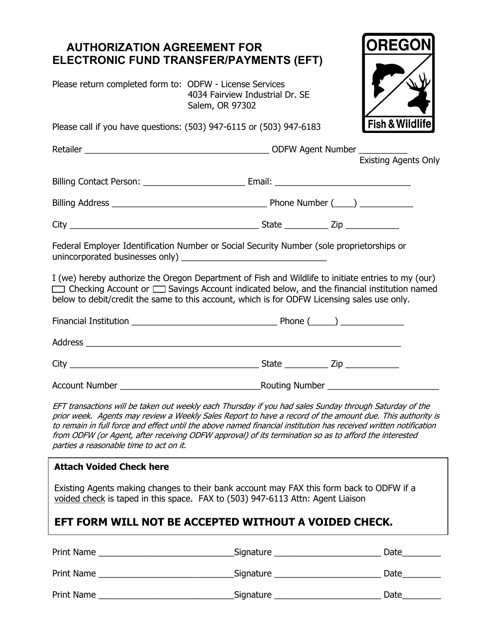

This document is used for granting permission to authorize electronic fund transfers/payments in the state of Oregon.

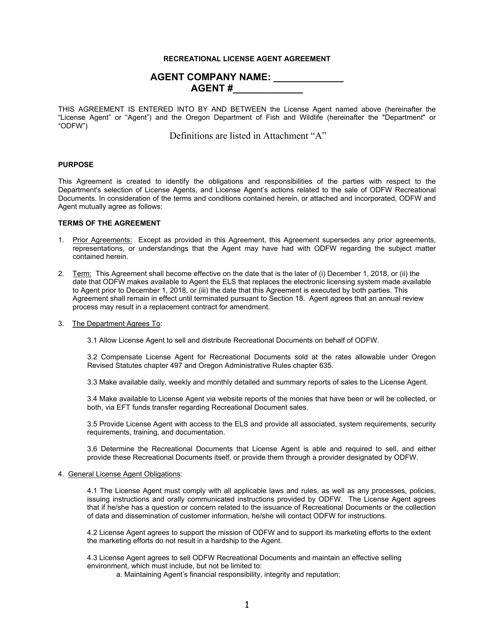

This document is for Recreational License Agents in Oregon. It outlines the agreement between the agent and the state regarding the sale of recreational licenses.

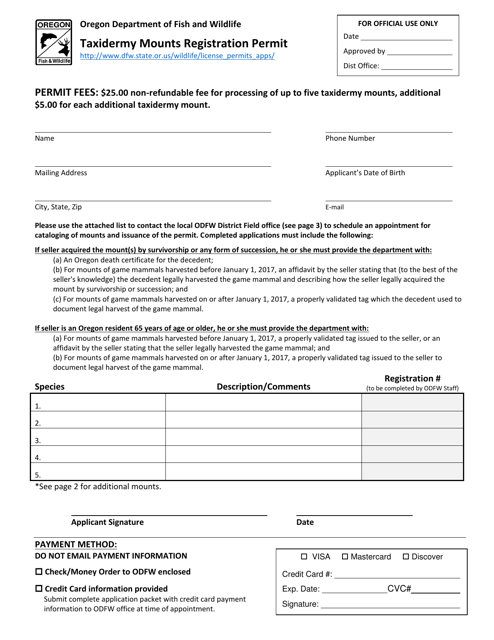

This document is for obtaining a registration permit for taxidermy mounts in the state of Oregon.

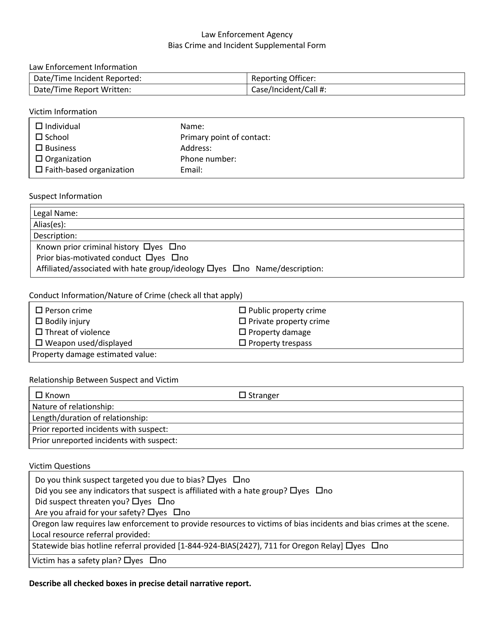

This form is used for reporting incidents of bias crime or hate incidents to the law enforcement agency in Oregon. It helps gather additional information related to the incident for investigative purposes.

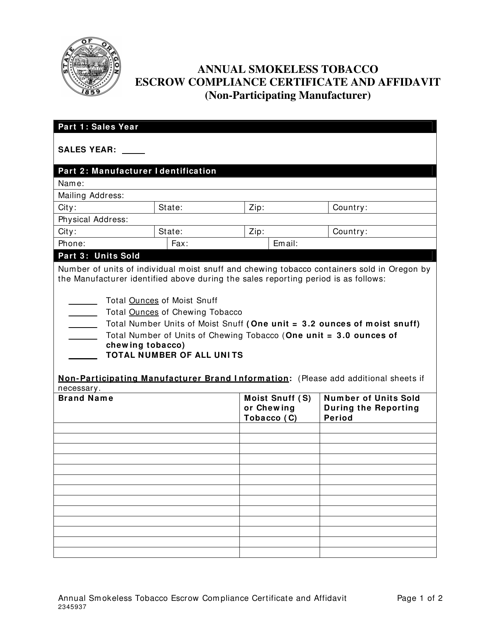

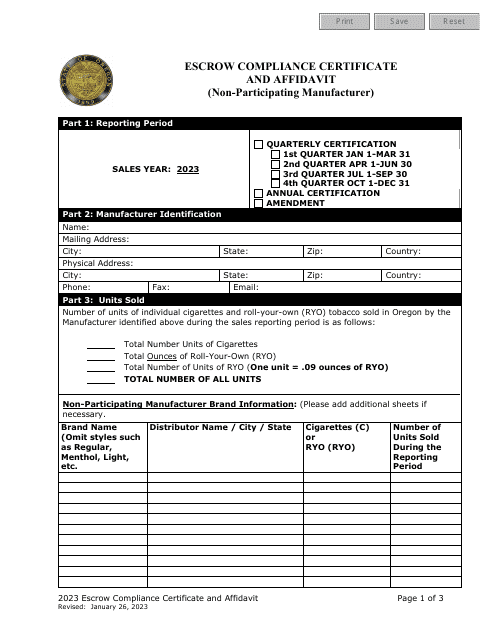

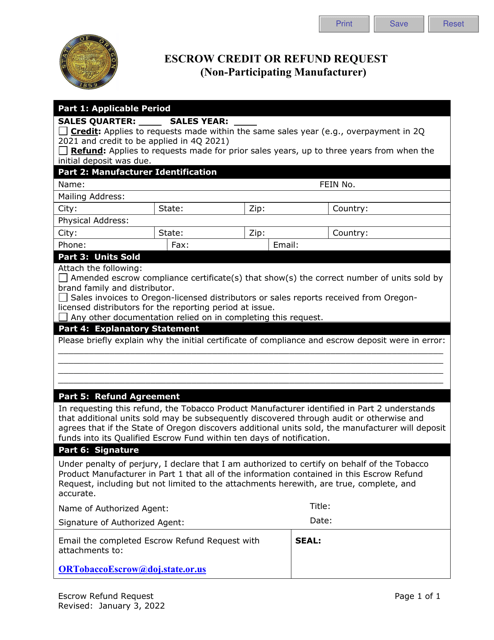

This form is used for submitting an annual compliance certificate and affidavit by non-participating tobacco manufacturers in Oregon who have established an escrow account for smokeless tobacco products.

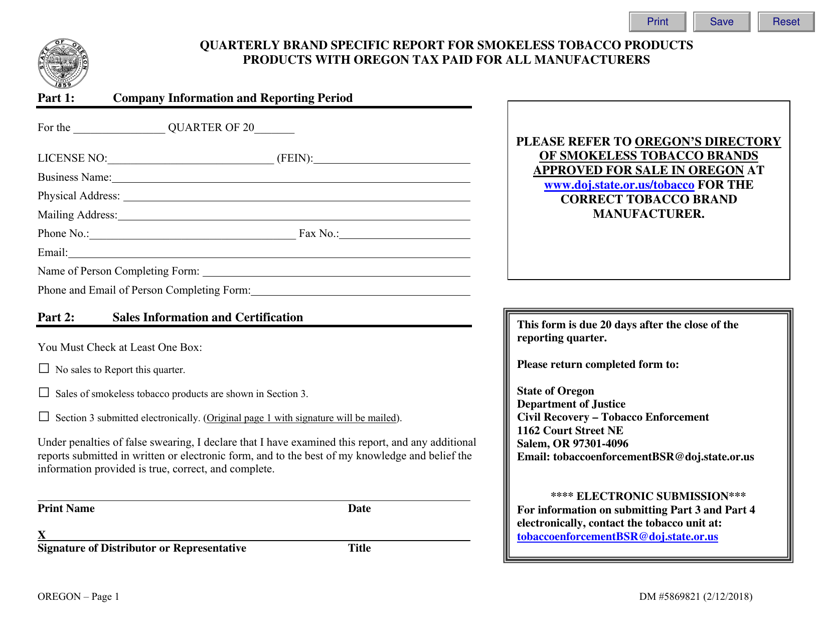

This form is used for reporting quarterly sales of smokeless tobacco products with Oregon tax paid. All manufacturers are required to submit this report to the state of Oregon.

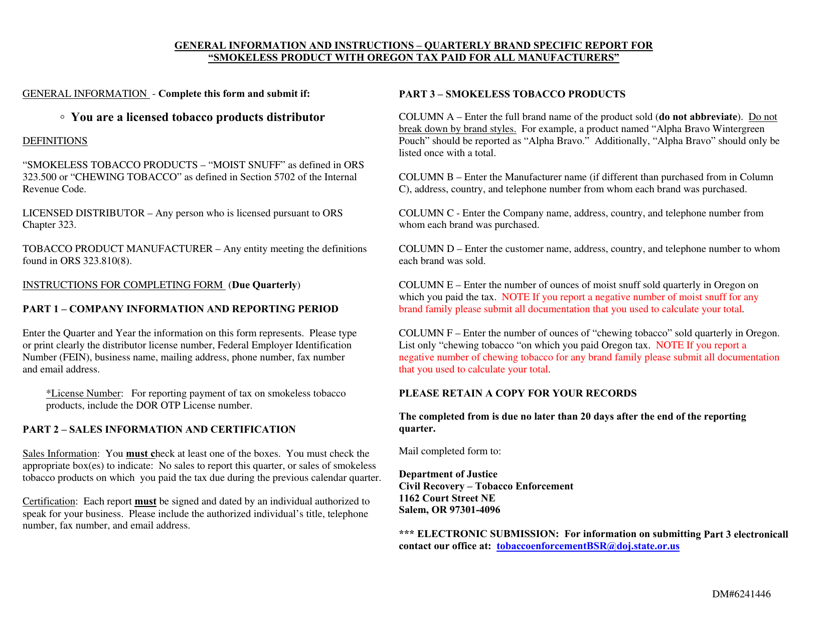

This Form is used for filing a quarterly brand-specific report for smokeless tobacco products that have Oregon tax paid. It is required for all manufacturers operating in Oregon.

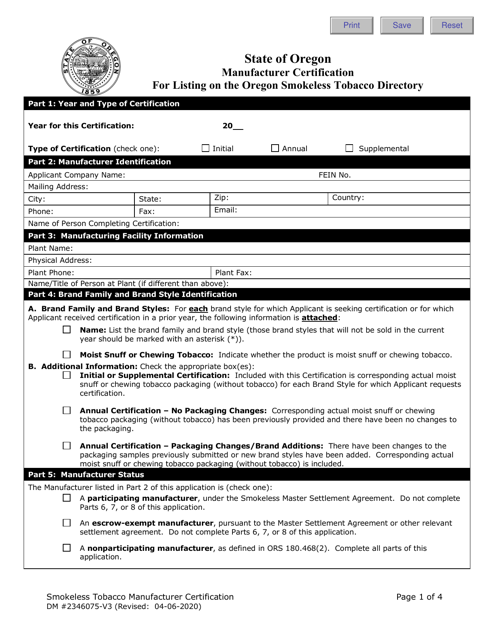

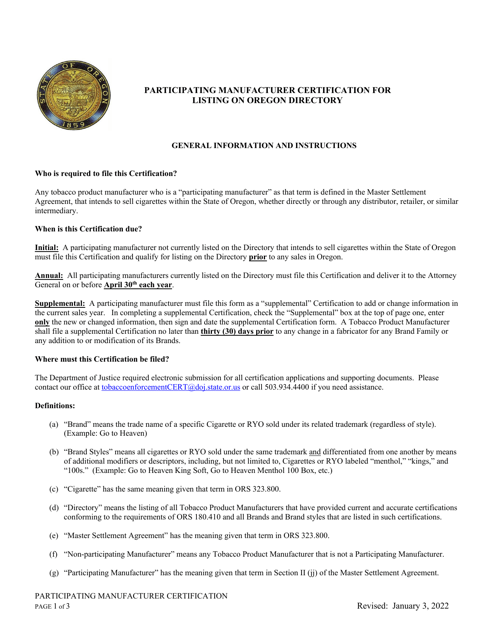

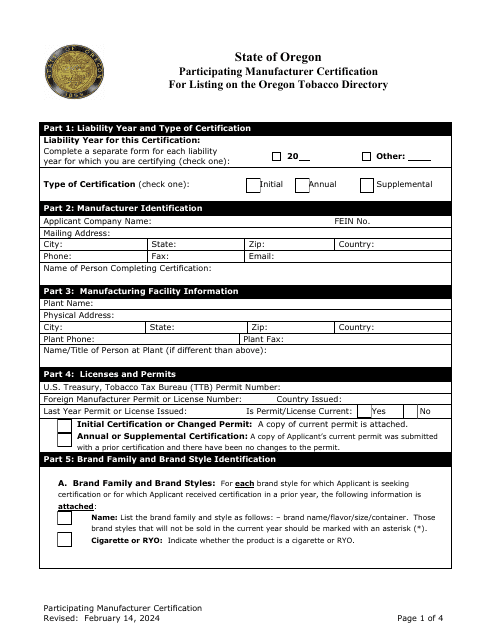

This Form is used for manufacturers to certify their smokeless tobacco products for listing on the Oregon Smokeless Tobacco Directory.

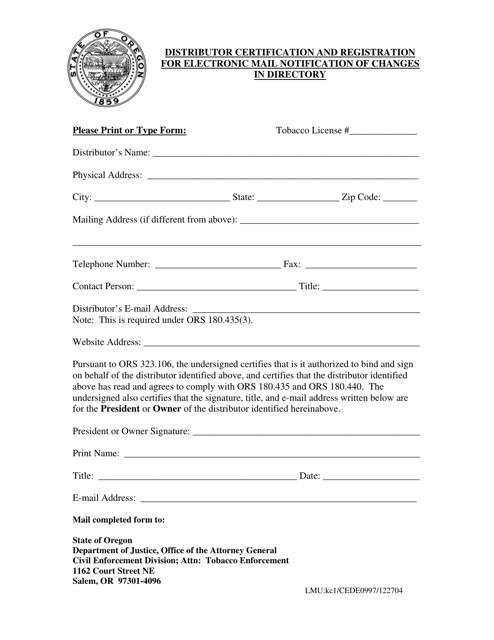

This document is for distributors in Oregon who want to certify and register for electronic mail notification of changes in the directory. It provides instructions on how to stay updated on any changes in the directory through email notifications.

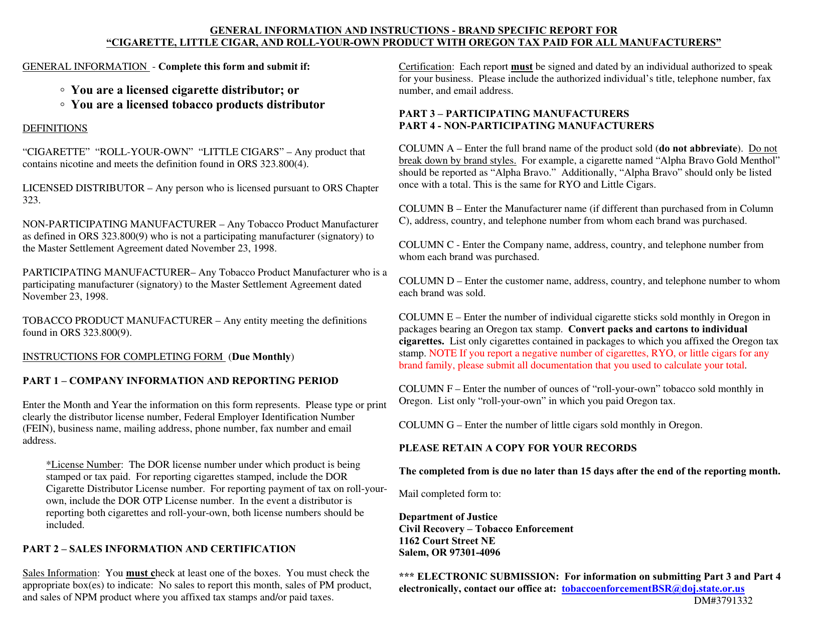

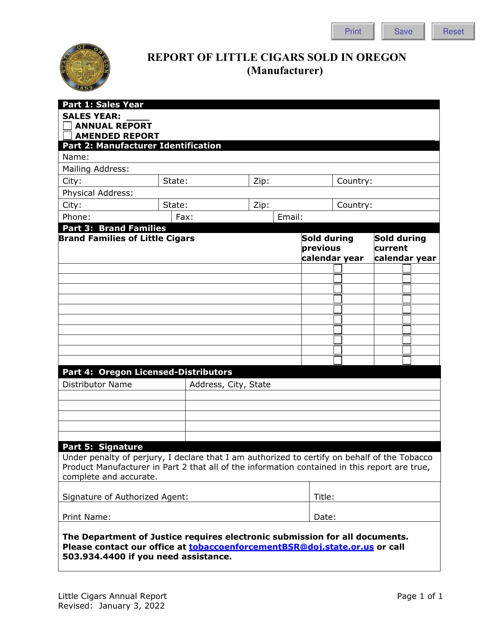

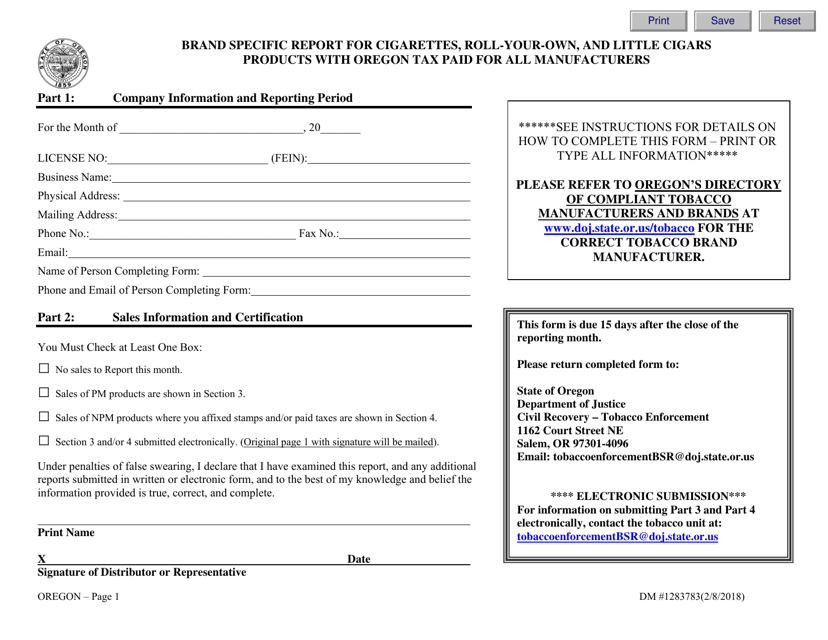

This Form is used for reporting cigarette, roll-your-own, and little cigar products with Oregon tax paid for all manufacturers in Oregon.

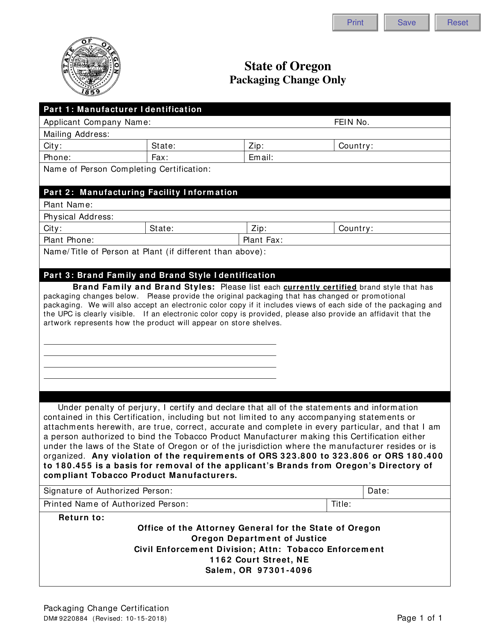

This Form is used for requesting a packaging change for a product in Oregon.

This form is used for reporting brand-specific information on cigarettes, roll-your-own tobacco, and little cigars products that have had Oregon taxes paid by all manufacturers. It is specific to the state of Oregon.

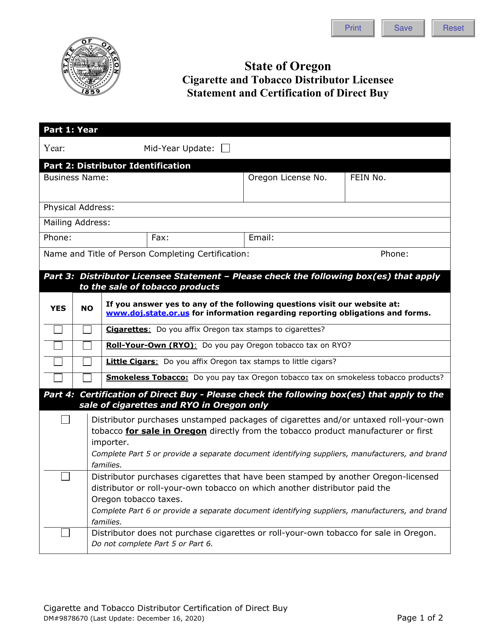

This Form is used for cigarette and tobacco distributors in Oregon to provide a statement and certification of direct buy.

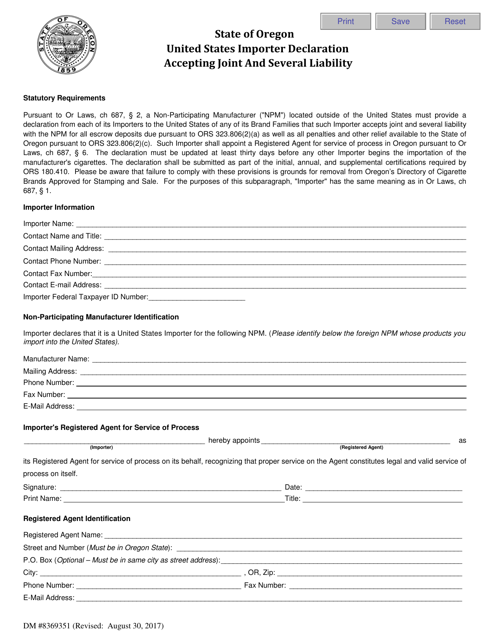

This form is used for an importer in the United States, specifically in the state of Oregon, to declare acceptance of joint and several liability for imports.

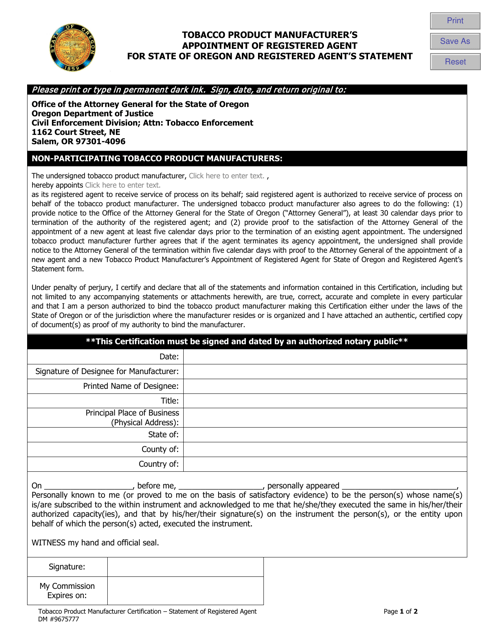

This form is used for tobacco product manufacturers to appoint a registered agent for the state of Oregon and for the registered agent to provide a statement confirming their appointment.

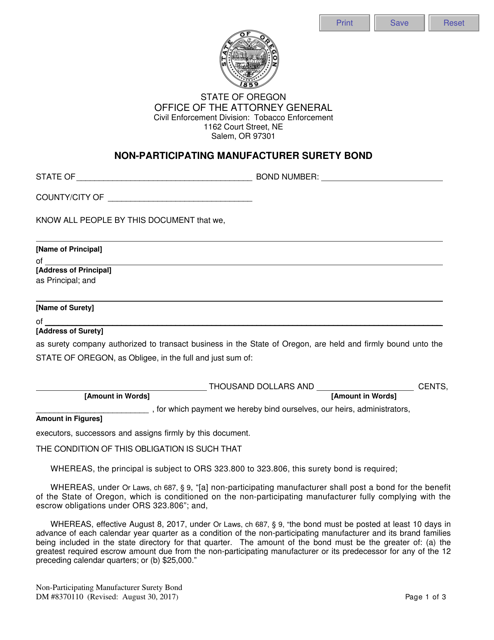

This form is used for non-participating manufacturers in Oregon to provide a surety bond.

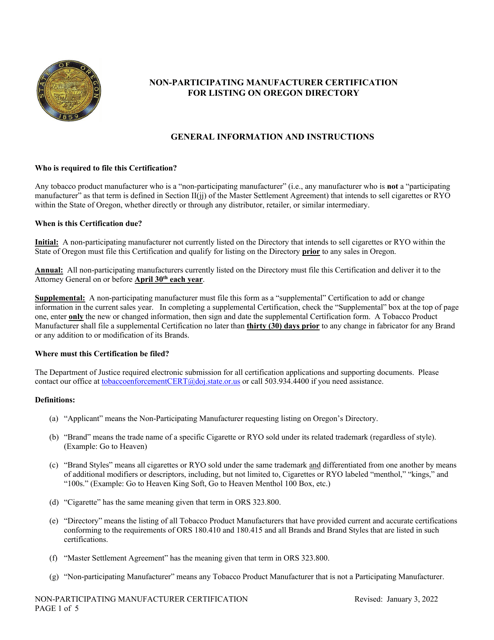

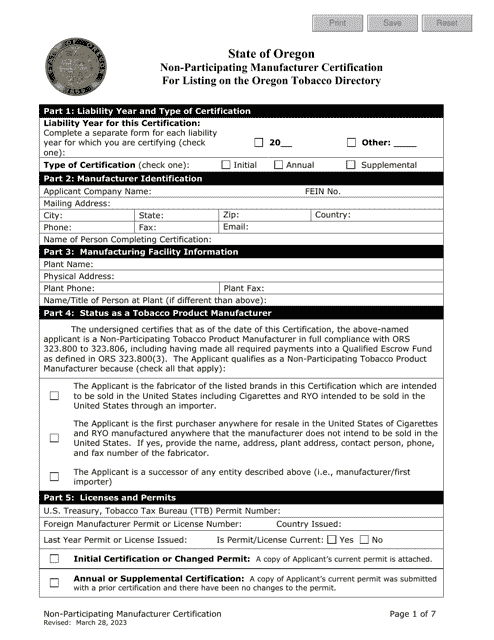

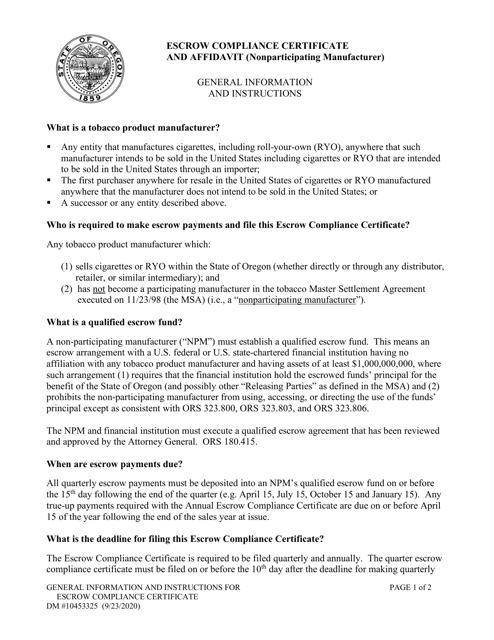

This document provides instructions for completing the Escrow Compliance Certificate and Affidavit for Non-participating Manufacturers in Oregon. It ensures compliance with escrow requirements related to tobacco settlement funds.

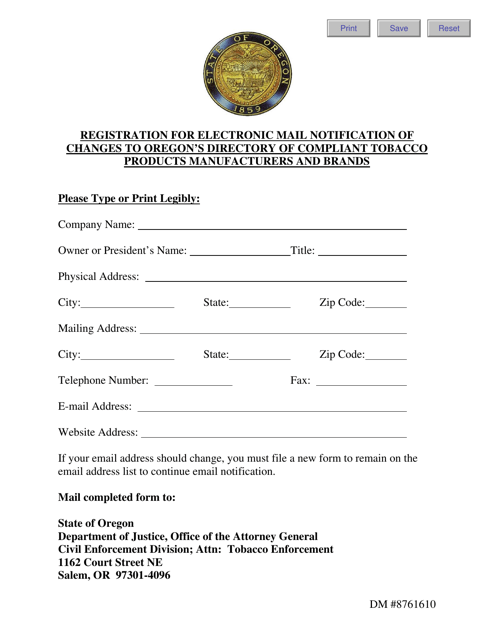

This Form is used for registering for electronic mail notification of changes to Oregon's directory of compliant tobacco products manufacturers and brands.

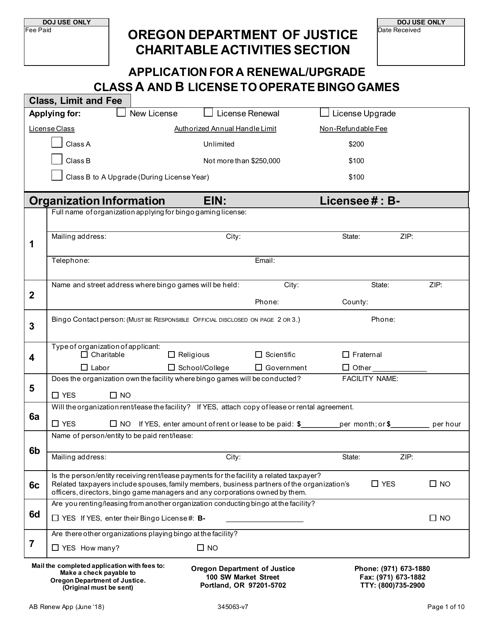

This document is used for applying to renew or upgrade a Class A and B license to operate bingo games in Oregon.

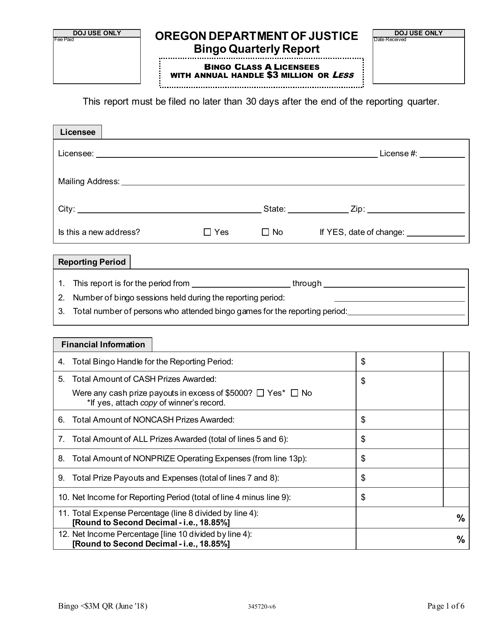

This document is for reporting quarterly financial information for Bingo Class A organizations in Oregon that handle $3 million or less in revenue.

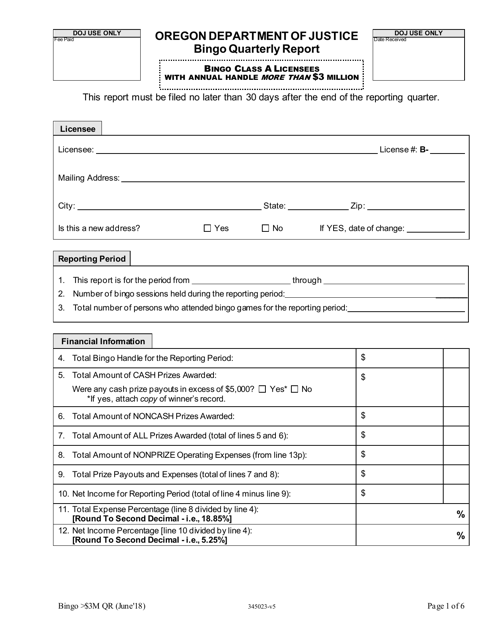

This document is a quarterly report for Bingo Class A operations that handle $3 million or more in Oregon.

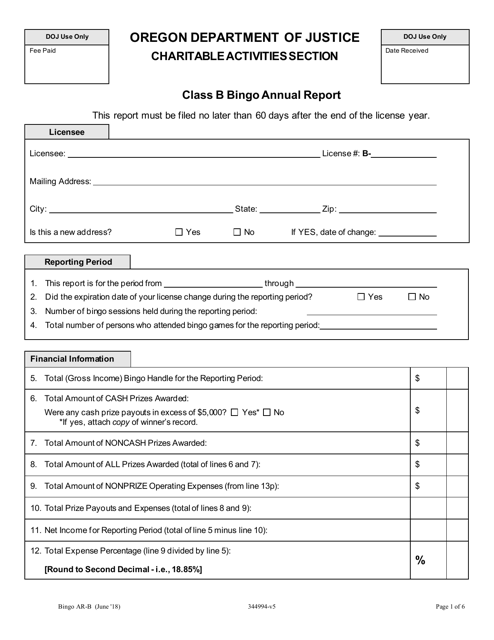

This document is the annual report for Class B Bingo in Oregon. It provides information and updates on the status and operations of Class B Bingo games in the state.

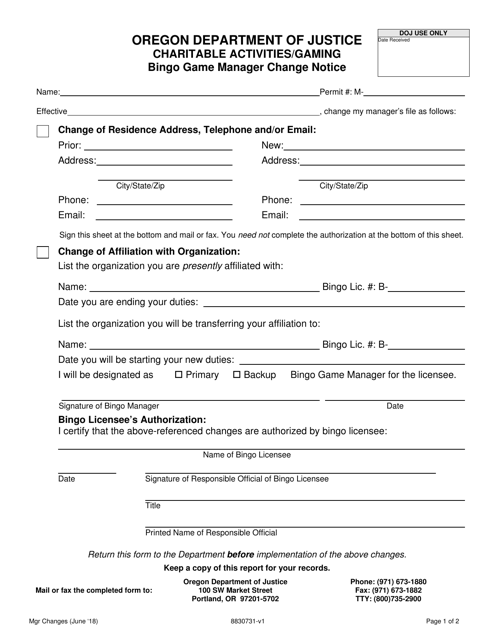

This document provides a notice of changes made to the bingo game manager in the state of Oregon.