Fill and Sign Oregon Legal Forms

Documents:

5198

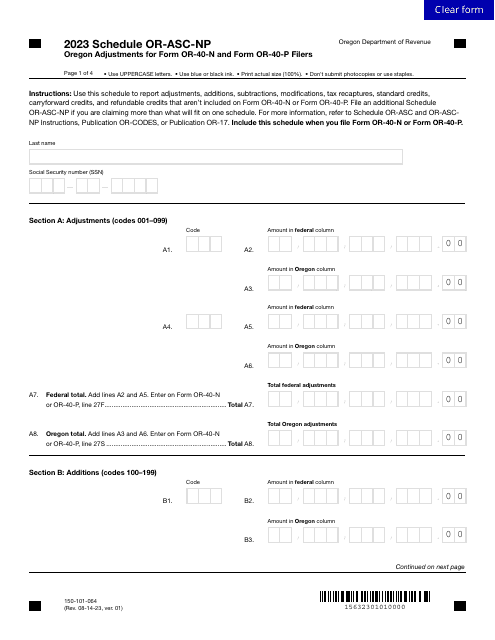

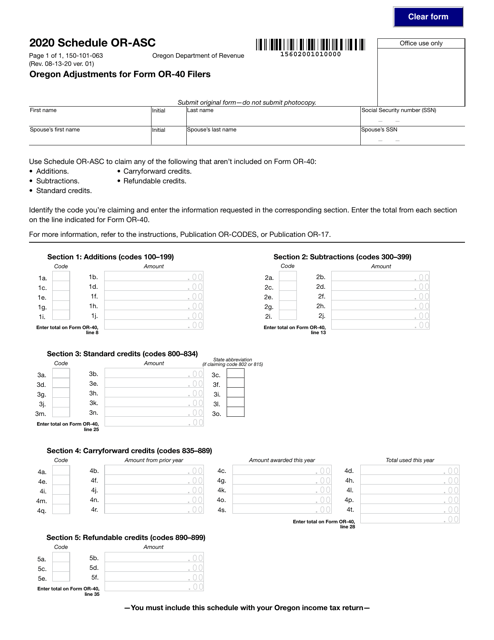

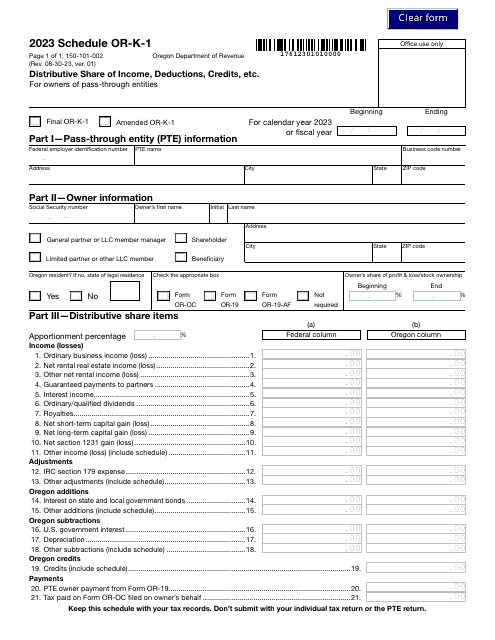

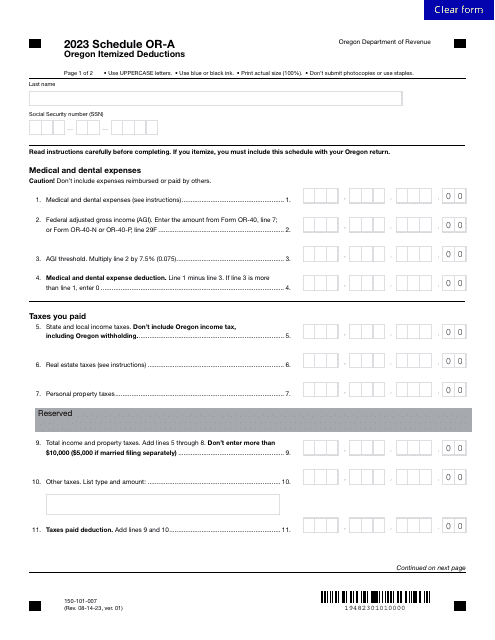

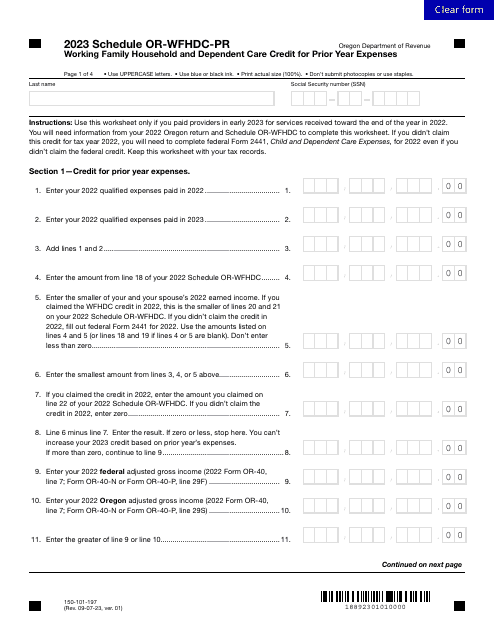

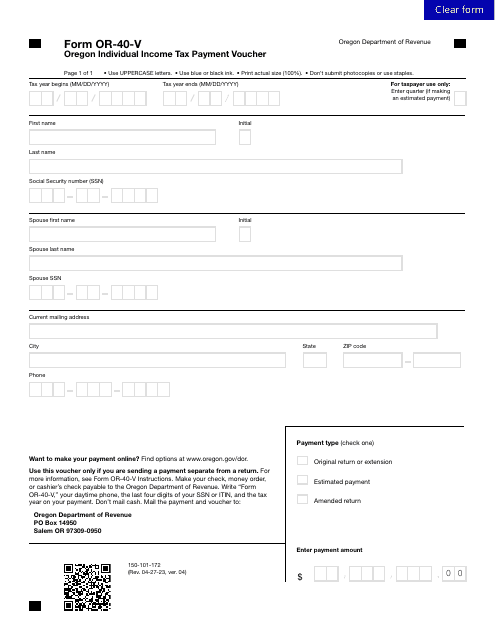

This form is used for making adjustments to the Oregon tax return (Form OR-40) filed by individuals in Oregon. It is specifically designed for Oregon residents and allows them to make corrections or additions to their original tax return. This form helps taxpayers in Oregon ensure that their tax returns are accurate and complete.

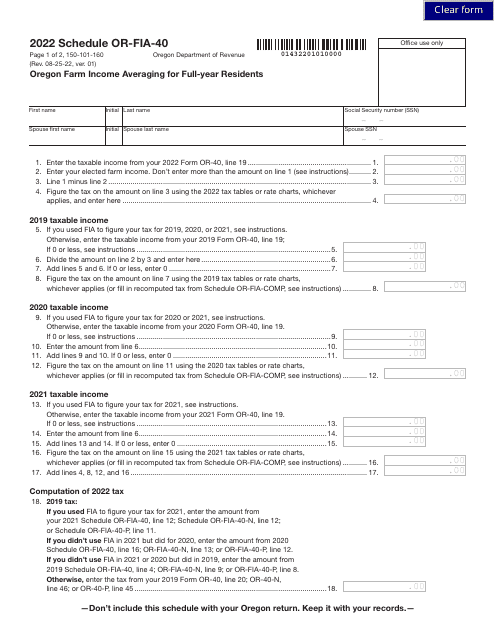

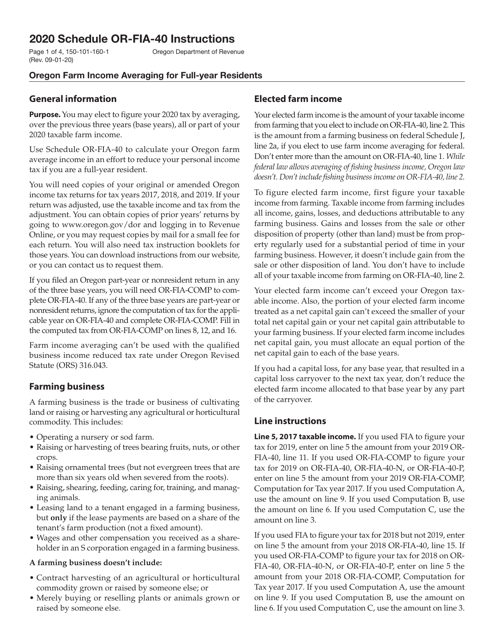

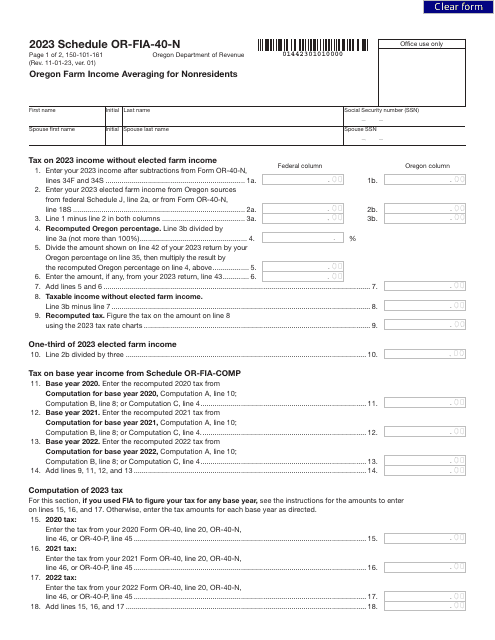

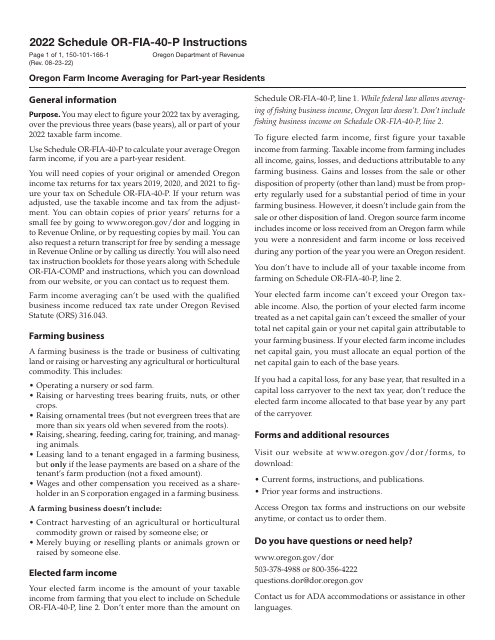

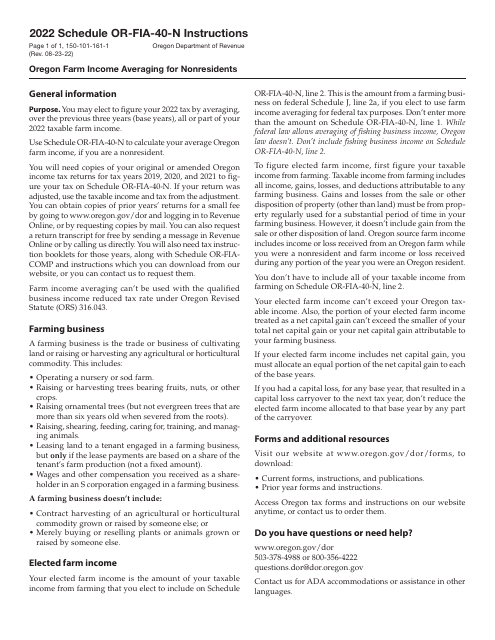

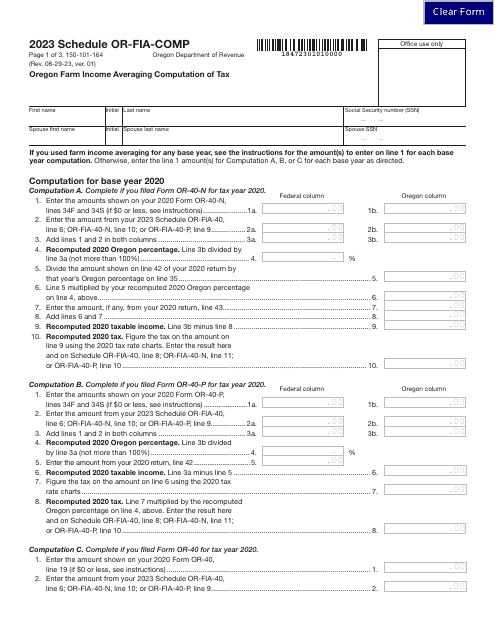

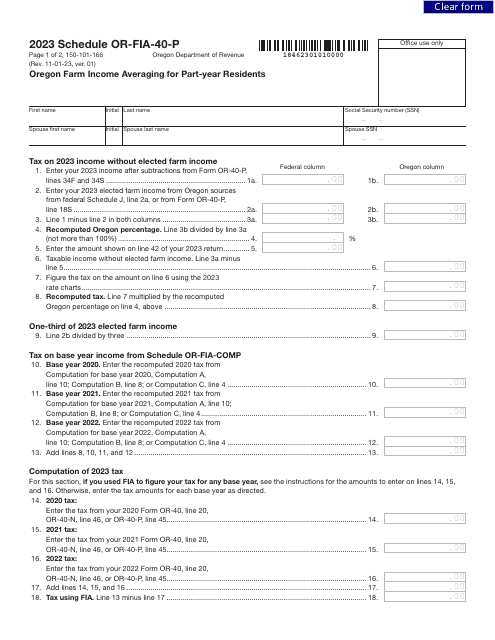

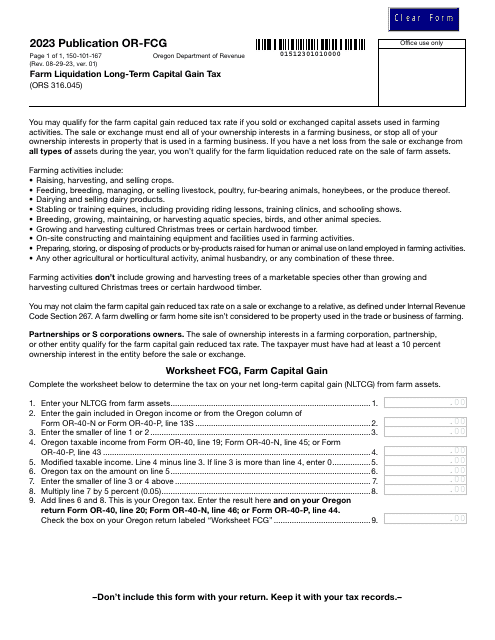

This Form is used for Oregon residents who are farmers to calculate their average income for tax purposes. It helps them determine if they qualify for income averaging and how to report their farm income.

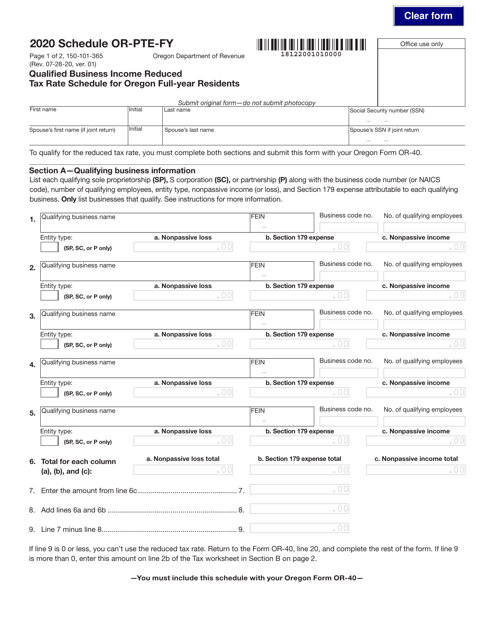

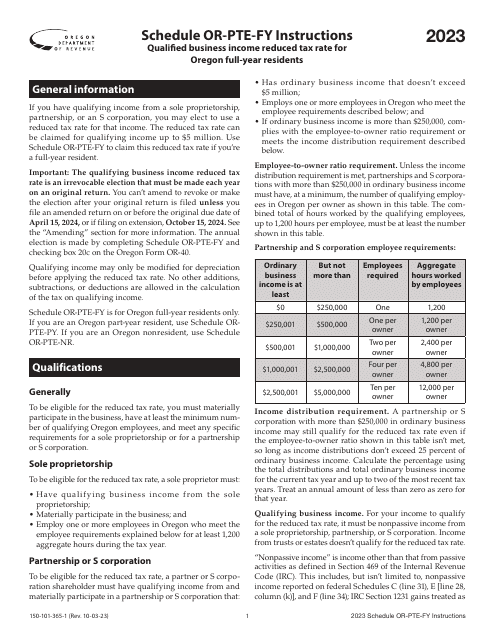

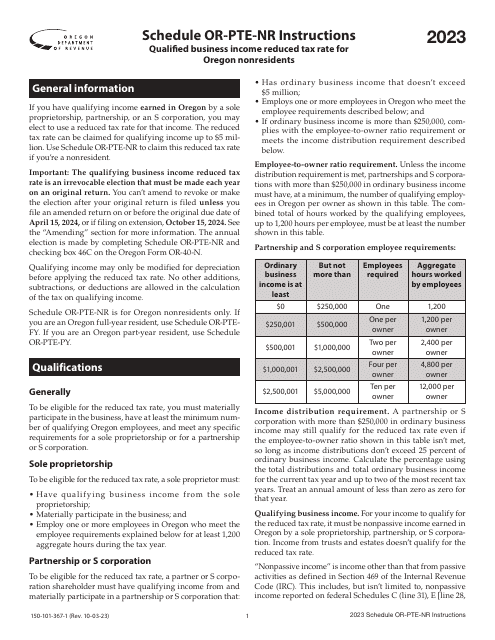

This form is used for Oregon full-year residents to calculate the reduced tax rate for qualified business income.

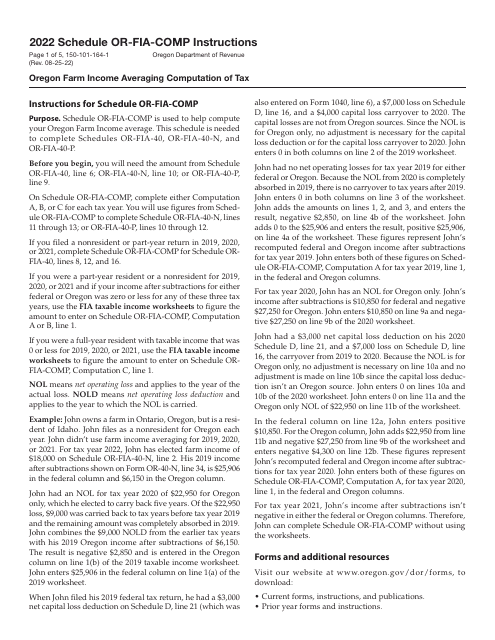

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon, 2023

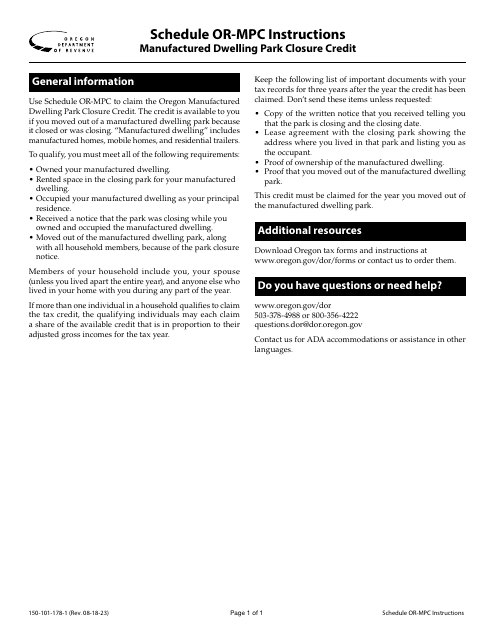

Instructions for Form 150-101-178 Schedule OR-MPC Manufactured Dwelling Park Closure Credit - Oregon

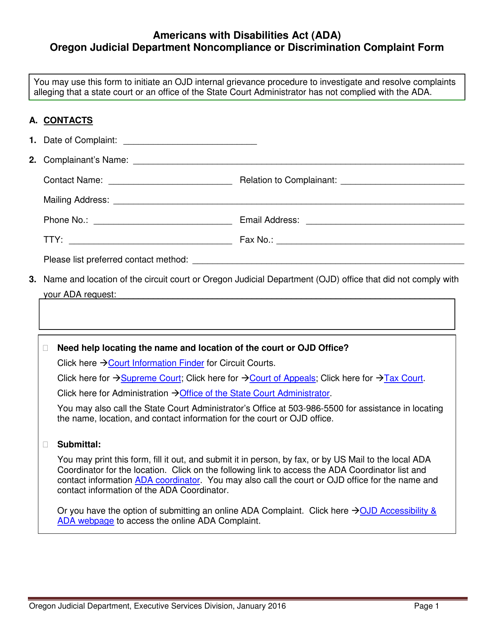

This document is used for filing a complaint regarding noncompliance or discrimination related to the Americans with Disabilities Act (ADA) against the Oregon Judicial Department in Oregon.

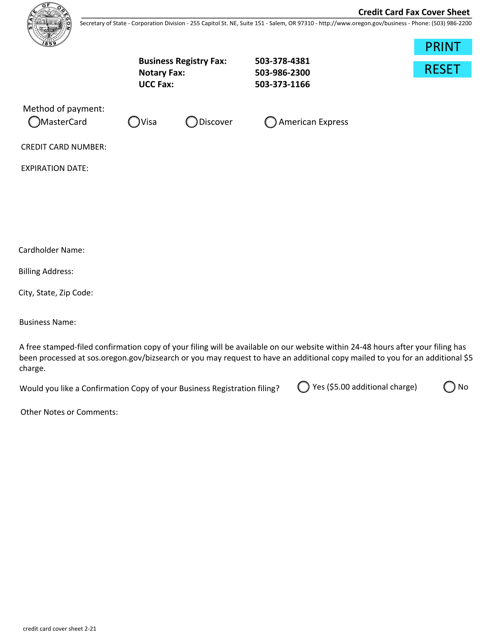

This document is a fax cover sheet specifically designed for credit card-related matters in the state of Oregon. It helps ensure secure transmission of confidential information.

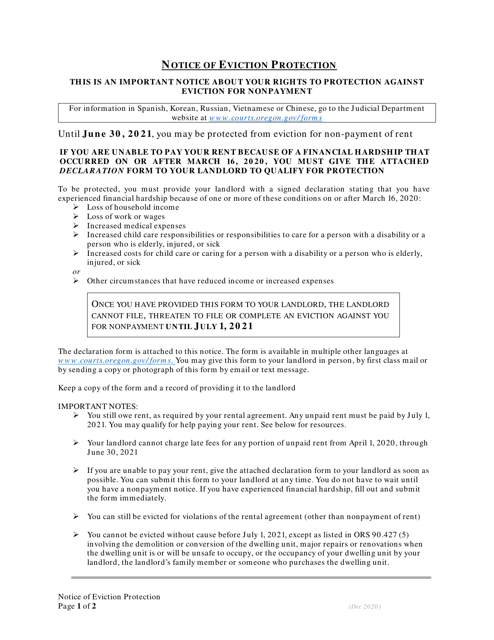

This document is for residents in Oregon who are facing financial hardship and need protection from eviction. It declares the individual's financial difficulties to provide evidence for their eligibility for eviction protection.