Fill and Sign Indiana Legal Forms

Documents:

2277

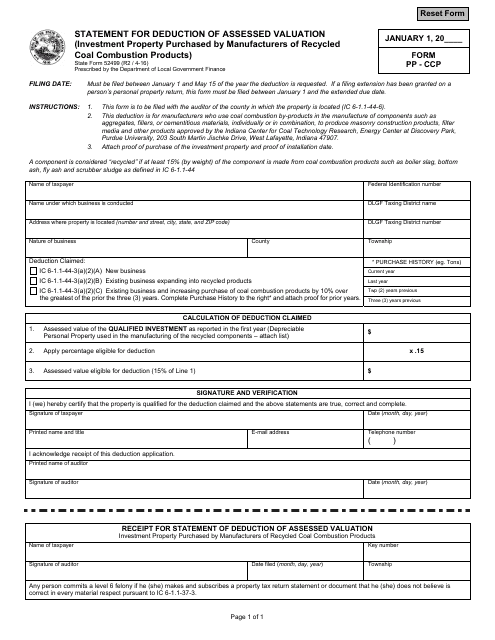

This document is used for reporting the deduction of assessed valuation for investment property purchased by manufacturers of recycled coal combustion products in the state of Indiana.

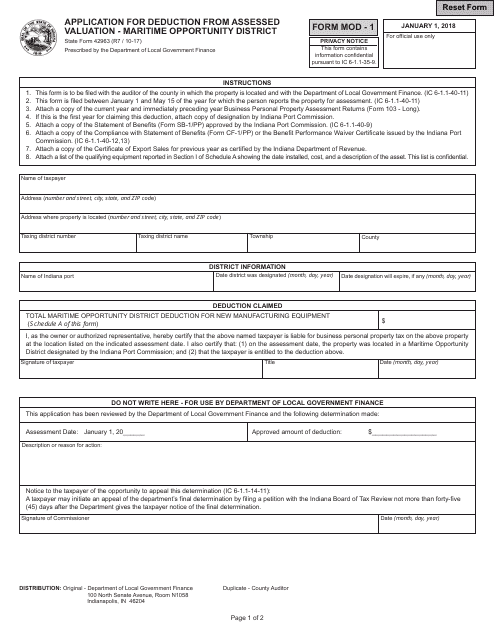

This Form is used for applying for a deduction from the assessed valuation in the Maritime Opportunity District of Indiana.

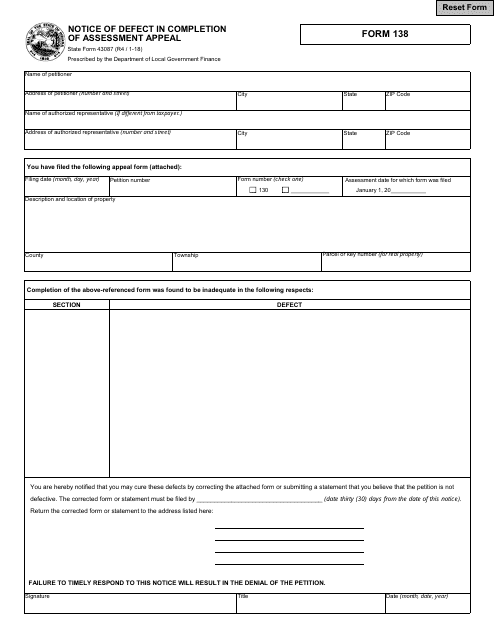

This form is used for notifying individuals in Indiana about a defect in the completion of their assessment appeal.

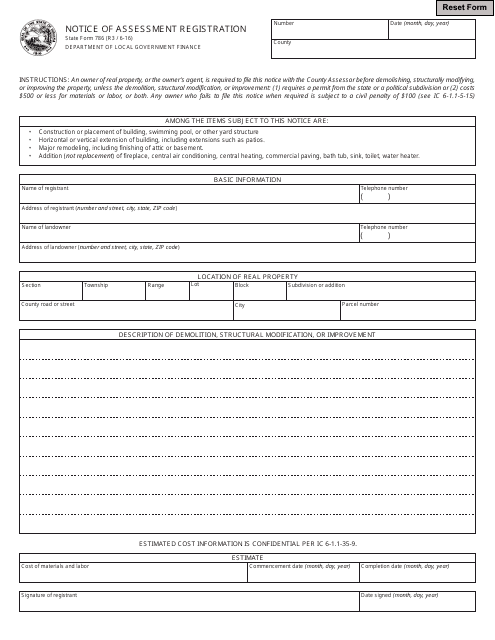

This form is used for registering a notice of assessment in the state of Indiana.

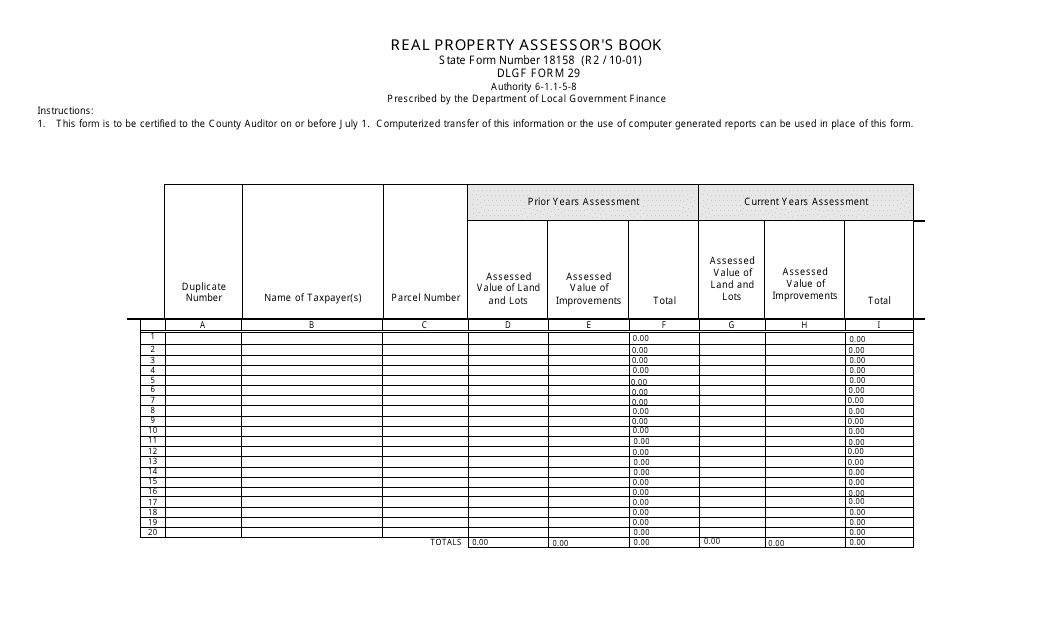

This form is used for the Real Property Assessor's Book in Indiana.

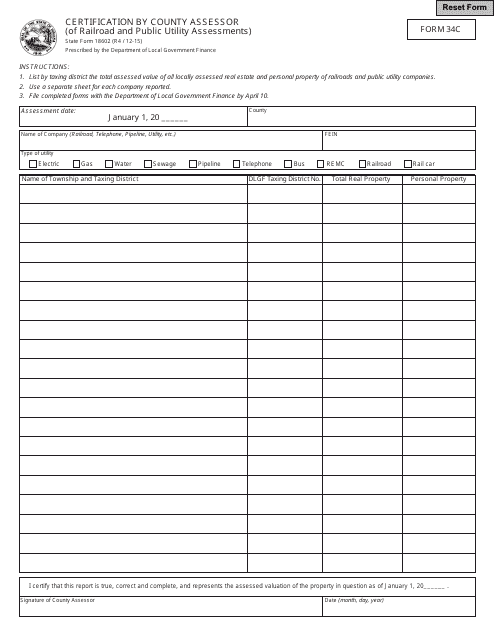

This form is used for the certification by the county assessor in Indiana for railroad and public utility assessments.

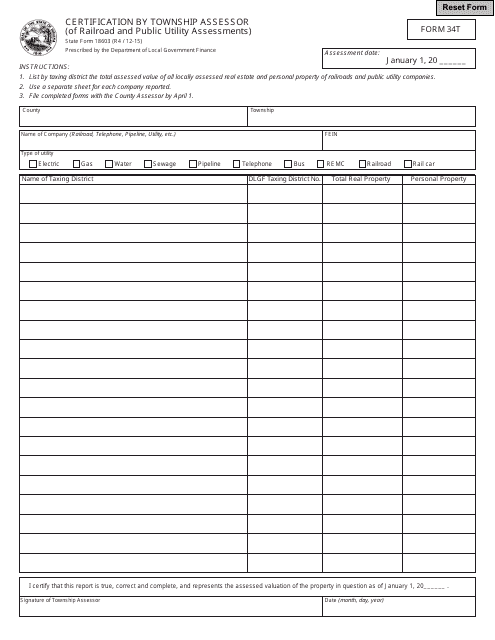

This type of document is used for certifying railroad and public utility assessments by the Township Assessor in Indiana.

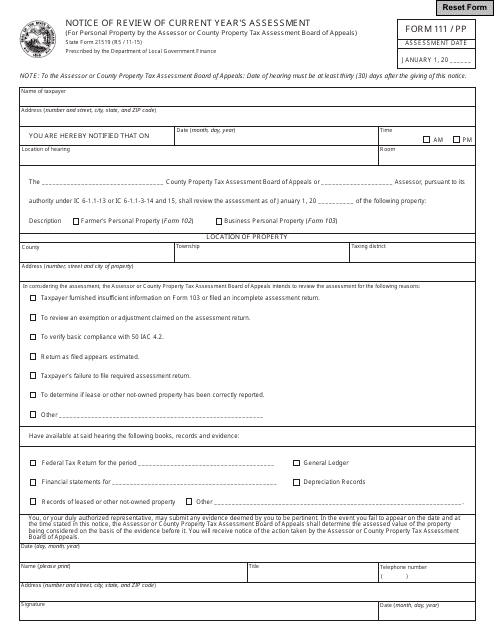

This form is used for notifying Indiana residents about the review of their current year's assessment.

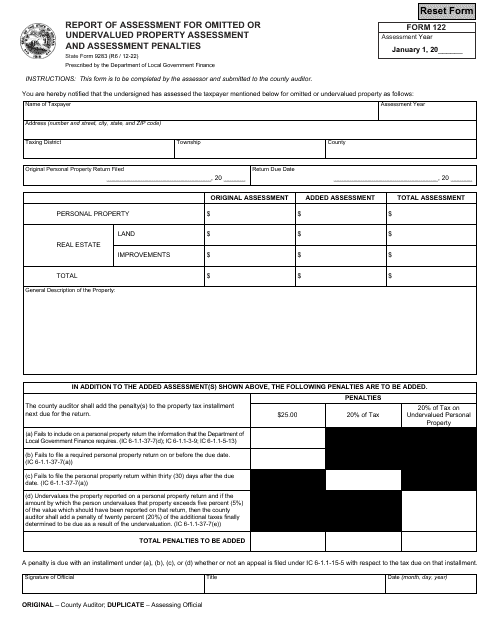

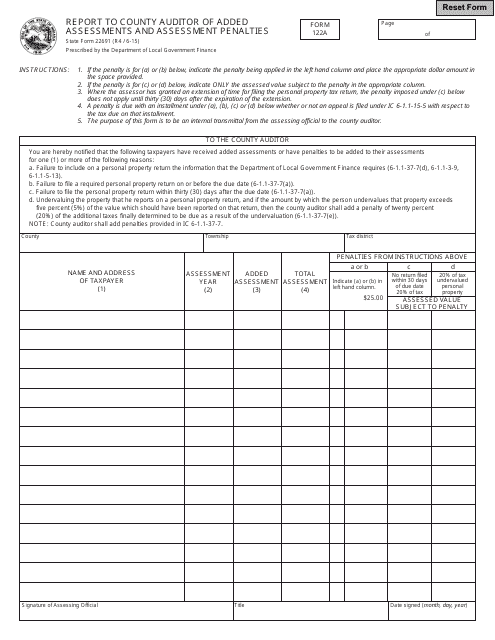

This form is used for reporting added assessments and assessment penalties to the county auditor in Indiana.

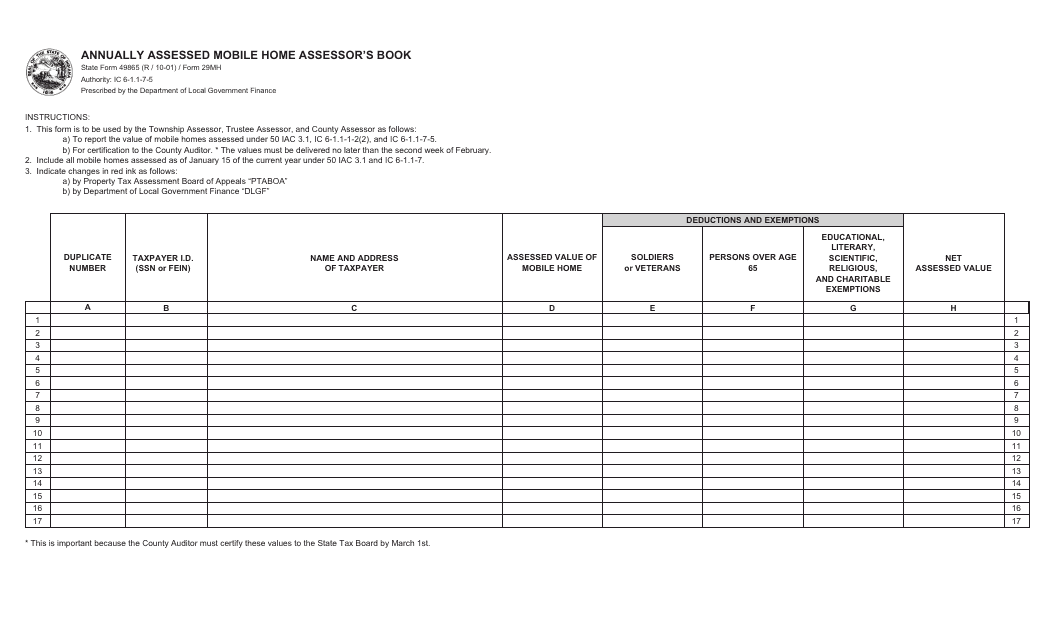

This Form is used for annually assessing mobile homes in Indiana. It is the Assessor's Book for tracking and documenting information about mobile homes in the state.

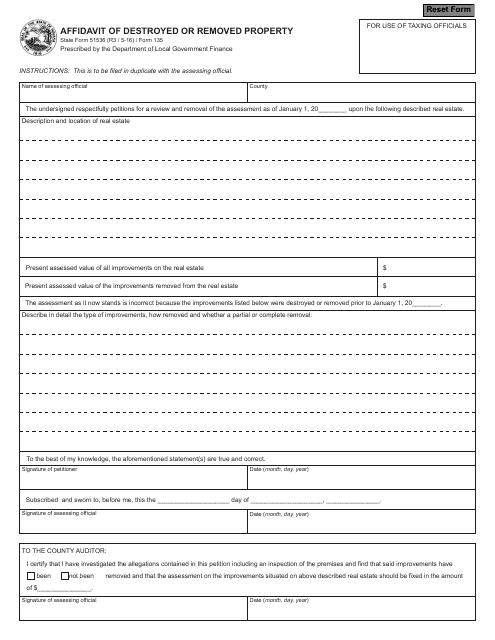

This Form is used for filing an Affidavit of Destroyed or Removed Property in the state of Indiana.

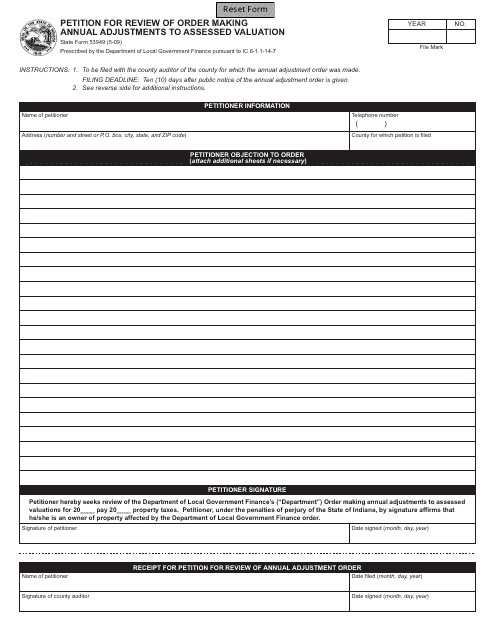

This form is used for filing a petition to review an order that makes annual adjustments to the assessed valuation of property in the state of Indiana.

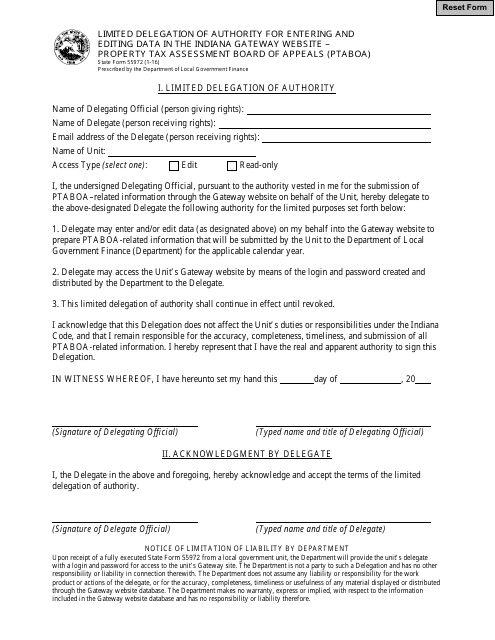

This form is used for granting limited delegation of authority to enter and edit data in the Indiana Gateway Website for the Property Tax Assessment Board of Appeals (PTABOA) in Indiana.

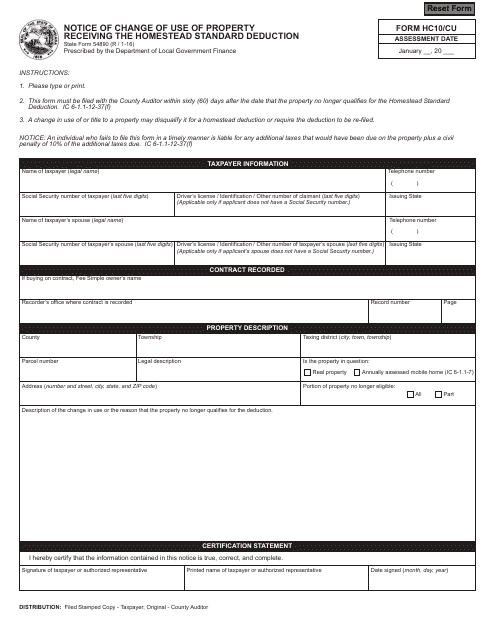

This Form is used for notifying the state of Indiana about the change in use of a property that is receiving the homestead standard deduction.

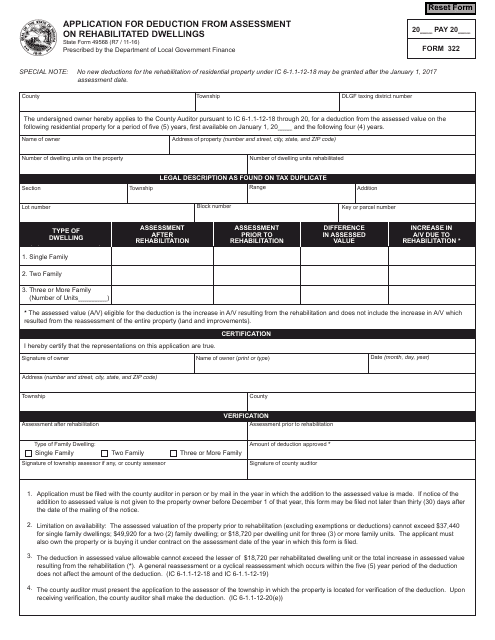

This form is used for applying for a deduction from assessment on rehabilitated dwellings in Indiana.

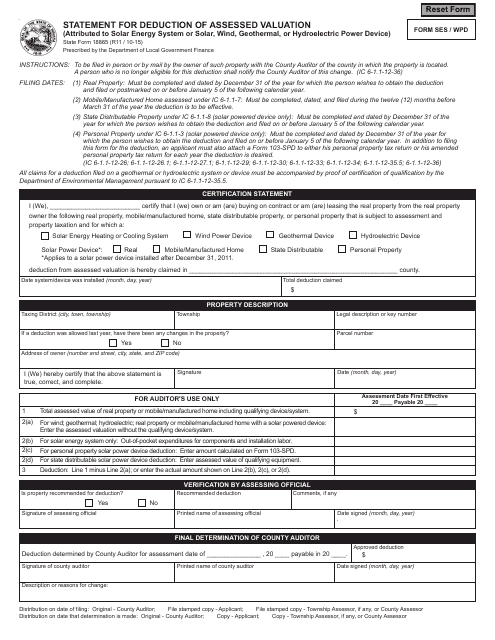

This form is used for submitting a statement to request a deduction in the assessed valuation of property due to the installation of a solar energy system or wind, geothermal, or hydroelectric power device in Indiana.

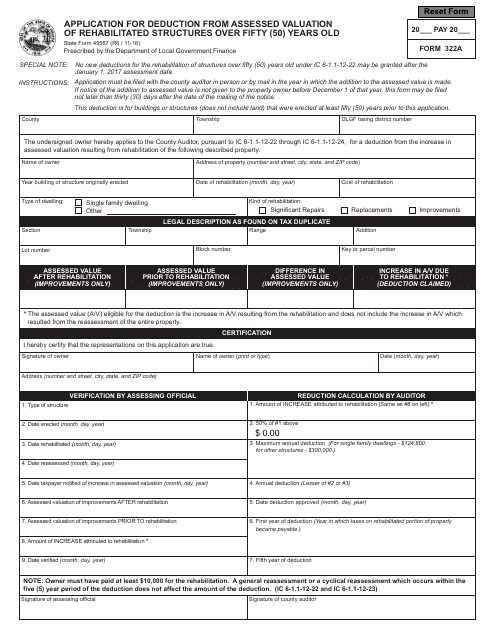

This Form is used for applying for a deduction from the assessed valuation of rehabilitated structures over 50 years old in the state of Indiana.

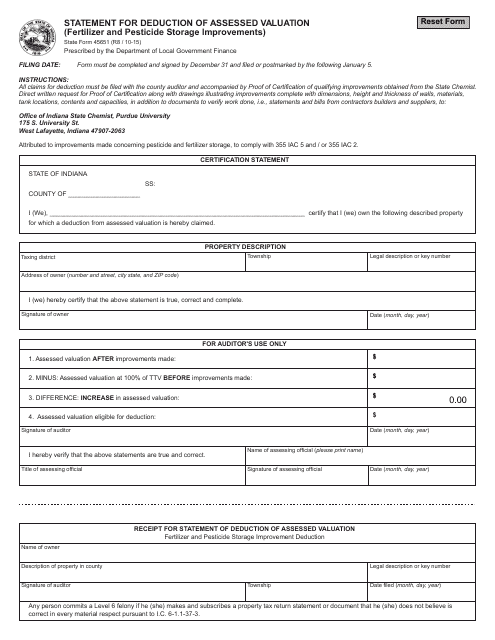

This form is used for claiming a deduction for the assessed valuation of fertilizer and pesticide storage improvements in the state of Indiana.

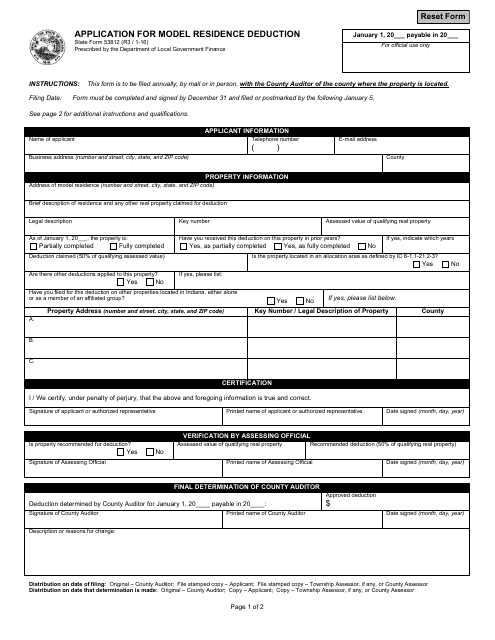

This form is used for Indiana residents who want to apply for a model residence deduction on their state taxes.

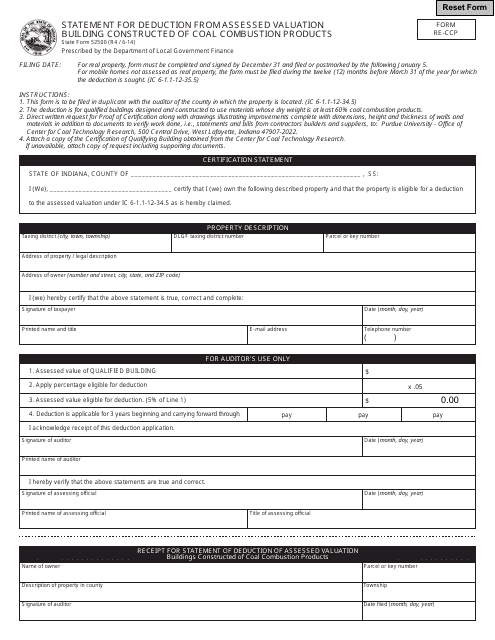

This form is used for reporting the deduction of assessed valuation for buildings constructed of coal combustion products in Indiana.

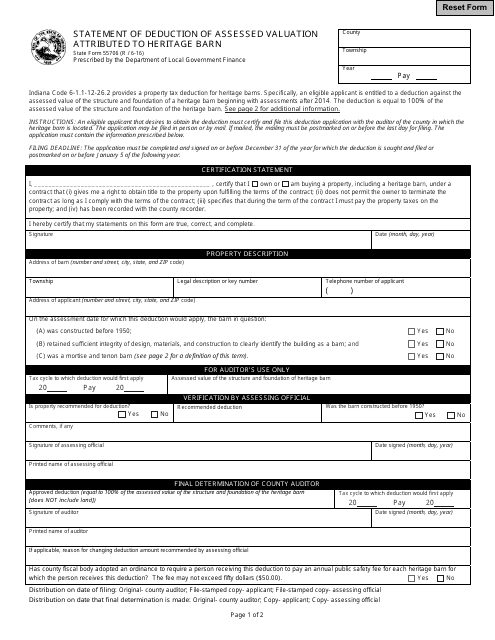

This document is used for recording the deduction of assessed valuation from a heritage barn in Indiana.

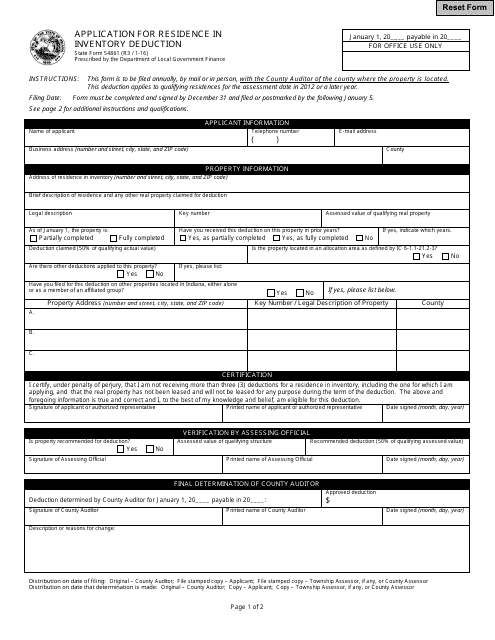

This Form is used for applying for residence in inventory deduction in the state of Indiana.

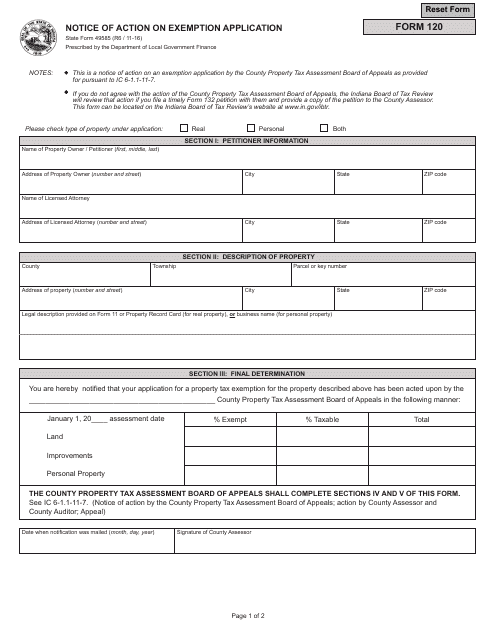

This form is used in Indiana to notify individuals about the action taken on their exemption application.

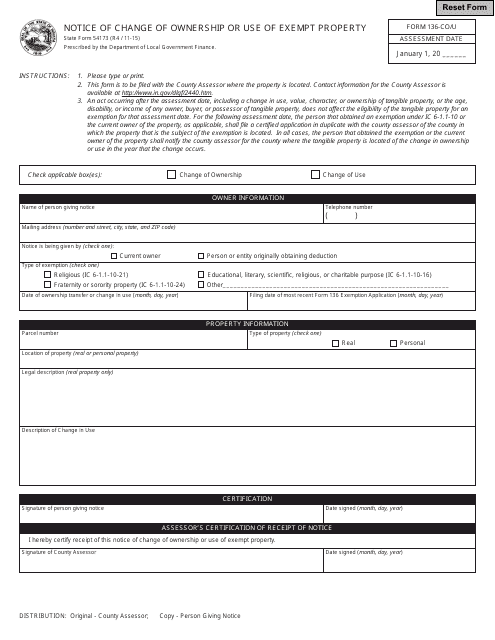

This form is used for notifying the state of Indiana about a change in ownership of exempt property. It is also known as Form 136-CO/U or State Form 54173.