Fill and Sign Indiana Legal Forms

Documents:

2277

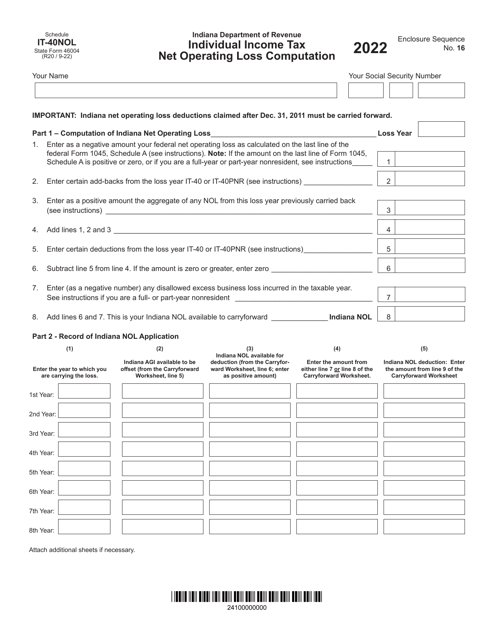

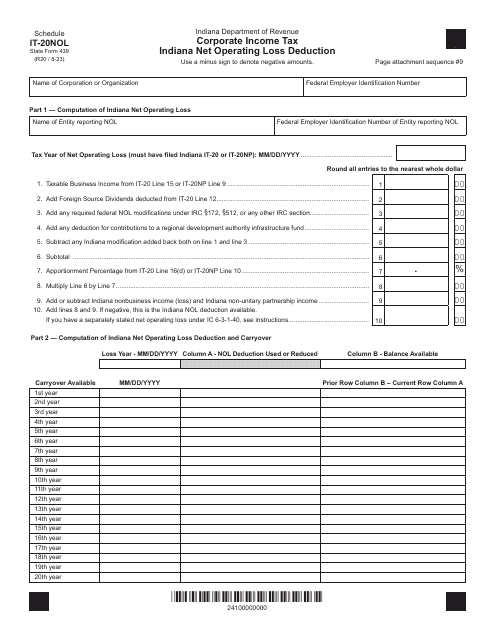

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

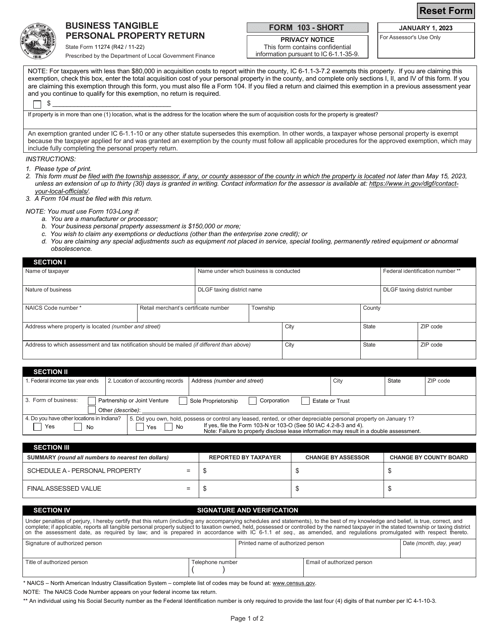

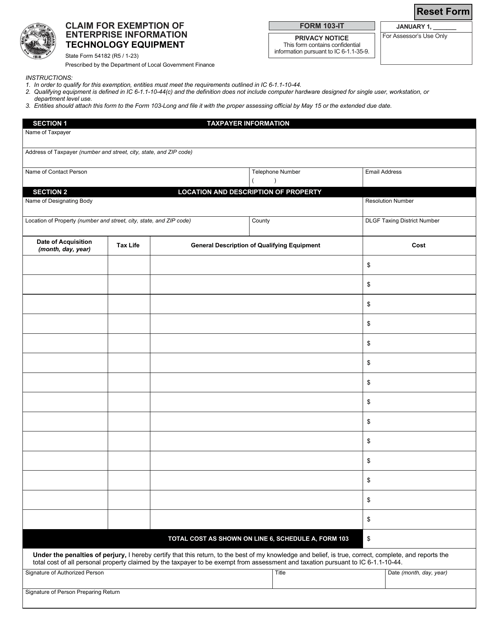

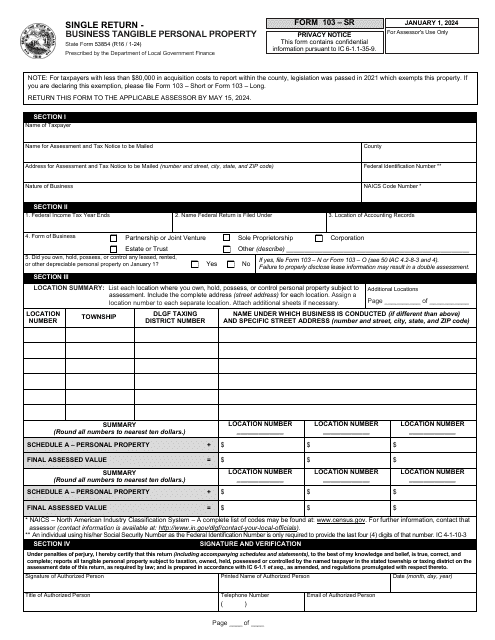

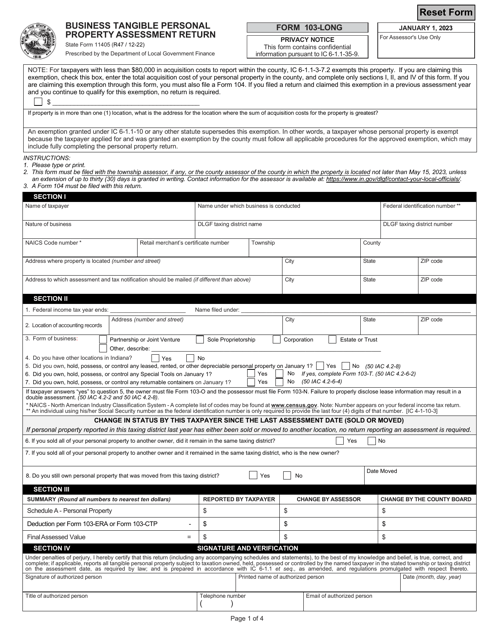

This Form is used for reporting business tangible personal property in Indiana. It is used to calculate and report the value of tangible assets owned by a business for taxation purposes.

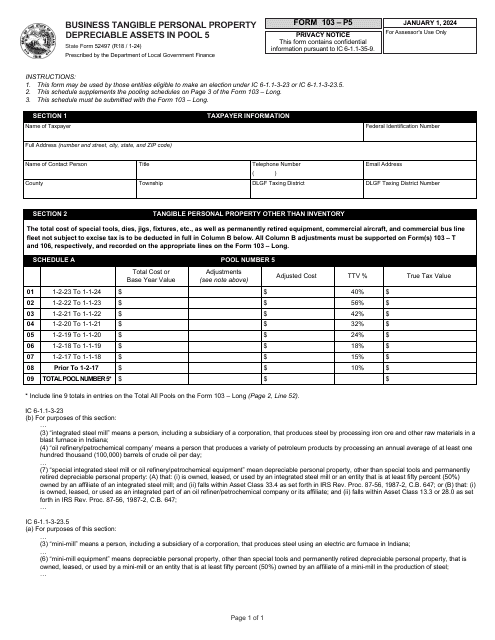

State Form 52497 (103-P5) Business Tangible Personal Property Depreciable Assets in Pool 5 - Indiana

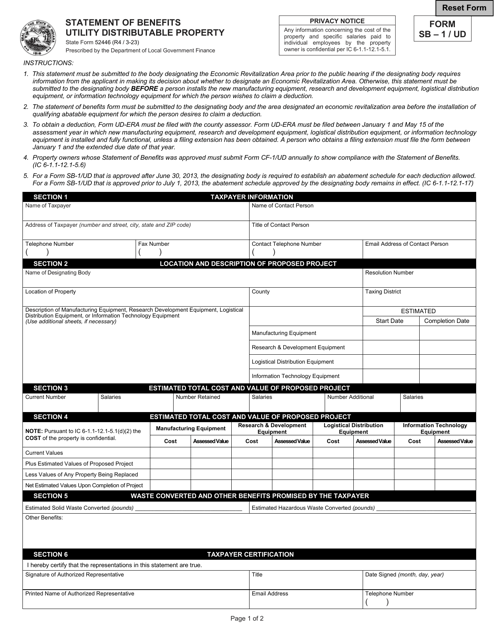

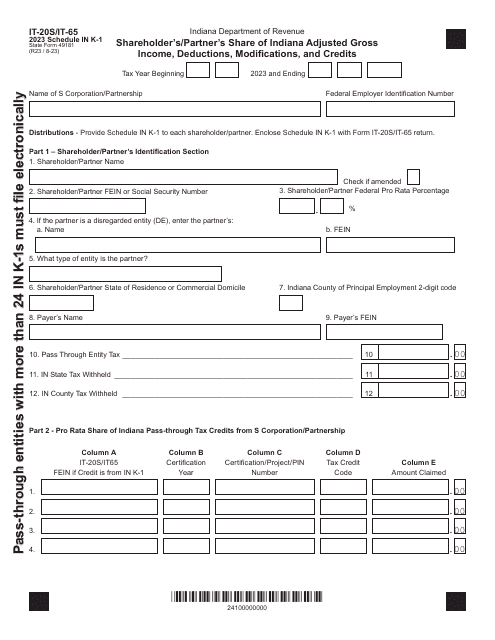

This Form is used for reporting utility distributable property and benefits in the state of Indiana.

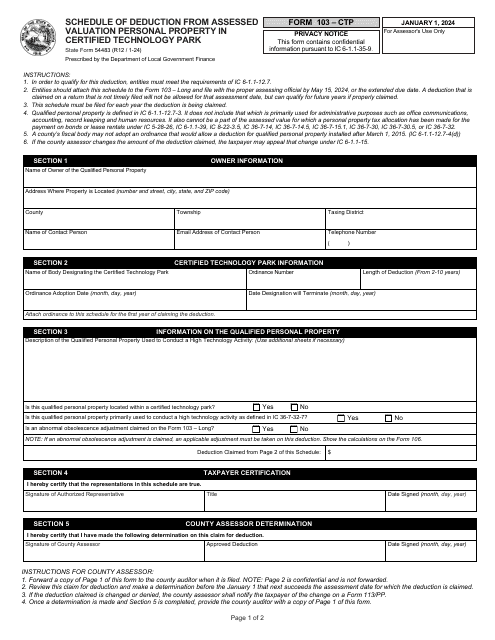

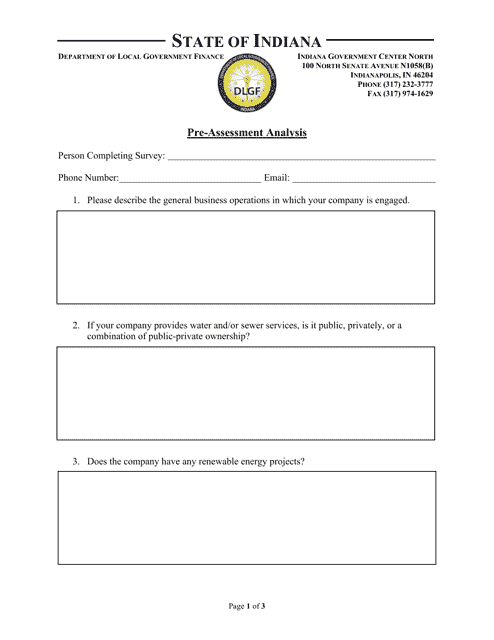

This document is a pre-assessment analysis for the state of Indiana. It provides an overview of the state's current situation and identifies areas that need further evaluation or improvement.