Fill and Sign Indiana Legal Forms

Documents:

2277

This document affirms the coordination between Head Start and Title I, Part A programs in Indiana.

This document is used for transferring ownership in the state of Indiana. It is used to officially transfer ownership of property, such as a car or real estate, from one person or entity to another.

This document is for conducting a survey on language usage at home in Indiana.

This document is used to gather information about the primary language spoken at home in the state of Indiana.

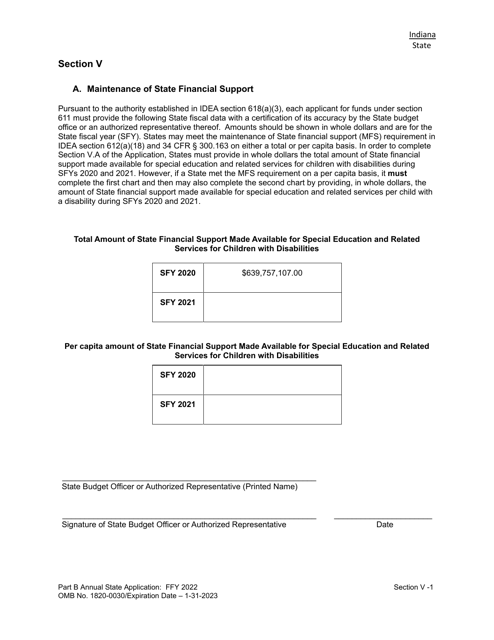

This document outlines the guidelines and requirements for the maintenance of state financial support in the state of Indiana. It includes information on how funds are allocated and the responsibilities of recipients in ensuring that the support is maintained.

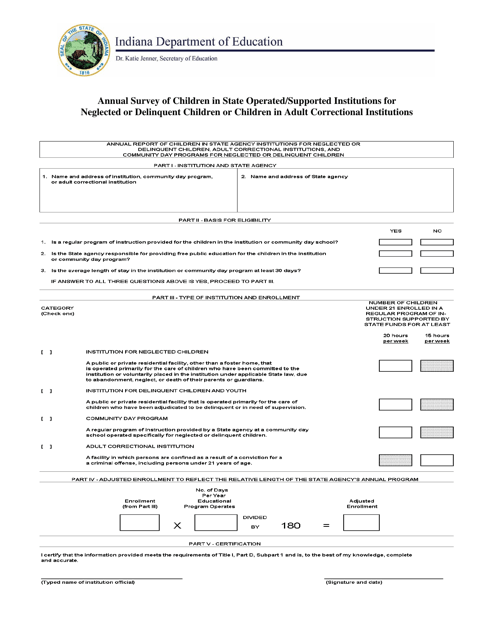

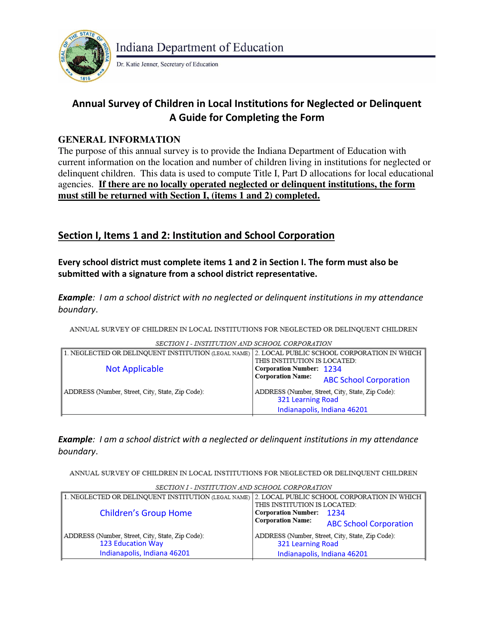

This document is the Annual Survey of Children in State Operated/Supported Institutions for Neglected or Delinquent Children or Children in Adult Correctional Institutions in the state of Indiana. It provides information about the number and characteristics of children in these institutions.

This form is used for conducting the Annual Survey of Children in State Operated/Supported Institutions for Neglected or Delinquent Children or Children in Adult Correctional Institutions in Indiana. It provides instructions on how to collect information about children in these institutions for reporting purposes.

This document is for Indiana educators who are seeking reimbursement for expenses related to improving teacher quality. It provides instructions on how to complete the Title II-A Improving Teacher Quality Reimbursement Form.

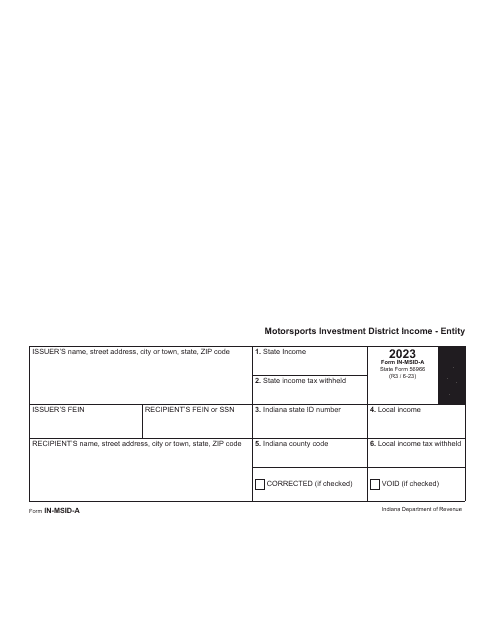

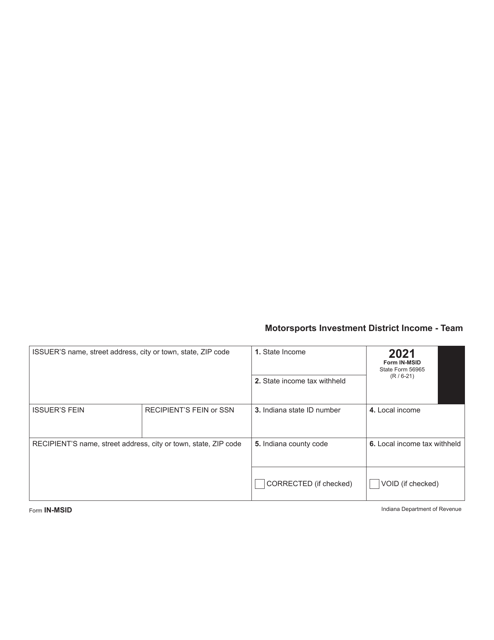

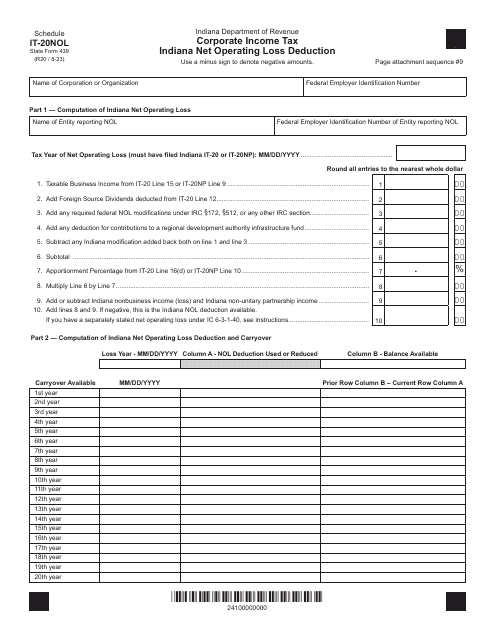

This document is used to report income for motorsports teams in the Motorsports Investment District in Indiana.

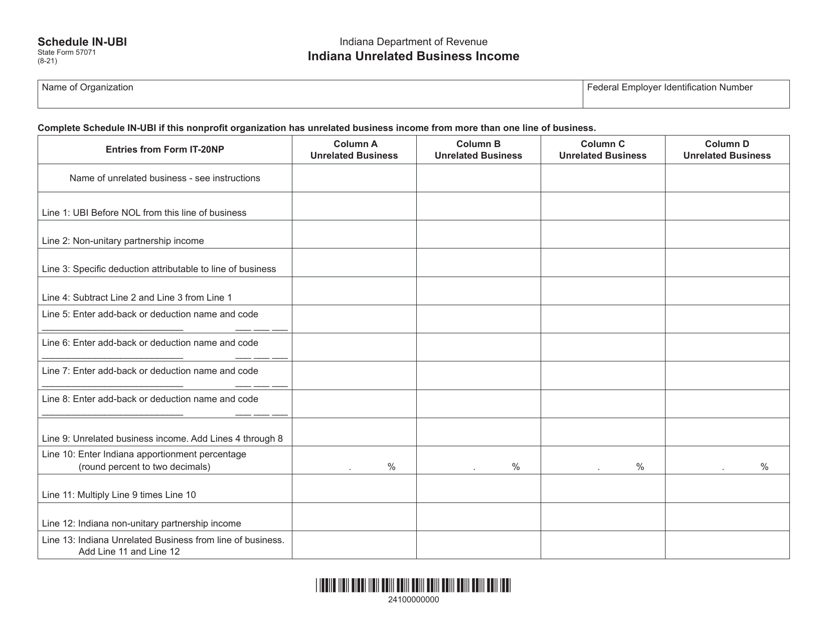

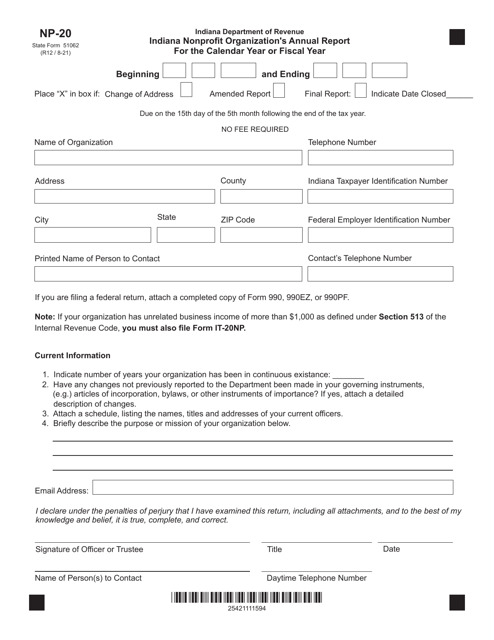

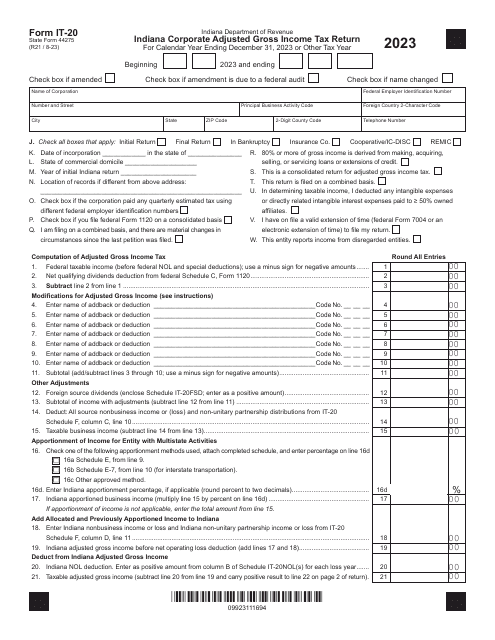

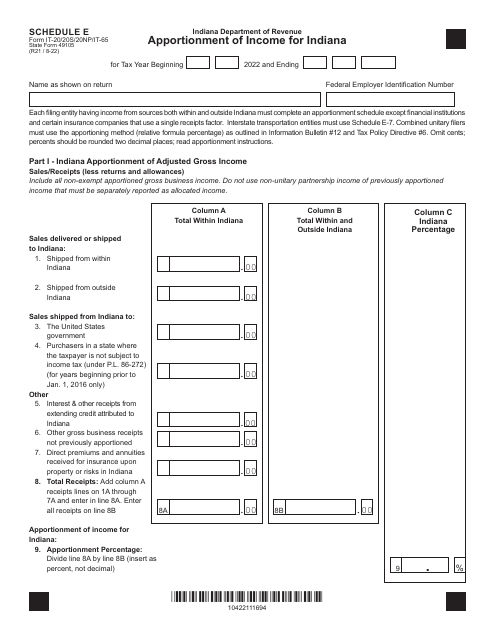

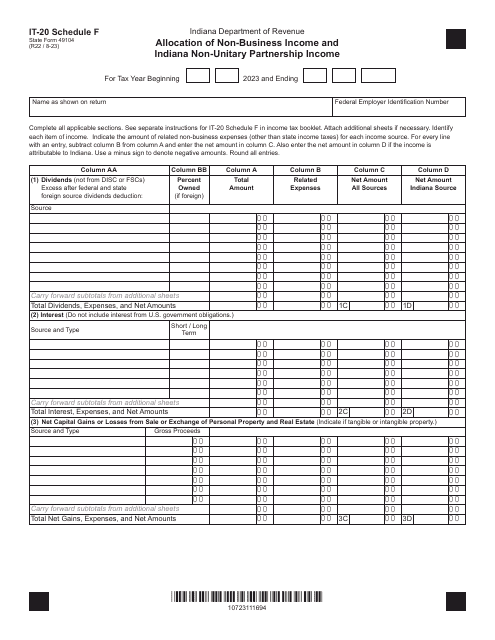

This Form is used for reporting Indiana Unrelated Business Income for organizations in Indiana.

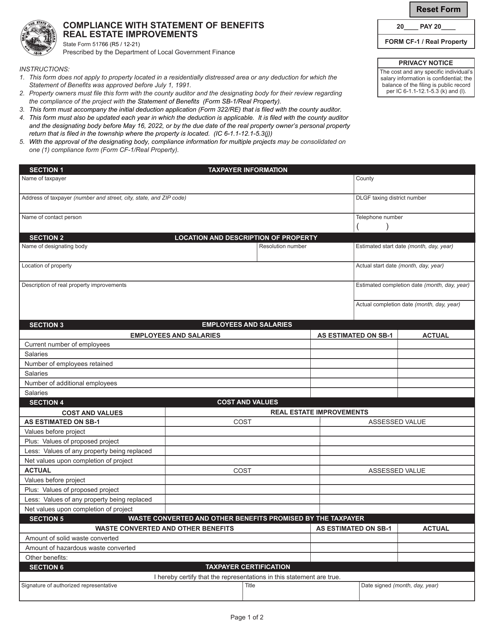

This form is used for compliance with the statement of benefits for real estate improvements in Indiana.

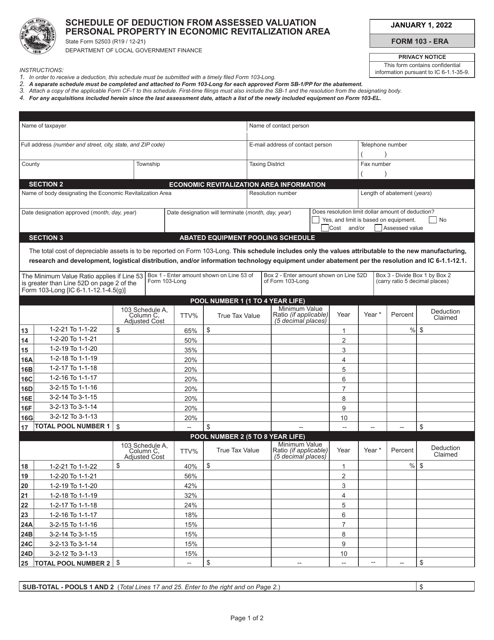

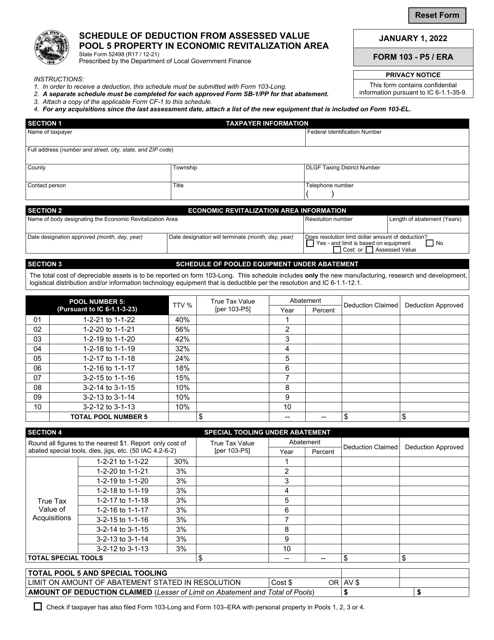

This form is used for reporting the schedule of deductions from assessed valuation for personal property in an Economic Revitalization Area in Indiana.

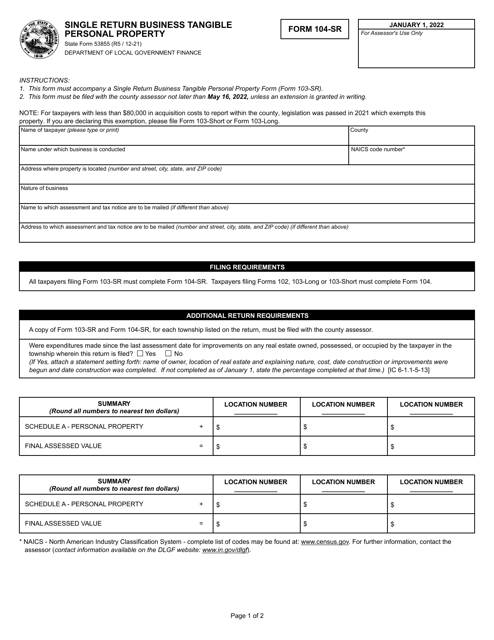

This Form is used for reporting business tangible personal property for single return in the state of Indiana.

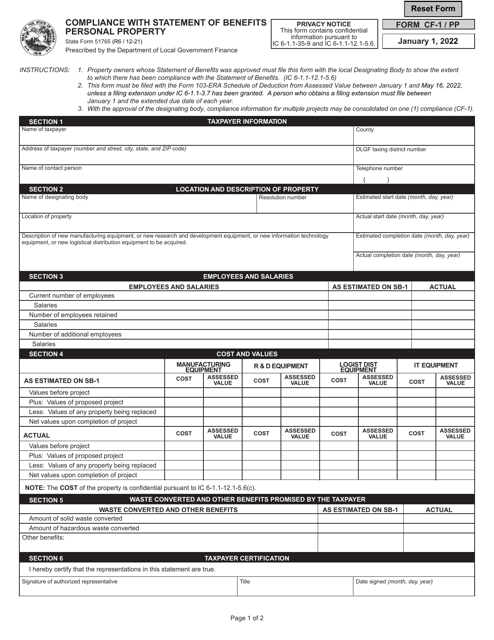

This Form is used for compliance with the statement of benefits for personal property in Indiana. It helps ensure that individuals are accurately reporting their personal property holdings.

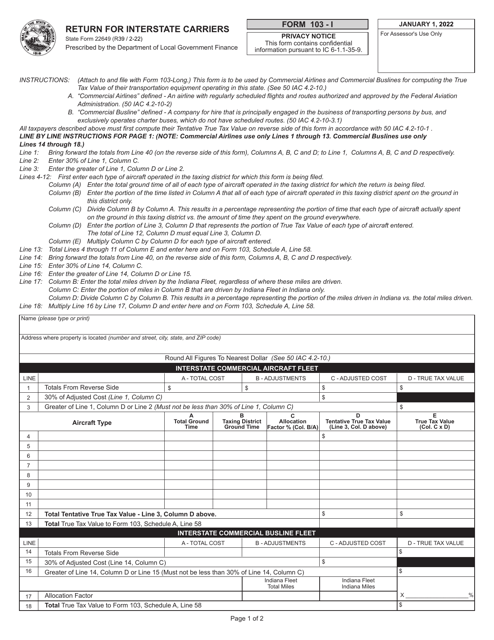

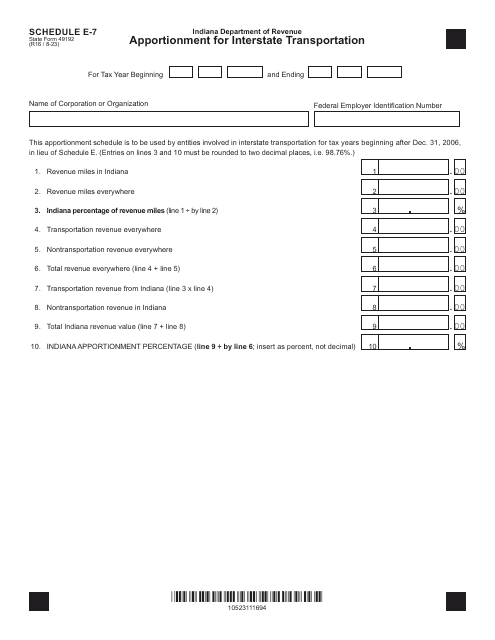

This Form is used for filing the annual tax return for interstate carriers operating in the state of Indiana.

This form is used for reporting deductions from the assessed value of properties in an Economic Revitalization Area in Indiana.

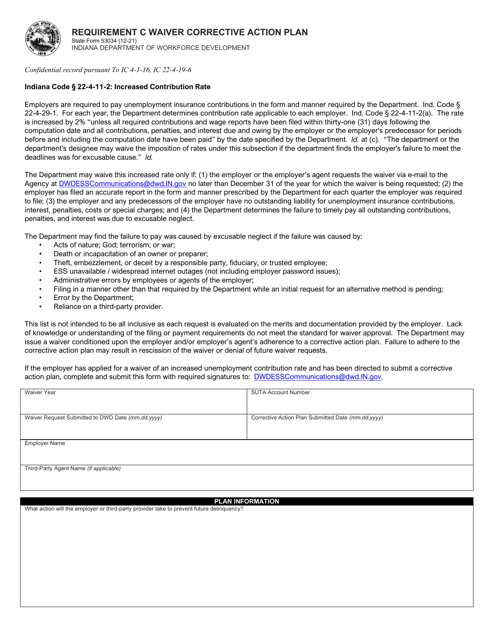

This document is a corrective action plan for a waiver requirement in the state of Indiana (Form 53034). It outlines the necessary steps to address any deficiencies or non-compliance and ensure compliance moving forward.

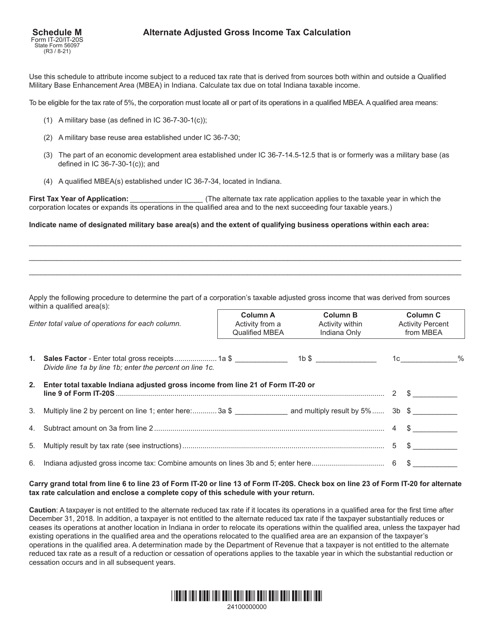

This form is used for calculating the alternate adjusted gross income tax in Indiana. It is applicable for both IT-20 and IT-20S forms.