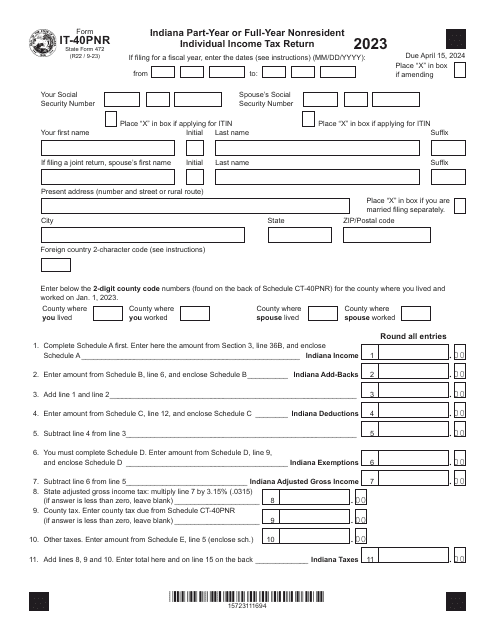

Fill and Sign Indiana Legal Forms

Documents:

2277

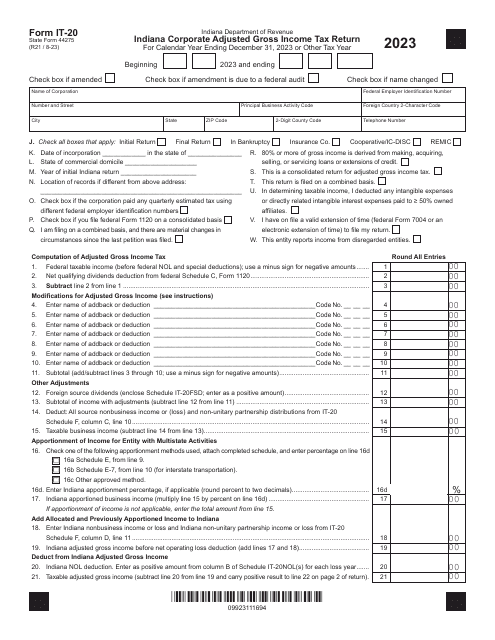

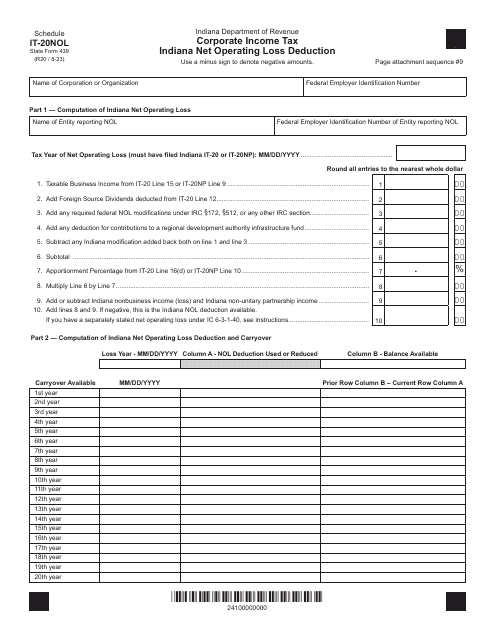

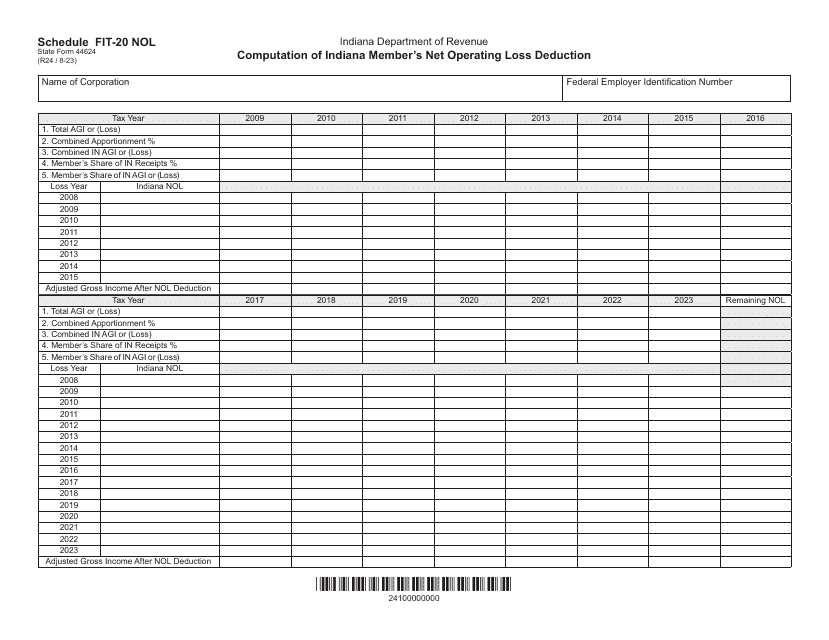

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

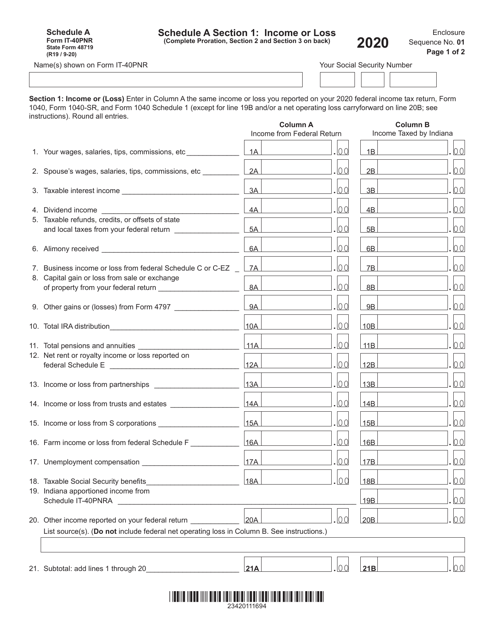

This form is used for reporting income or loss, proration, and adjustments to income in Indiana.

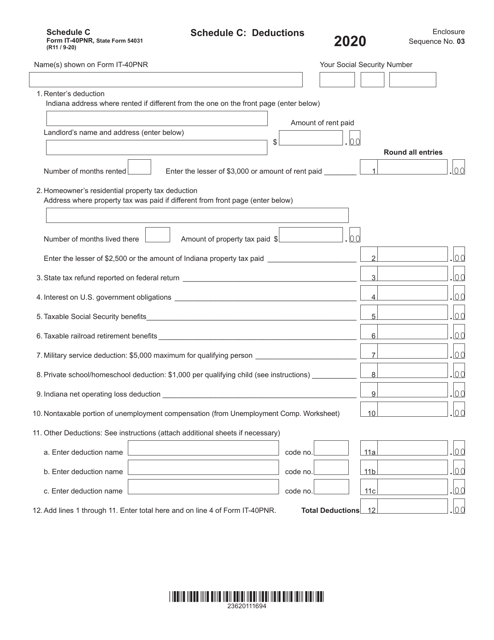

This form is used for claiming Schedule C deductions on the Indiana tax return (IT-40PNR). It allows Indiana residents to deduct business expenses related to self-employment or small business activities.

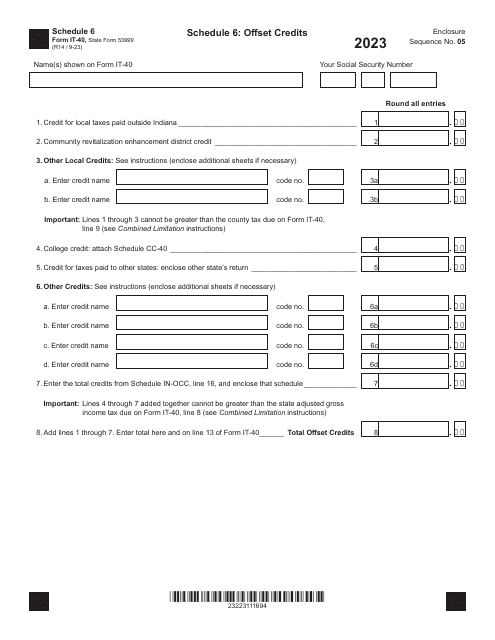

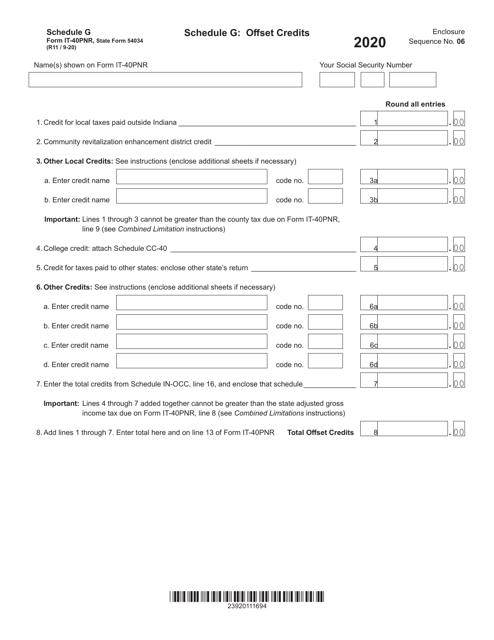

This document is used for reporting offset credits on Schedule G when filing the Indiana state tax form 54034 (IT-40PNR).

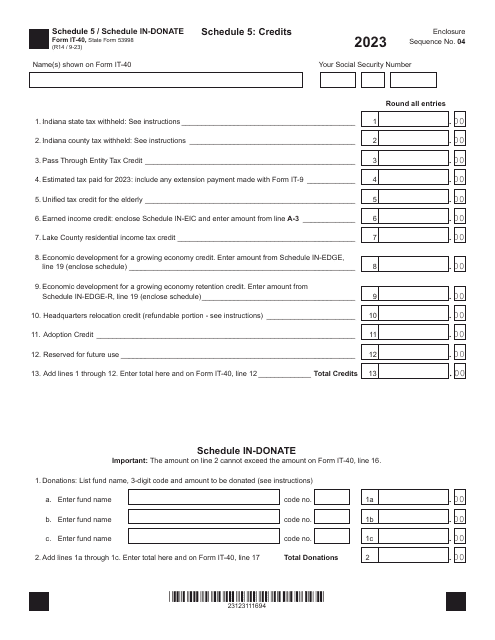

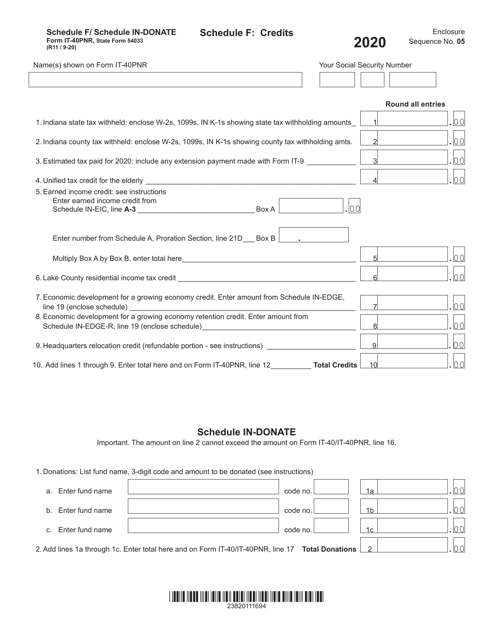

This Form is used for claiming IN-DONATE credits on Schedule F for Indiana state taxes.

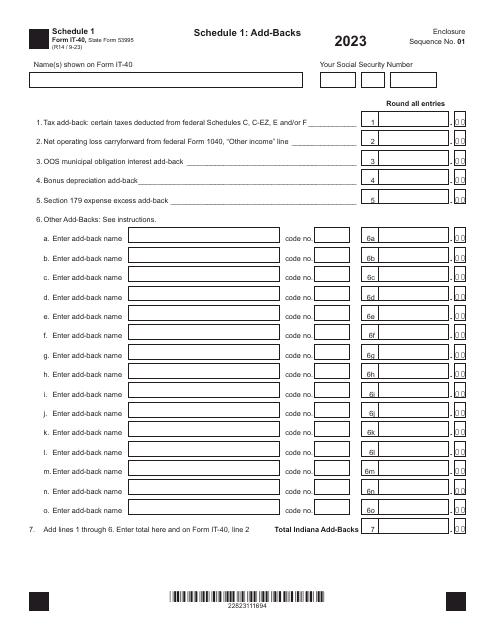

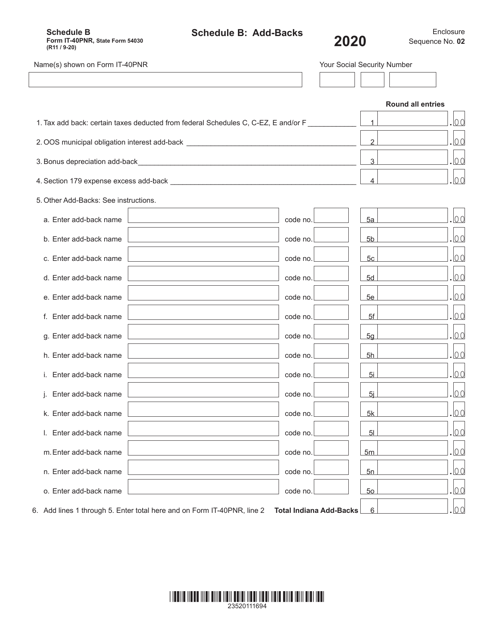

This Form is used for reporting add-backs on Schedule B of the Indiana IT-40PNR tax return. It helps taxpayers determine which expenses or deductions need to be added back to their income for tax purposes in the state of Indiana.

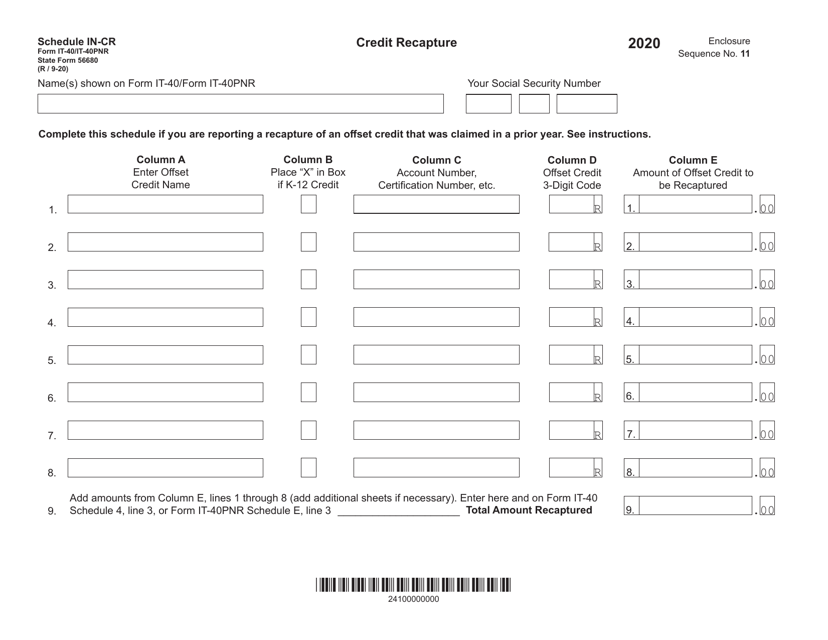

This Form is used for reporting and recapturing certain tax credits in Indiana for individuals filing the IT-40 or IT-40PNR.

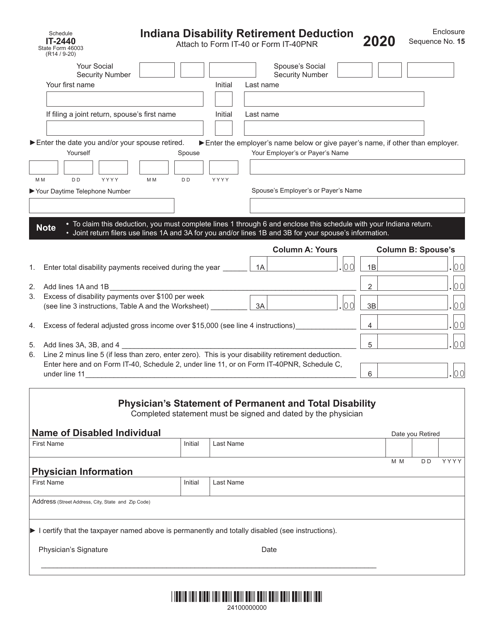

This document is used for claiming disability retirement deductions in the state of Indiana.

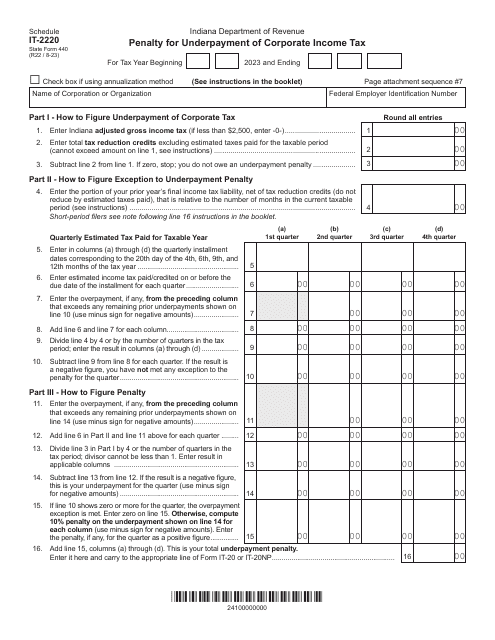

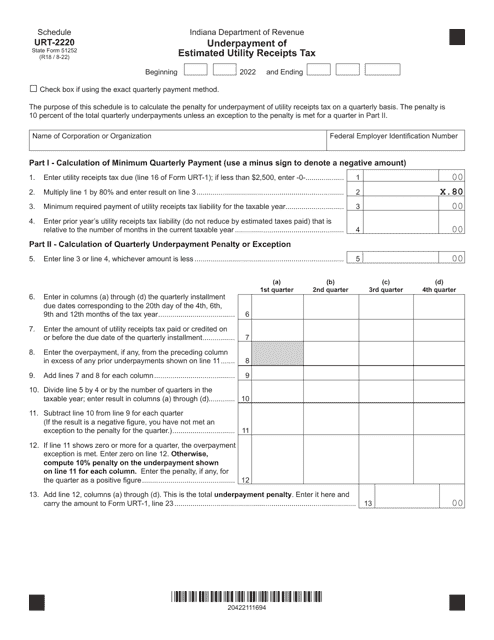

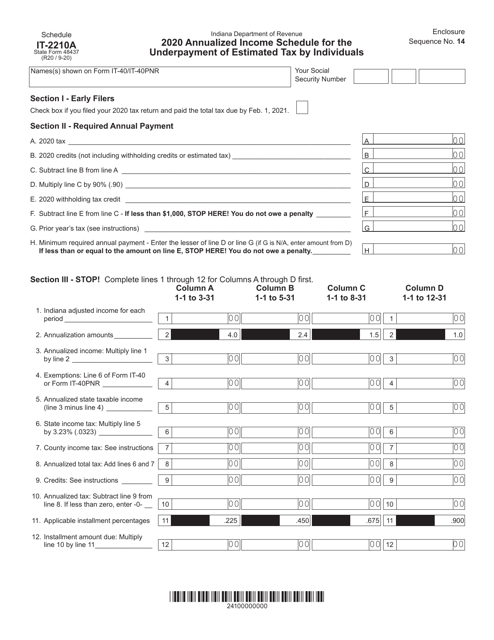

This form is used for calculating the underpayment of estimated tax by individuals in Indiana. It is an annualized income schedule that helps individuals determine if they owe any additional tax due to underestimating their income throughout the year.