Schedule Eic Templates

Are you eligible for the Earned Income Credit (EIC)? Discover how you can maximize your tax benefits with Schedule EIC. This document group is a collection of important forms and instructions that can help qualifying individuals claim their earned income credit.

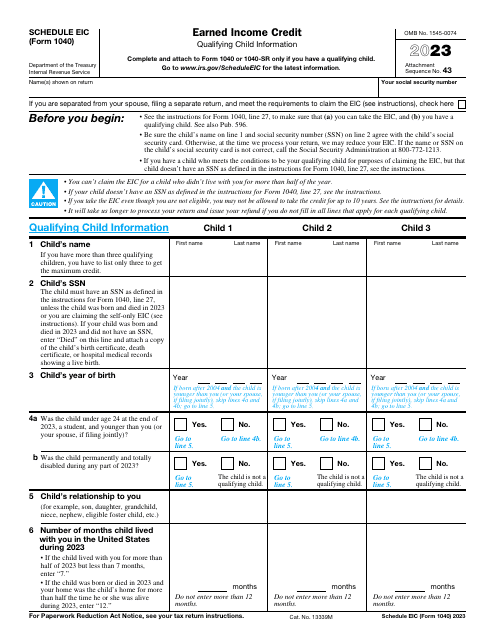

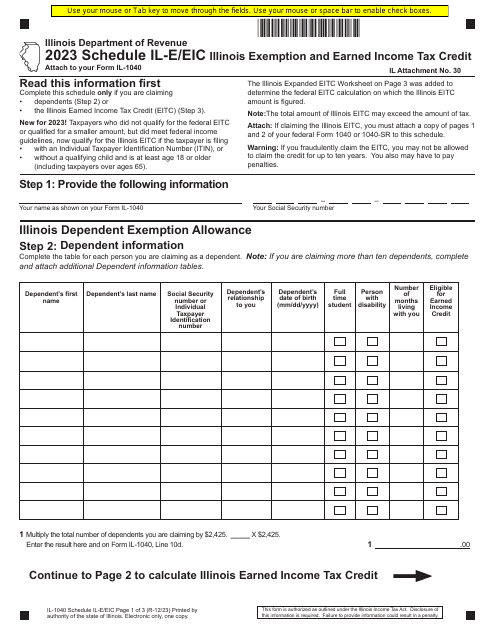

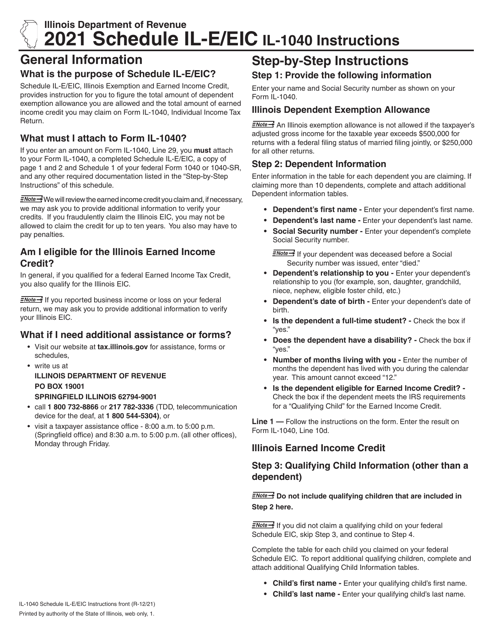

Also known as Schedule EIC, this set of documents includes various forms, such as the IRS Form 1040 (1040-SR) Schedule EIC Earned Income Credit and the Form IL-1040 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit - Illinois. These forms are essential for individuals who meet specific income requirements and have qualifying dependents.

By utilizing these documents, you can access valuable information and instructions to accurately claim the earned income credit. Whether you are filling out your federal tax return using the IRS Form 1040 Schedule EIC Earned Income Credit or your state tax return with the Form IL-1040 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit - Illinois, these resources provide the necessary guidance.

Take advantage of the Schedule EIC document group to ensure that you don't miss out on potential tax savings. With step-by-step instructions and clear guidelines, these documents streamline the process of claiming the earned income credit. By understanding the eligibility criteria and properly completing the required forms, you can reduce your tax liability and potentially receive a refund.

Don't navigate the complexities of the earned income credit alone. Leverage the Schedule EIC document group to simplify the process and maximize your tax benefits. Explore the various forms and instructions available to ensure you meet all the requirements and take full advantage of the earned income credit.