Fuel Expenses Templates

Are you looking for a way to effectively manage your fuel expenses? Look no further! Our fuel expense management system provides a comprehensive solution for tracking and reporting your fuel expenses. Whether you are a business owner or an individual, managing your fuel expenses can be a hassle. With our system, you can easily keep track of every gallon of fuel you purchase and ensure that you are maximizing your tax credits.

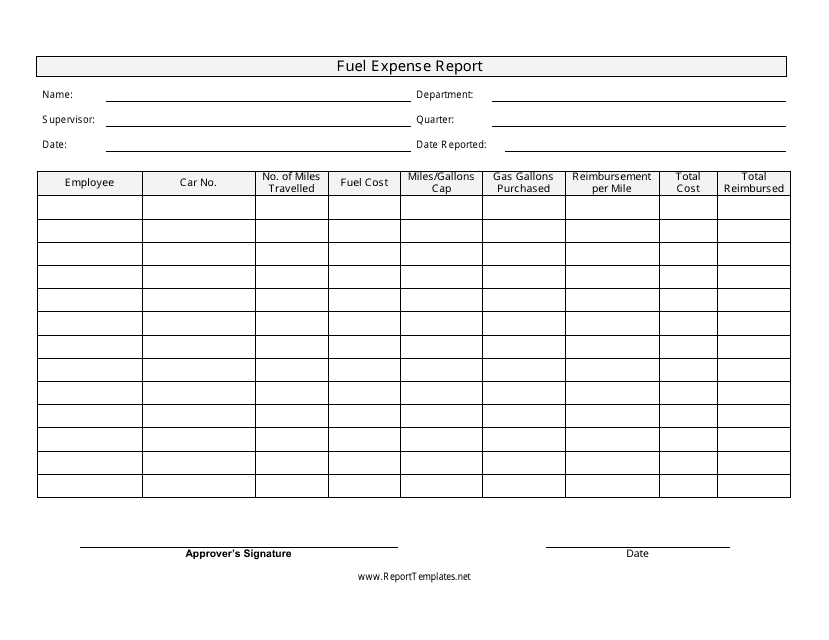

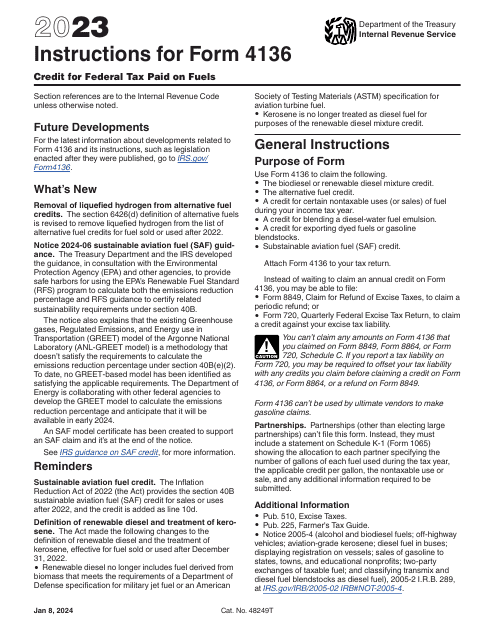

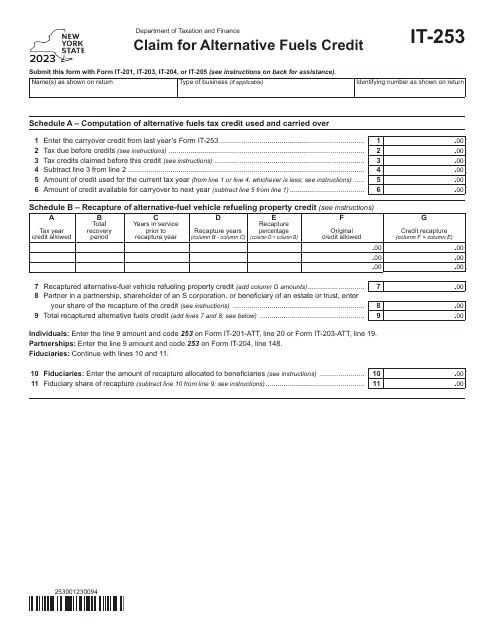

Our fuel expense system provides a variety of resources to help you stay organized and save money. We offer a fuel expense report template that allows you to easily input your fuel expenses and generate a detailed report. This report can be used for tax purposes or for internal tracking within your business. Additionally, we provide instructions for IRS Form 4136 Credit for Federal Tax Paid on Fuels, ensuring that you are taking advantage of all available tax credits.

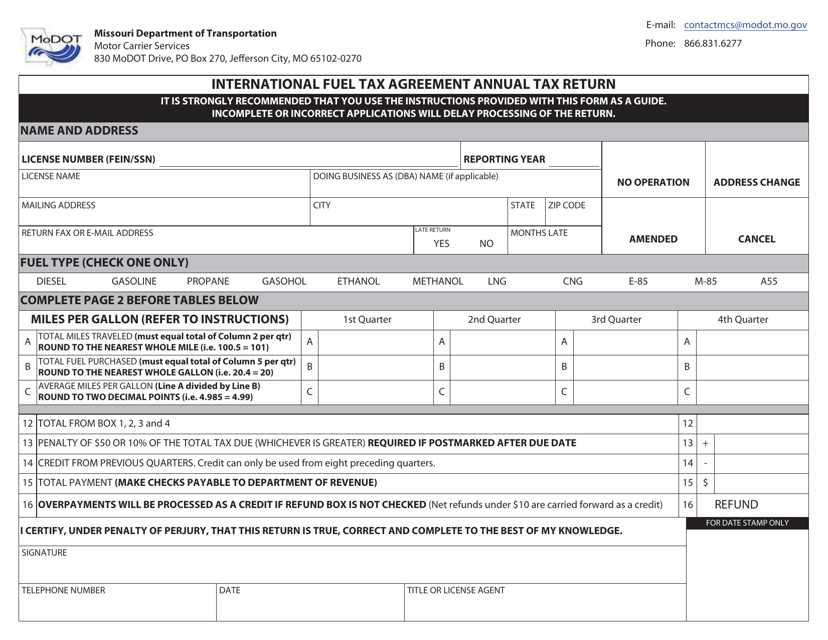

In addition to our US-focused resources, we also offer resources for international fuel tax agreements. Our International Fuel Tax AgreementAnnual Tax Return - Missouri document provides guidance on reporting fuel taxes for interstate carriers. Whether you are a trucking company or a transportation service provider, our resources can help you navigate the complex world of fuel tax compliance.

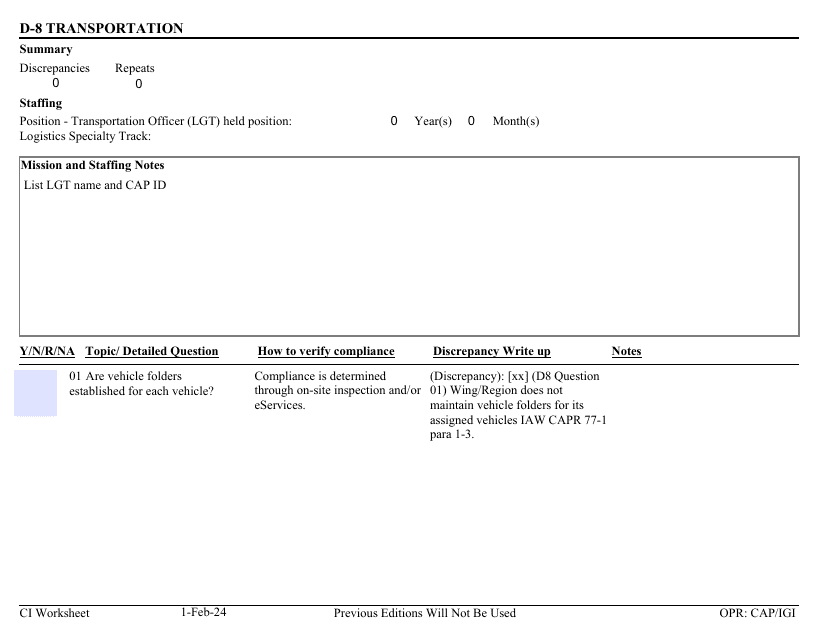

We understand that every business and individual has unique fuel expense needs, which is why we offer a customizable form, Form D-8 Ci Worksheet - Transportation. This form can be tailored to fit your specific needs, allowing you to track and report fuel expenses in a way that makes sense for you.

Don't let fuel expenses become a burden. Take control of your fuel expenses with our comprehensive fuel expense management system. Start saving time and money today!

Documents:

11

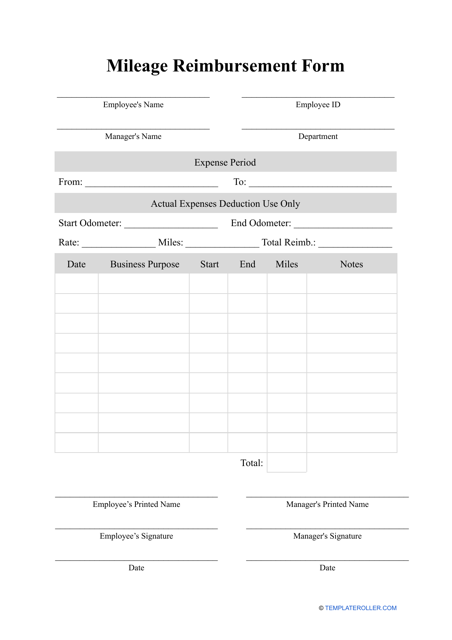

This document is a template for reporting fuel expenses. It can be used to track and document the costs associated with fuel usage in various situations, such as for business travel or personal vehicle expenses.

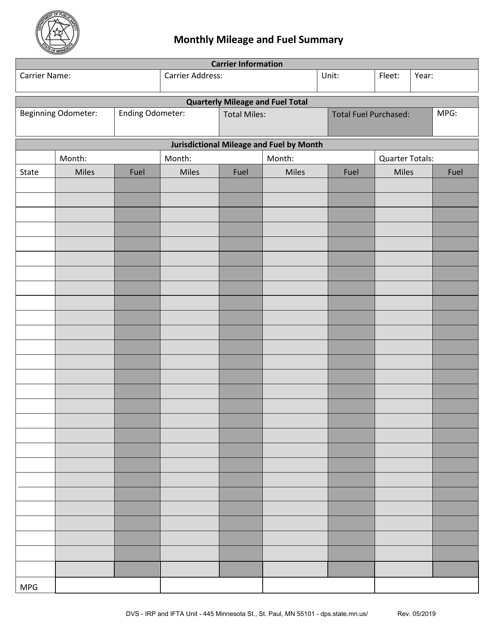

This document provides a summary of the monthly mileage and fuel usage in the state of Minnesota. It helps track and analyze the amount of mileage and fuel consumption in the state on a monthly basis.

Fill out this form to have your employer compensate for some costs that you encounter on your business-related trips.

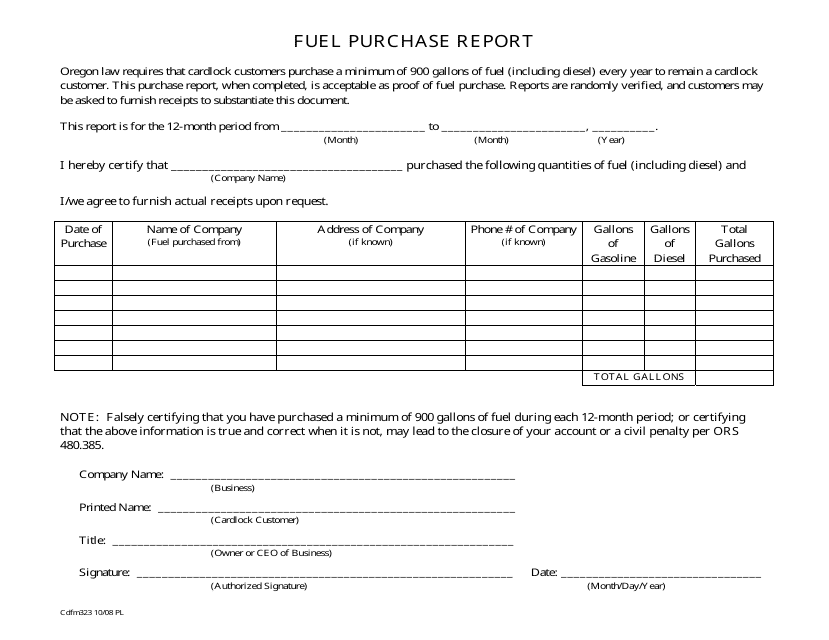

This form is used for reporting fuel purchases in the state of Oregon.

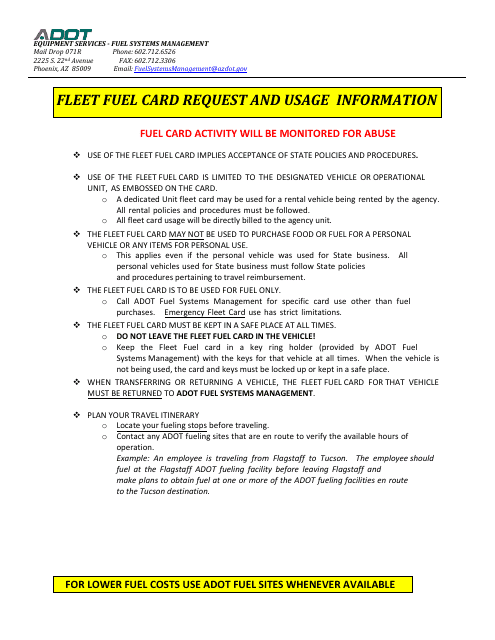

This form is used for applying for a fleet fuel card in the state of Arizona. It is used by individuals or businesses who own a fleet of vehicles and need a fuel card for convenient fuel purchases.

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.