Property Tax Abatement Templates

Are you a property owner looking to save money on your property taxes? You've come to the right place. Our property tax abatement program is designed to help property owners reduce their tax burden by applying for various abatement and exemption options. With our easy-to-use forms and comprehensive resources, we make the process of applying for property tax abatements simple and hassle-free.

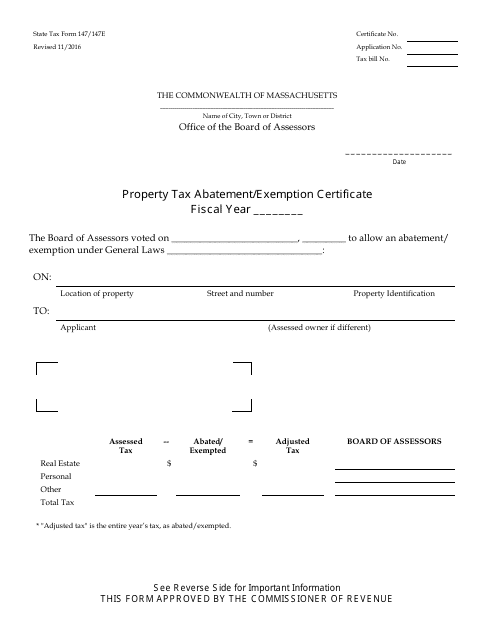

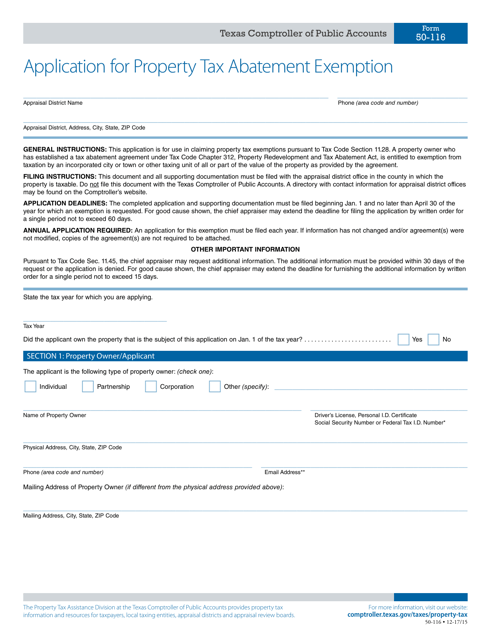

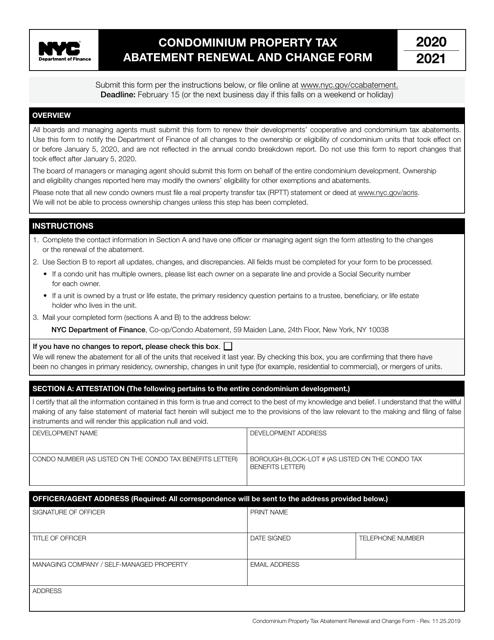

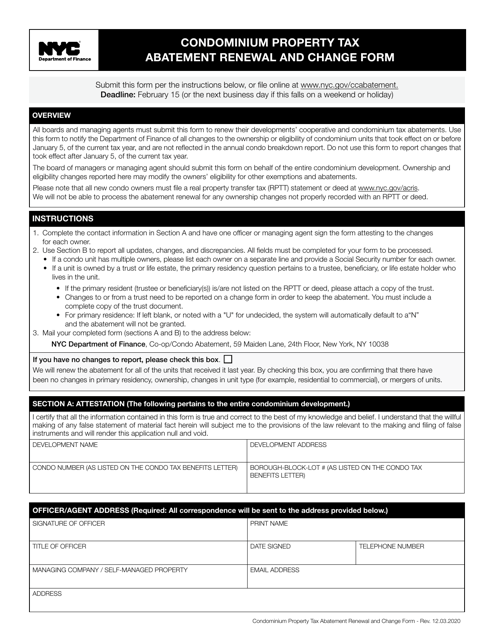

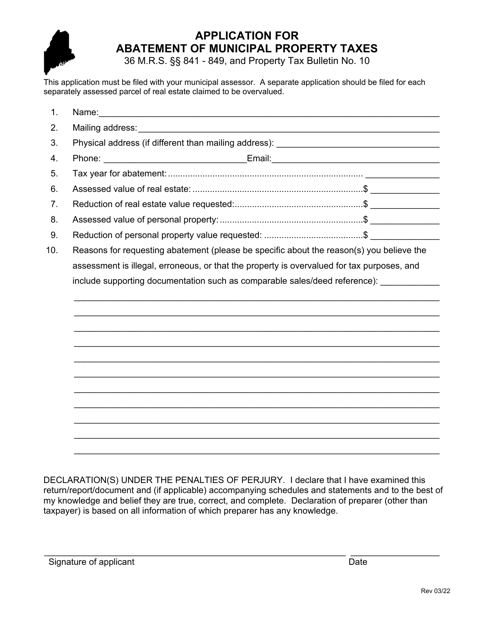

Whether you're a homeowner in Massachusetts and need to submit the State Form 147/147E Property Tax Abatement/Exemption Certificate or a Texan looking for the Form 50-116 Application for Property Tax Abatement Exemption, we have the right documents to assist you. If you own a condominium in New York City, we also offer the Condominium Property Tax Abatement Renewal and Change Form, helping you renew and update your abatement application. Additionally, Maine residents can find the Application for Abatement of Municipal Property Taxes to seek relief from their property tax obligations.

Our property tax abatement program is here to ensure that you receive the maximum benefits available to you. By exploring our user-friendly resources and accessing the necessary forms, you can take advantage of the available property tax abatement options and potentially save thousands of dollars each year. Start the process today and discover how property tax abatement can provide financial relief for property owners like you.

Documents:

9

This form is used for requesting property tax abatement or exemption in Massachusetts. It is used to provide information about the property and the reason for seeking the abatement or exemption.

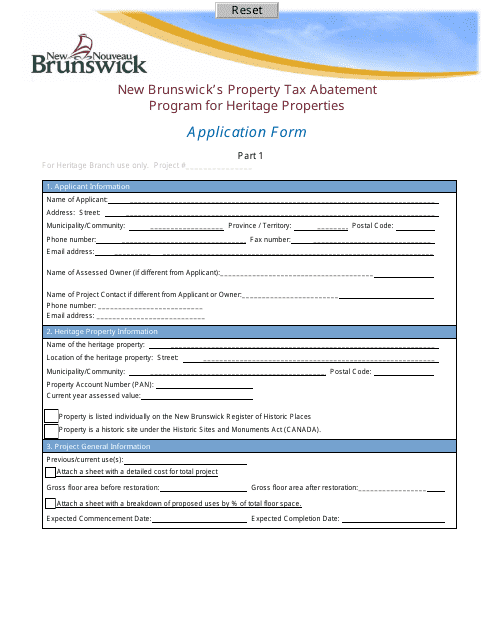

This form is used for applying to New Brunswick's Property Tax Abatement Program for Heritage Properties. This program provides tax relief for owners of historic properties in New Brunswick, Canada.

This form is used for applying for a property tax abatement exemption in Texas.

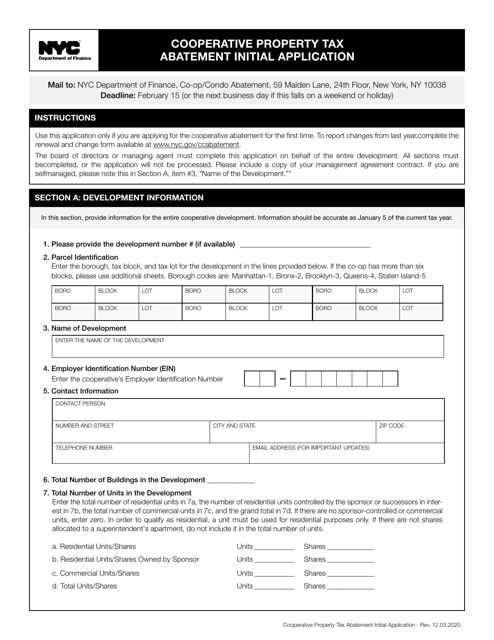

This form is used for renewing and changing the property tax abatement for condominiums in New York City.

This form is used for renewing and making changes to the property tax abatement for condominiums in New York City.

This form is used for requesting a reduction or elimination of municipal property taxes in the state of Maine. It allows property owners to seek relief from excessive tax payments.

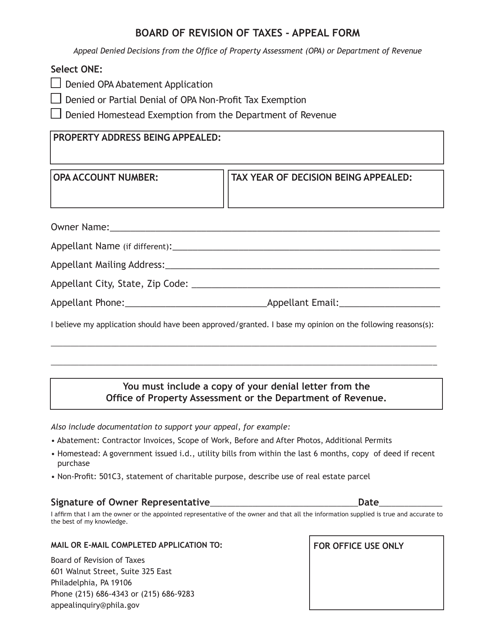

This Form is used for appealing a denied abatement or exemption in the City of Philadelphia, Pennsylvania.