Refund Due Templates

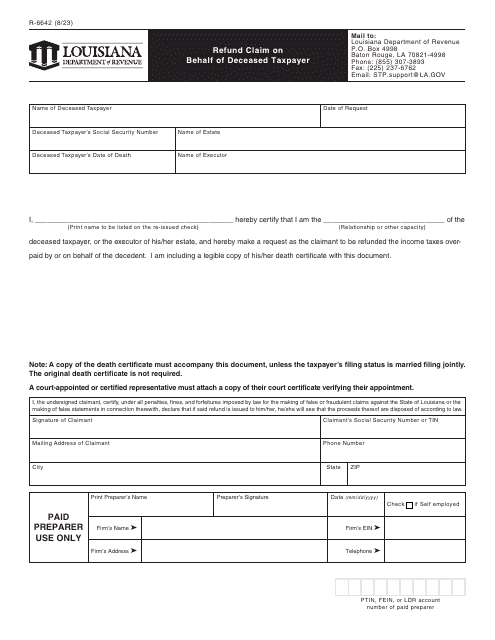

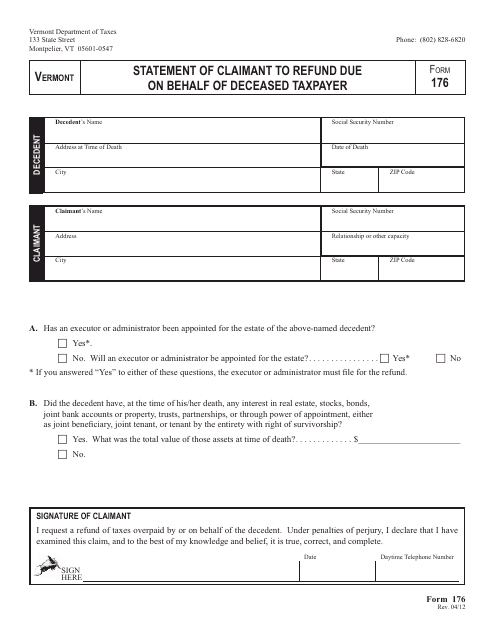

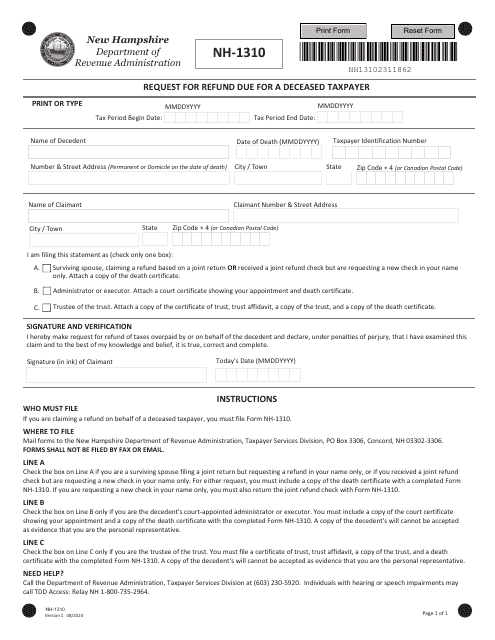

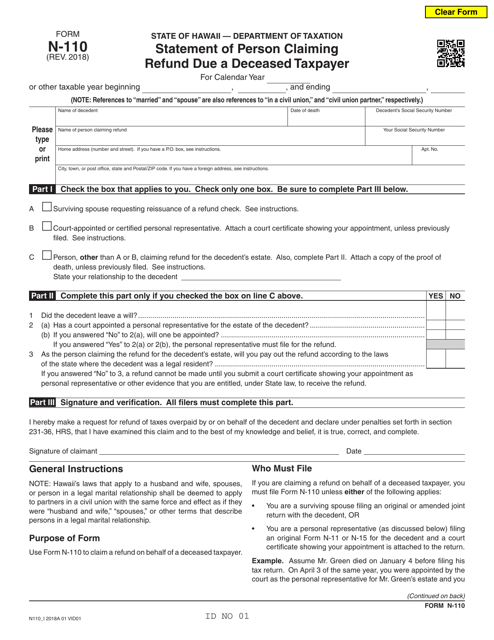

Are you looking for information about claiming a refund that is due to you or a deceased taxpayer? Look no further! Our document collection on refund due provides you with all the necessary forms and information needed to claim a refund that is owed to you or a deceased taxpayer.

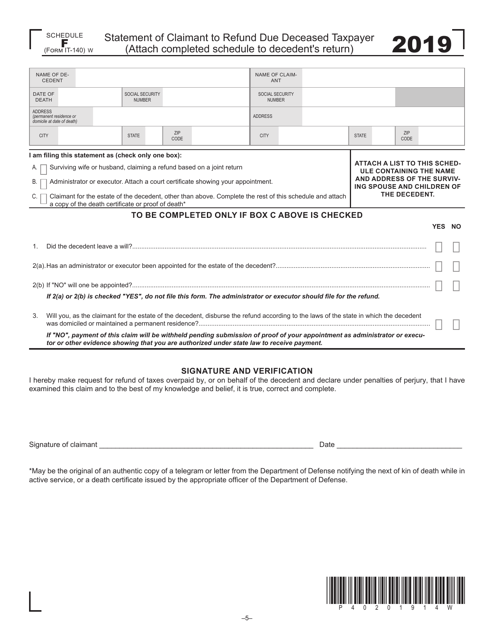

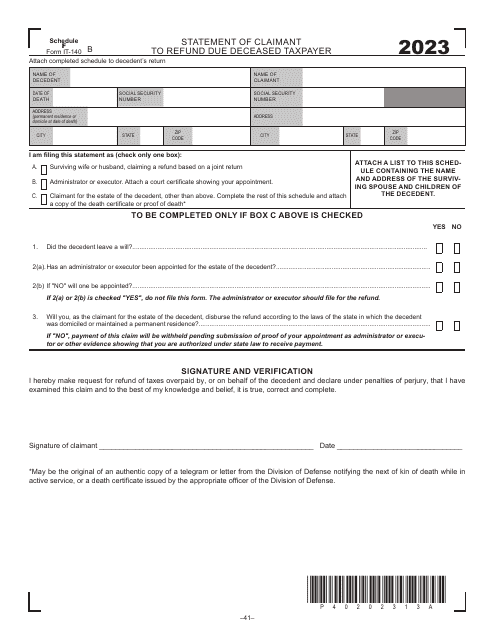

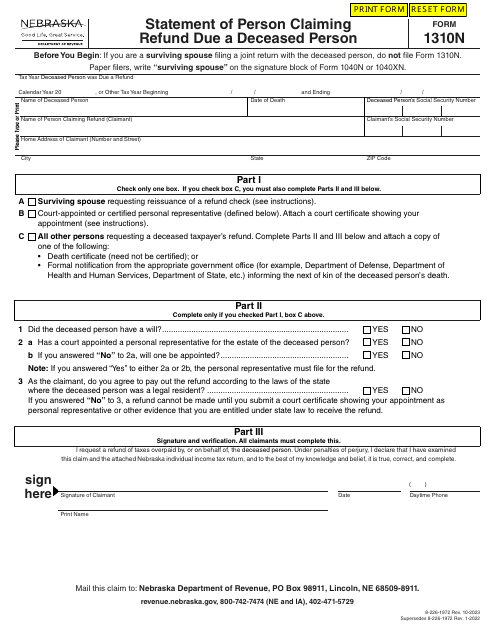

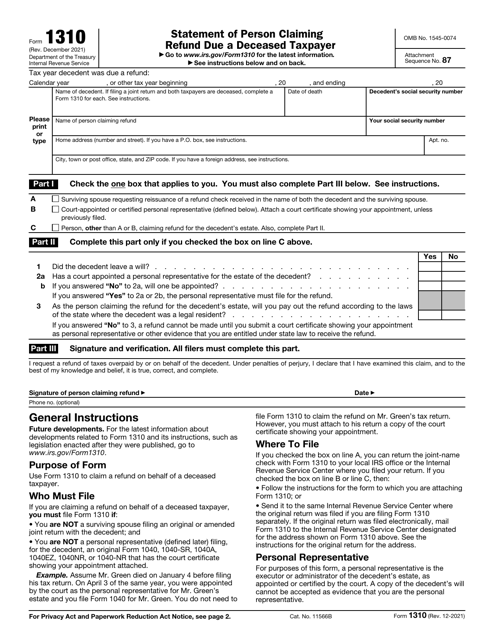

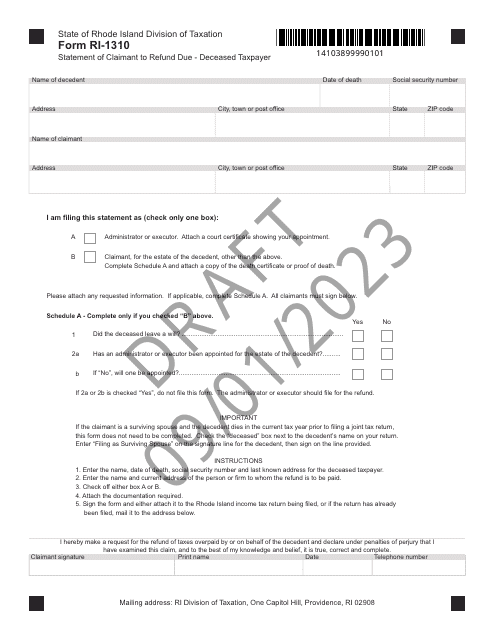

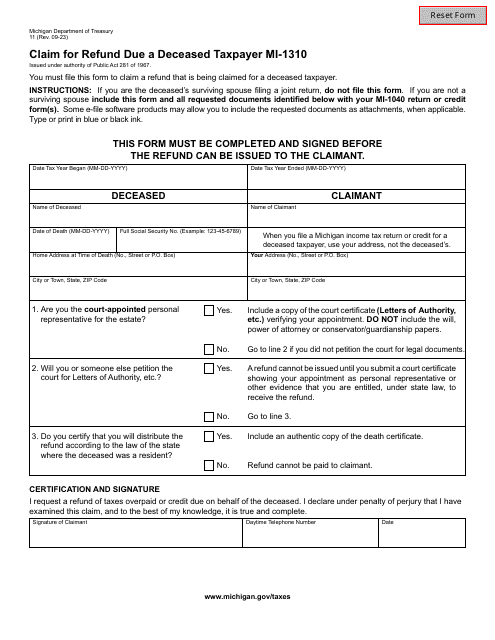

Whether you are a resident of West Virginia, Nebraska, Rhode Island, Michigan, or any other state, we have you covered! Our collection includes forms such as Form IT-140 Schedule F Statement of Claimant to Refund Due Deceased Taxpayer - West Virginia, Form 1310N Statement of Person Claiming Refund Due a Deceased Person - Nebraska, IRS Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer, Form RI-1310 Statement of Claimant to Refund Due - Deceased Taxpayer - Draft - Rhode Island, and Form MI-1310 (11) Claim for Refund Due a Deceased Taxpayer - Michigan, and more!

Don't miss out on the opportunity to receive the refund you deserve. Explore our comprehensive collection of documents on refund due and ensure that you receive the money that is rightfully yours or the deceased taxpayer.

Documents:

10

This document is used for making a claim for a refund on behalf of a deceased taxpayer in the state of Vermont.

This Form is used for claiming a refund on behalf of a deceased taxpayer in West Virginia.