Loan Conditions Templates

Loan conditions, also known as the terms and conditions of a loan, outline the agreement between a lender and borrower. These conditions determine the rules and requirements that must be met throughout the duration of the loan. Whether you're purchasing a home, applying for a business loan, or seeking financial assistance, understanding the loan conditions is essential.

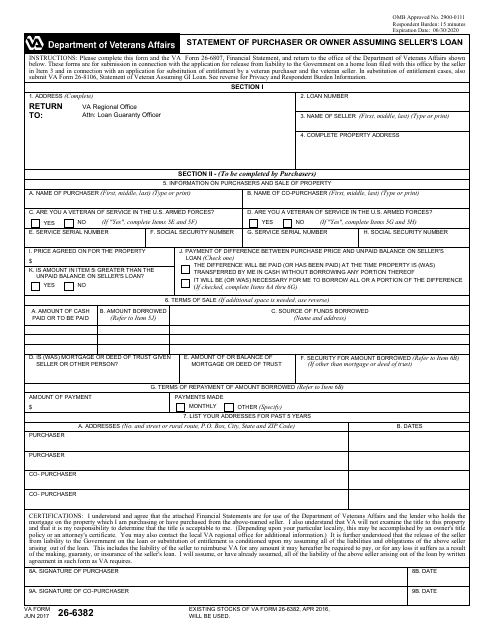

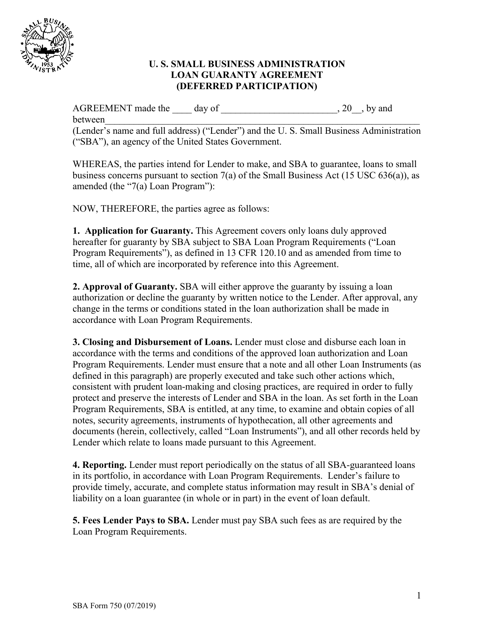

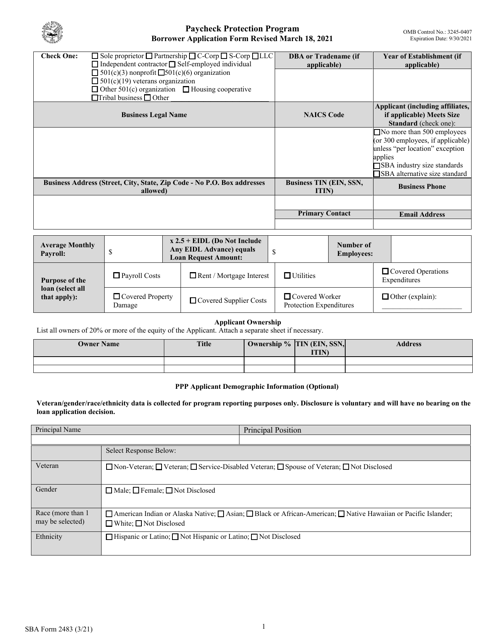

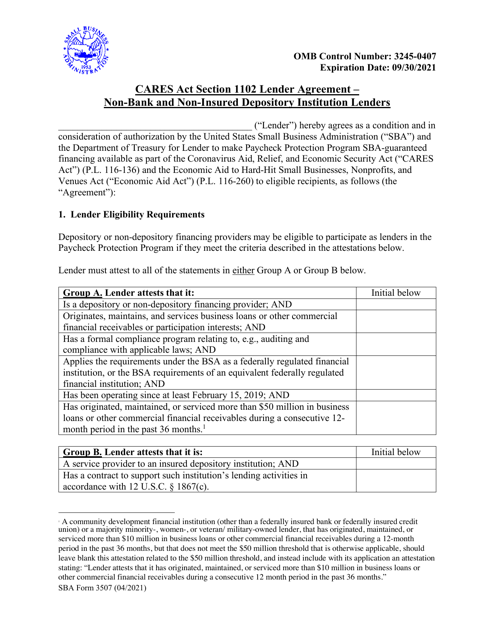

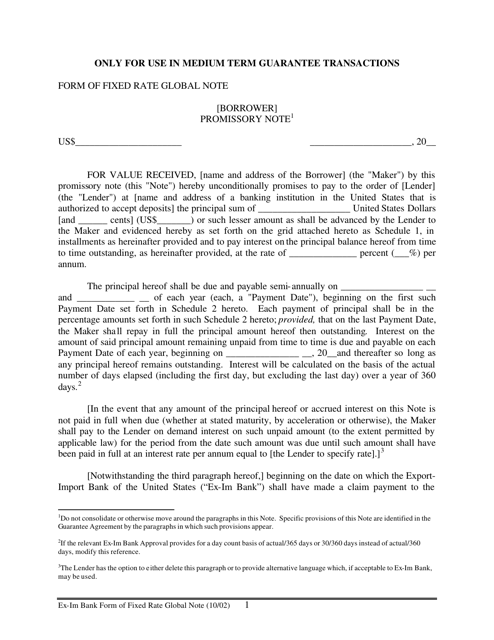

The loan conditions document collection includes a variety of forms and agreements that are commonly used in different loan scenarios. For instance, the VA Form 26-6382, also known as the Statement of Purchaser or Owner Assuming Seller's Loan, is typically used in situations where a buyer takes over an existing mortgage from a seller. On the other hand, the SBA Form 2483 Paycheck Protection Program Borrower Application Form and the SBA Form 3507 CARES Act Section 1102 Lender Agreement - Non-bank and Non-insured Depository Institution Lenders, are crucial documents for small businesses looking to secure financial assistance.

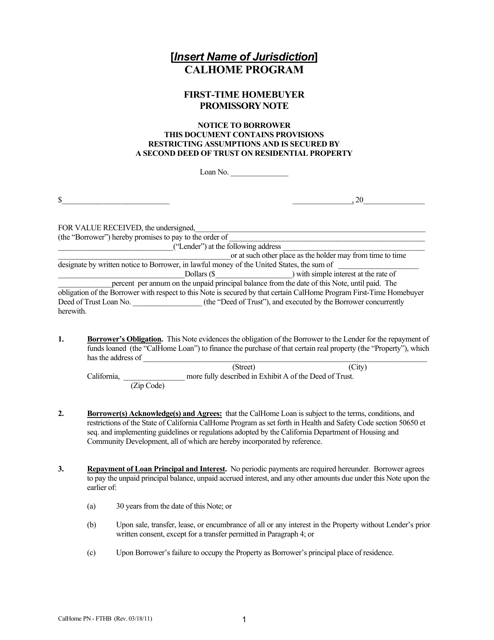

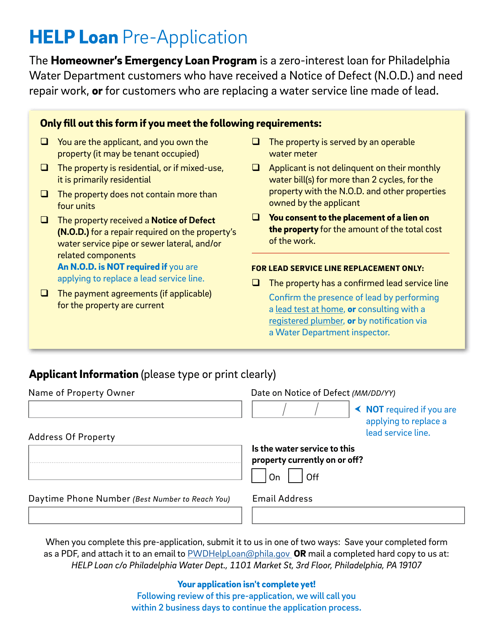

First-Time Homebuyer Promissory Note - Calhome Program - California is a document specific to first-time homebuyers participating in the Calhome Program in California. This note outlines the terms and conditions of the loan for eligible individuals in the state. Additionally, the Help Loan Pre-application - City of Philadelphia, Pennsylvania, is a form utilized by residents of Philadelphia who are seeking financial assistance through the city's Help Loan Program.

Understanding the loan conditions and ensuring compliance with the terms set forth in these documents is crucial for both borrowers and lenders. By familiarizing yourself with the loan conditions, you can make informed decisions, mitigate risks, and ensure a smooth borrowing experience. Apply for a loan with confidence by carefully reviewing and understanding the loan conditions before signing any agreements.

Documents:

24

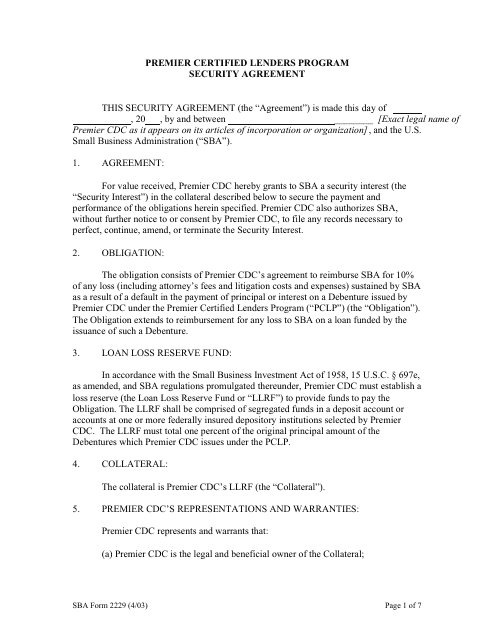

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

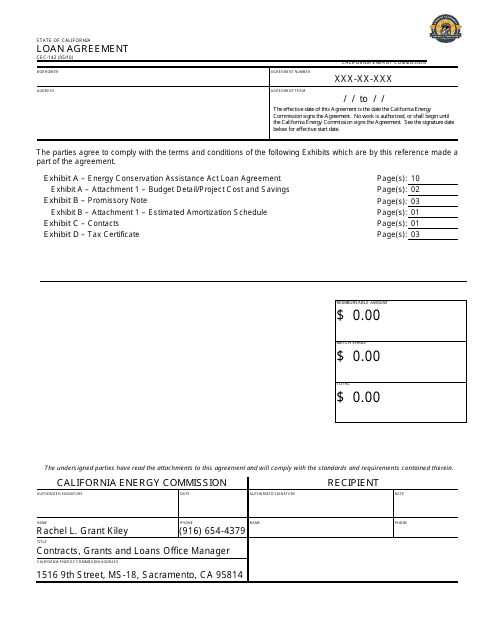

This form is used for creating a loan agreement in the state of California. It outlines the terms and conditions of the loan, including the amount borrowed, interest rates, and repayment terms.

This Form is used for buyers or owners who are assuming the seller's loan.

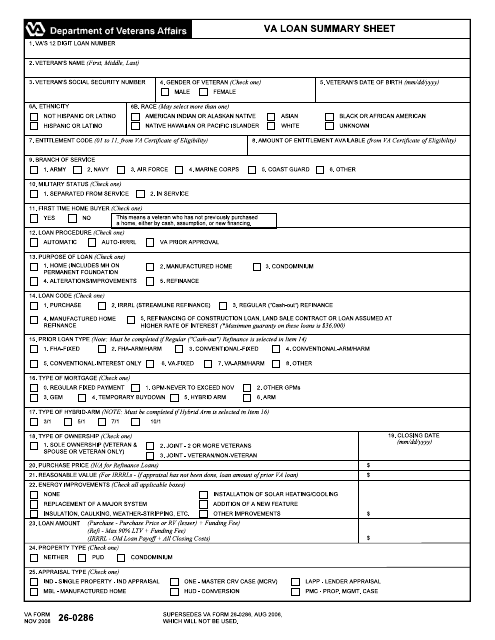

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

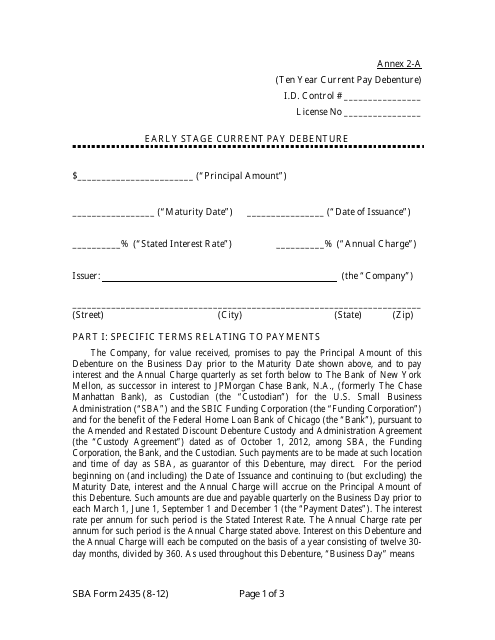

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

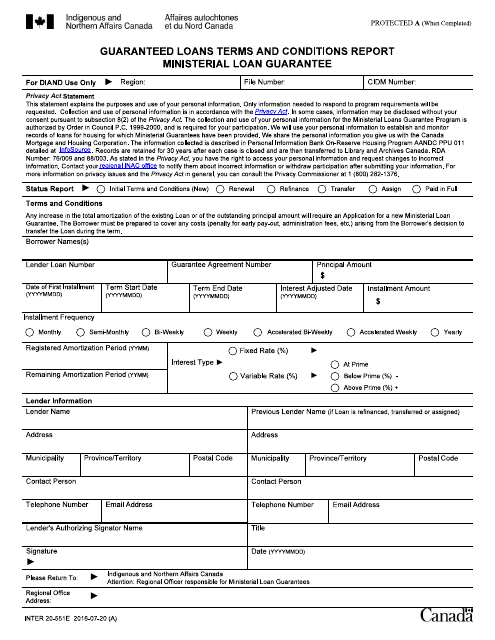

This form is used for reporting the terms and conditions of Ministerial Loan Guarantee for guarantee loans in Canada.

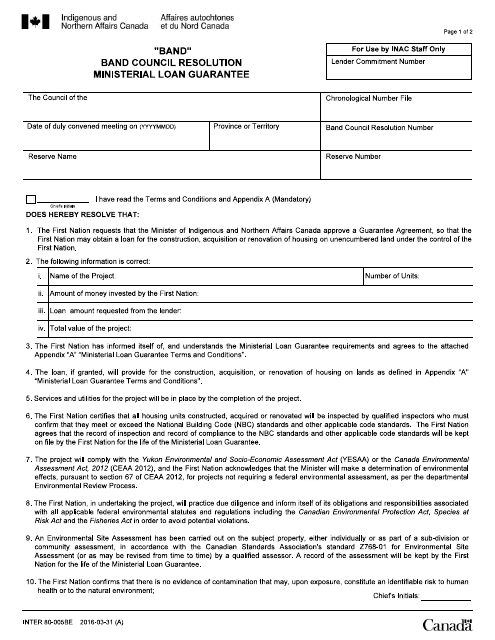

This Form is used for a Band Council Resolution in Canada to obtain a Ministerial Loan Guarantee.

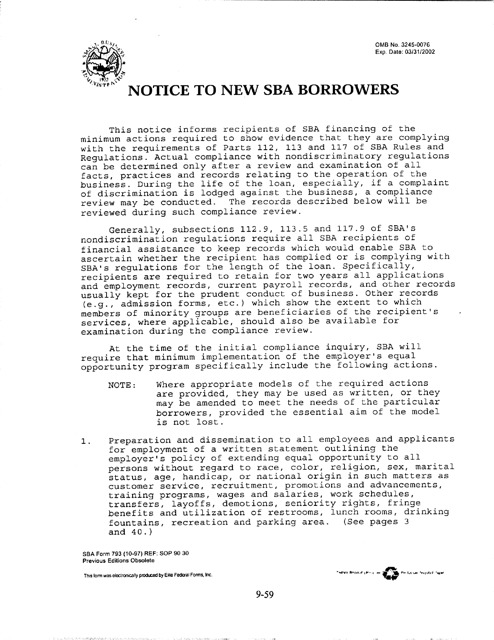

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

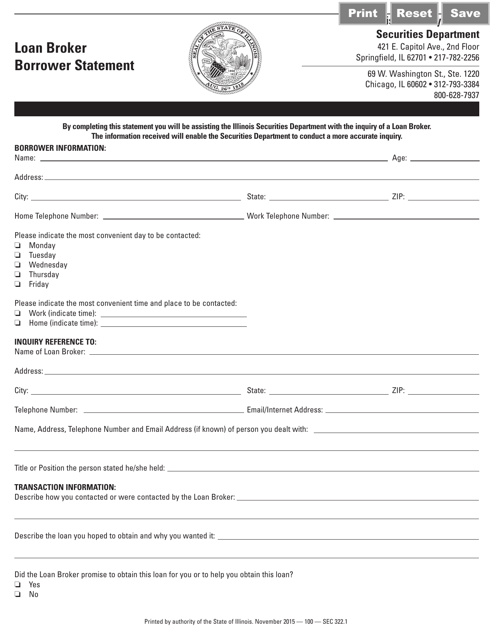

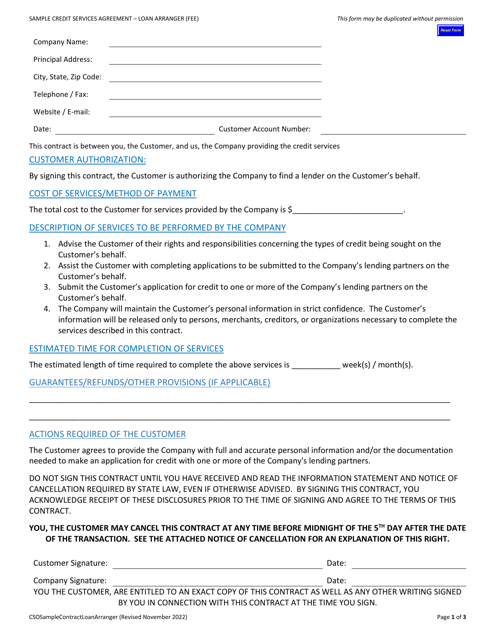

This form is used for borrowers in Illinois who are working with a loan broker. It is a statement that includes important information about the borrower's financial situation and their agreement with the loan broker.

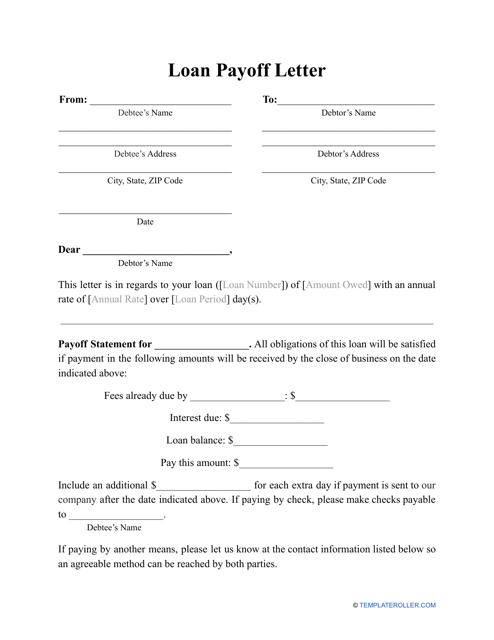

This letter provides detailed instructions on how to pay off a loan.

This document is a Loan Guaranty Agreement specific to the state of Virginia. It outlines the terms and conditions of a loan guarantee between the borrower and the guarantor.

This document is for notifying individuals about unilateral actions taken in regards to PCLP CDCs/PCLP approved loans.

This type of agreement is used when a corporation borrows money from a shareholder in order to explain the details of the loan and to serve as evidence of the debt.

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

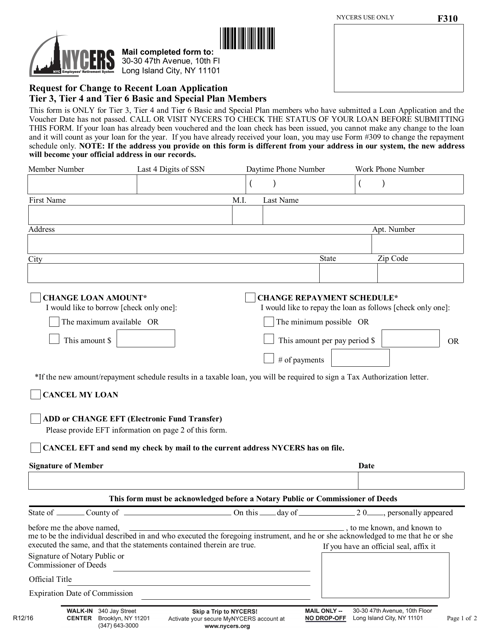

This Form is used for requesting a change to a recent loan application for Tier 3, Tier 4, and Tier 6 Basic and Special Plan Members in New York City.

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

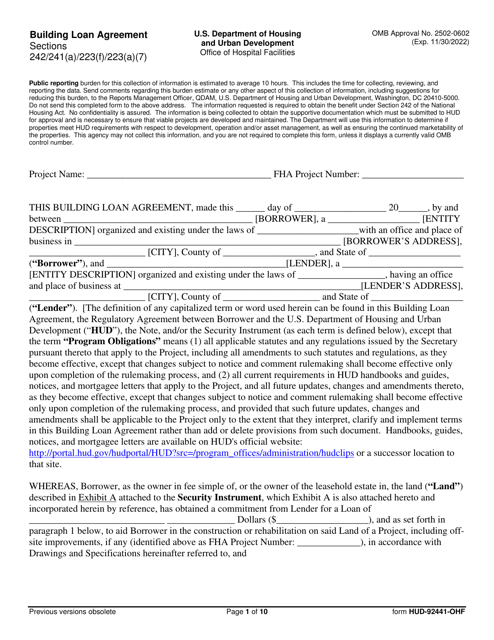

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

This document is a pre-application form for a loan assistance program offered by the City of Philadelphia in Pennsylvania. It helps residents of Philadelphia apply for financial assistance for various purposes, such as home repairs or small business development.

This agreement is used when loan arrangers in Wisconsin provide credit services for borrowers. It outlines the terms and conditions of the credit arrangement.

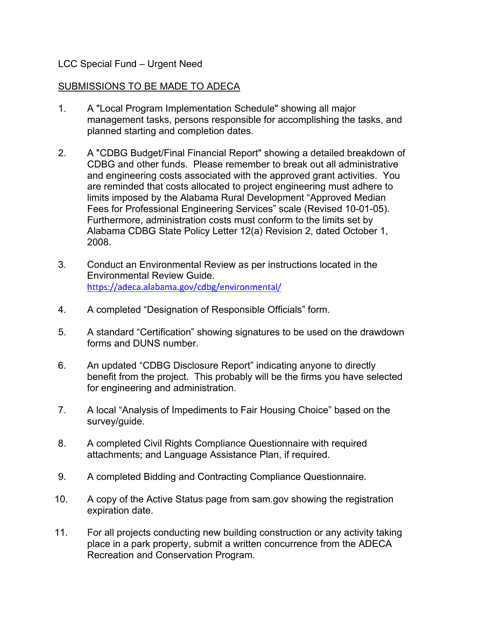

This document is a checklist for Urgent Need Applications in Alabama for a Letter of Conditional Commitment.