Little Cigars Templates

Welcome to our webpage dedicated to little cigars, also known as little cigar or little cigars form! Whether you are a retailer, a manufacturer, or a individual looking for information on little cigars, this is the place for you.

Little cigars are a popular alternative to traditional cigars, offering a similar smoking experience in a smaller size. They come in a variety of flavors and are often enjoyed by those who appreciate a quicker smoke. However, it is important to stay informed about the regulations and requirements surrounding little cigars.

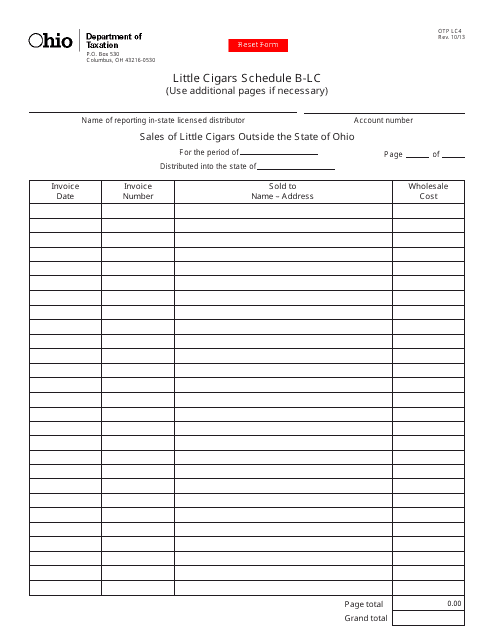

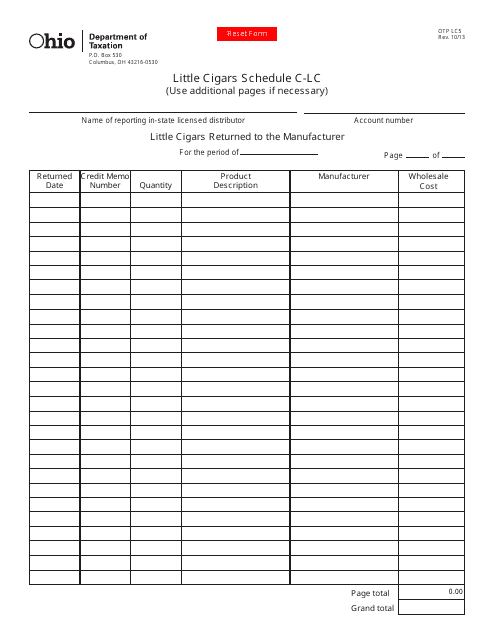

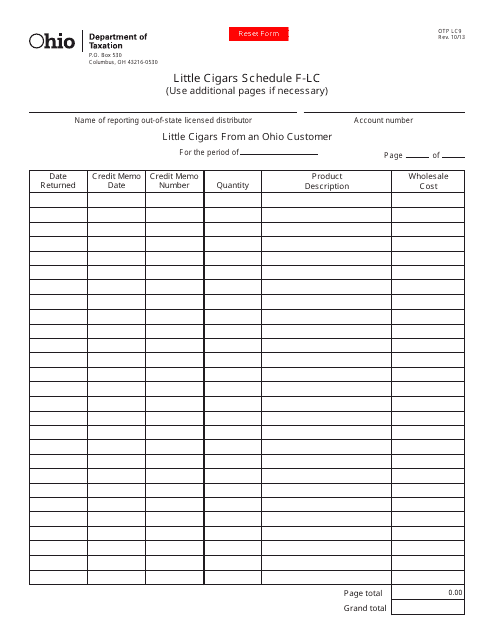

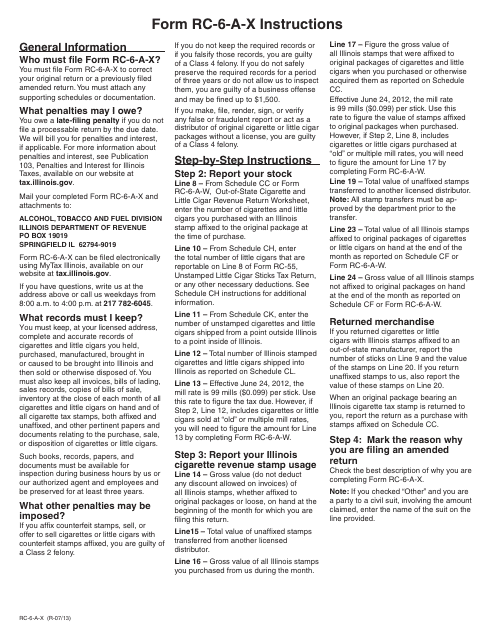

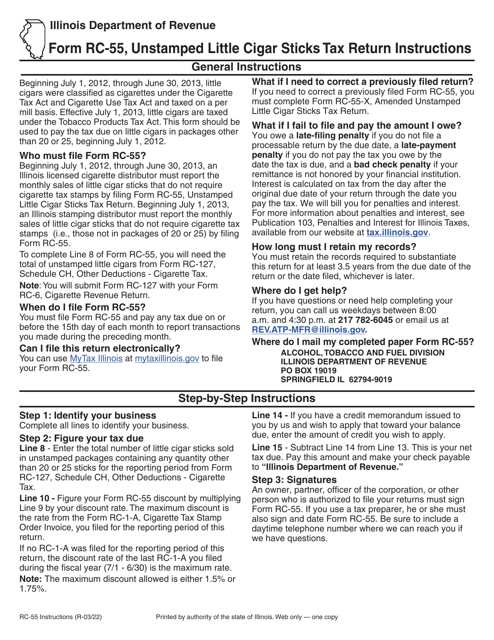

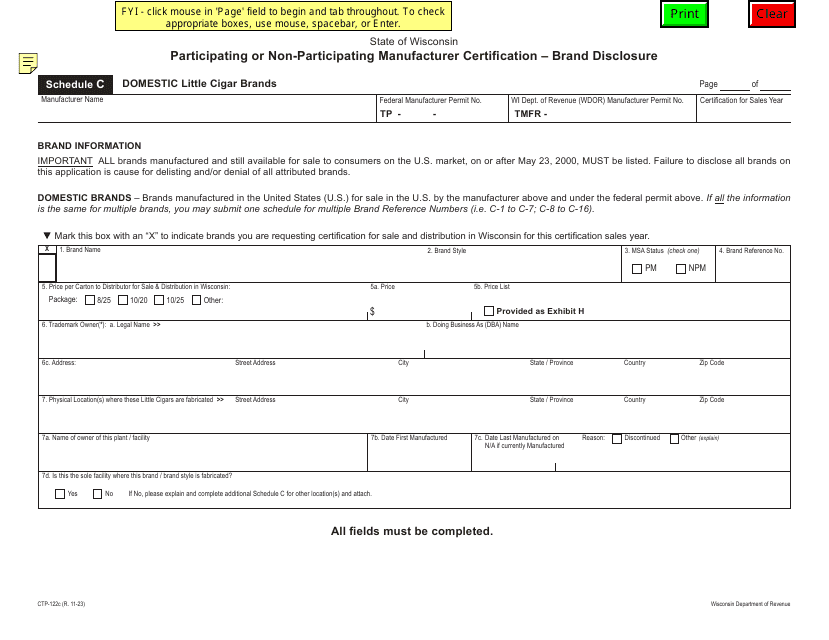

Our collection of documents related to little cigars includes various forms and instructions that you may need to fill out and follow, depending on your jurisdiction. For example, you can find documents such as the "Form OTP LC4 Little Cigars Schedule B-Lc" which pertains to the sales of little cigars outside the State of Ohio. Similarly, the "Instructions for Form RC-6-A-X, 435 Amended Out-of-State Cigarette and Little Cigar Revenue Return" provides guidance on reporting and amending out-of-state cigarette and little cigar revenue in Illinois.

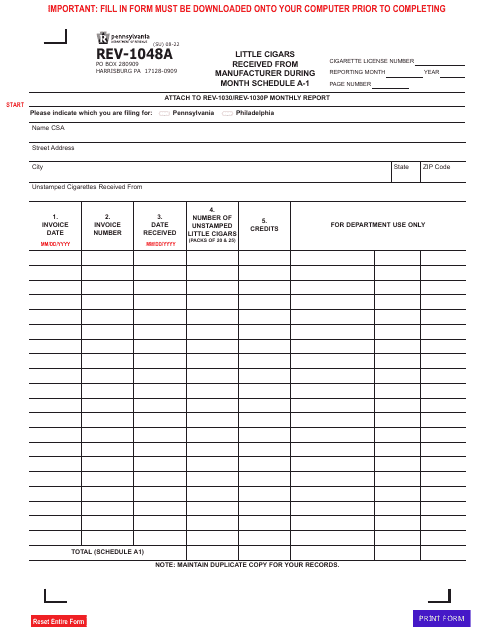

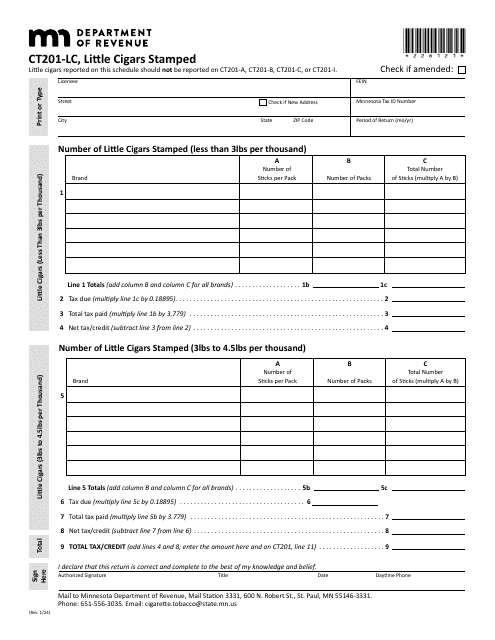

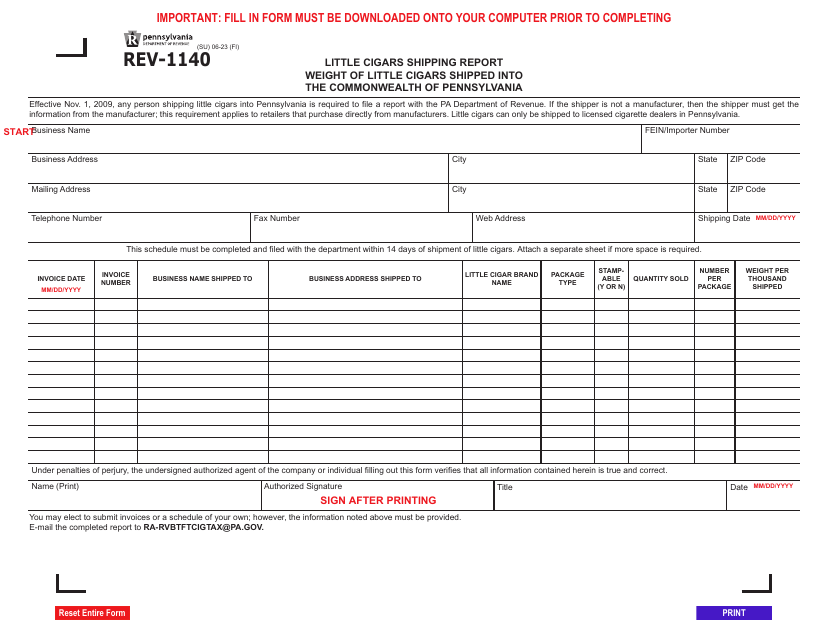

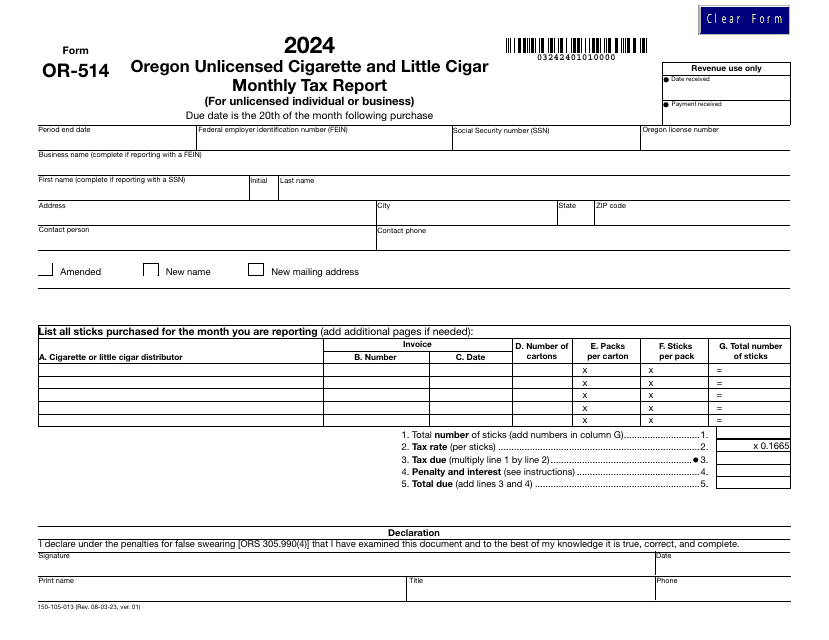

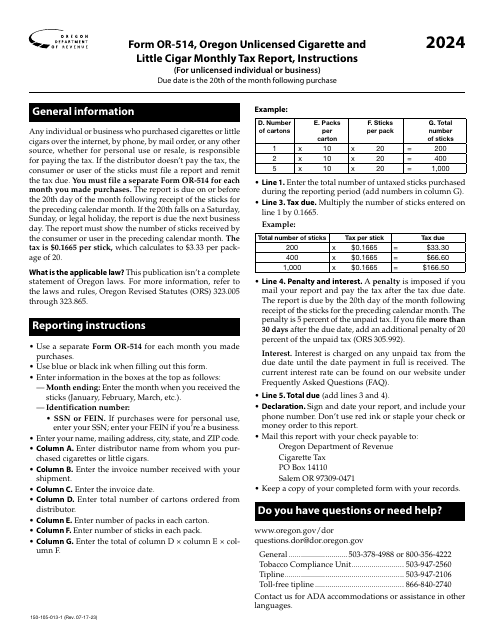

If you are in Oregon, you will find the "Form OR-514 (150-105-013) Oregon Unlicensed Cigarette and Little Cigar Monthly Tax Report" and its corresponding instructions helpful for reporting your taxes. In Pennsylvania, there is the "Form REV-1140 Little Cigars Shipping Report" that focuses on the weight of little cigars shipped into the Commonwealth.

No matter where you are located or what aspect of little cigars you are involved in, our collection of documents will serve as a valuable resource to ensure compliance with applicable regulations. At [your company name], we understand the importance of staying informed and up-to-date. That's why we have carefully curated this collection to cater to your specific needs.

Explore our comprehensive collection of little cigar documents today and access the information you need to navigate the world of little cigars with ease.

Documents:

49

This Form is used for reporting the sales of little cigars outside the state of Ohio in Ohio.

This Form is used for reporting the return of Little Cigars to the manufacturer in Ohio.

This Form is used for reporting little cigars purchased by an Ohio customer in Ohio.

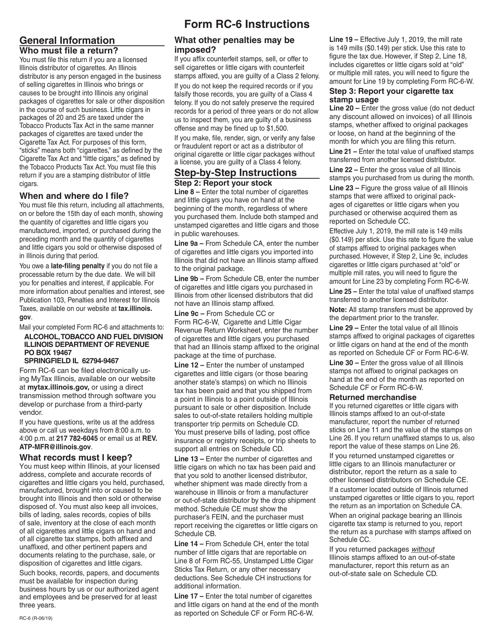

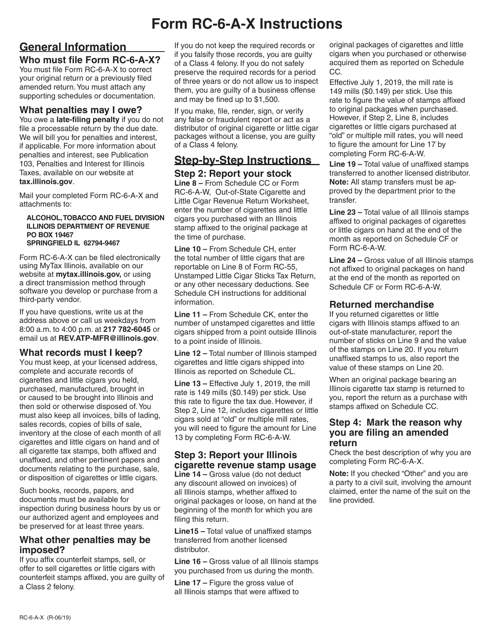

This form is used for submitting an amended revenue return for out-of-state cigarette and little cigar sales in Illinois. Follow the instructions provided to correctly fill out and submit the form.

This form is used for reporting and remitting cigarette and little cigar revenue generated from sales made outside the state of Illinois.

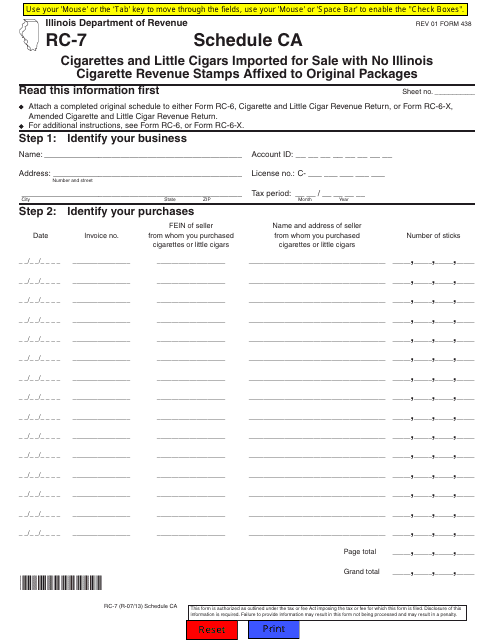

This form is used for reporting the import of cigarettes and little cigars that are being sold in Illinois without the required cigarette revenue stamps attached to the original packages.

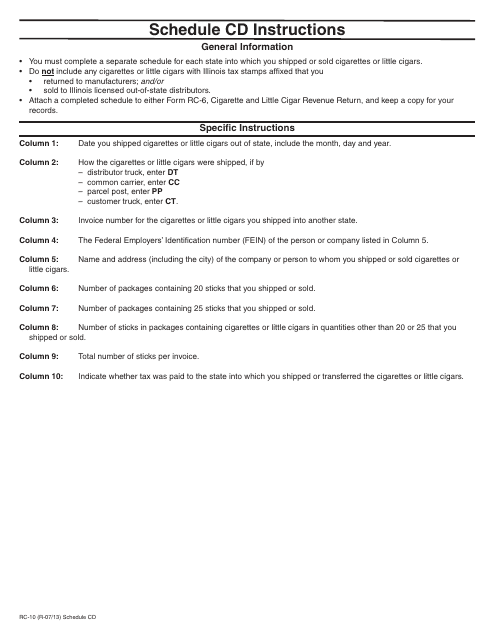

This Form is used for reporting out-of-state cigarette and little cigar sales or shipments in Illinois. It provides instructions for filling out Form RC-10 Schedule CD.

This Form is used for filing an amended cigarette and little cigar revenue return in the state of Illinois. It provides instructions on how to correctly report and correct any errors on the original return.

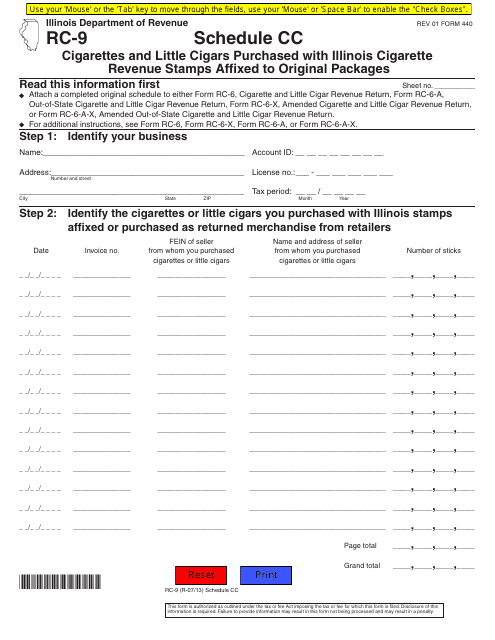

This form is used for reporting the purchase of cigarettes and little cigars in Illinois that have revenue stamps affixed to their original packages.

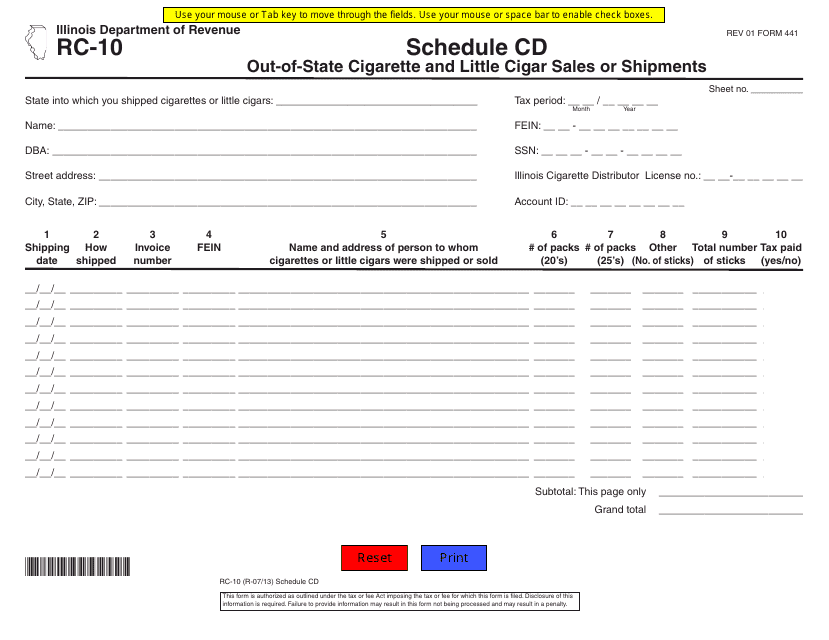

This Form is used for reporting out-of-state cigarette and little cigar sales or shipments in Illinois.

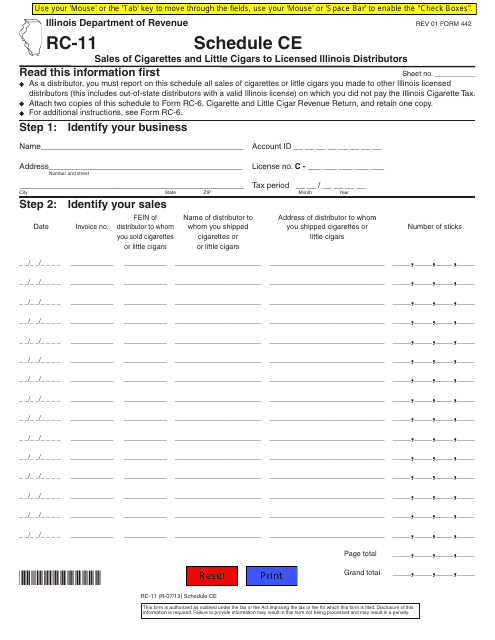

This form is used for reporting sales of cigarettes and little cigars to licensed Illinois distributors in Illinois.

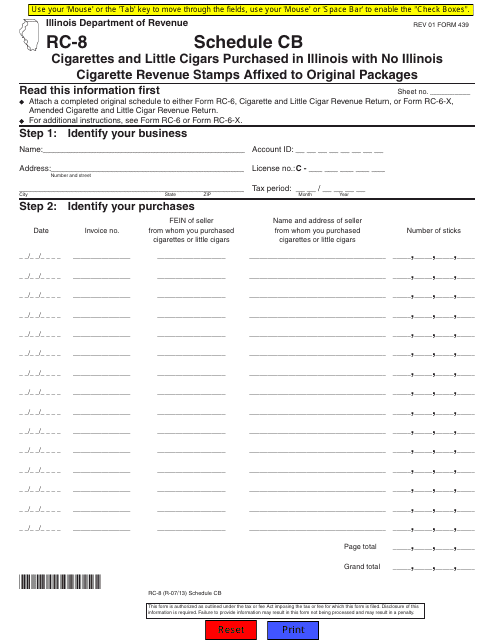

This form is used for reporting the purchase of cigarettes and little cigars in Illinois that do not have Illinois cigarette revenue stamps attached to the original packaging.

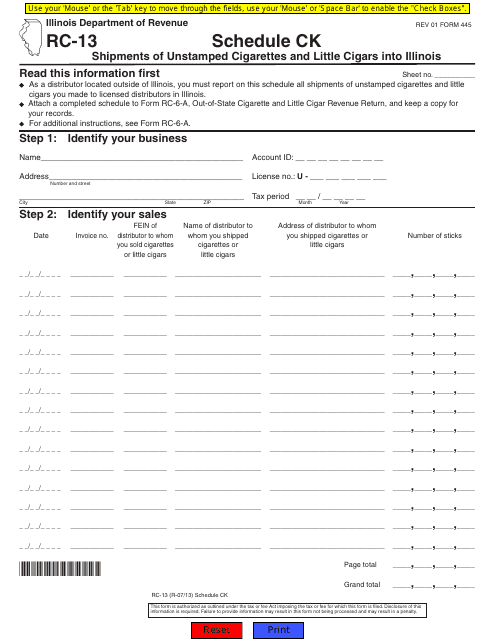

This form is used for reporting shipments of unstamped cigarettes and little cigars into Illinois.

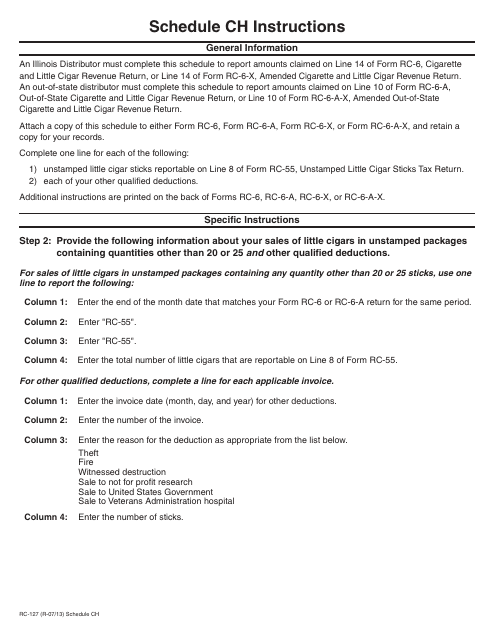

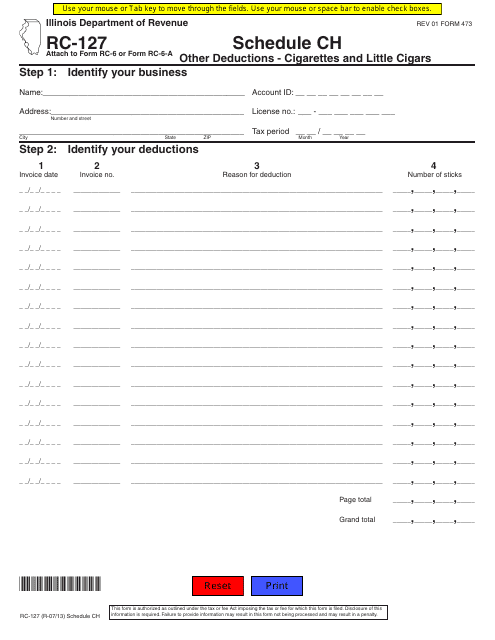

This form is used for reporting other deductions related to cigarettes and little cigars in the state of Illinois.

This form is used for reporting other deductions related to cigarettes and little cigars in the state of Illinois.

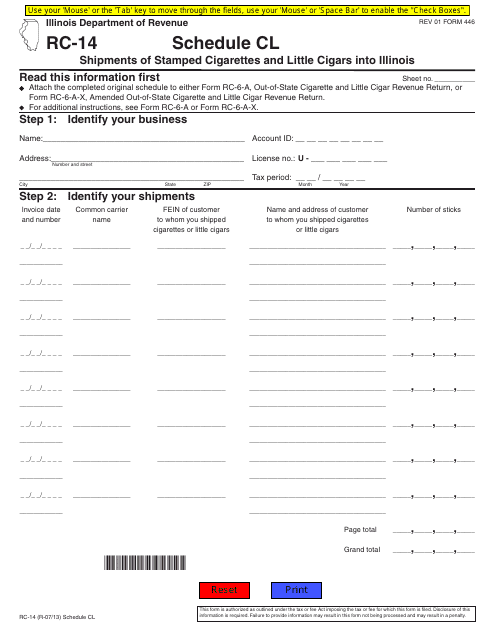

This document is for reporting shipments of stamped cigarettes and little cigars into Illinois.

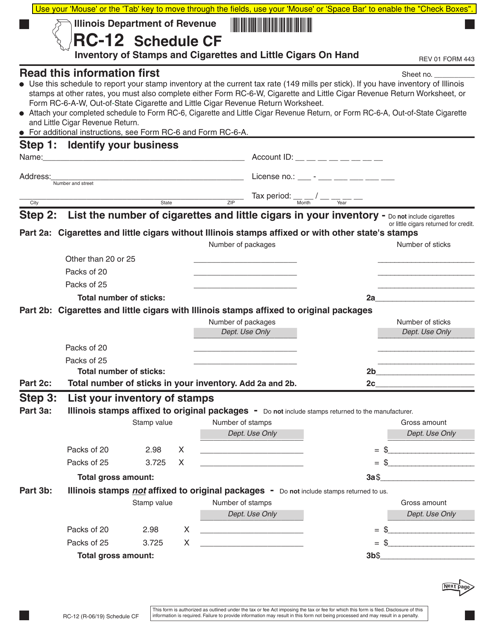

Form RC-12 (443) Schedule CF Inventory of Stamps and Cigarettes and Little Cigars on Hand - Illinois

This document is used for reporting the inventory of stamps, cigarettes, and little cigars that a person or business in Illinois has on hand.

This Form is used for reporting and paying cigarette and little cigar revenue in the state of Illinois.

This Form is used for filing an amended out-of-state cigarette and little cigar revenue return for the state of Illinois. It provides instructions on how to report any changes or corrections to the original return.

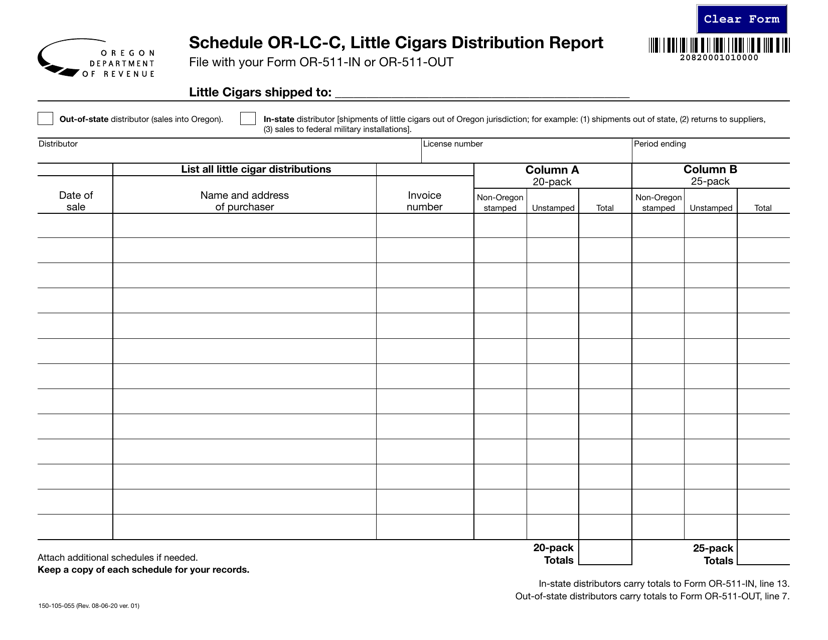

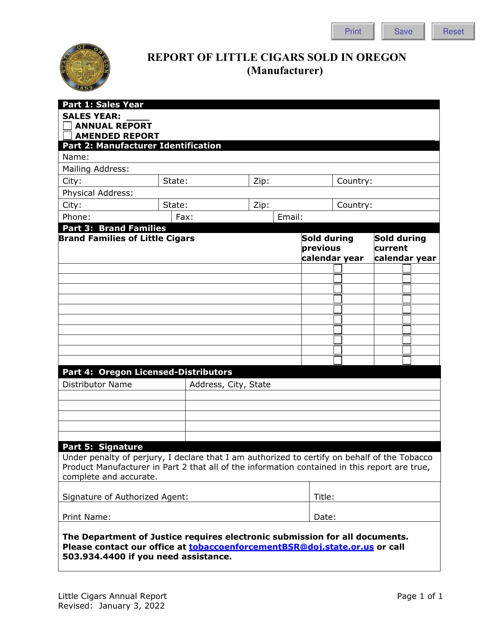

This form is used for reporting the distribution of little cigars in Oregon.

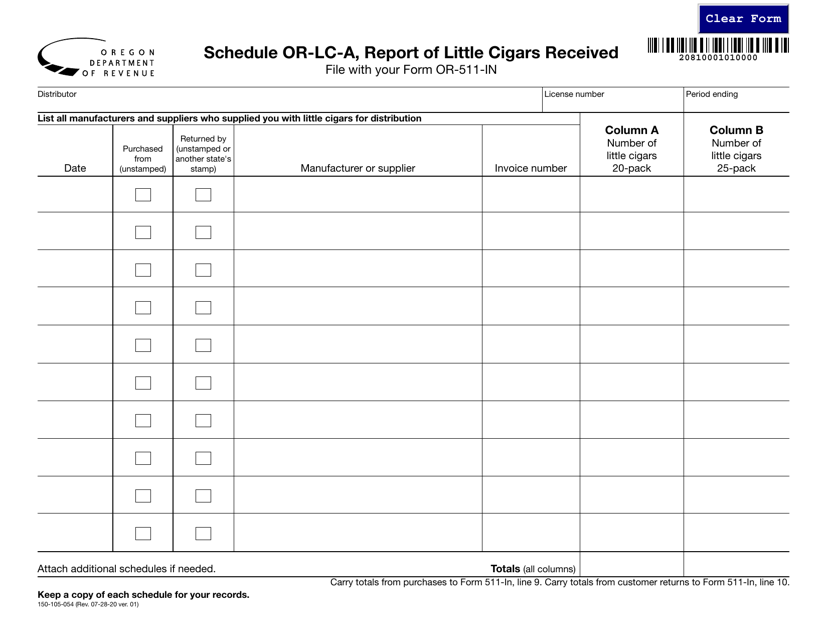

This form is used for reporting little cigars received in Oregon. It is Form 150-105-054 Schedule OR-LC-A.

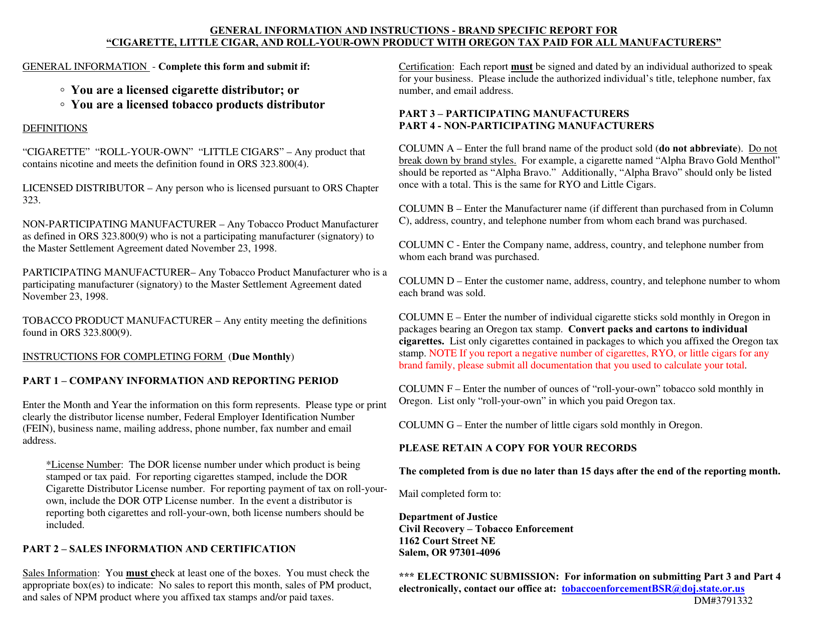

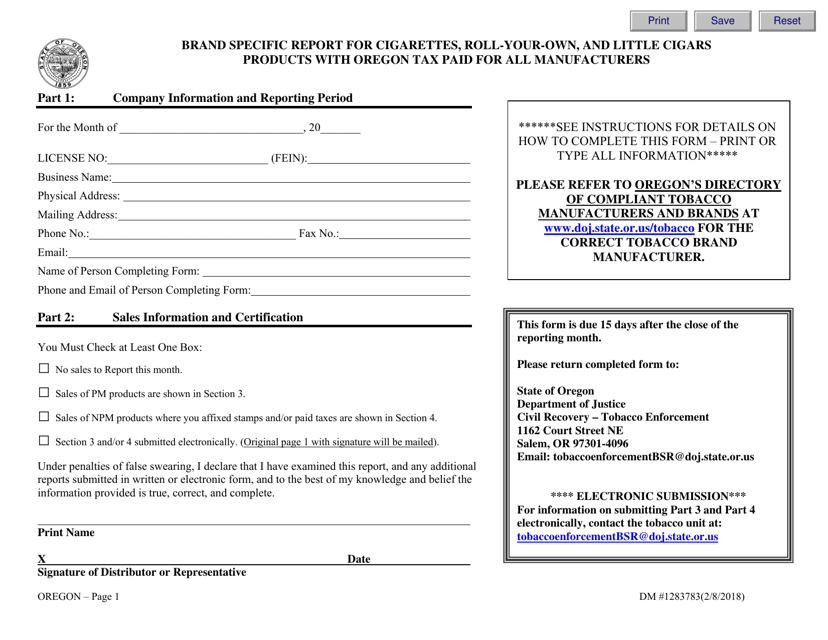

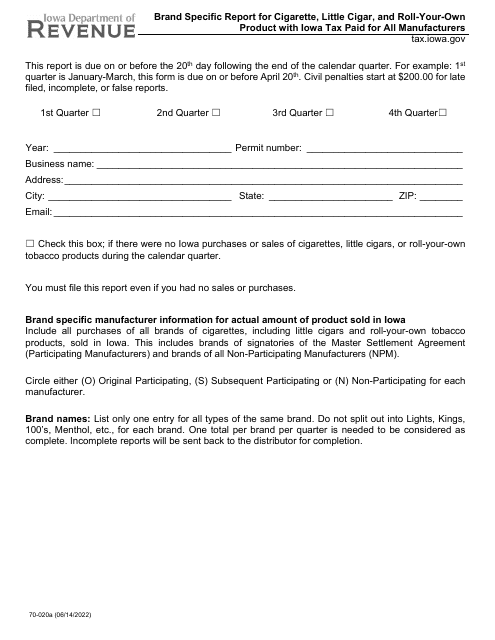

This Form is used for reporting cigarette, roll-your-own, and little cigar products with Oregon tax paid for all manufacturers in Oregon.

This form is used for reporting brand-specific information on cigarettes, roll-your-own tobacco, and little cigars products that have had Oregon taxes paid by all manufacturers. It is specific to the state of Oregon.

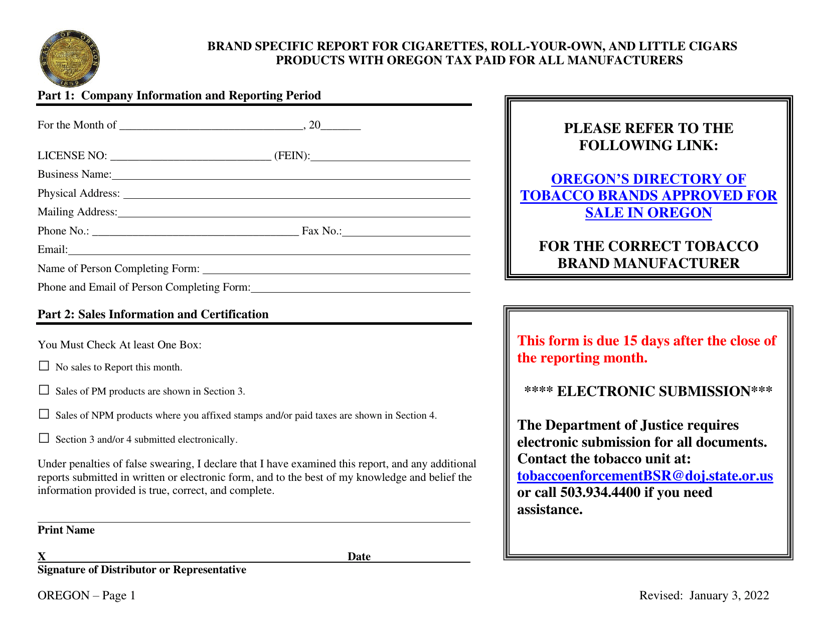

This document is a brand-specific report for cigarettes, roll-your-own tobacco, and little cigars products with Oregon tax paid. It includes a signature cover page for all manufacturers.

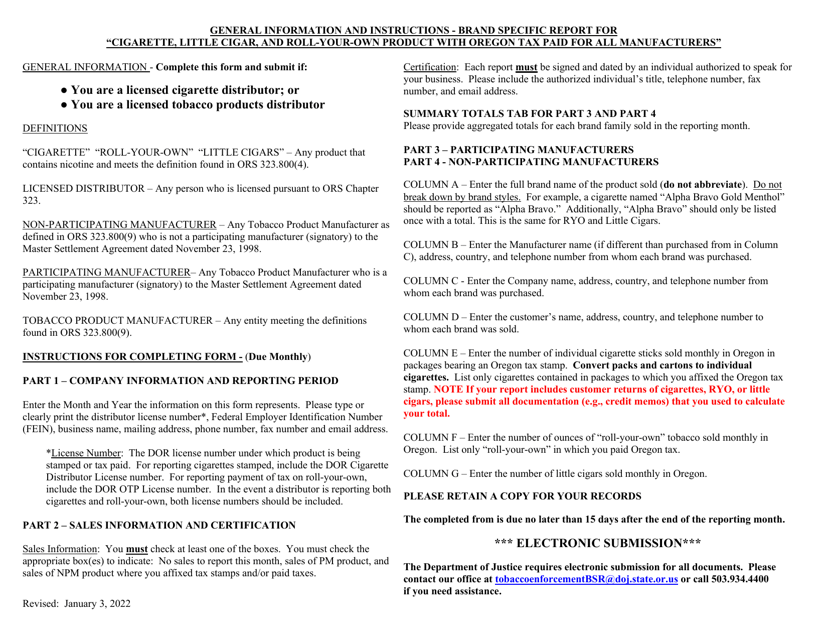

This document provides instructions for preparing a brand-specific report for cigarettes, roll-your-own tobacco, and little cigars products with Oregon tax paid for all manufacturers. It is specific to the state of Oregon.