Federal Tax Lien Templates

Federal Tax Lien Information

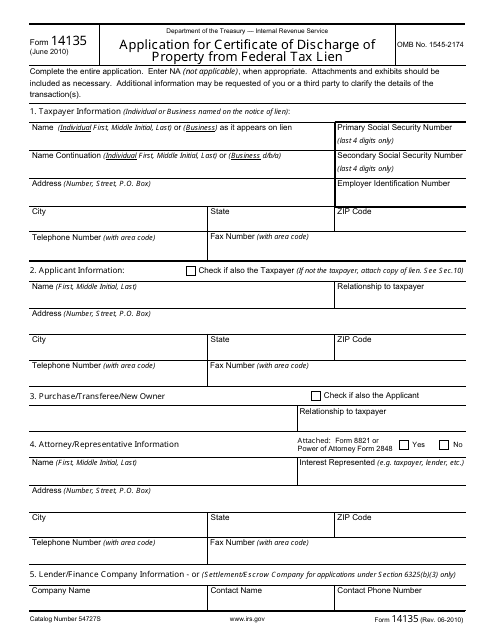

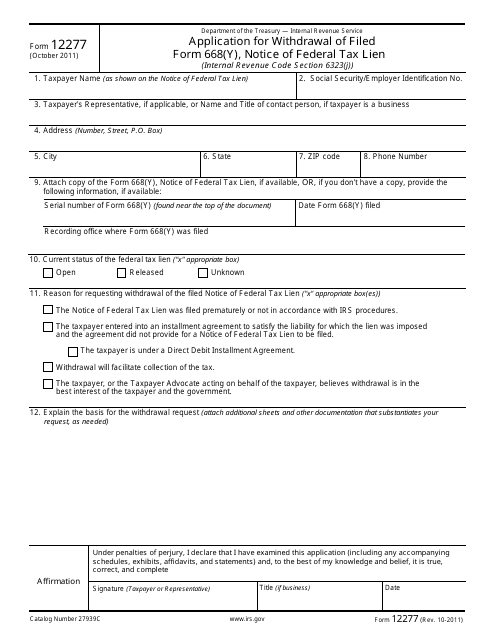

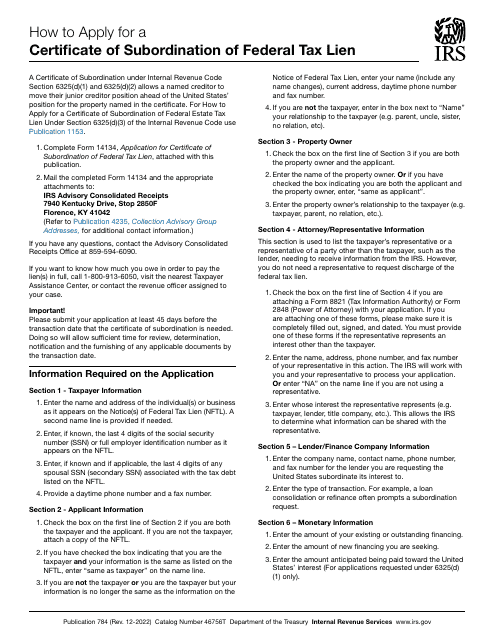

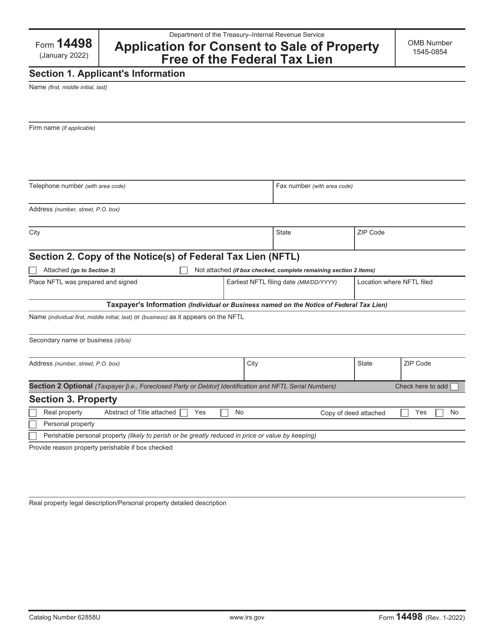

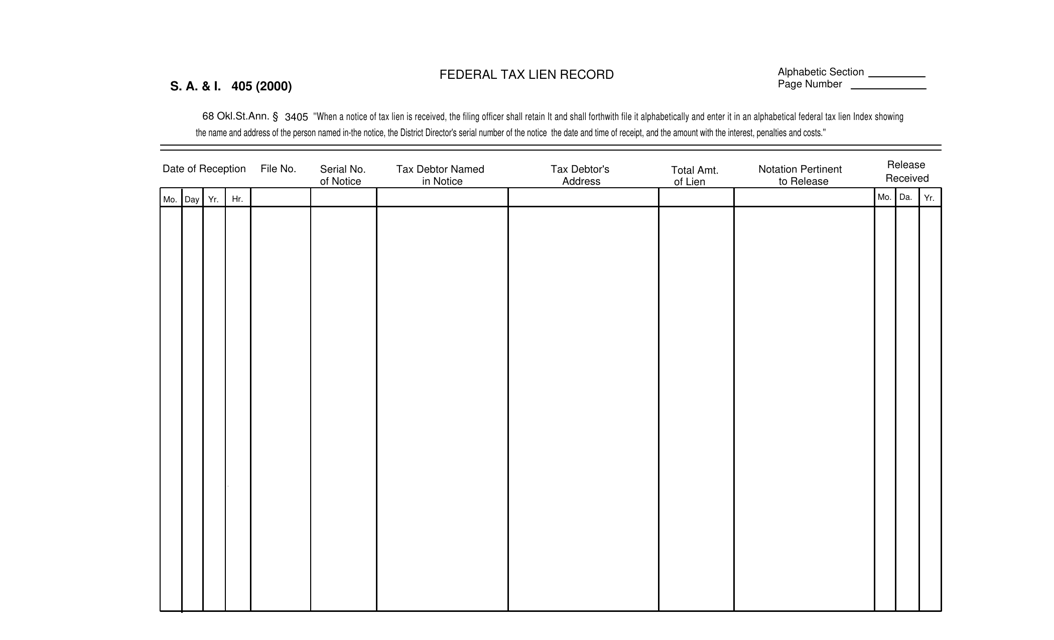

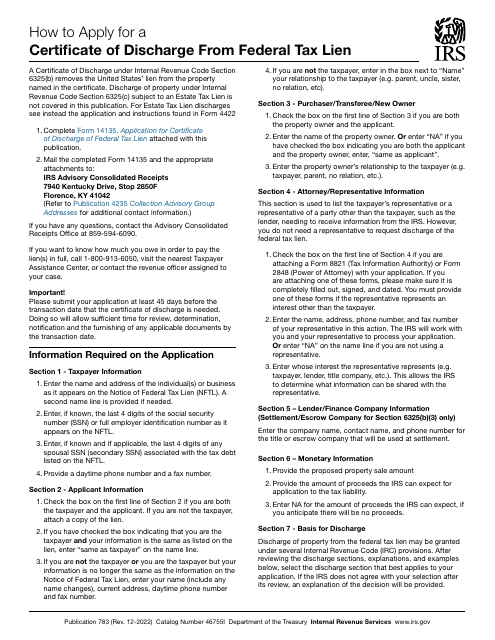

Looking for information about federal tax liens? Our comprehensive resource provides everything you need to know about federal tax liens, also known as IRS Form 14135 Application for Certificate of Discharge of Property From Federal Tax Lien, IRS Form 12277 Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien, IRS Form 14498 Application for Consent to Sale of Property Free of the Federal Tax Lien, Form S.A.& I.405 Federal Tax Lien Record - Oklahoma, and Instructions for IRS Form 14135 Application for Certificate of Discharge of Property From Federal Tax Lien.

A federal tax lien is a claim by the government on a taxpayer's property for the unpaid amount of federal taxes. This powerful tool allows the government to protect its interests and ensure the collection of outstanding tax debts. Our webpage provides a comprehensive overview of federal tax liens, including how they work, how to apply for a discharge or withdrawal, and how to obtain consent for the sale of property free of the federal tax lien.

Whether you're a taxpayer seeking information on how to resolve a federal tax lien or a professional looking to guide your clients through the process, our webpage is your go-to resource. We break down complex IRS forms and provide detailed instructions for each step of the process. You'll find answers to common questions, helpful tips, and guidance on navigating the intricacies of federal tax liens.

Don't let the complexities of a federal tax lien overwhelm you. Explore our webpage today and gain a comprehensive understanding of this important aspect of tax law.

Documents:

9

This Form is used for applying for a certificate of discharge of property from a federal tax lien by the IRS.

This form is used for recording federal tax liens in the state of Oklahoma. It is used to notify the public of the government's legal claim against a taxpayer's property.