Annual Tax Templates

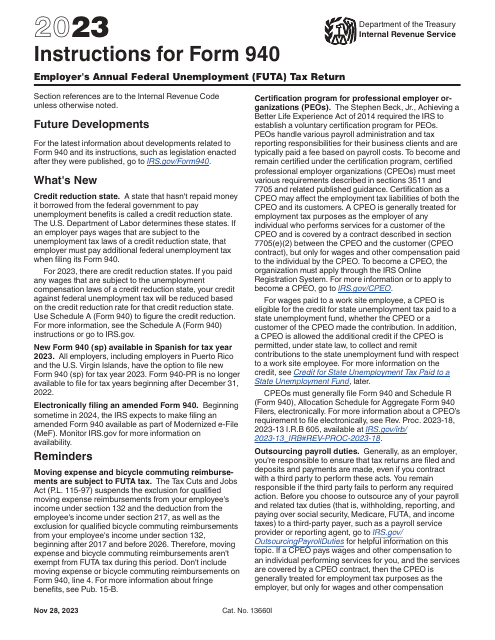

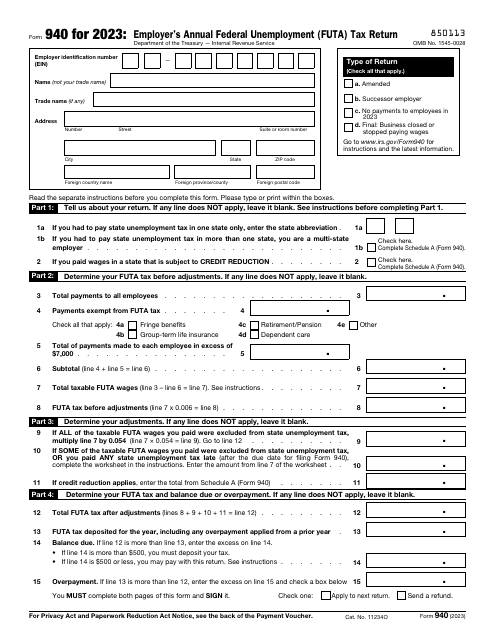

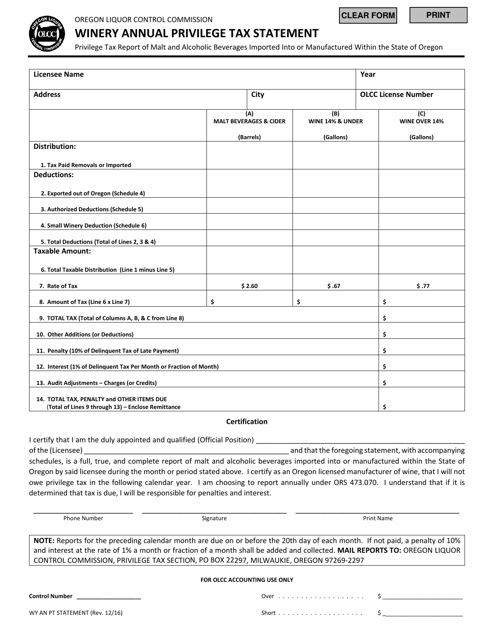

Looking for information on annual tax filing? Our webpage provides comprehensive resources and guidance for your annual tax obligations. Whether you are an employer filing the IRS Form 940 Employer's Annual Federal Unemployment (Futa) Tax Return or a small business owner looking for instructions on completing the Winery Annual Privilege Tax Statement in Oregon, we've got you covered.

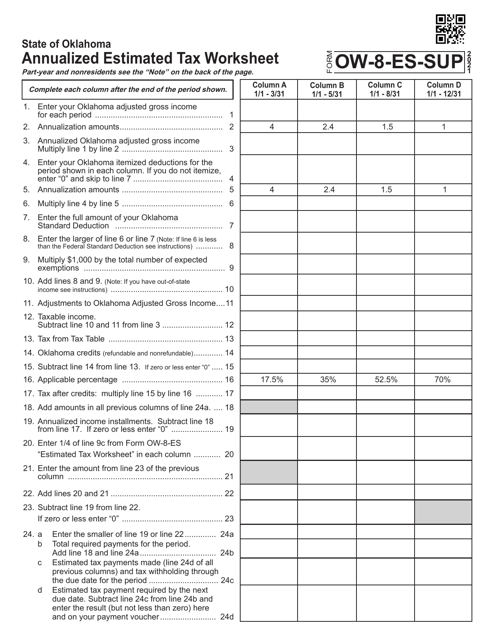

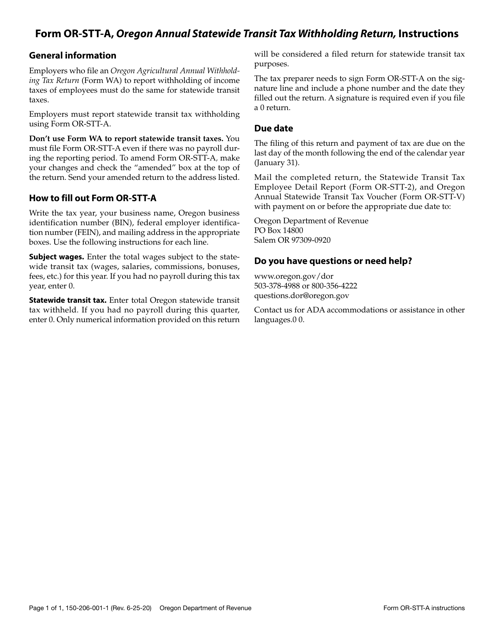

Our collection of documents includes step-by-step instructions, downloadable forms, and useful tips to ensure you meet your annual tax obligations accurately and efficiently. From the Form OW-8-ES-SUP Annualized Estimated Tax Worksheet in Oklahoma to the Instructions for Form OR-STT-A, 150-206-001 Oregon Annual Statewide Transit Tax Withholding Return, you'll find everything you need to navigate the intricate world of annual tax filing.

No need to stress about annual tax compliance. Trust our resources to simplify the process and help you complete your annual tax forms with confidence. Explore our webpage now and stay on top of your annual tax responsibilities.

Documents:

7

This Form is used for filing the Oregon Annual Statewide Transit Tax Withholding Return to report and pay the transit tax withheld from employees' wages in Oregon.

This document is used for reporting and paying the annual privilege tax for wineries in Oregon.