Hard Cider Templates

Welcome to our webpage dedicated to hard cider, also known as hard apple cider or simply cider. On this page, you will find a collection of documents related to the production, distribution, and sale of hard cider.

Hard cider, a popular alcoholic beverage made from fermented apple juice, has been enjoyed for centuries. With its distinct flavors and refreshing taste, it has gained a loyal following among cider enthusiasts. Whether you are a cider producer, retailer, distributor, or consumer, these documents will provide you with valuable information and resources.

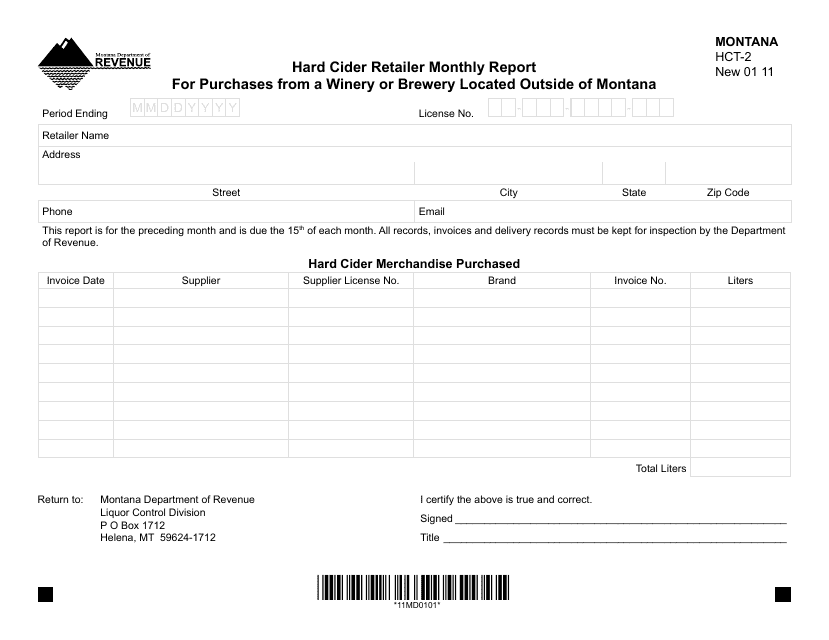

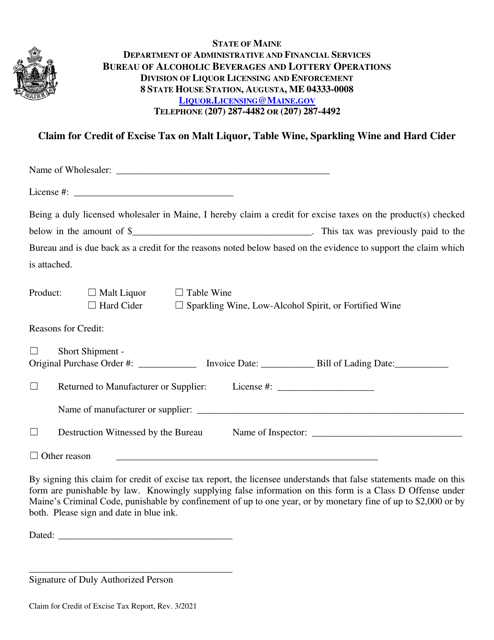

Our collection includes a variety of documents from different regions and jurisdictions. For example, you will find forms such as the Form HCT-2 Hard Cider Retailer Monthly Report for Purchases From a Winery or Brewery Located Outside of Montana, which is specific to Montana's regulations. Similarly, the Claim for Credit of Excise Tax on Malt Liquor, Table Wine, Sparkling Wine, and Hard Cider is a key document in Maine's regulatory framework.

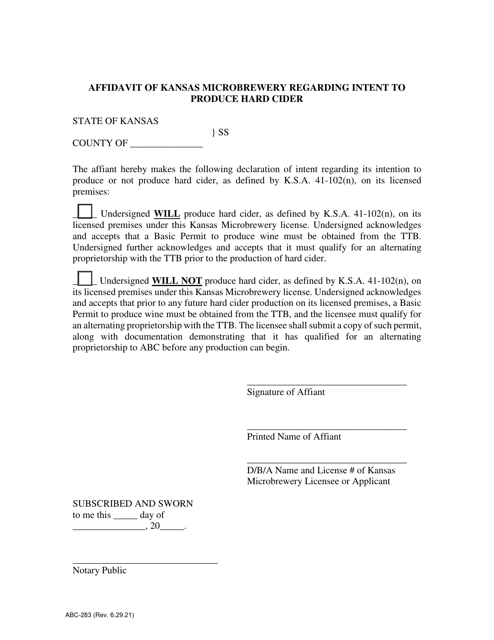

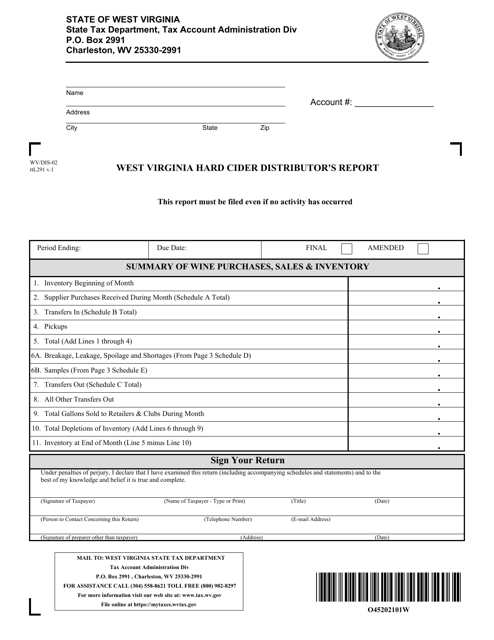

If you are a producer, you may find the Form ABC-283 Affidavit of Kansas Microbrewery Regarding Intent to Produce Hard Cider helpful in navigating the requirements set by the state of Kansas. Distributors will find the Form WV/DIS-02 West Virginia Hard Cider Distributor's Report particularly useful for keeping track of their cider inventory and sales in West Virginia.

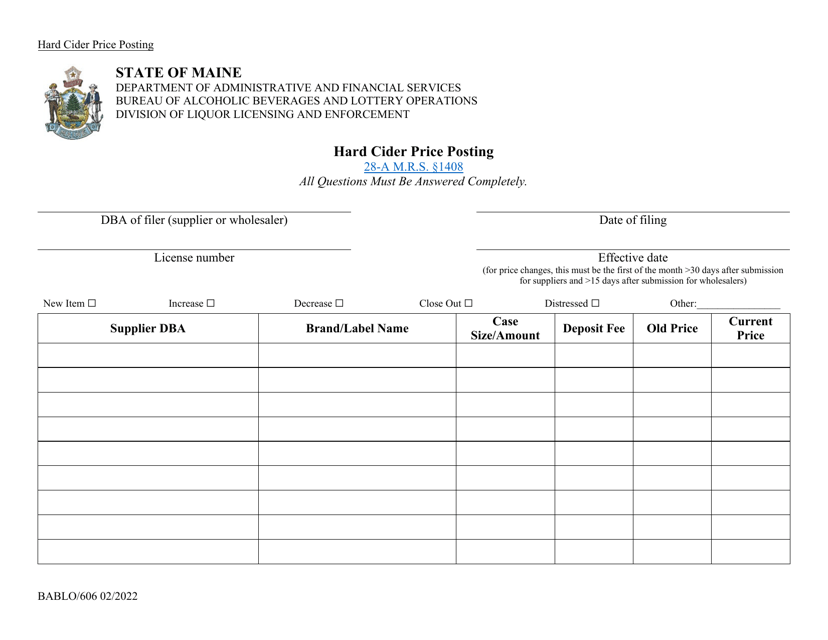

Additionally, we have included the Form BABLO/606 Hard Cider Price Posting, which is relevant to the pricing and labeling requirements in Maine.

No matter where you are located or what your role is in the hard cider industry, these documents will serve as a valuable resource to help you navigate the regulations and requirements. Browse through our collection to find the information you need to successfully operate in the world of hard cider.

Please note that the availability and specifics of these documents may vary depending on your location and the applicable laws and regulations. It is always important to consult with legal and regulatory experts to ensure compliance with the relevant authorities.

Documents:

6

This form is used for retailers in Montana to report their monthly purchases of hard cider from wineries or breweries located outside of Montana. It is required by the Montana Department of Revenue for tax purposes.

This document is used to claim credit for excise tax paid on malt liquor, table wine, sparkling wine, and hard cider in the state of Maine.

This form is used for Kansas microbreweries to declare their intention to produce hard cider.

This form is used for West Virginia Hard Cider Distributors to report their activities and sales in the state of West Virginia.

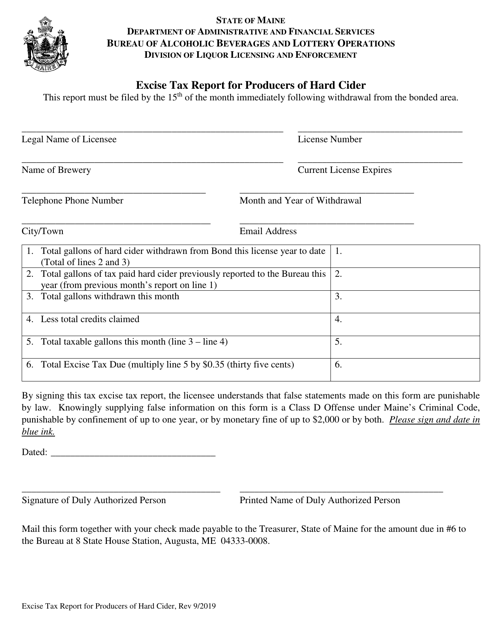

This form is used for reporting excise taxes by producers of hard cider in the state of Maine.

This form is used for posting the price of hard cider in the state of Maine.