Supplemental Assessment Templates

Supplemental Assessment: Providing Property Tax Relief for New Construction

Welcome to our website dedicated to supplemental assessment, also known as claim for new construction exclusion from supplemental assessment. In many jurisdictions across the United States, property owners may be eligible for property tax relief if they have made significant improvements or constructed new buildings on their properties. Supplemental assessment is designed to ensure that property taxes are fair and reflect the changes in property value due to new construction.

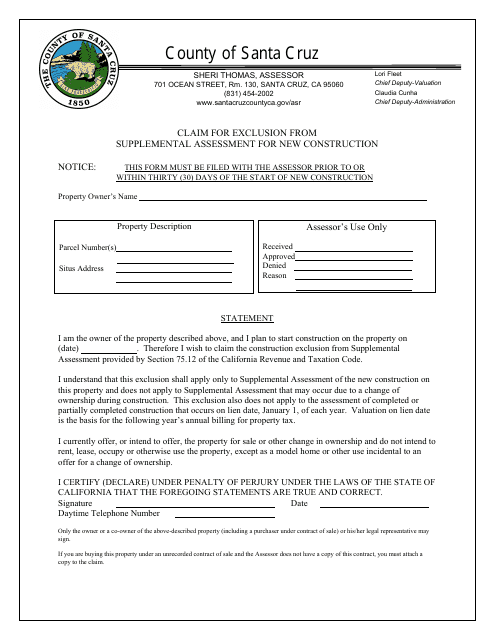

Our website provides valuable information and resources for property owners looking to apply for supplemental assessment. Whether you are in the City and County of San Francisco, Shasta County, San Diego County, Fresno County, Santa Cruz County, or any other county in California, our website offers detailed instructions and forms needed to initiate the claim process. We strive to make the process as seamless and straightforward as possible, so you can focus on enjoying the benefits of your new construction without the burden of increased property taxes.

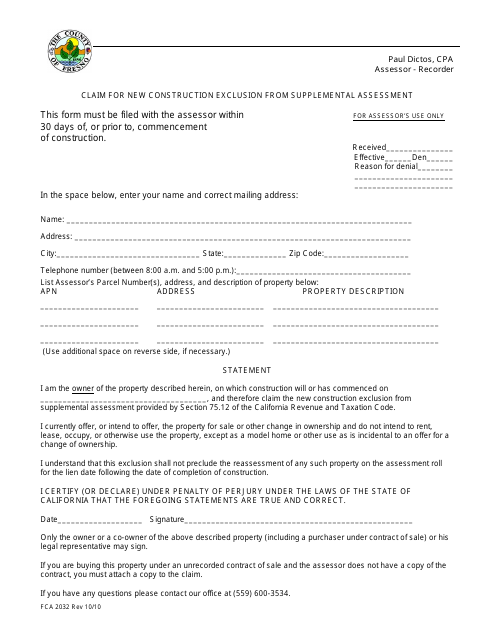

On our website, you will find the necessary claim forms, such as Form PT-64, Form FCA2032, and more, specific to your county. In addition, we provide step-by-step guides that will walk you through the entire application process, ensuring that you provide all the required information accurately and meet the deadlines set by your local taxing authority.

We understand that property taxes can be a significant expense for property owners, especially when new construction or improvements have been made. Our mission is to help you navigate the supplemental assessment process with ease and confidence. Our experienced and knowledgeable team is here to answer any questions you may have and provide guidance throughout the entire process.

If you are a property owner in California or any other state with a supplemental assessment program, we invite you to explore our website and take advantage of the resources we offer. Discover how you can potentially reduce your property tax liability and make the most of your new construction investment. Start your supplemental assessment application today and experience the benefits of fair property taxation.

Documents:

10

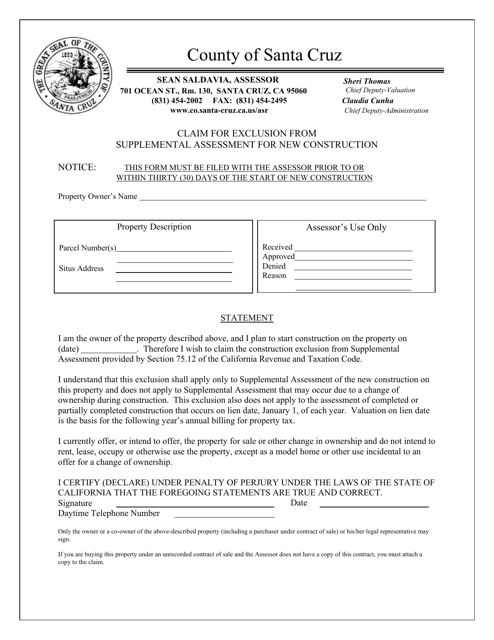

This form is used for requesting exclusion from supplemental assessment for new construction in the state of California.

This Form is used for evaluating HIPAA compliance for non-trs workers in Texas. It is a supplemental assessment to ensure privacy and security of personal health information.

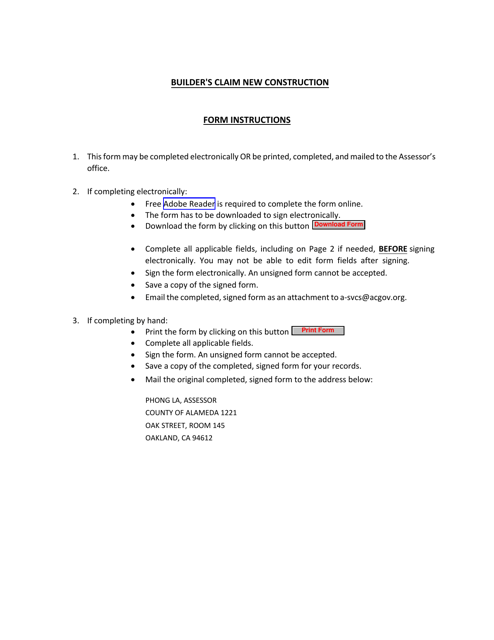

This form is used for builders in Alameda County, California to claim an exemption from supplemental assessment for new construction projects.

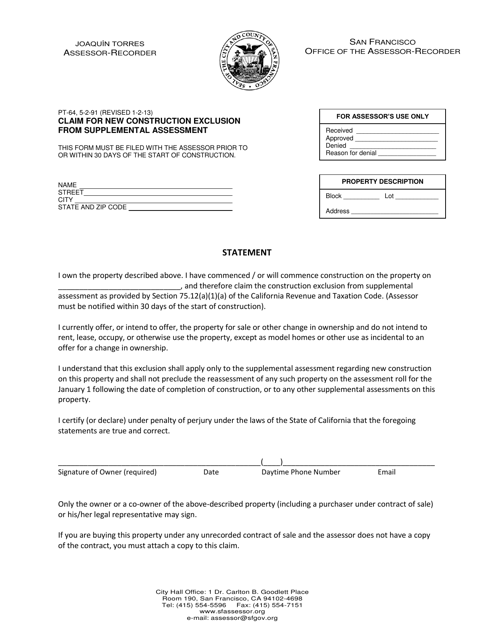

This form is used for claiming an exclusion from supplemental assessment for newly constructed property in the City and County of San Francisco, California.

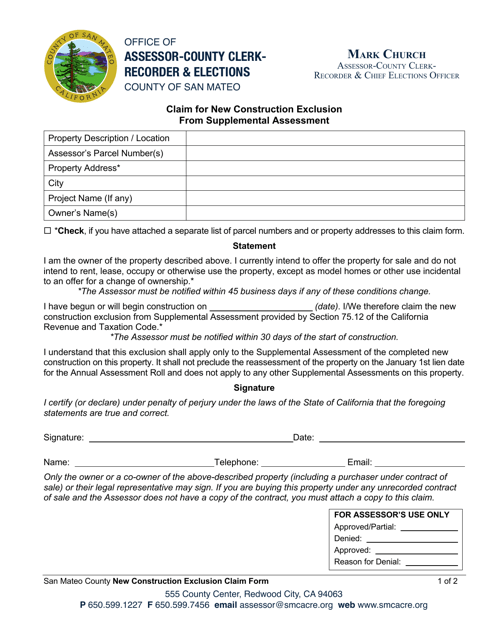

This form is used for claiming an exclusion from supplemental assessment for new construction in San Mateo County, California.

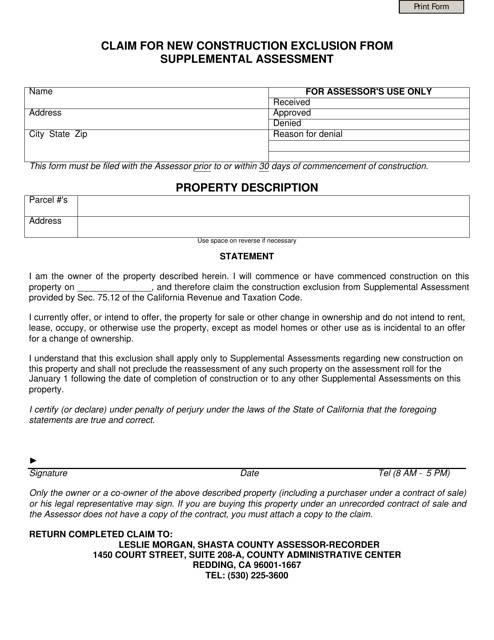

This form is used for claiming a new construction exclusion from supplemental assessment in Shasta County, California

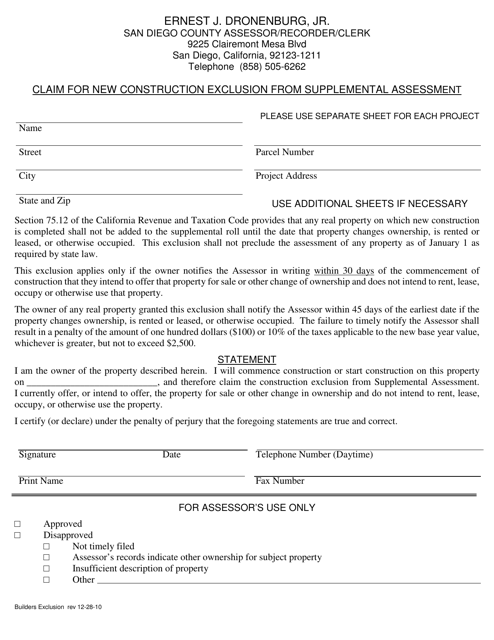

This form is used for claiming the exclusion from supplemental assessment for new construction in San Diego County, California. It allows property owners to request a reassessment of their property value due to new construction, which may result in a lower tax assessment.

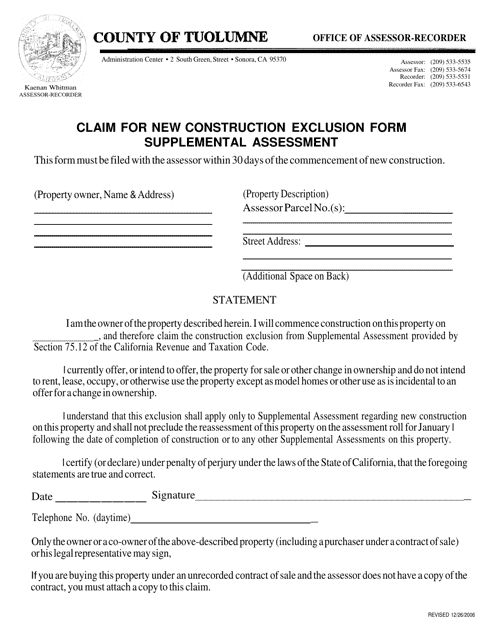

This Form is used to request a supplemental assessment for new construction in Tuolumne County, California. It helps to determine the value of the new construction for property tax purposes.

This Form is used for claiming new construction exclusion from supplemental assessment in Fresno County, California.