Collection Due Process Templates

Are you facing issues with the IRS collection process? Are you looking for a fair and impartial way to resolve your tax disputes? Look no further than the Collection Due Process (CDP), also known as the Equivalent Hearing.

At times, individuals and businesses find themselves in a situation where they receive a notice from the IRS regarding the collection of taxes owed. This can be a daunting and overwhelming experience, but the Collection Due Process or Equivalent Hearing provides you with an opportunity to challenge the IRS's actions and present your case.

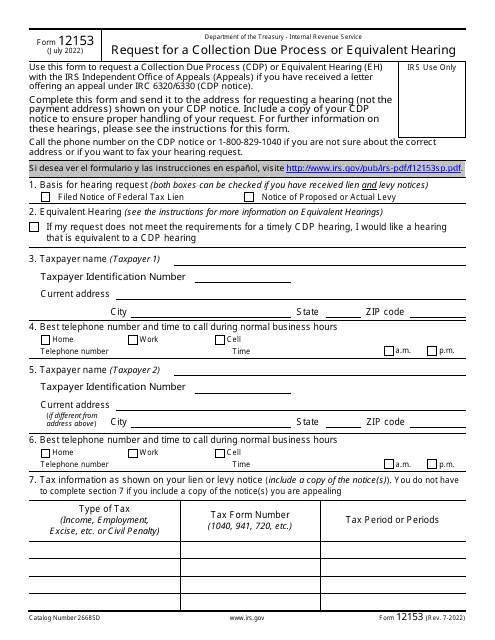

The process begins by filing IRS Form 12153 - Request for a Collection Due Process or Equivalent Hearing. This form allows you to request a review of the proposed collection action and presents your reasons for disagreement. The IRS will then schedule a hearing with an impartial officer who will carefully consider your case.

During the hearing, you will have the chance to present your arguments and provide any supporting documentation. This is your opportunity to prove that the IRS's proposed collection action is unjustified or that there are alternative ways to satisfy your tax debt. The impartial officer will carefully review all the information presented and make a decision based on the facts and applicable tax laws.

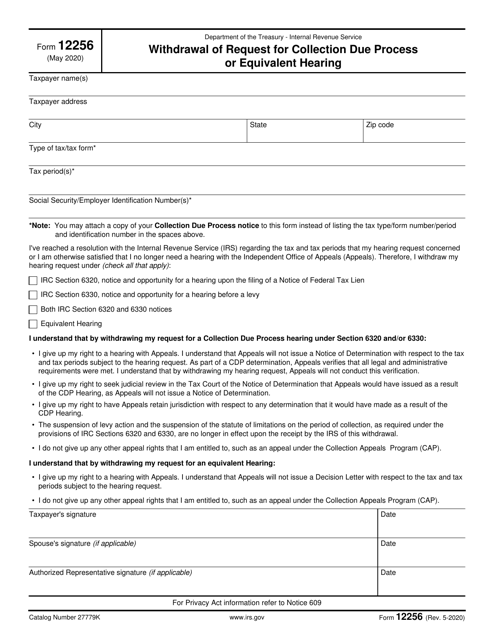

If you change your mind or decide that a hearing is no longer necessary, you can withdraw your request by submitting IRS Form 12256 - Withdrawal of Request for Collection Due Process or Equivalent Hearing.

The Collection Due Process or Equivalent Hearing serves as a safety net, ensuring that the IRS follows proper procedures and gives you a fair chance to resolve your tax issues. It provides a formal and structured process to address your concerns and find a resolution. Whether you are an individual or a business entity, this process offers a level playing field and an opportunity to present your case.

Don't let the fear of the IRS collection process overwhelm you. Take advantage of the Collection Due Process or Equivalent Hearing to protect your rights and resolve your tax disputes in a fair and impartial manner. Contact us today to learn more about this process and how we can assist you in navigating through it.

Documents:

5

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.