Tax Settlement Agreement Templates

Are you struggling with tax issues and looking for a way to settle your tax obligations? Look no further! Our tax settlement agreement services provide a practical and effective solution to help you resolve your tax debts. Whether you refer to it as a tax settlement agreement, an offer in compromise, or any other alternate name, our team of experts is here to assist you every step of the way.

Our comprehensive tax settlement agreement services cater to individuals and businesses across the United States and Canada, ensuring that everyone has access to the assistance they need. When you avail of our services, we will work closely with you to understand your unique tax situation and develop a customized plan that suits your needs.

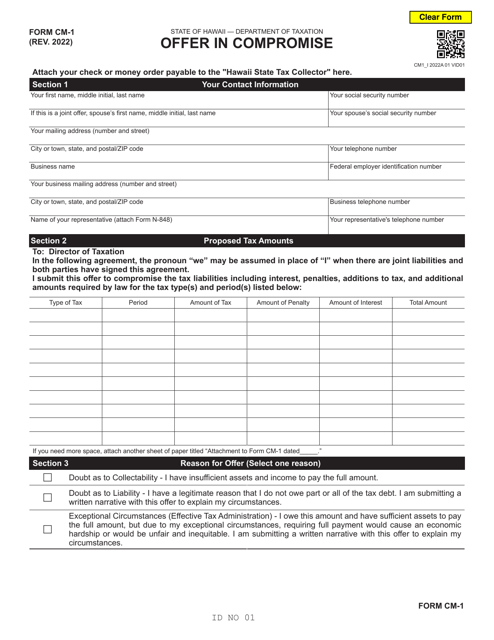

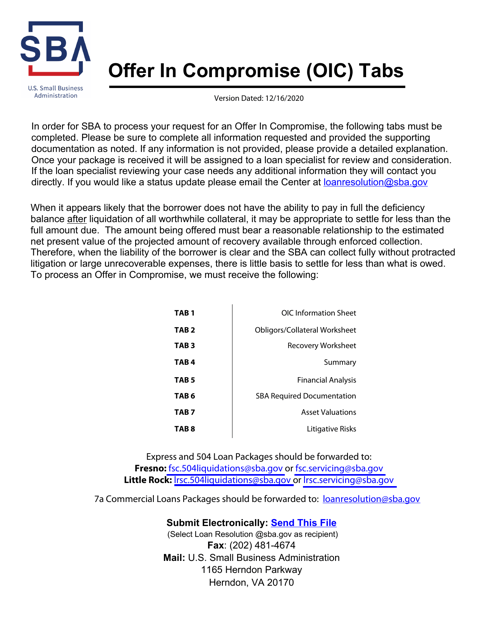

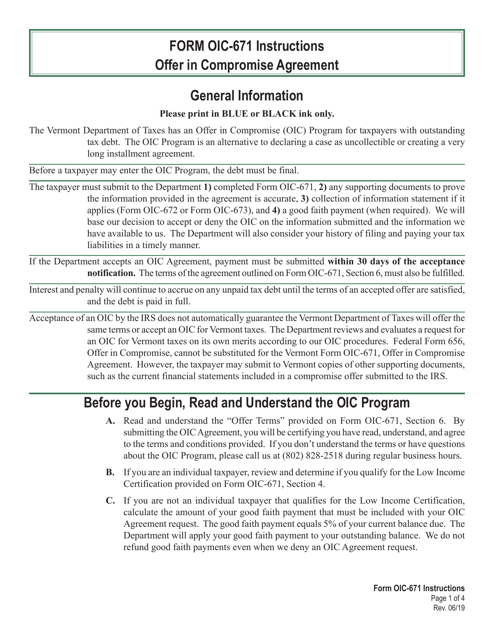

By utilizing various forms and applications such as Form CM-1 Offer in Compromise (Hawaii), Offer in Compromise (OIC) Tabs, VT Form OIC-671 Offer in Compromise Agreement (Vermont), Offer in Compromise Application for Individuals (Mississippi), and IRS Form 656 Offer in Compromise, we can negotiate with tax authorities on your behalf to reach a favorable settlement agreement. Our experienced professionals have an in-depth understanding of the tax laws and regulations governing these processes and will use their expertise to maximize your chances of a successful outcome.

Don't let tax debts overwhelm you. Take advantage of our reliable tax settlement agreement services today. Let us handle the complexities of dealing with tax authorities while you focus on getting your finances back on track. Contact us now to learn more about our services and start your journey towards tax relief.

Documents:

12

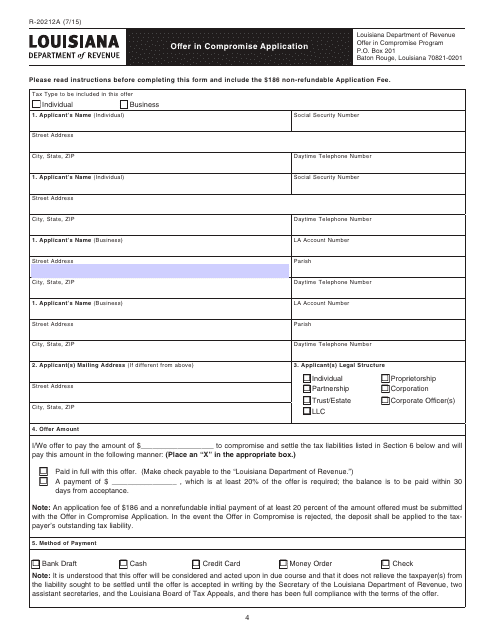

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

This form is used for making an offer in compromise to the state of Vermont. It is an agreement to settle a taxpayer's debt for less than the full amount owed.

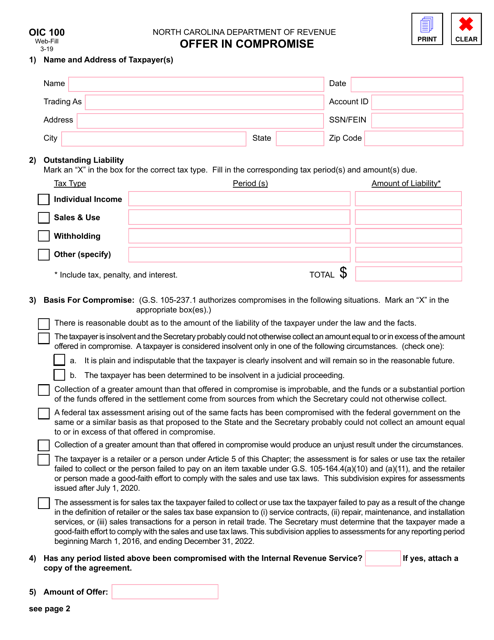

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

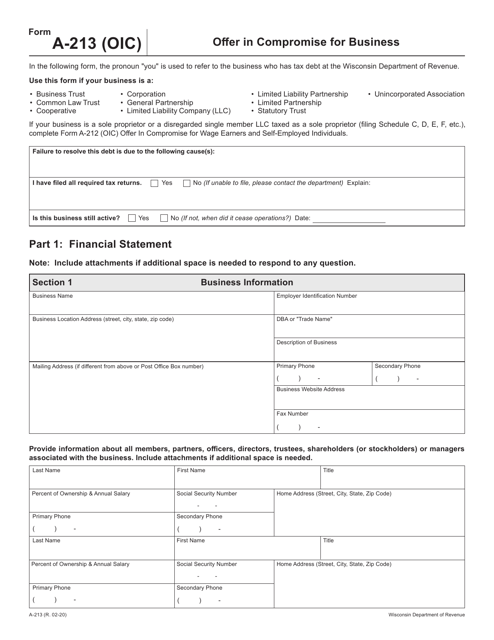

This form is used for making an offer in compromise for a business located in Wisconsin.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.