Employer Credit Templates

Are you an employer looking for potential tax benefits related to hiring and supporting certain groups of individuals? Look no further than the Employer Credit program. Also known as Employment Credit or Employment Credits, this program offers various financial incentives that can help lighten the burden on your company's finances.

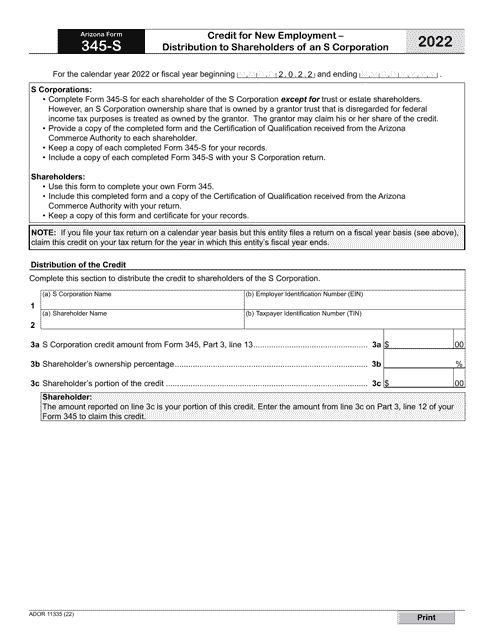

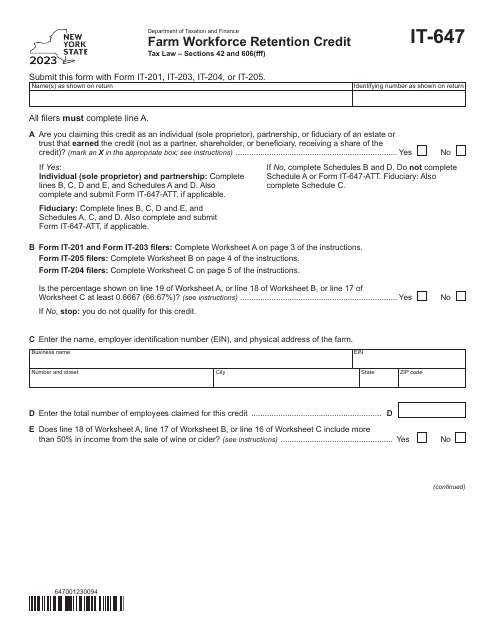

Under the Employer Credit program, you may be eligible for tax credits based on certain criteria. These credits, sometimes referred to as Employer Credits or Employers Credit, are designed to reward businesses that contribute to the growth and well-being of their communities. By taking advantage of these credits, you can not only enhance your bottom line but also make a positive impact on the lives of deserving individuals.

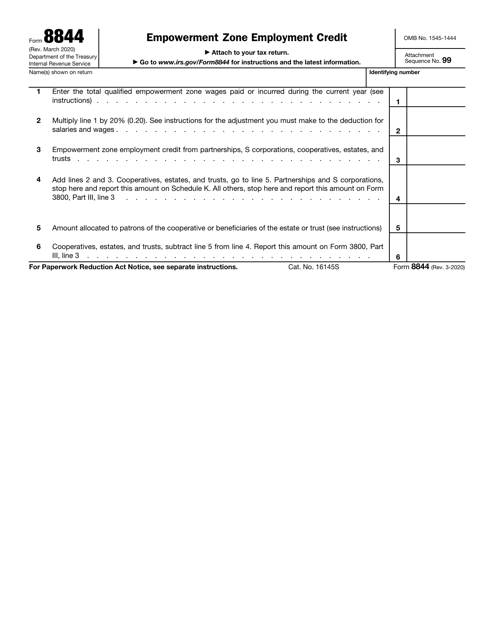

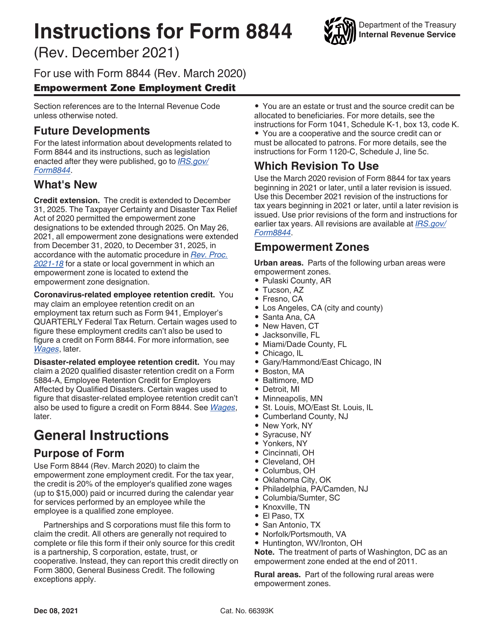

One example of the Employer Credit program is the Empowerment Zone Employment Credit. This particular credit, documented in IRS Form 8844, offers incentives to employers who hire employees residing in designated empowerment zones. By filling out this form accurately, you can potentially reduce your tax liability while promoting employment opportunities in economically distressed areas.

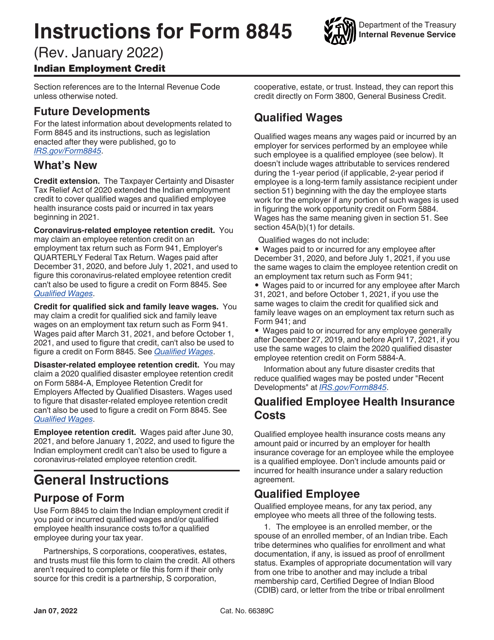

Another credit worth exploring is the Indian Employment Credit, covered in the instructions for IRS Form 8845. This credit aims to encourage businesses to hire Native American individuals and promote job creation within Native American communities. By following the instructions provided, you can navigate the application process and potentially qualify for this credit.

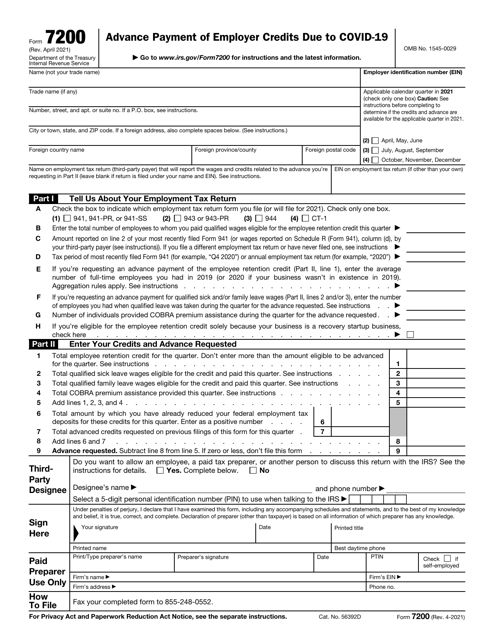

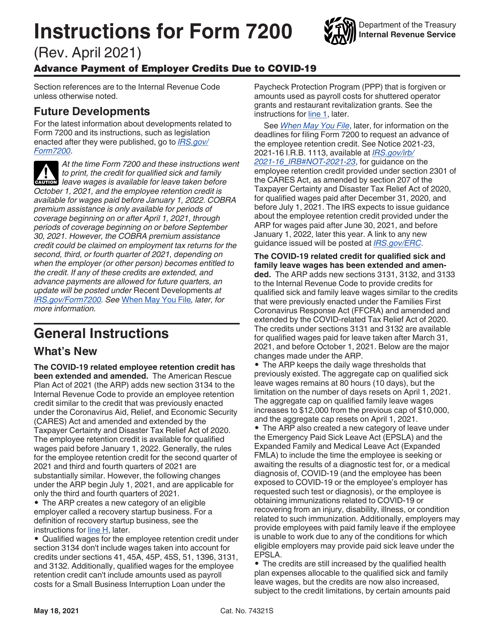

In light of recent events, there is also the Advance Payment of Employer Credits Due to Covid-19, which can be found in IRS Form 7200. This form and its instructions offer a unique opportunity for employers to receive financial assistance during challenging times such as the ongoing pandemic. By requesting an advance payment, you can alleviate some of the financial strain caused by the necessary adaptations to your business.

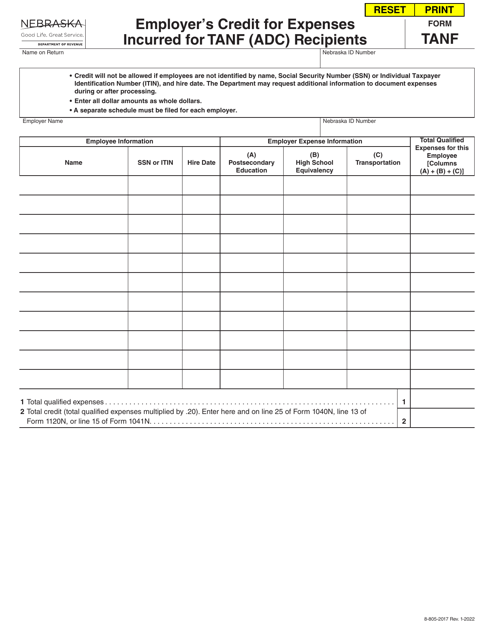

In certain regions, such as Nebraska and Maine, additional Employer Credits are available. For instance, Nebraska offers the TANF Employer's Credit for Expenses Incurred for TANF (Adc) Recipients. By completing the appropriate forms and meeting the eligibility requirements, employers in Nebraska can save on taxes while promoting the well-being of Temporary Assistance for Needy Families (TANF) recipients.

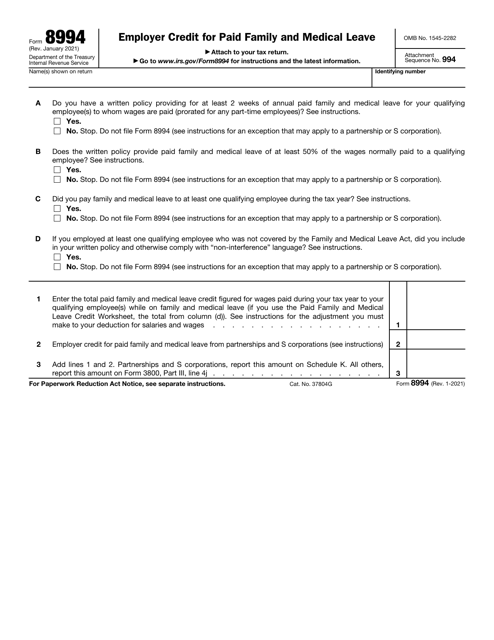

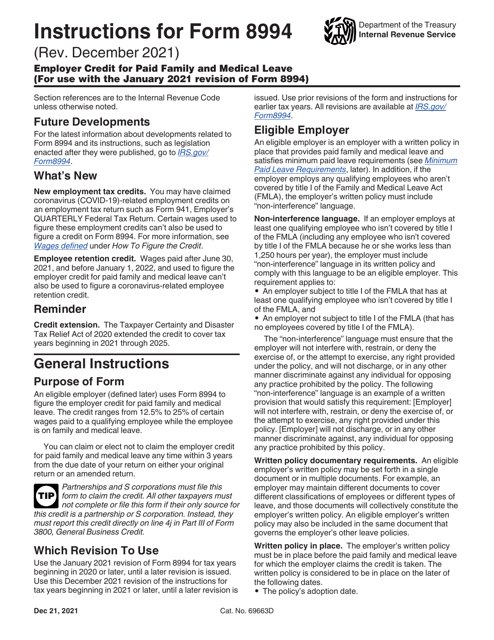

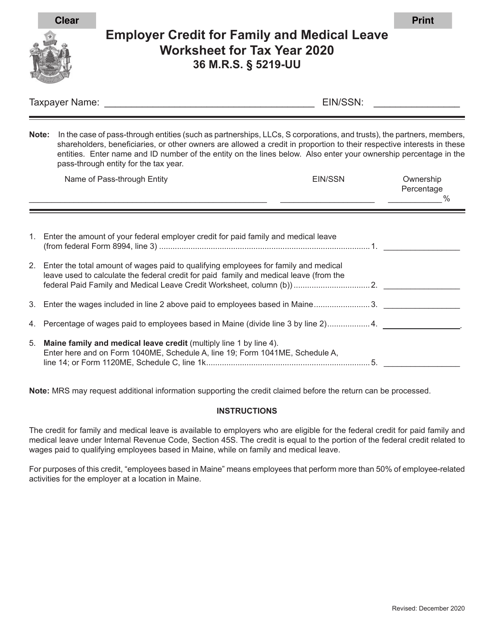

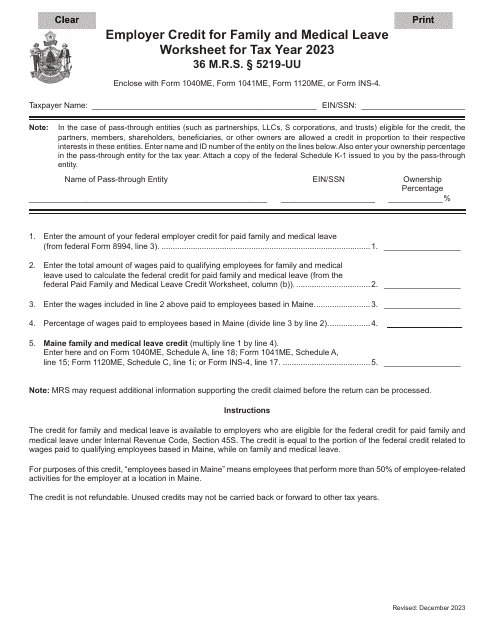

Maine, on the other hand, provides the Employer Credit for Family and Medical Leave Worksheet. This credit is designed to encourage employers to offer family and medical leave benefits to their employees. By completing the worksheet accurately, you can determine the amount of credit you may be eligible for based on the qualified family and medical leave wages you provide to your employees.

In conclusion, the Employer Credit program, also known as Employment Credit or Employment Credits, offers a wide range of tax incentives to employers. By taking advantage of these opportunities, you can not only reduce your tax liability but also contribute to the growth and well-being of various communities. Whether you qualify for the Empowerment Zone Employment Credit, the Indian Employment Credit, or other opportunities such as the Advance Payment of Employer Credits Due to Covid-19 or specific regional credits, exploring these programs is worth your while.

Documents:

30

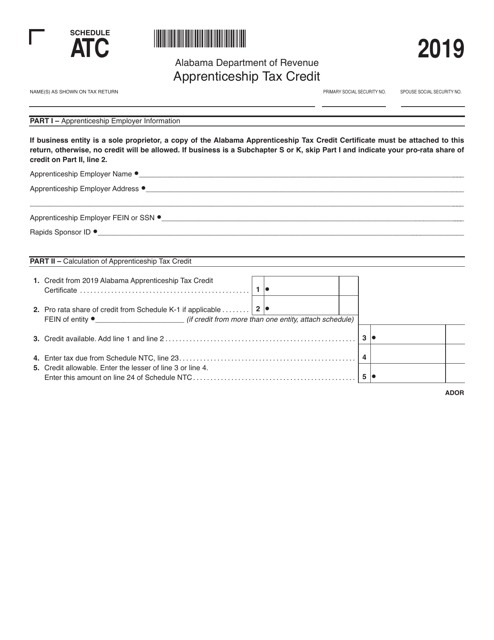

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

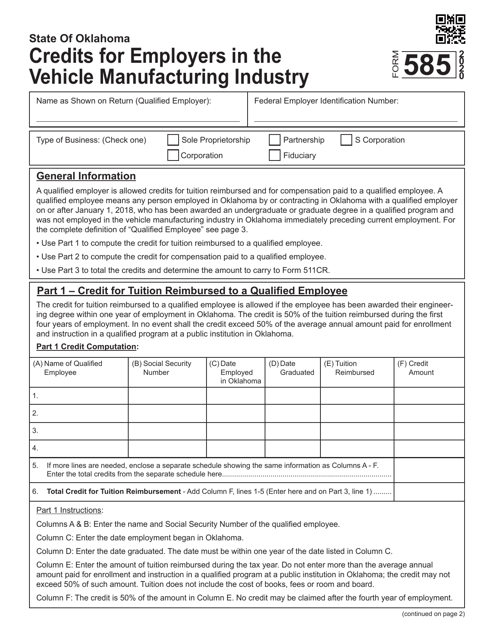

This Form is used for employers in the vehicle manufacturing industry in Oklahoma to claim credits.

This worksheet is used by employers in Maine to calculate the credit for family and medical leave. The credit is a tax incentive designed to encourage employers to provide paid leave for their employees.

This form is used for employers to claim a credit for the expenses incurred for hiring recipients of the Temporary Assistance for Needy Families (TANF) program in Nebraska.

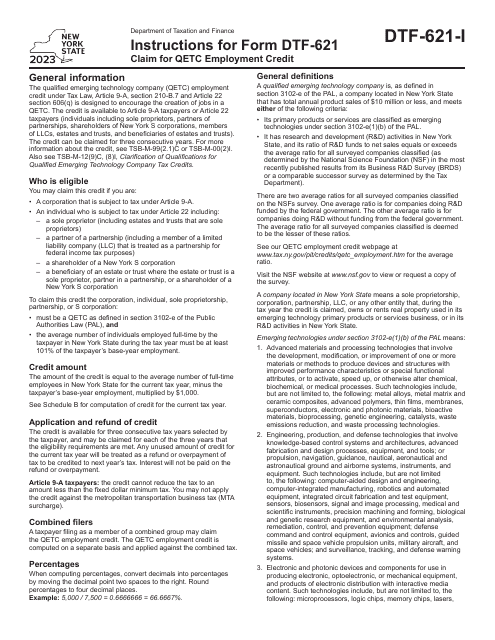

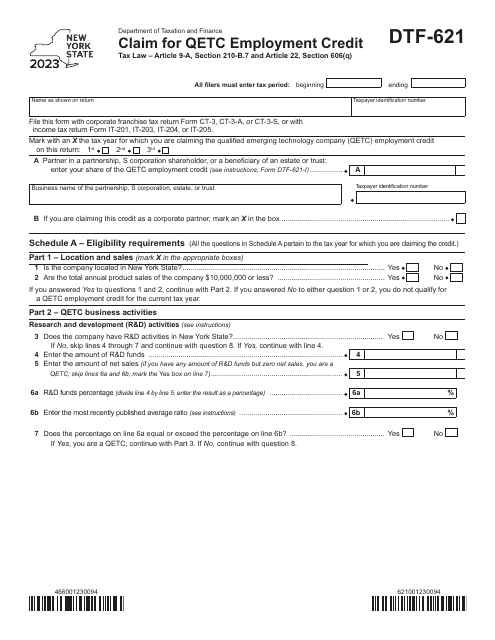

This Form is used for claiming the QETC Employment Credit in the state of New York. It provides instructions on how to fill out and submit the form to receive the credit.