Gambling Income Templates

Are you one of the lucky winners at the casino or the lottery? If so, you will need to report your gambling income to the appropriate authorities. This collection of documents, also known as gambling income or certain gambling winnings, provides the necessary information and forms to make sure you comply with the tax regulations.

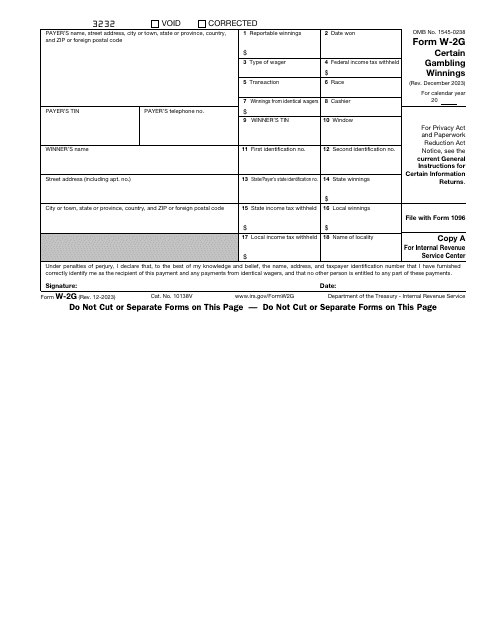

One important document in this collection is the IRS Form W-2G Certain Gambling Winnings. This form outlines the specific details of your winnings, including the type of gambling, the amount won, and the taxes withheld. It is essential for accurately reporting your gambling income to the Internal Revenue Service.

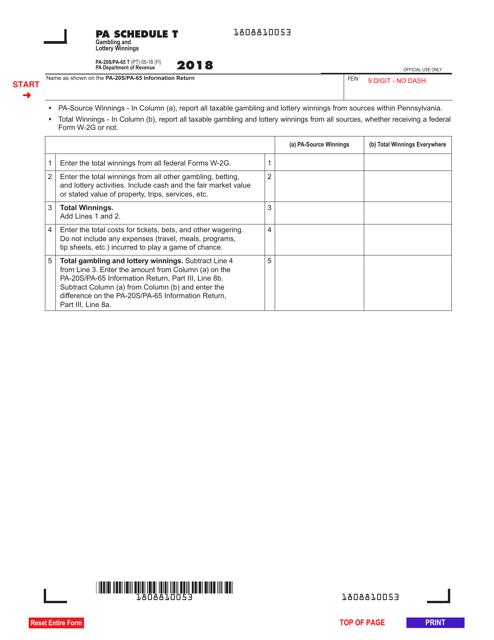

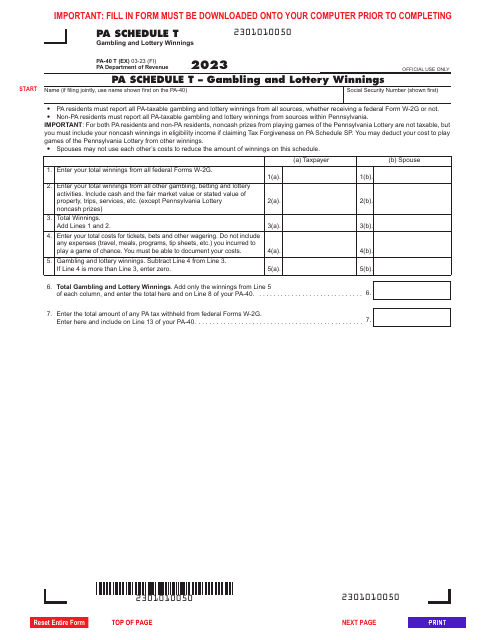

In addition to federal forms, some states require their own documentation for reporting gambling income. For example, the Form PA-20S (PA-65 T) Schedule T Gambling and Lottery Winnings is used in Pennsylvania to report such income. Similarly, the Form PA-40 Schedule T Gambling and Lottery Winnings is another document specific to Pennsylvania taxpayers. These state-specific forms ensure that you meet any additional reporting requirements imposed by your state's taxation authority.

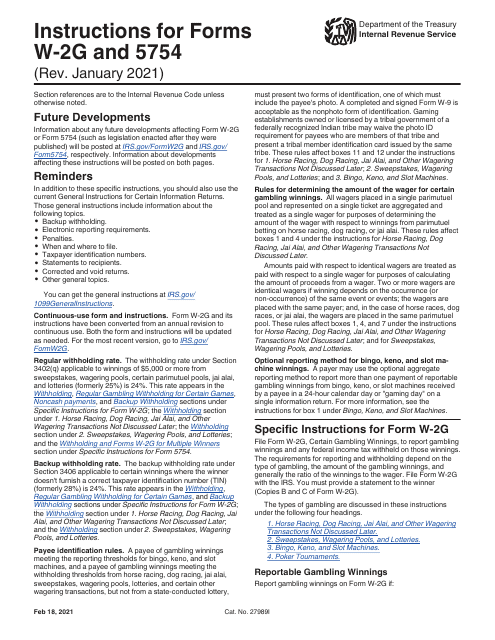

To help you navigate through the instructions and requirements of reporting gambling income, there are detailed instructions available for the IRS Form W-2G, 5754. These instructions provide step-by-step guidance on how to complete the necessary forms accurately and avoid any potential errors or inaccuracies.

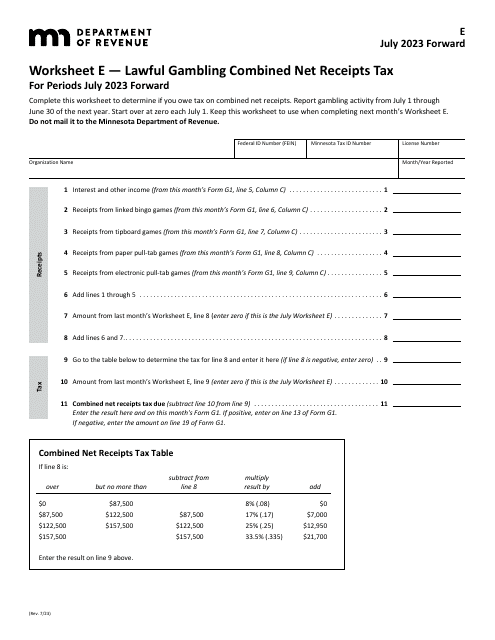

Furthermore, if you are involved in lawful gambling and need to calculate your combined net receipts tax, the Worksheet E Lawful Gambling Combined Net Receipts Tax for Minnesota is a helpful tool. This worksheet assists you in determining the taxable amount based on your lawful gambling activities in Minnesota.

Don't leave your gambling income to chance! Ensure that you have the correct documentation and understanding of the reporting requirements. With this collection of documents related to gambling income, you can stay compliant and avoid any unnecessary complications with the tax authorities.

Documents:

7

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

This form is used for reporting gambling and lottery winnings in the state of Pennsylvania.