Fuel Import Templates

Fuel Import - Importing Energy for the Roads

Looking to import fuels for your business? Look no further! Our fuel import documents will provide you with all the information you need to successfully import fuels into the USA, Canada, and other countries. Whether you are a fuel importer or simply interested in the process of bringing imported fuels into the market, our collection of documents will be your go-to resource.

Alternative Energy Importation - Opening New Horizons

With an array of alternate names such as fuel importers, fuel imports, and imported fuels, our fuel import documents cater to a wide range of interests and needs. Discover how these documents can navigate you through the intricate world of fuel importation, providing step-by-step guidance on legal requirements, tax returns, schedules of disbursements, and much more.

Import Fuel with Confidence - Compliant and Efficient

Importing fuels can be a complex process. However, with our carefully curated collection of fuel import documents, you can feel confident in your ability to navigate the legal, financial, and logistical aspects of importing energy products. Be sure to familiarize yourself with the instructions provided in each document to ensure compliance with the specific regulations of your desired destination.

Stay Ahead of the Game - Fuel Import Intelligence

Our fuel import documents are continuously updated to reflect the latest changes in regulations and requirements. By utilizing our resources, you are equipping yourself with the most up-to-date information necessary to stay ahead of the competition. Stay in the know and make informed decisions when it comes to importing fuels for your business.

Fuel Import in Action - Meeting Your Specific Needs

Whether you are a licensed distributor, an importer with a specialized tax return, or simply seeking information on tankwagon importers' schedules, our fuel import documents cover a wide range of scenarios. No matter your specific needs, our collection is designed to assist and guide you through the importation process, making it as seamless and efficient as possible.

(Note: The generated text is a sample and may not accurately represent the actual content of the documents)

Documents:

15

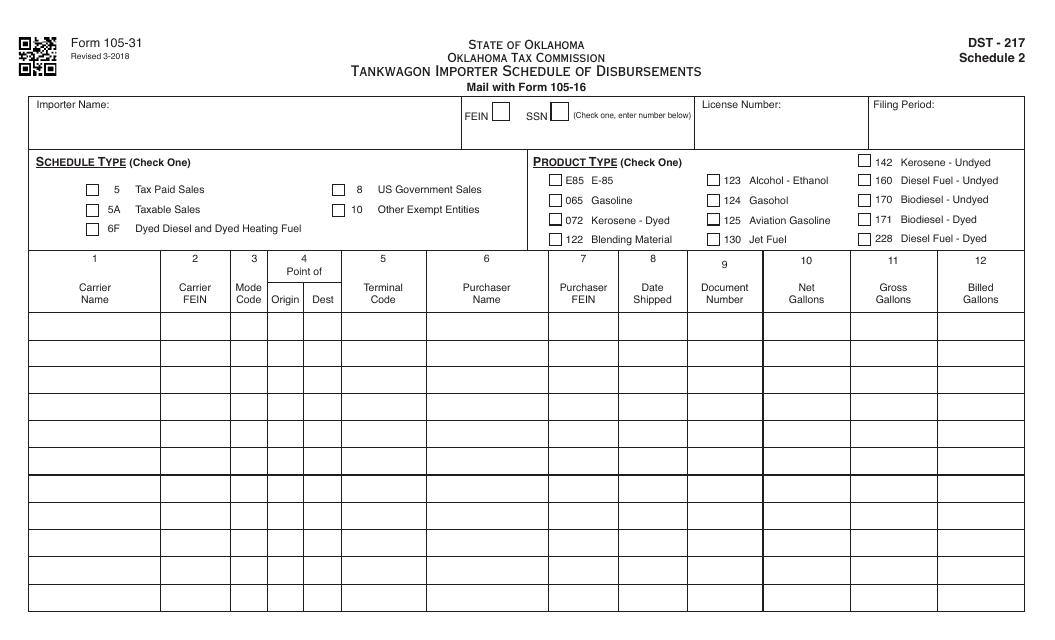

This Form is used for recording the schedule of disbursements made by tankwagon importers in Oklahoma.

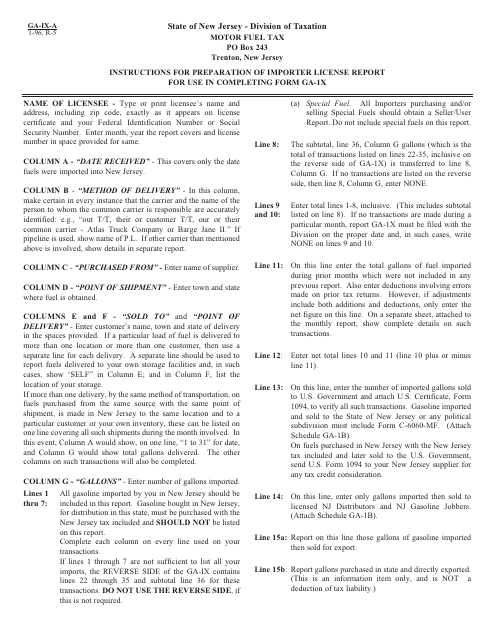

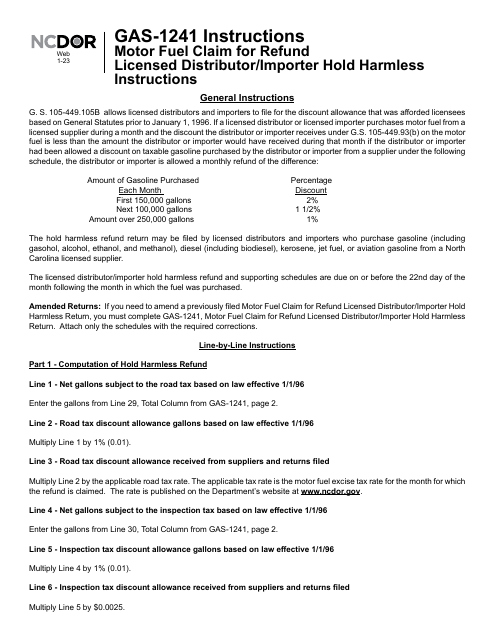

This Form is used for reporting motor fuel imports by fuel importers in the state of New Jersey. It provides instructions on how to fill out and submit the GA-IX-A, GA-1X Motor Fuel Importer Report to the relevant authorities.

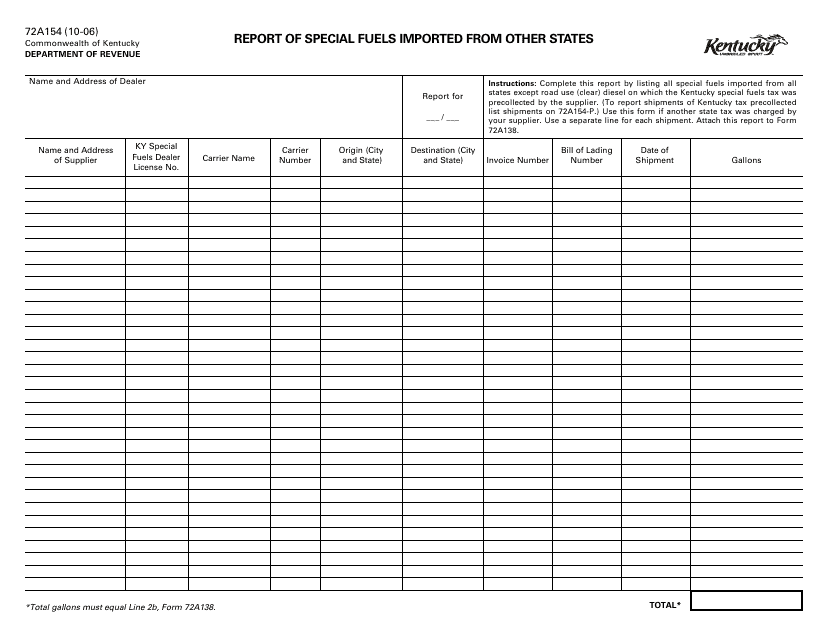

This form is used for reporting special fuels that are imported from other states to Kentucky.

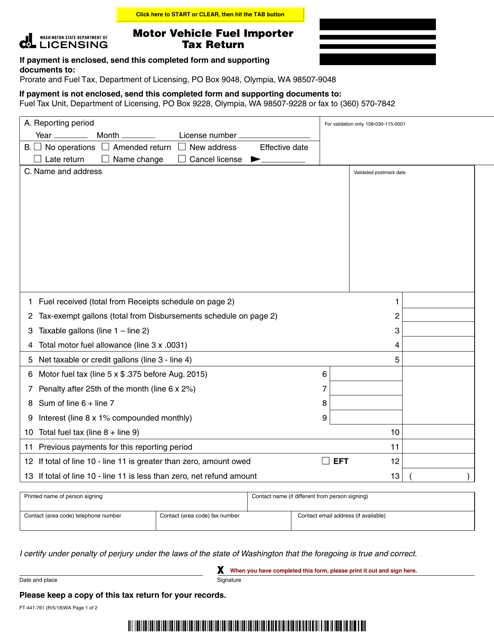

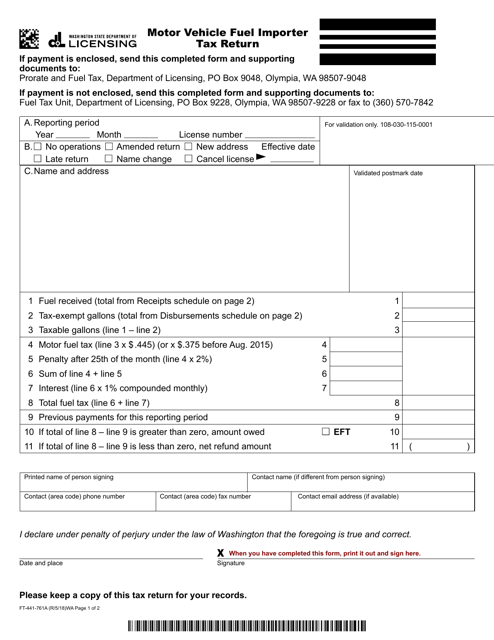

This Form is used for filing the Motor Vehicle Fuel Importer Tax Return in the state of Washington

This Form is used for filing special fuel import taxes in the state of Washington. It provides instructions on how to complete and submit the Form FT-441-763.

This document is used for filing the Motor Vehicle Fuel Importer Tax Return in the state of Washington. It provides instructions on how to accurately report and pay the required tax for importing motor vehicle fuel into the state.

This form is used for reporting and paying the motor vehicle fuel importer tax in the state of Washington.

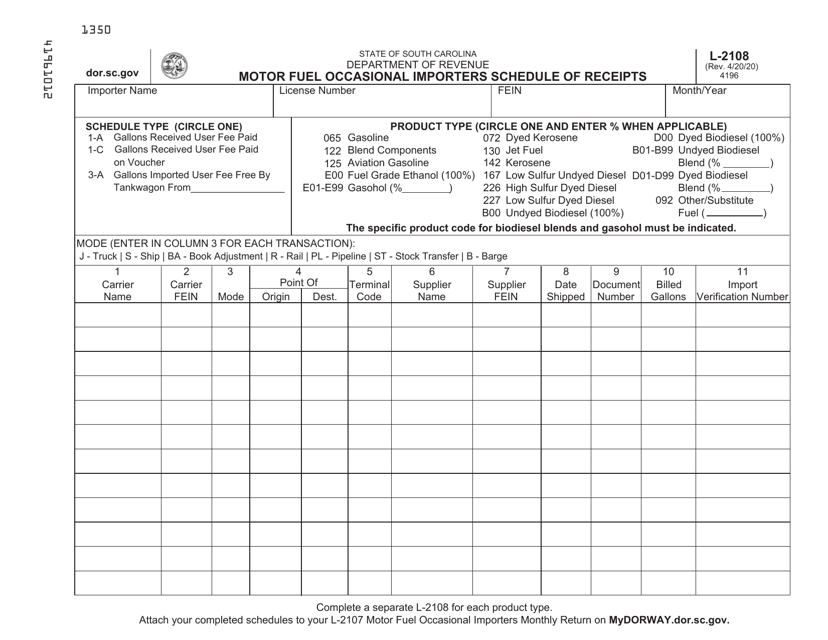

This form is used for occasional importers of motor fuel in South Carolina to report their receipts.

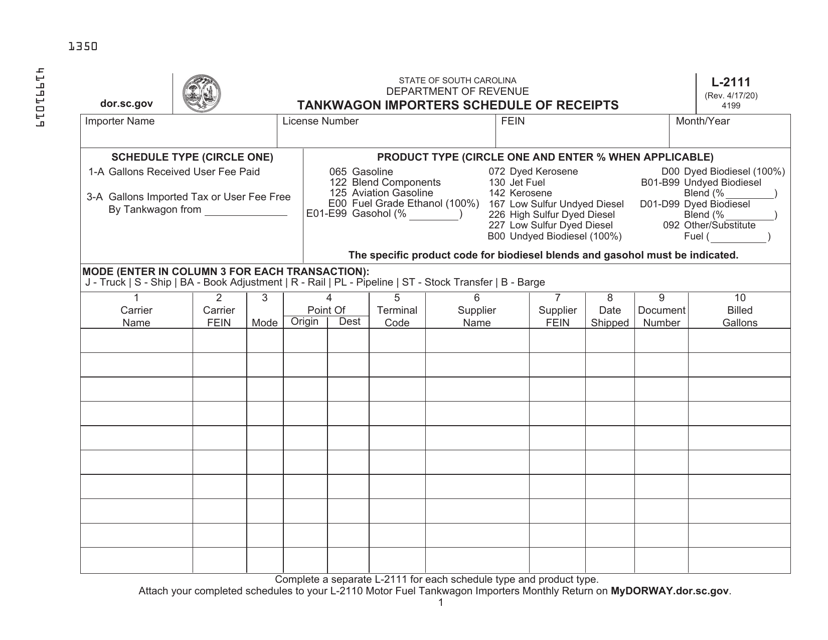

This form is used for tankwagon importers in South Carolina to report their schedule of receipts.

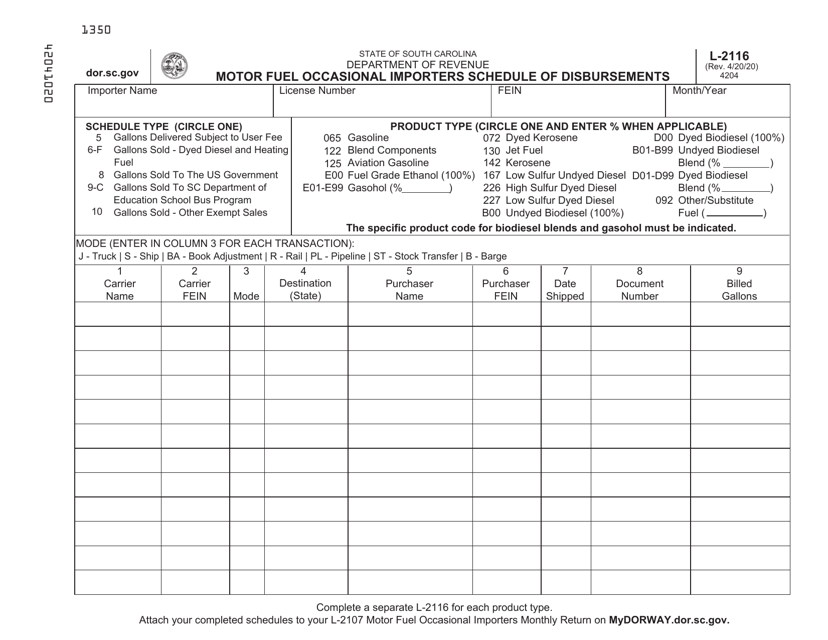

This form is used for recording the schedule of disbursements for occasional importers of motor fuel in South Carolina.

This Form is used for motor vehicle fuel importers in Washington to file their tax return.