Income Tax Extension Templates

Are you facing difficulties in filing your income tax return on time? Don't worry, we've got you covered. Our income tax extension documents group offers you the flexibility to extend the deadline for filing your tax return.

With our income tax extension service, you can request additional time for filing your tax return without any penalties or fees. Whether you are an individual, a corporation, a partnership, or a trust, we have the right document for you.

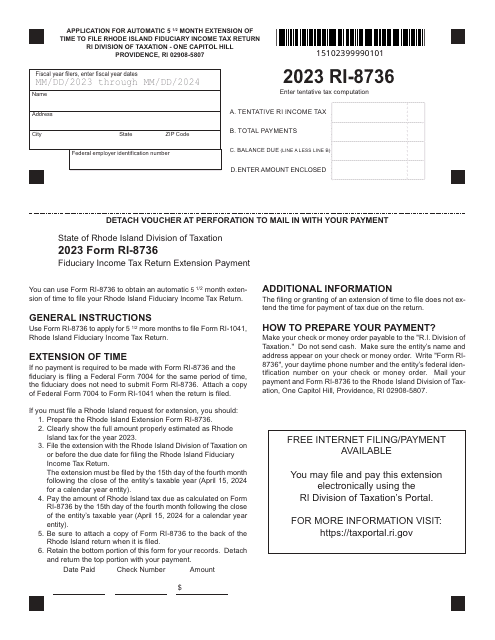

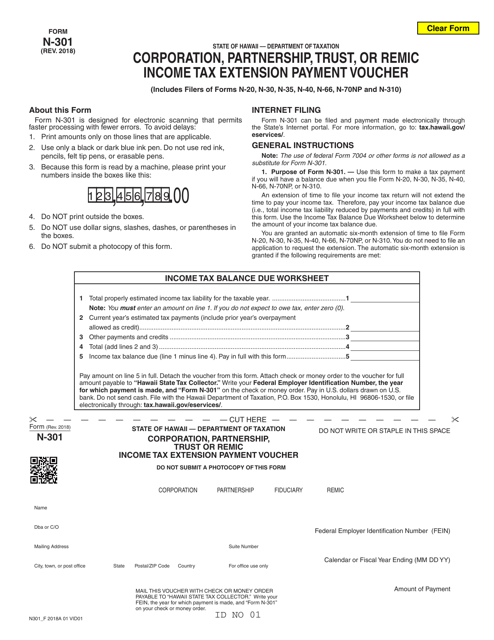

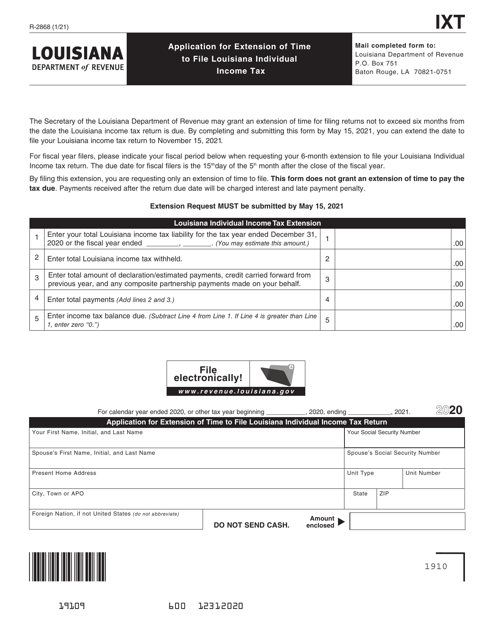

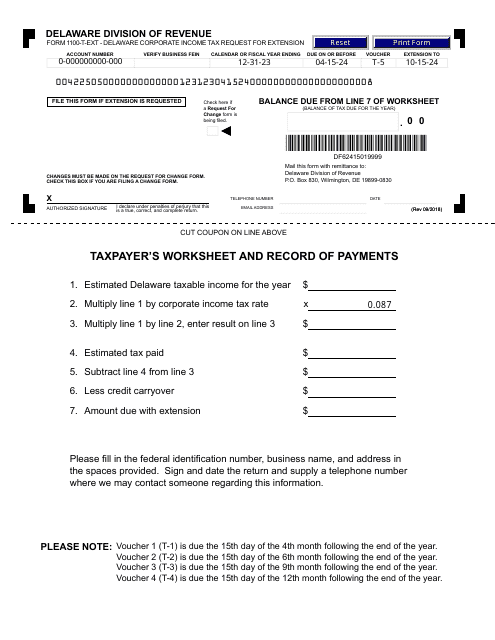

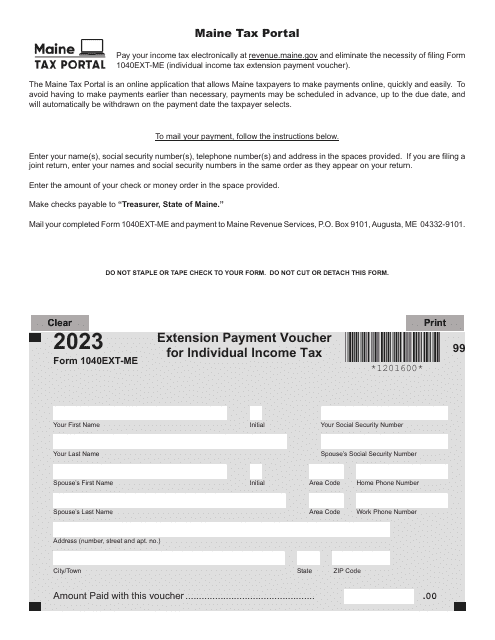

Our collection includes forms such as Form RI-8736 Fiduciary IncomeTax Return Extension Payment in Rhode Island, Form N-301 Corporation, Partnership, Trust, or REMIC Income Tax Extension Payment Voucher in Hawaii, Form R-2868 Application for Extension of Time to File Louisiana Individual Income Tax in Louisiana, Form 1100-T-EXT Delaware Corporate Income TaxRequest for Extension in Delaware, and Form 1040EXT-ME Extension Payment Voucher for Individual Income Tax in Maine.

By using our income tax extension service, you can avoid the stress of meeting the tax deadline and buy yourself some extra time to gather all the necessary information and documents. It is a convenient and hassle-free option to ensure that your tax return is filed accurately and on time.

Don't let the pressure of the tax season get to you. Take advantage of our income tax extension service and enjoy peace of mind knowing that you have ample time to complete your tax preparations. Let us handle the paperwork while you focus on what matters most to you.

Choose our income tax extension service today and experience the convenience and relief it provides. Say goodbye to the last-minute rush and let us help you stay organized and compliant with your tax obligations. Start the process now and get the extension you need.

Documents:

5