Tax Claims Templates

Documents:

62

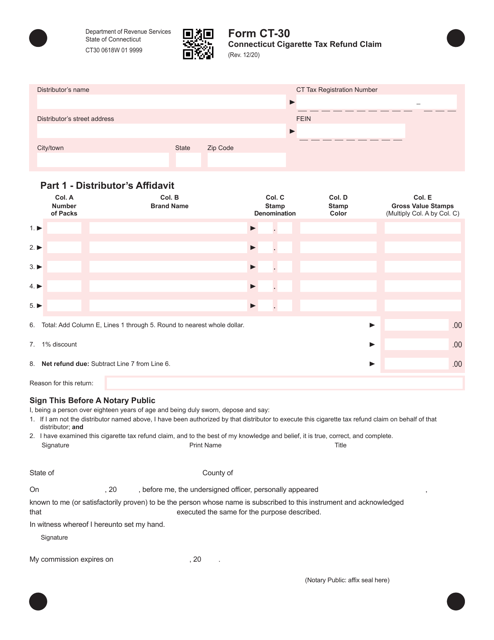

This form is used for claiming a refund of cigarette taxes paid in the state of Connecticut.

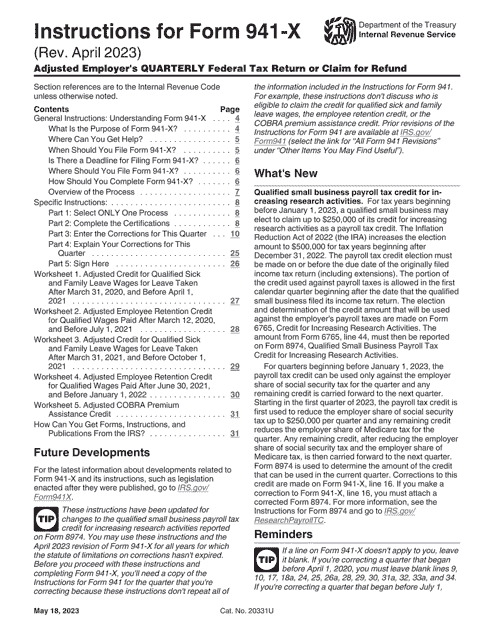

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

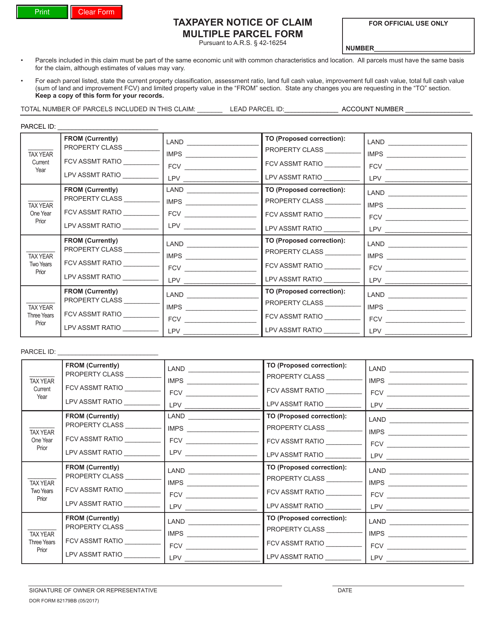

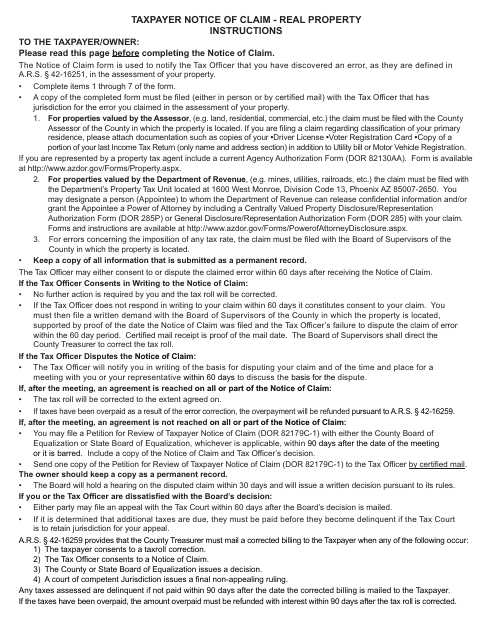

This document is used for filing a taxpayer notice of claim for multiple parcels in the state of Arizona.

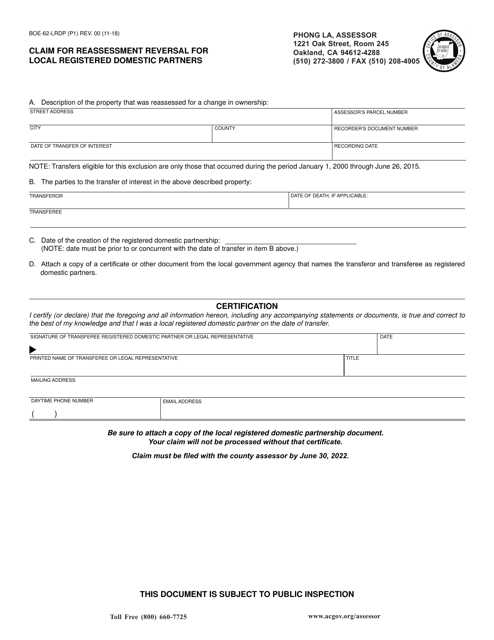

This form is used for claiming reassessment reversal for local registered domestic partners in Alameda County, California.

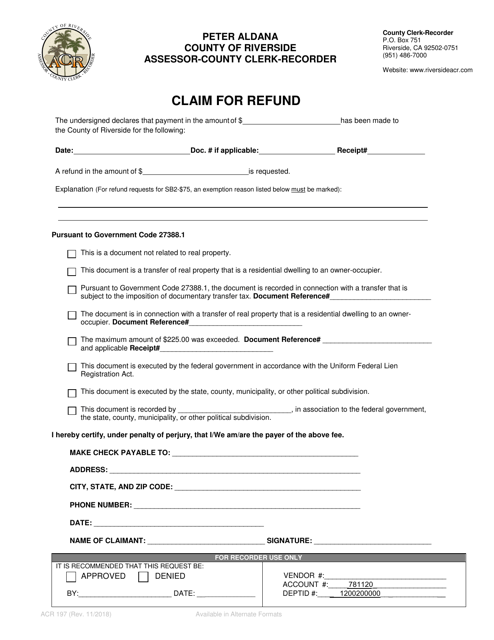

This document is used for claiming a refund in the County of Riverside, California.

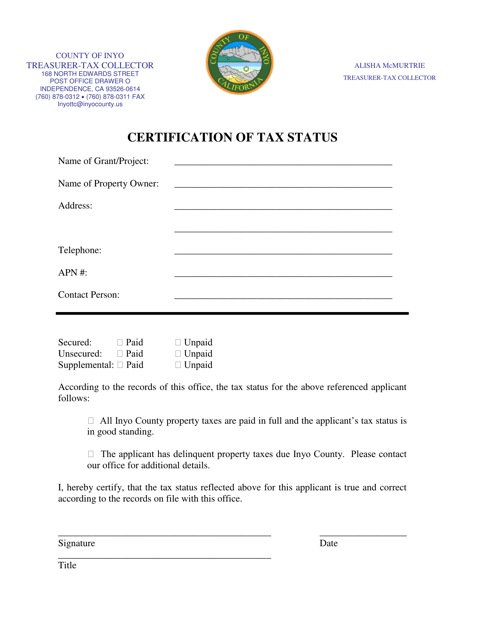

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

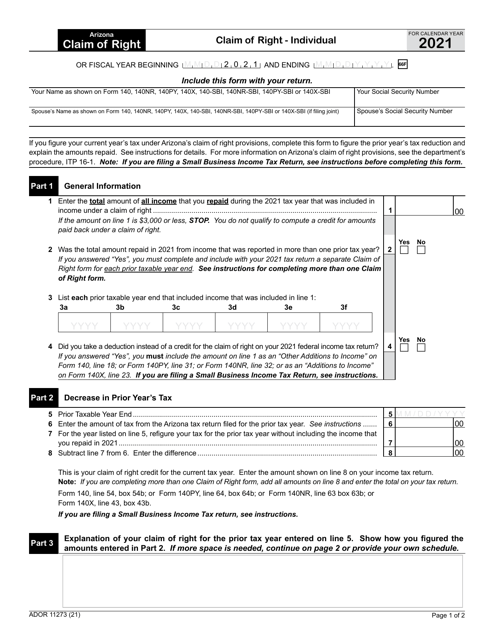

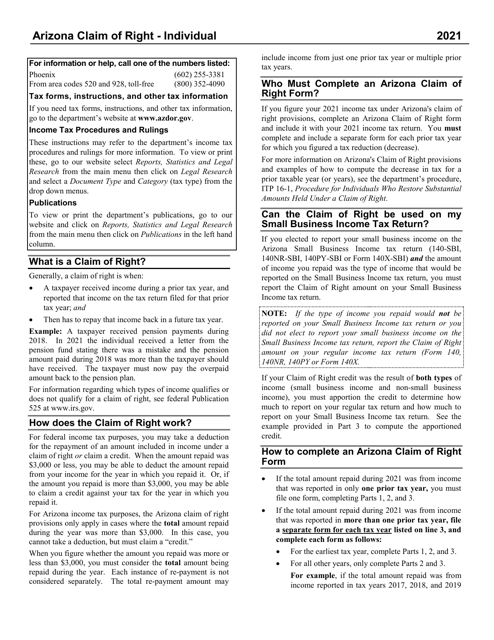

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

This Form is used for claiming the right to a refund on individual taxes paid in Arizona. It provides instructions for completing and filing Form ADOR11273.

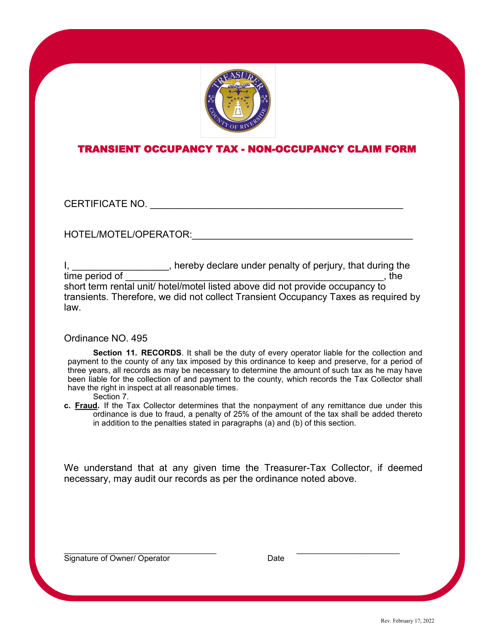

This Form is used for filing a non-occupancy claim for transient occupancy tax in Riverside County, California.

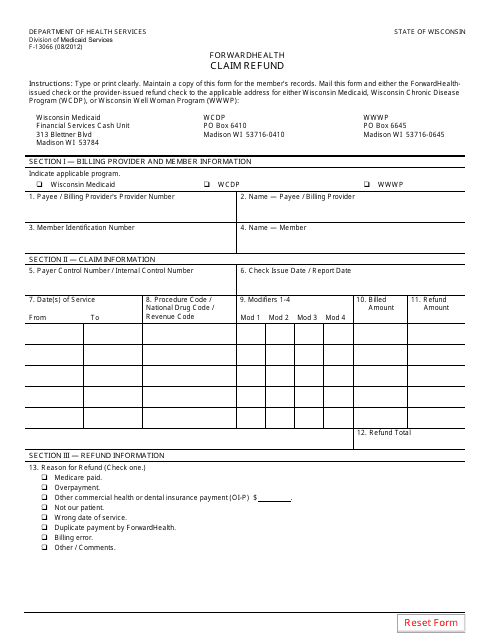

This Form is used for claiming a refund in the state of Wisconsin.