Full Year Templates

Looking for information about filing taxes for a full year? Look no further! Our comprehensive collection of documents and forms will provide you with all the information you need to accurately calculate and file your taxes for the entire year.

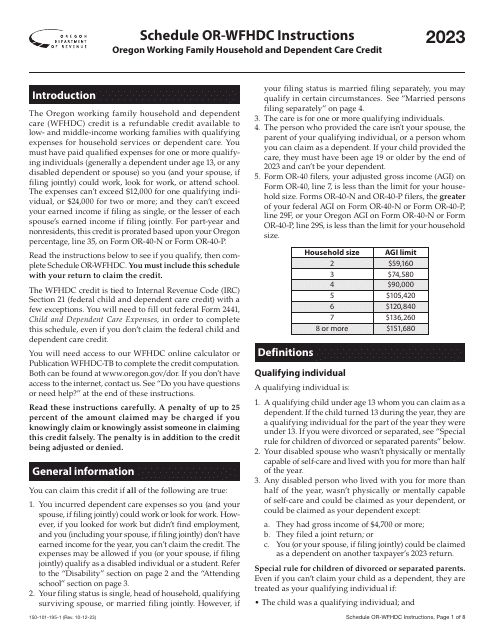

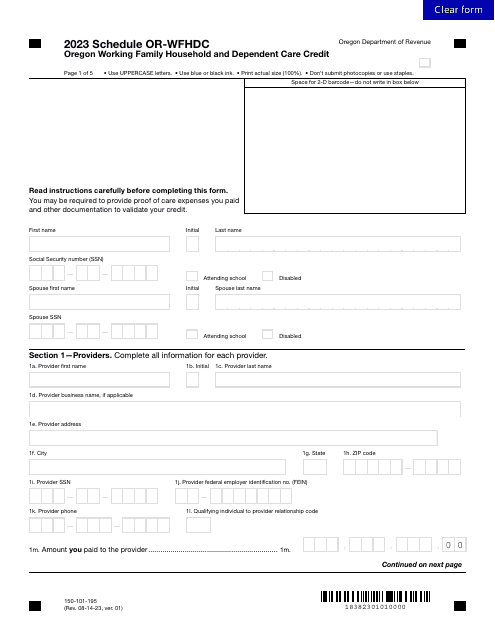

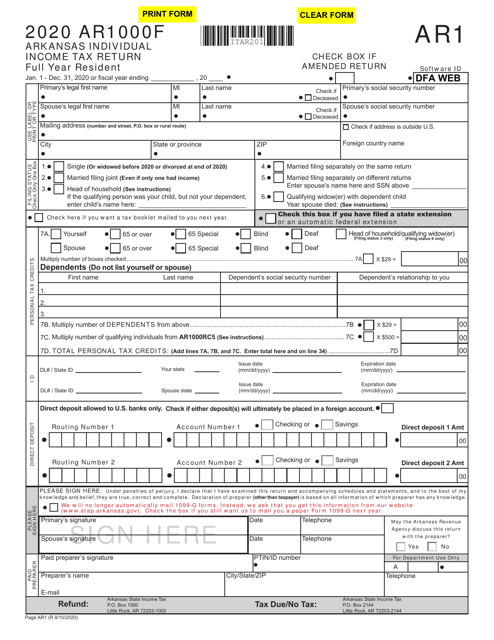

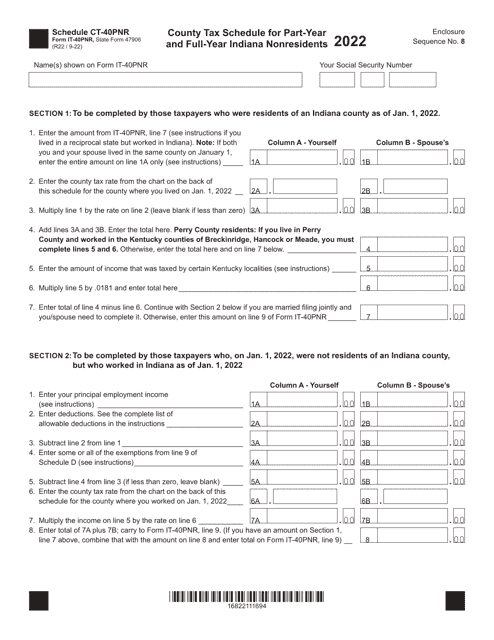

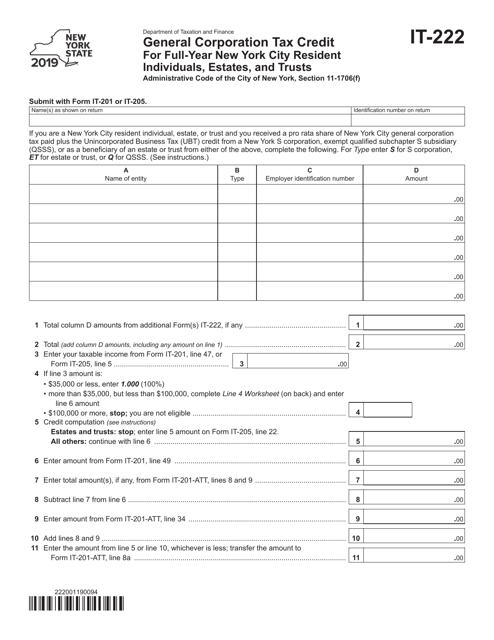

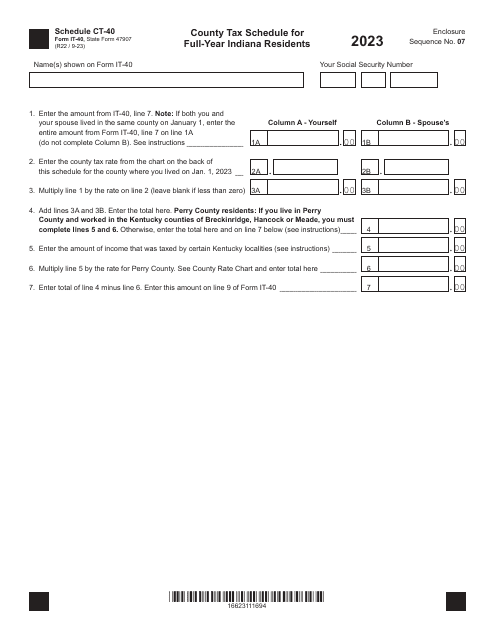

Whether you are a resident, nonresident, or part-year resident, our extensive library includes documents such as Form 1040NR Schedule II Full Year Nonresident Tax Calculation, Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit for Full-Year, Part-Year, and Nonresidents, Form IT-222 General Corporation Tax Credit for Full-Year New York City Resident Individuals, Estates, and Trusts, and Form AR1000F Arkansas Full Year Resident Individual Income Tax Return.

These forms cover a wide range of tax-related topics and are designed to help you accurately report your income, identify deductions and credits, and navigate the complex tax laws.

Don't waste time searching through countless websites or struggling to find the right information. Our full year document collection is your one-stop resource for everything related to filing taxes for a full year. Stay organized, save time, and ensure that you are fully compliant with tax regulations by utilizing our comprehensive collection of full year tax documents.

Documents:

14

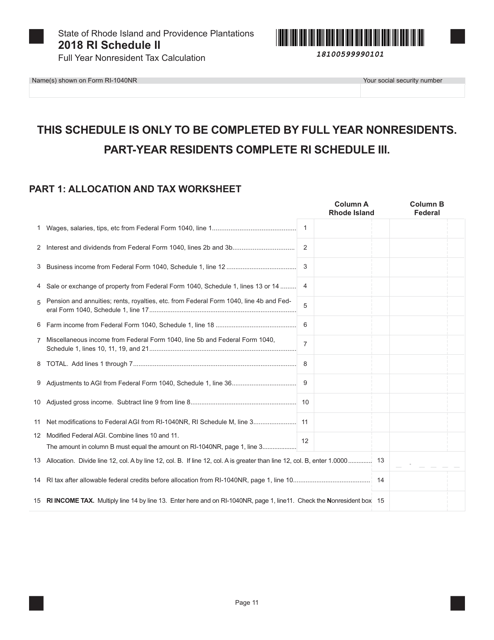

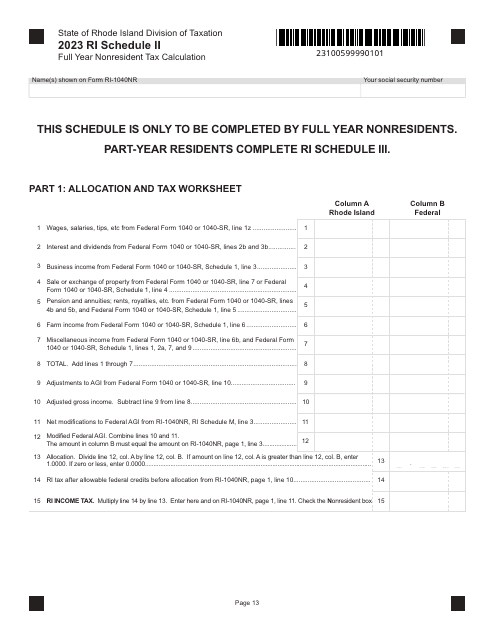

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

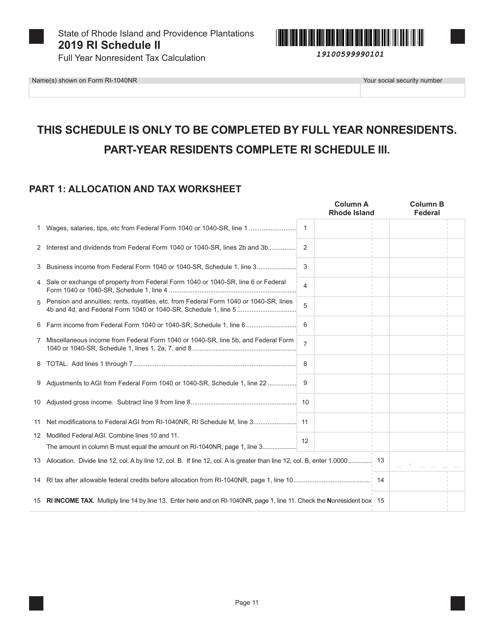

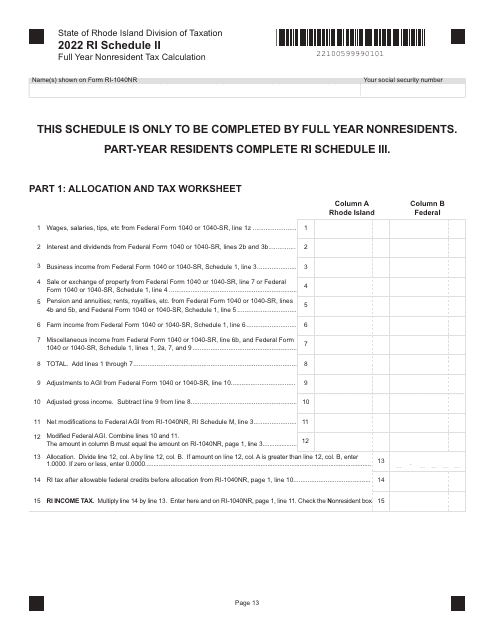

This type of document is used for calculating the full-year nonresident tax in Rhode Island if you are a nonresident of the United States.

This form is used for claiming the General Corporation Tax Credit for full-year New York City resident individuals, estates, and trusts in New York. It allows eligible taxpayers to reduce their tax liability.