Tax Deductions for Business Templates

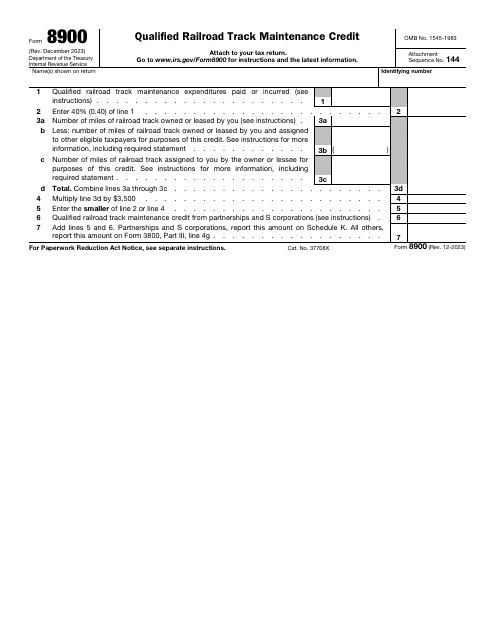

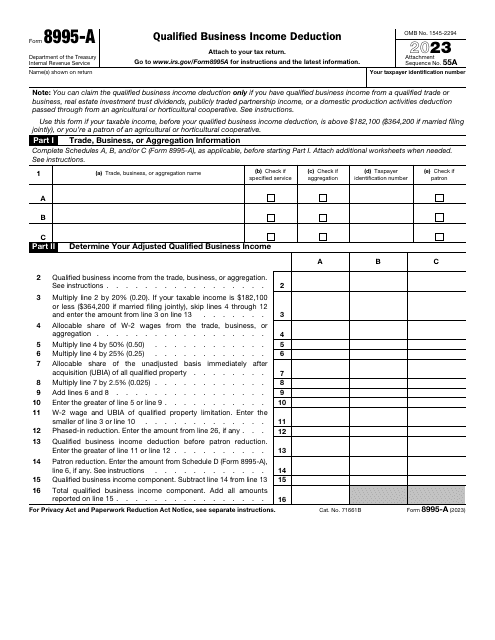

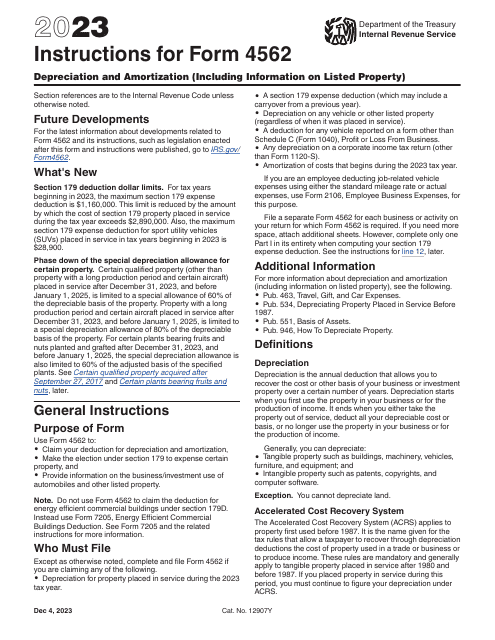

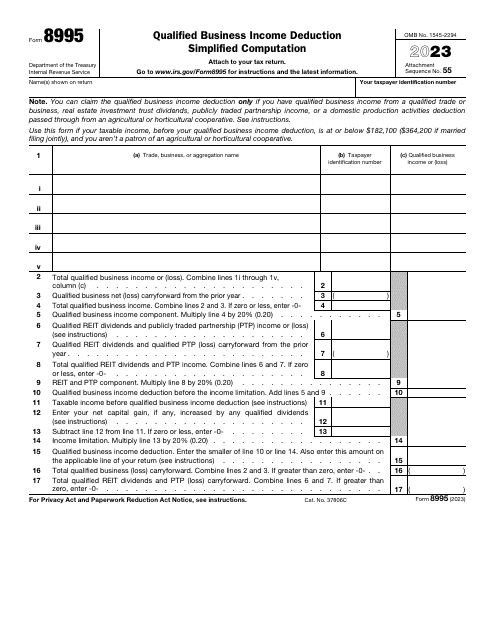

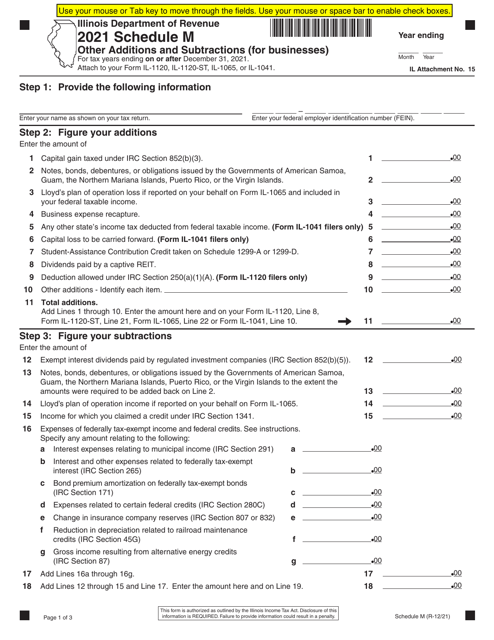

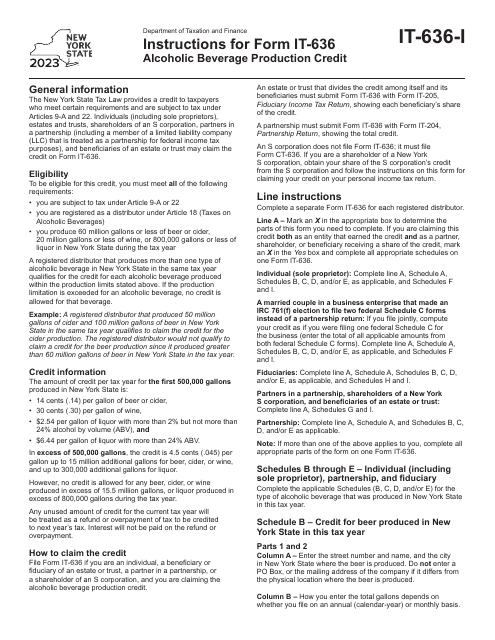

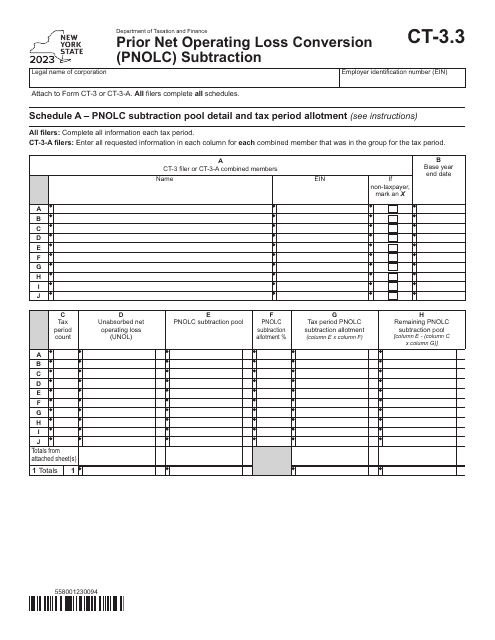

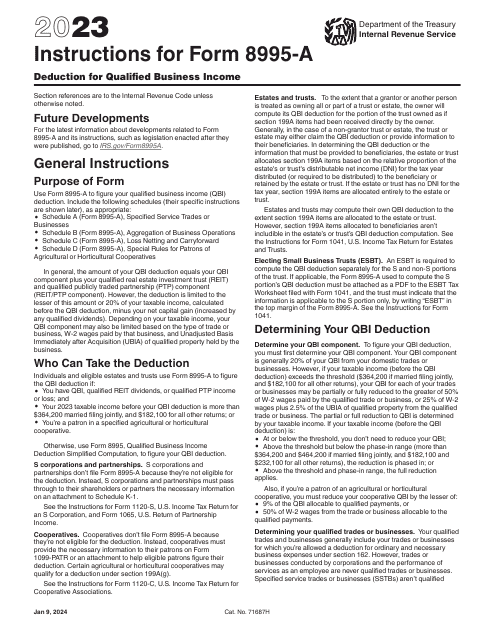

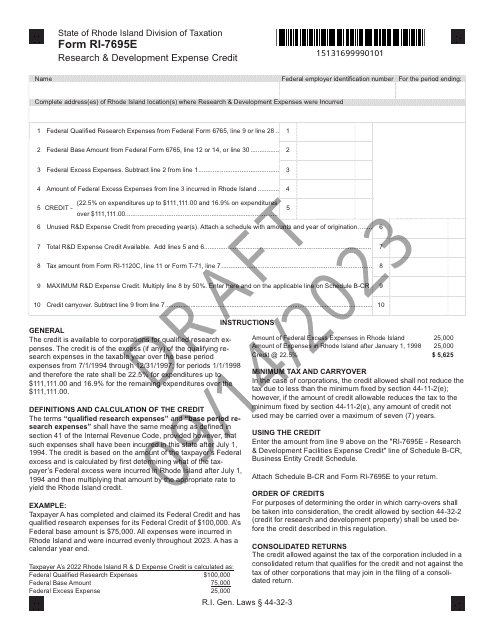

Looking for ways to maximize your business's tax deductions? Our tax deductions for business guide has you covered. We understand that every penny counts when it comes to running a successful business, which is why we have compiled a comprehensive collection of documents, including IRS Form 8900 Qualified Railroad Track Maintenance Credit, Form D-400 Schedule A North Carolina Itemized Deductions, Instructions for IRS Form 4562 Depreciation and Amortization, IRS Form 8995 Qualified BusinessIncome Deduction Simplified Computation, and Instructions for IRS Form 8995-A Deduction for Qualified Business Income, to help you navigate the complex world of tax deductions.

Our tax deductions for business resource provides you with all the information you need to take advantage of the tax benefits available to businesses. Whether you're a small startup or a large corporation, understanding and utilizing these deductions can help you save money and reinvest it back into your business.

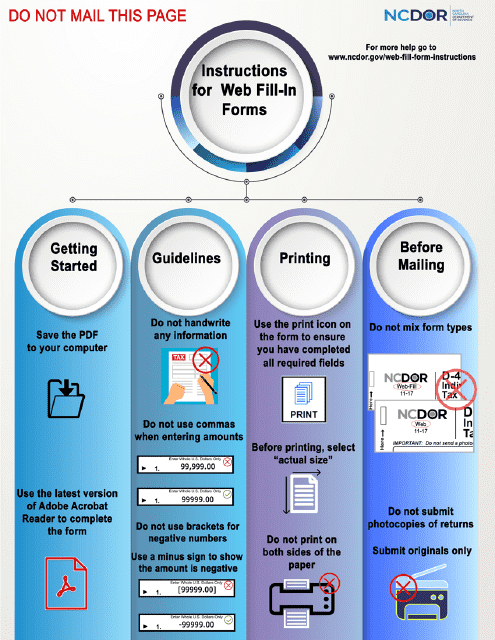

With our easy-to-use and informative documents, you'll learn about the various tax deductions you may be eligible for, such as depreciation and amortization, qualified business income deduction, and more. Our collection of forms, schedules, and instructions provides step-by-step guidance on how to claim these deductions, ensuring you stay compliant with IRS regulations.

Don't miss out on potential savings for your business. Explore our tax deductions for business collection today and discover how you can reduce your tax liability and keep more money in your pocket. Maximize your deductions and optimize your business's financial health with our comprehensive resource.

Documents:

12

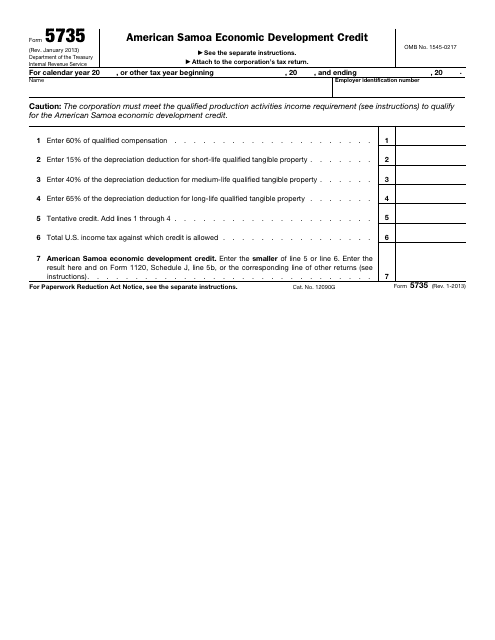

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.