Overseas Income Templates

Are you earning income overseas? If so, you may need to familiarize yourself with the various tax documents and instructions related to your overseas income. These documents are crucial for reporting your earnings and ensuring compliance with the Internal Revenue Service (IRS).

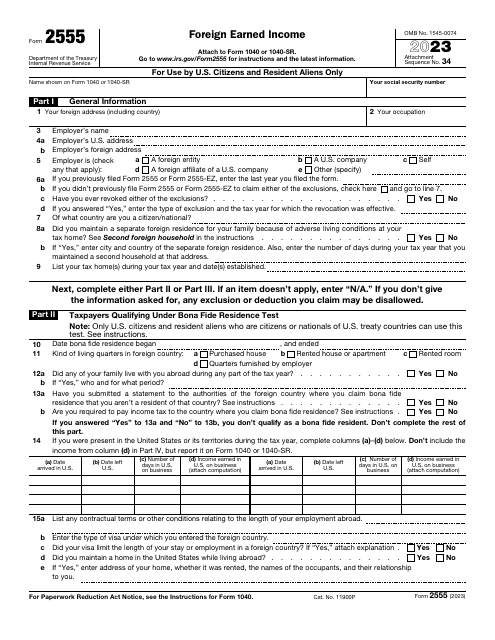

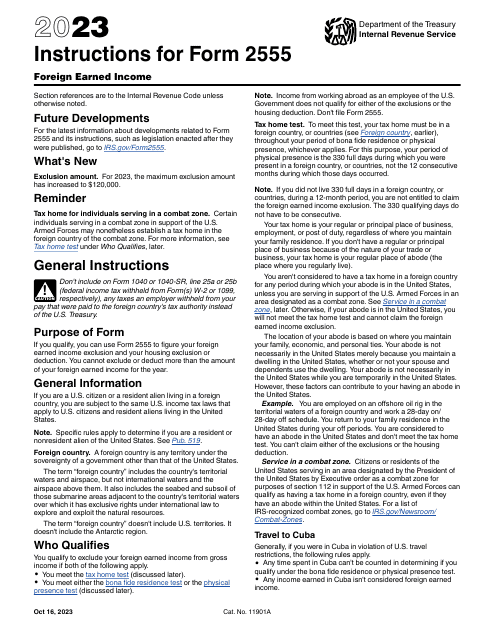

One essential document is the IRS Form 2555 Foreign Earned Income. This form is used to report your foreign earned income and claim any applicable exclusions or deductions. It provides clear instructions on how to calculate your foreign earned income and how to qualify for certain tax benefits.

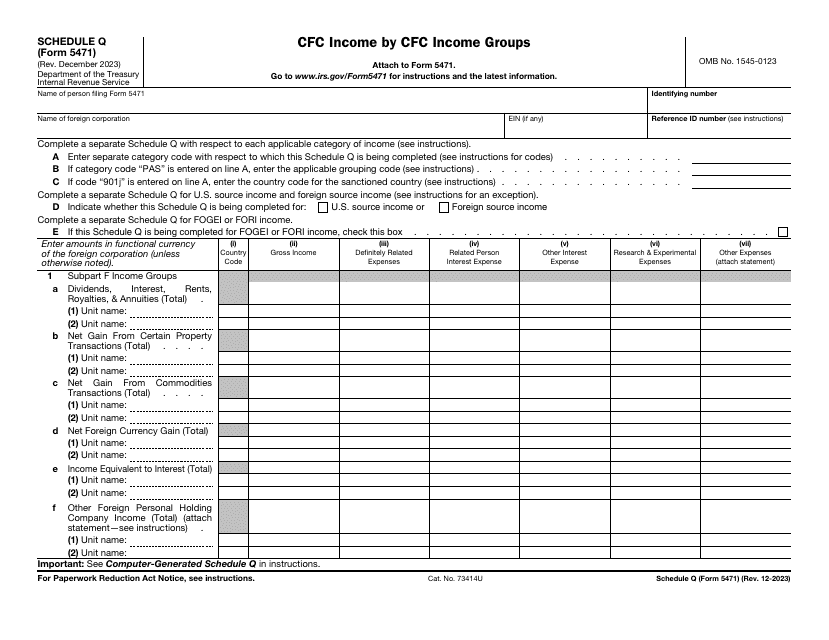

Another important document in the overseas income category is the IRS Form 5471 Information Return of U.S. Persons With Respect to Certain Foreign Corporations. If you are a U.S. person with ownership or control over a foreign corporation, you may be required to file this form. It requests detailed information about the foreign corporation's financial activities and ensures that U.S. taxpayers are disclosing their interests in foreign businesses.

Navigating through these forms and instructions can be complex, which is why it is important to educate yourself and seek professional guidance if needed. By understanding the IRS requirements and properly completing these documents, you can minimize your tax liability and avoid potential penalties.

So, whether you are an expat earning income abroad or a U.S. person with foreign investments, make sure to stay informed on the necessary documentation for reporting your overseas income. By effectively filling out these forms and following the provided instructions, you can ensure compliance and peace of mind when it comes to your tax obligations.

Documents:

7