Required Minimum Distribution Templates

Are you approaching retirement age? If so, you may have heard about the required minimum distribution (RMD) or required minimum distributions (RMDs). This is an important topic that you need to understand to ensure you're making the most of your retirement savings.

At its core, the RMD is a mandatory withdrawal that individuals with certain retirement accounts must start taking once they reach a certain age. The purpose of the RMD is to ensure that individuals are using their retirement savings as intended – as a source of income during retirement.

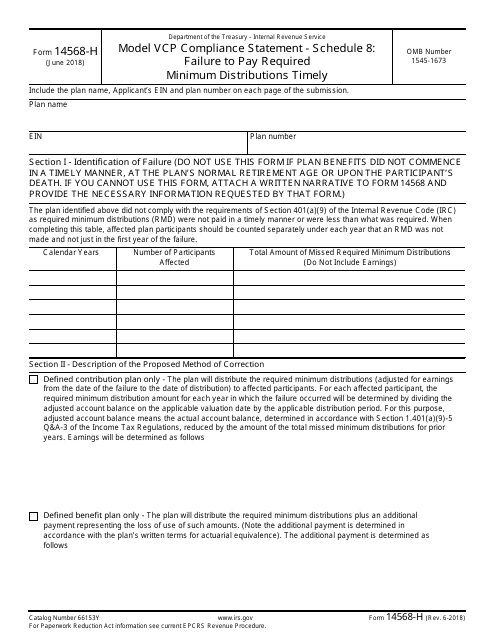

The Internal Revenue Service (IRS) is responsible for overseeing RMDs and has specific guidelines and forms for individuals to follow. For example, one commonly used form is the IRS Form 14568-H Model VCP Compliance Statement - Schedule 8: Failure to Pay Required Minimum Distributions Timely. This form is used to report any failure to pay RMDs on time and provides a means for individuals to rectify any potential issues.

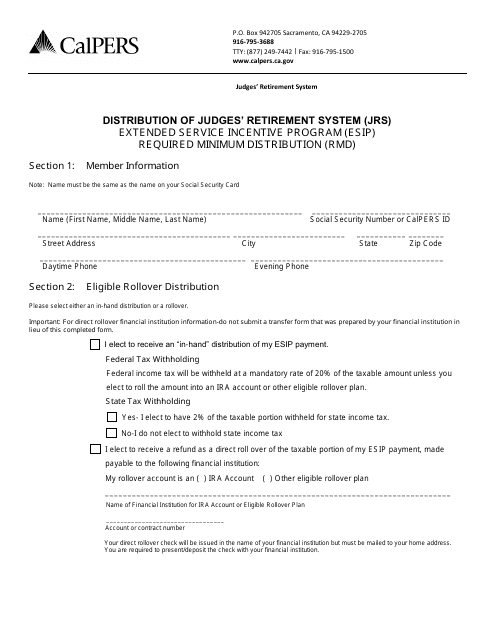

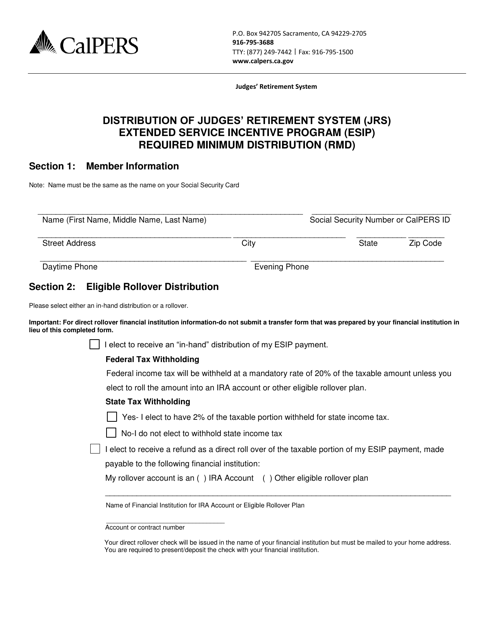

In addition to the IRS forms, some states also have their own specific forms for reporting RMDs. For example, the Distribution of Judges' Retirement System (JRS) Extended Service Incentive Program (ESIP) Required Minimum Distribution (RMD) Form is a specific form used in California to report RMDs for judges participating in the JRS ESIP program.

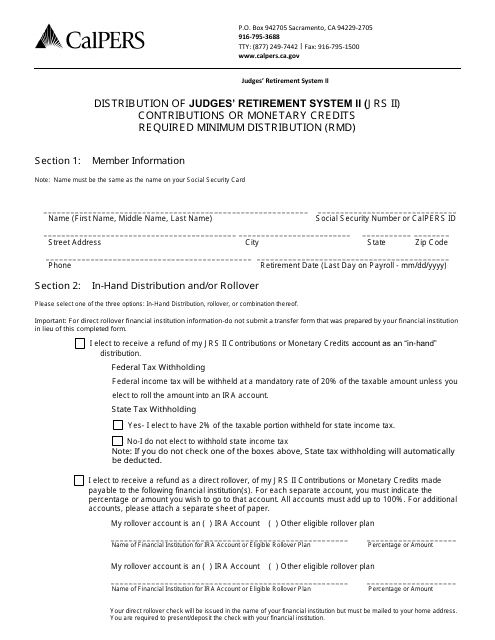

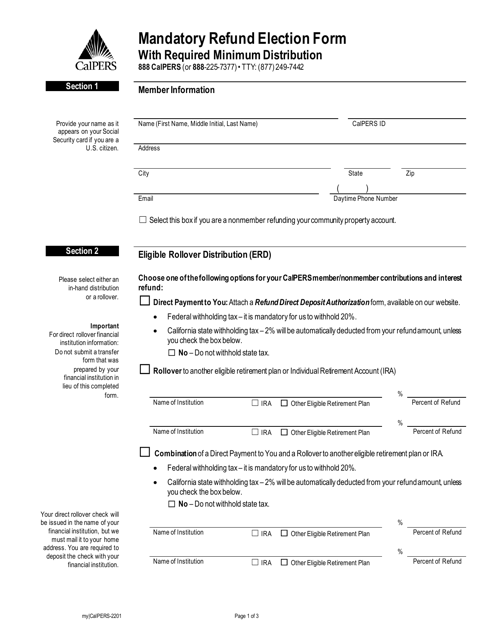

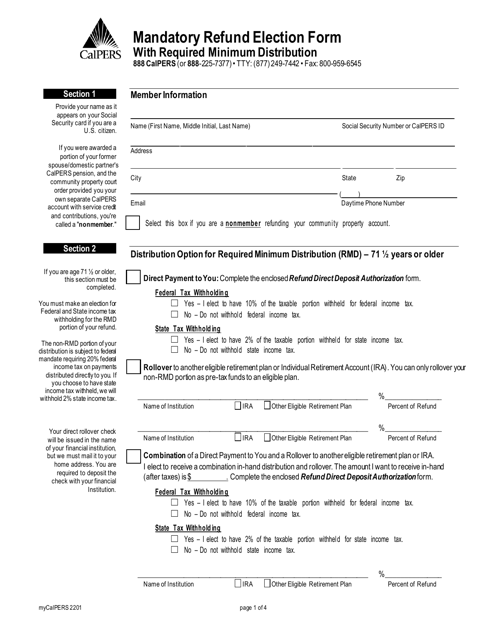

Similarly, the Form myCalPERS2201 Mandatory Refund Election Form with Required Minimum Distribution is another California-specific form that individuals may need to use if they are eligible for a refund while also needing to comply with RMD requirements.

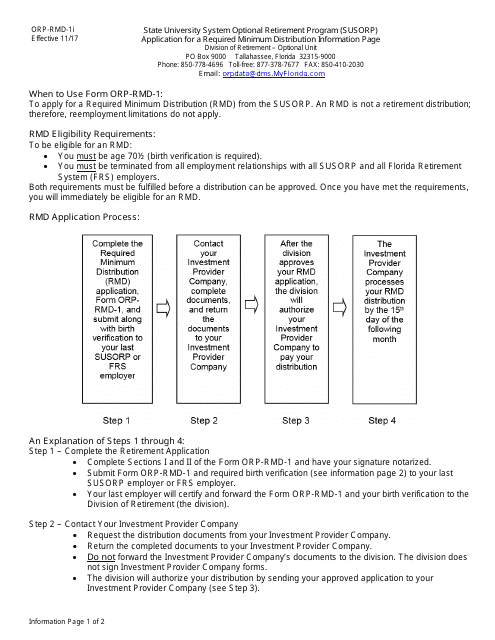

It's important to note that RMDs aren't just limited to California. Different states may have their own unique requirements and forms, such as the Form ORP-RMD-1 used in Florida for the State University System Optional Retirement Program (SUSORP).

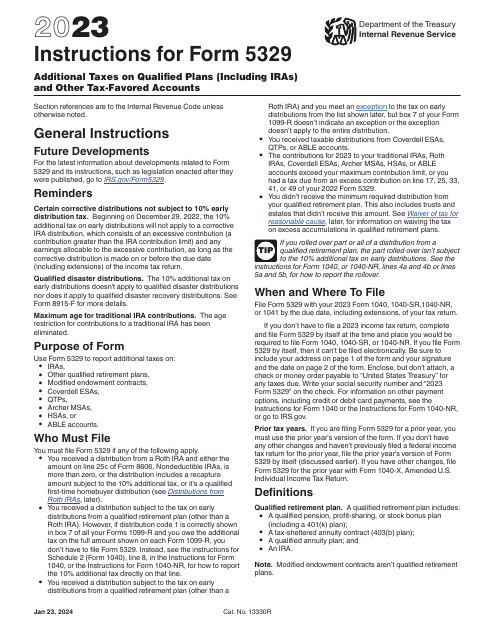

In conclusion, understanding and complying with the required minimum distribution (RMD) is crucial for individuals approaching retirement age. Whether you're navigating the IRS forms or state-specific requirements, it's important to stay informed and ensure you're fully meeting your obligations. Failure to do so may result in penalties and hinder your ability to make the most of your hard-earned retirement savings.

Documents:

8

This document is used for submitting a VCP compliance statement to the IRS for failure to pay required minimum distributions on time.

This type of document explains how the distribution of Judges' Retirement System II (JRS II) contributions or monetary credits is calculated in California. It also includes information on the required minimum distribution (RMD) for such contributions.

This Form is used for the distribution of funds from the Judges' Retirement System (JRS) Extended Service Incentive Program (ESIP) Required Minimum Distribution (RMD) in California.

This form is used for electing a mandatory refund with a required minimum distribution from CalPERS, the California Public Employees' Retirement System.

This type of document discusses the distribution of retirement benefits for judges in California, specifically the Extended Service Incentive Program (ESIP) and the Required Minimum Distribution (RMD) for the Judges' Retirement System (JRS).

This form is used for electing a mandatory refund with required minimum distribution from the California Public Employees' Retirement System (CalPERS).

This Form is used for applying for a Required Minimum Distribution from the State University System Optional Retirement Program (SUSORP) in Florida.