Trust Allocation Templates

Trust Allocation is a crucial process when it comes to managing trusts and ensuring their smooth functioning. This involves the allocation of funds and distributions to various beneficiaries or entities as specified in the trust agreement.

Our trust allocation services help individuals and organizations navigate the complex maze of rules and regulations that govern trust distributions. We understand the importance of accurate and precise allocation to ensure compliance with state-specific requirements and tax implications.

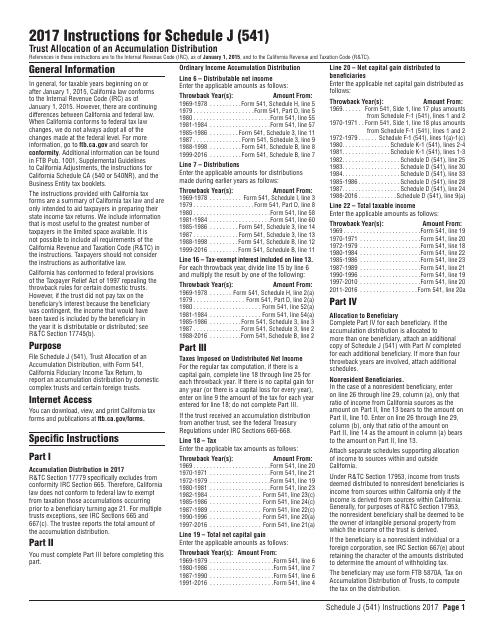

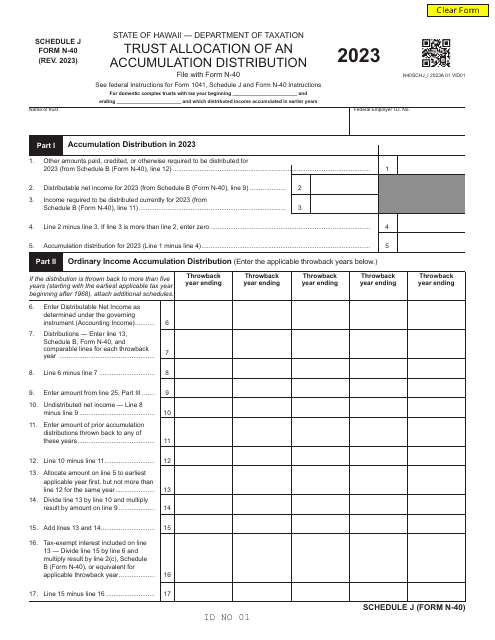

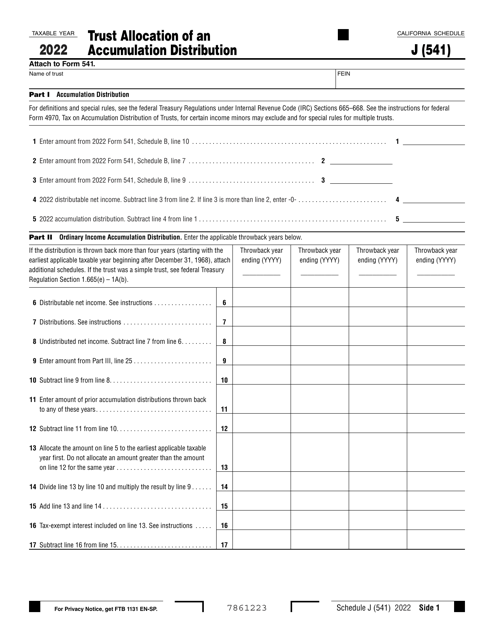

With our expert team and comprehensive knowledge of trust laws, we can assist you in preparing and filing various trust allocation forms, such as Form N-40 Schedule J Trust Allocation of an Accumulation Distribution in Hawaii or Form 541 Schedule J Trust Allocation of an Accumulation Distribution in California.

Our goal is to simplify the trust allocation process for our clients, providing them with peace of mind and confidence in the management of their trusts. Whether you are an individual trustee or a professional fiduciary, our trust allocation services will help you streamline your operations, optimize distributions, and ensure compliance with applicable laws and regulations.

Trust allocation may seem like a daunting task, but with our expertise and experience, we can make it a smooth and efficient process. Let us handle the complexities of trust allocation so that you can focus on what matters most – achieving your financial goals and providing for your beneficiaries.

Documents:

9

This Form is used for allocating accumulation distributions in trust for California residents.