Reporting Obligations Templates

Are you struggling to understand and meet your reporting obligations? Look no further! Our comprehensive collection of reporting obligations resources, also known as reporting obligation documents, is just what you need.

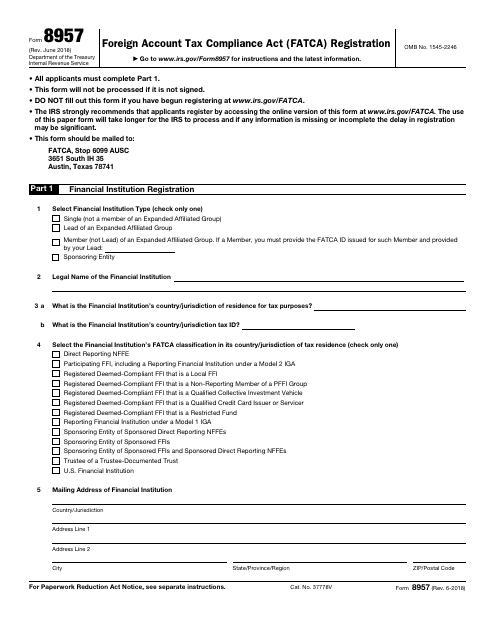

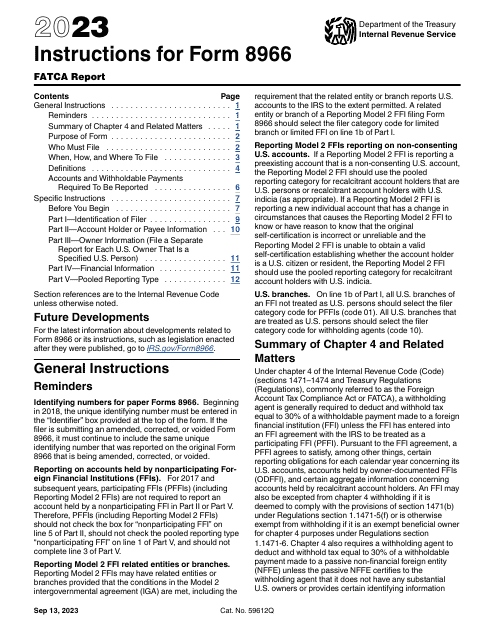

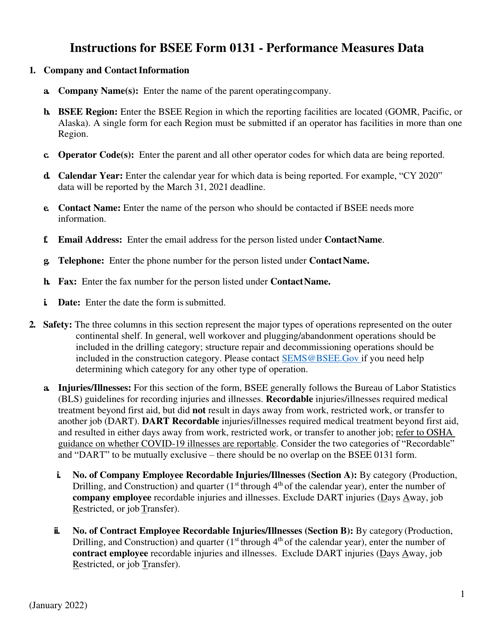

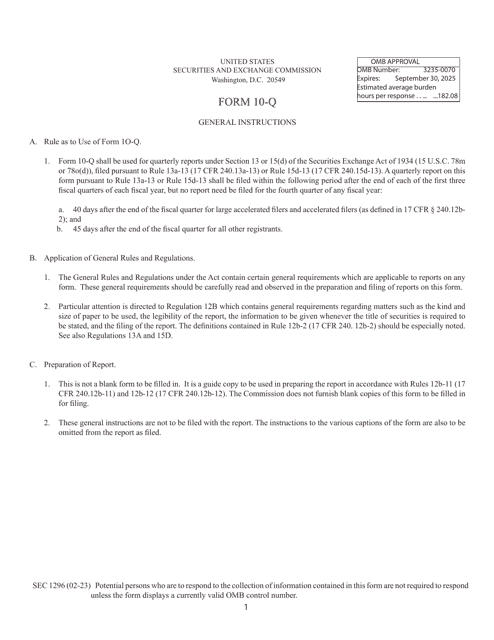

Our collection covers a wide range of reporting obligations, including vital forms and instructions like the IRS Form 8957 Foreign Account Tax Compliance Act (Fatca) Registration and the Instructions for IRS Form 8966 Fatca Report. These documents provide crucial guidance on fulfilling your obligations related to foreign account reporting and the Fatca requirements.

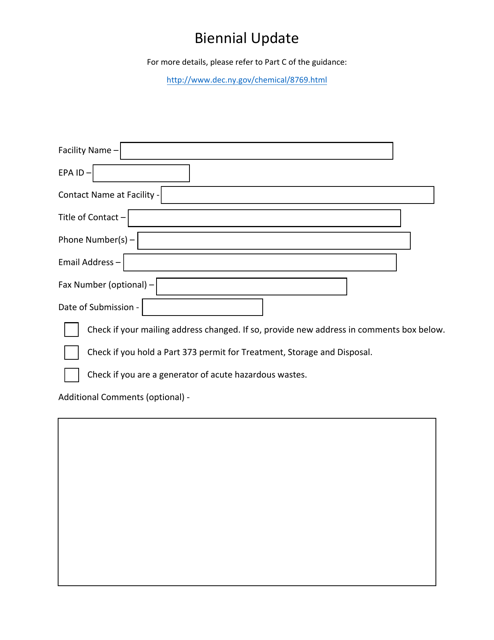

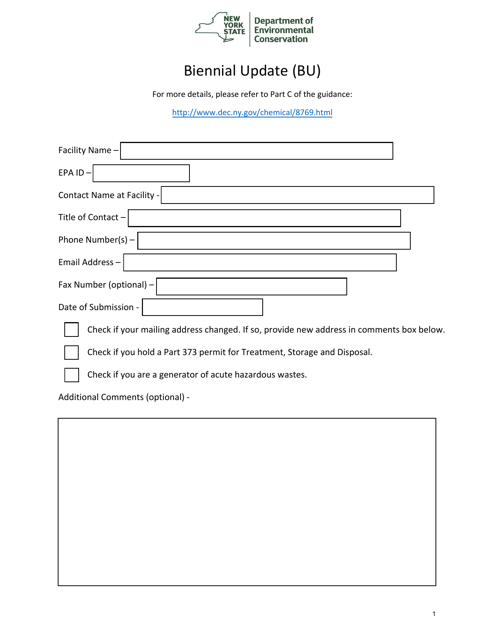

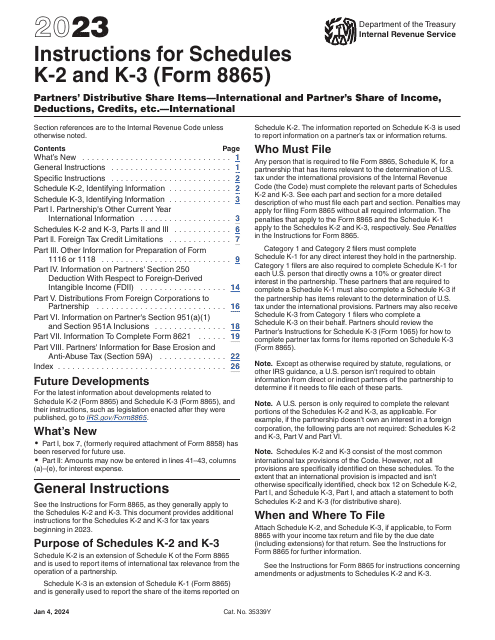

We also offer valuable resources like the Biennial Update - New York, which helps you navigate the reporting obligations specific to the state of New York. Additionally, our collection includes the Instructions for IRS Form 8865 Schedule K-2, K-3, which provide valuable insights for taxpayers involved in certain partnerships.

With our comprehensive reporting obligations collection, you'll gain the knowledge and understanding necessary to handle your reporting obligations with ease and confidence. Don't get overwhelmed by all the paperwork and regulatory requirements – rely on our trusted resources to simplify the process.

Save time and minimize the risk of non-compliance by accessing our reliable reporting obligations documents. We've got you covered, whether you're an individual taxpayer or a business owner. Say goodbye to confusion and frustration – let our reporting obligations resources be your guide.

Documents:

16

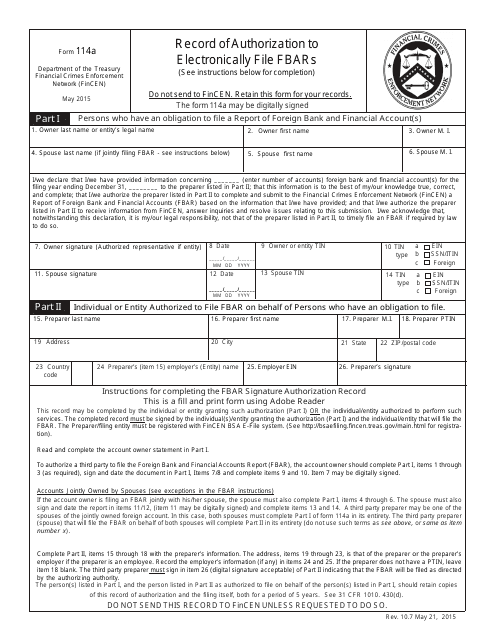

Use this document for releasing your authorization to an individual or organization to complete and file the FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). You can file using a third-party preparer.

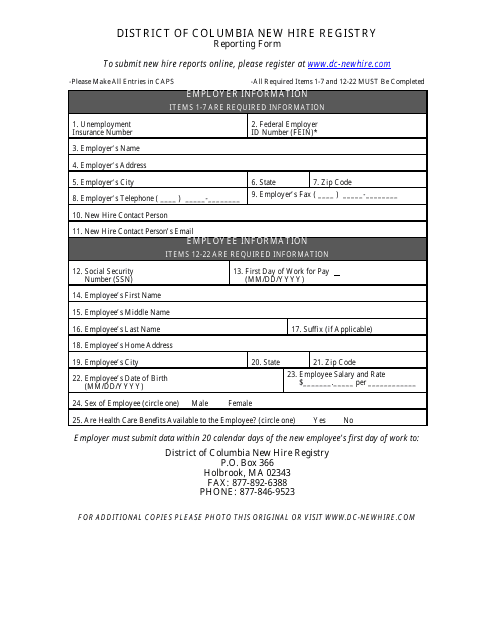

This form is used for reporting new hires to the District of Columbia New Hire Registry in Washington, D.C.

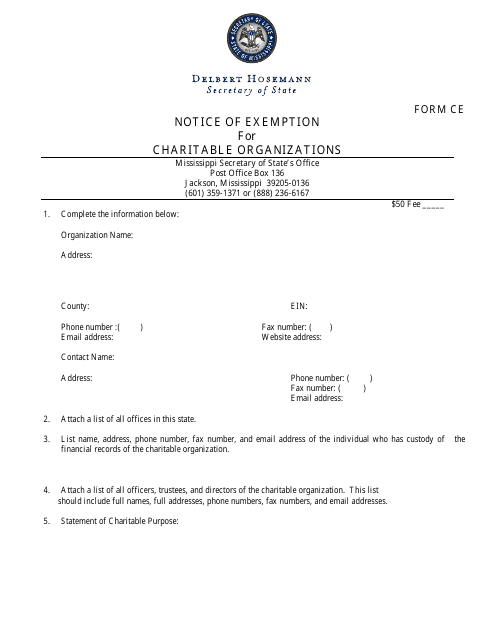

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

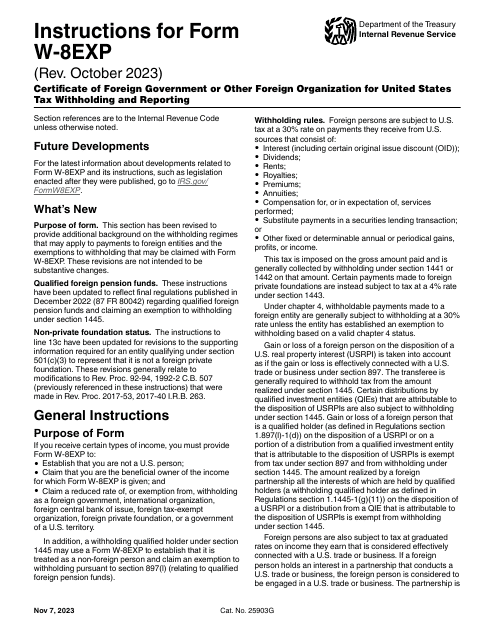

This form is used for registering under the Foreign Account Tax Compliance Act (FATCA) with the IRS to report foreign financial accounts.

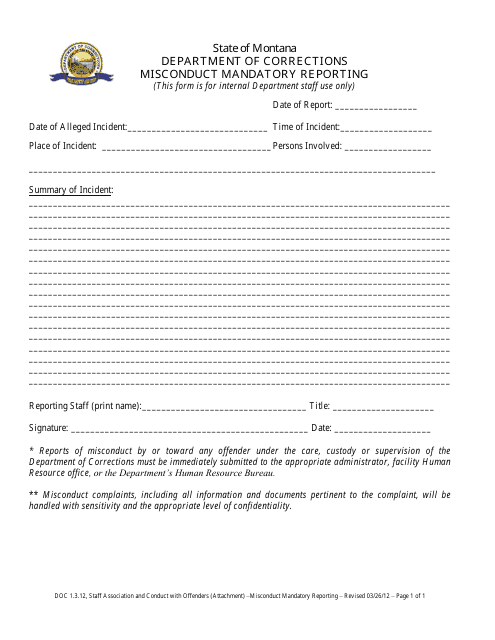

This Form is used for reporting misconduct in the state of Montana.

This document provides information on the biennial update process in New York state.

This document is used for filing a biennial update in the state of New York. It is required for certain businesses to provide updated information about their operations and ownership every two years.

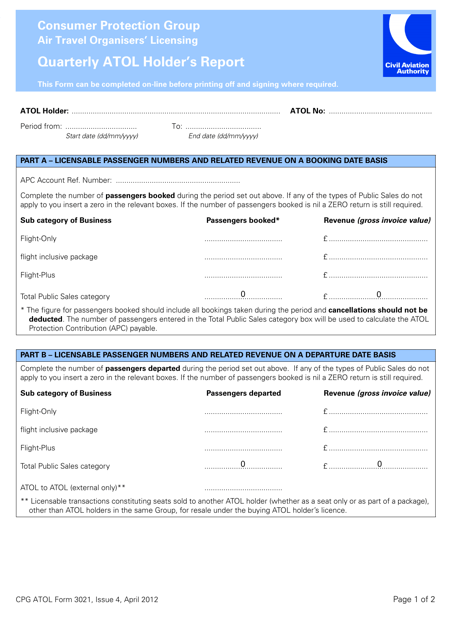

This document is used for submitting a quarterly report by ATOL holders in the United Kingdom. It is a requirement for license holders to provide this report to the Civil Aviation Authority (CAA) as part of their regulatory obligations.

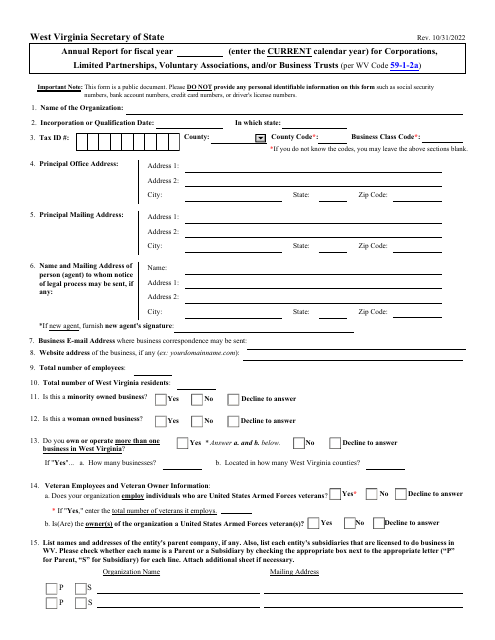

This document is an annual report required for corporations, limited partnerships, voluntary associations, and business trusts in West Virginia. It provides essential information about the entity's financial status, overall operations, and ownership structure.