Property Tax Assistance Templates

Are you looking for property tax assistance? We understand that property taxes can be a significant burden for individuals and families. That's why we offer a collection of documents that can help you navigate the complexities of obtaining property tax relief.

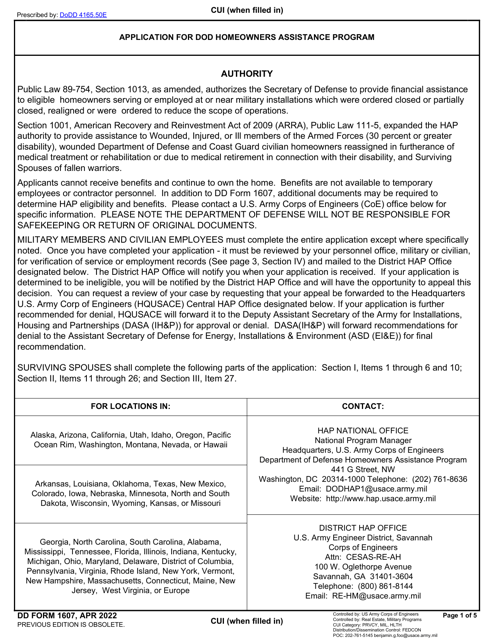

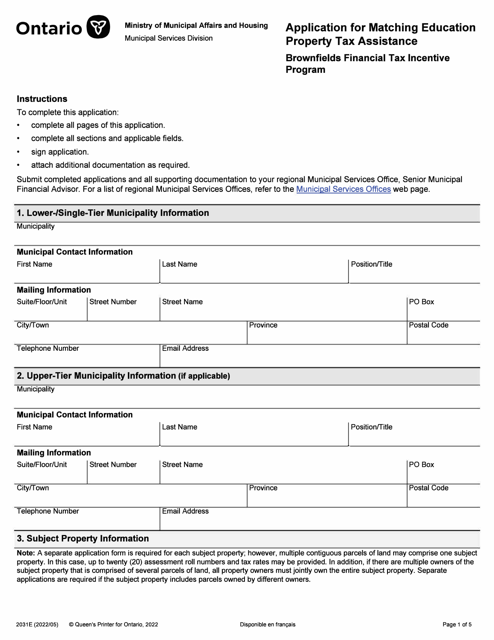

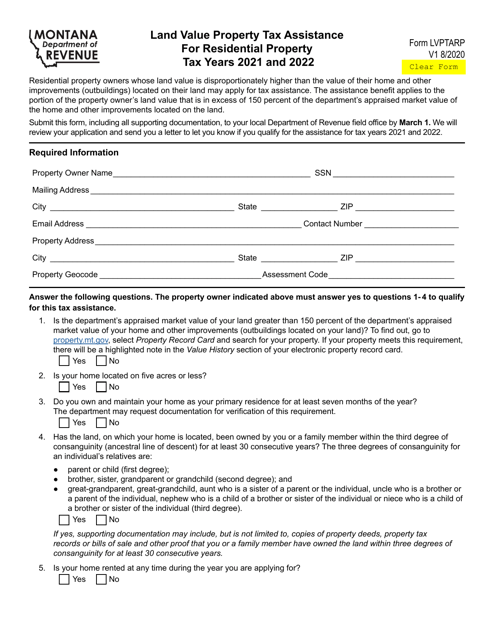

Our property tax assistance documents include various forms and applications tailored to specific regions and circumstances. For instance, individuals in Ontario, Canada, may benefit from completing Form 2031E, which is an application for matching education property tax assistance. Meanwhile, residents of Montana can find valuable information in Form LVPTARP, which pertains to land value property tax assistance for residential properties.

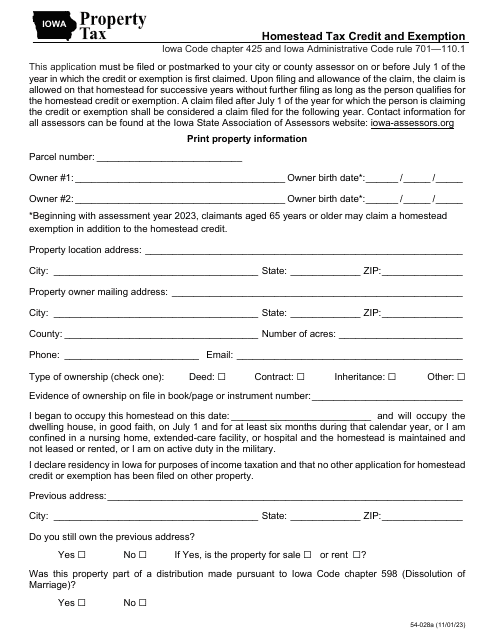

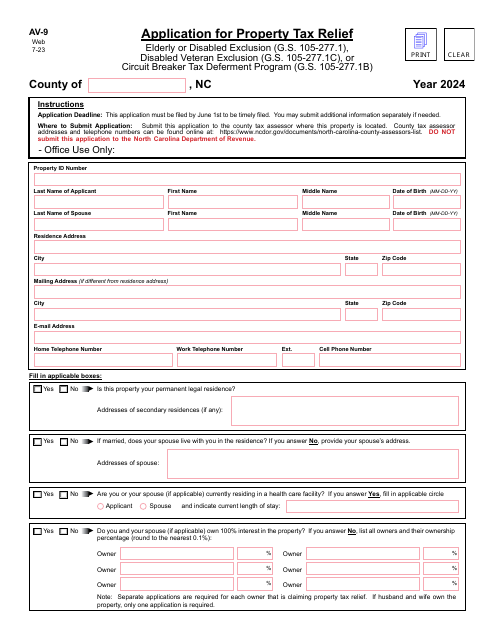

If you reside in Iowa, you might be interested in Form 54-028, which is the Homestead Tax Credit Application. By submitting this form, eligible homeowners can potentially qualify for tax credits. Similarly, North Carolina residents can apply for property tax relief through Form AV-9, offering potential financial assistance.

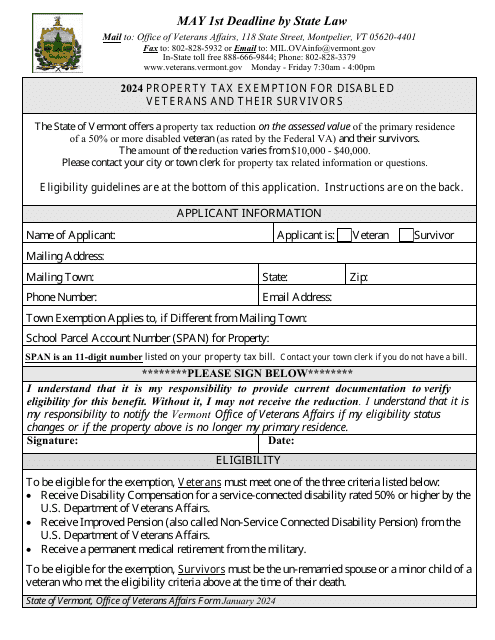

Moreover, we provide information on the property tax exemption available for disabled veterans and their survivors in Vermont. By understanding the eligibility criteria and completing the necessary documentation, eligible individuals can alleviate the burden of property taxes.

Our comprehensive collection of property tax assistance documents aims to simplify the process of seeking relief and making property ownership more accessible and manageable. So, whether you are a homeowner, a veteran, or someone facing financial hardship, these documents are designed to provide the guidance and support you need.

Take the first step toward property tax relief by exploring our property tax assistance documents today. We are here to help you navigate the intricacies of property taxes and find the assistance you deserve.

Documents:

7