Investment Interest Expense Deduction Templates

Looking to deduct your investment interest expenses? Look no further than the investment interest expense deduction documents. This collection of documents, also known as the investment interest expense deduction, provides valuable information and forms to help you claim this deduction on your tax return.

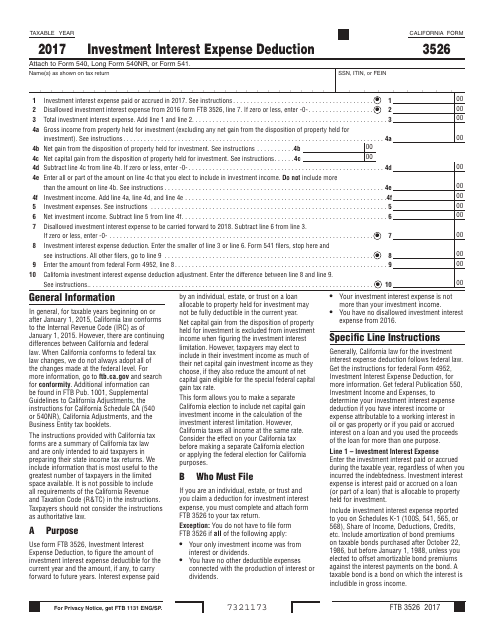

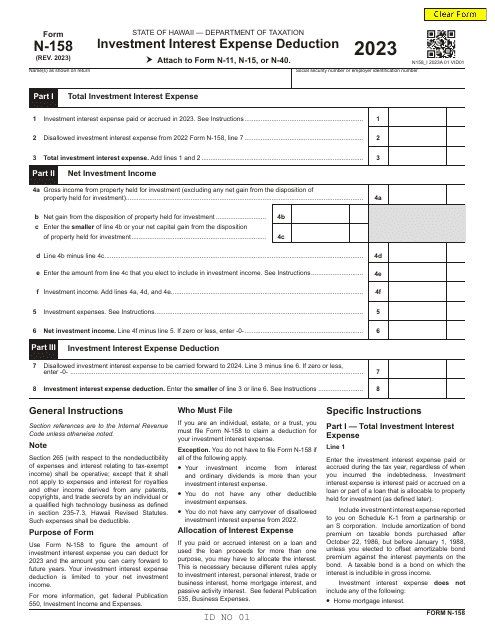

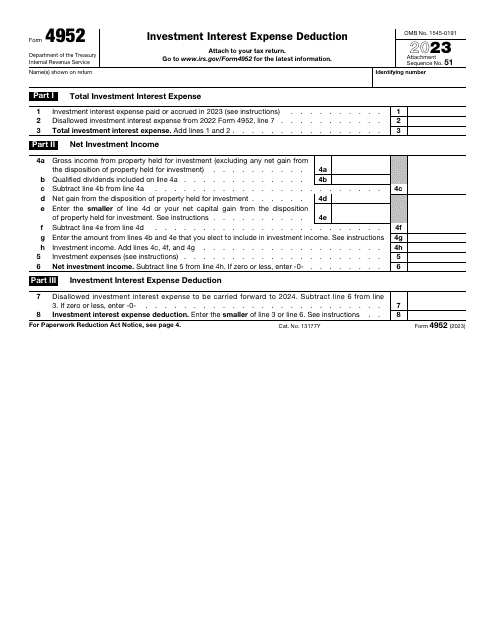

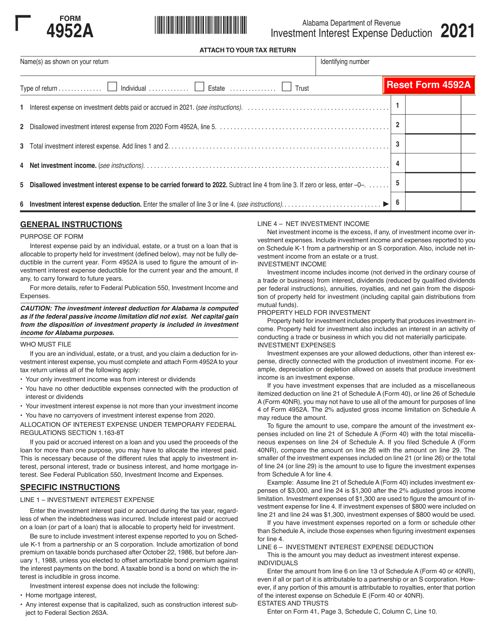

Whether you're a taxpayer in California, Alabama, or any other state, you'll find the necessary forms to calculate and report your investment interest expenses. From the Form FTB3526 Investment Interest Expense Deduction in California to the IRS Form 4952 Investment Interest Expense Deduction, these documents cover all the bases.

Claiming the investment interest expense deduction can be complex, but these documents are designed to make the process as straightforward as possible. With clear instructions and easy-to-use forms, you'll have all the information you need to accurately report your investment interest expenses and maximize your deductions.

The investment interest expense deduction documents offer valuable resources for individuals and businesses alike. Whether you're an individual taxpayer with investment income or a business owner with interest expenses related to investments, these documents will guide you through the process of claiming this deduction.

Don't miss out on potential tax savings. Explore the investment interest expense deduction documents today and ensure you're taking advantage of all available deductions. From state-specific forms to federal IRS forms, these documents have you covered. Start maximizing your investment interest expense deduction now.

Documents:

7

This form is used for claiming the investment interest expense deduction in the state of California. It allows taxpayers to deduct the interest expense paid on their investment loans.