Inheritance Tax Templates

Documents:

75

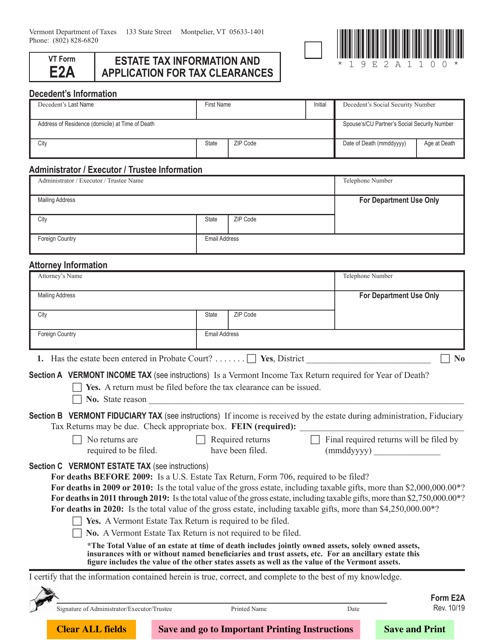

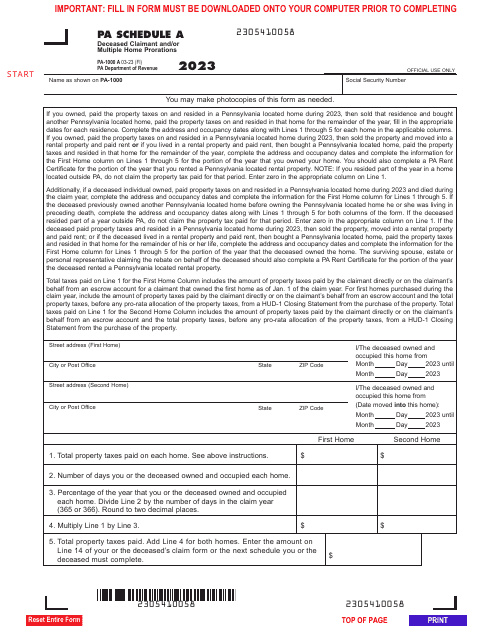

Individuals may prepare this supplemental document when they file an application for a grant of probate or a grant of letters of administration and have to confirm there is no inheritance tax due on the estate.

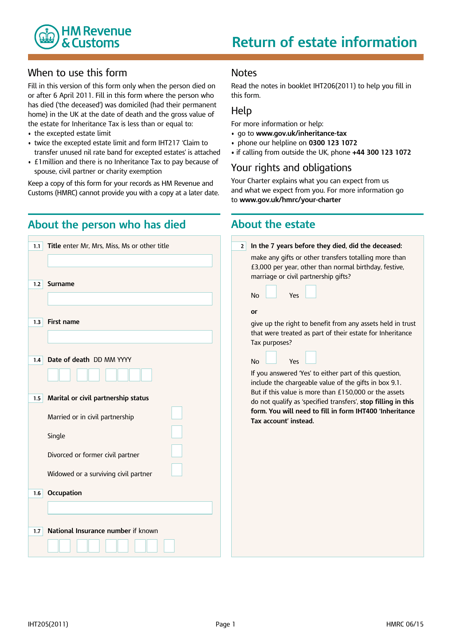

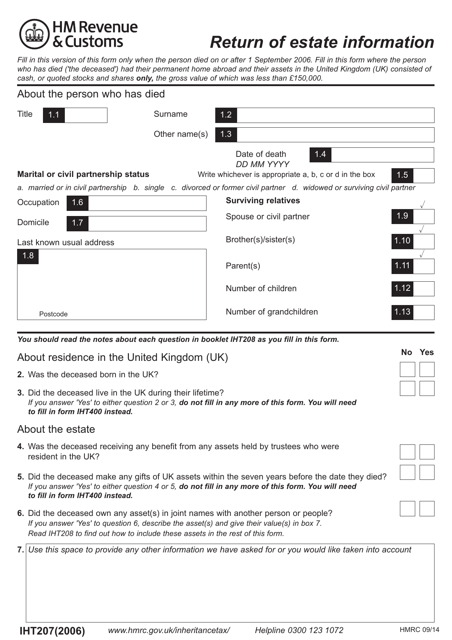

This form needs to be completed when a resident or citizen of the United Kingdom has passed away and their surviving relatives need to calculate the total assets left behind.

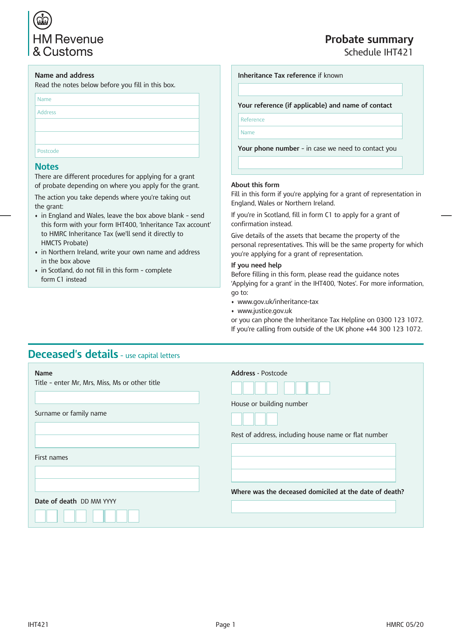

This form allows people responsible for the estates of deceased individuals to confirm the monetary value of those estates and apply for a grant of representation.

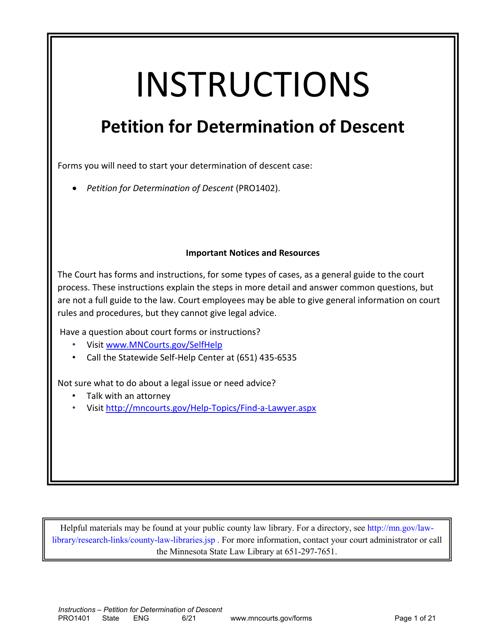

This form is used for filing a petition with the state of Minnesota to determine the descent of a person.

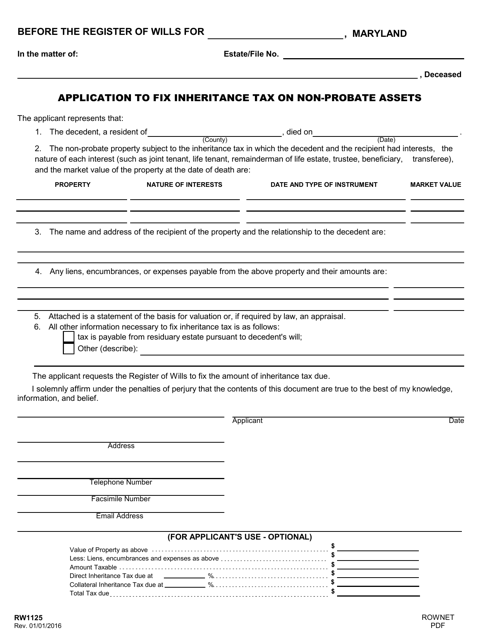

This Form is used for applying to fix inheritance tax on non-probate assets in the state of Maryland.

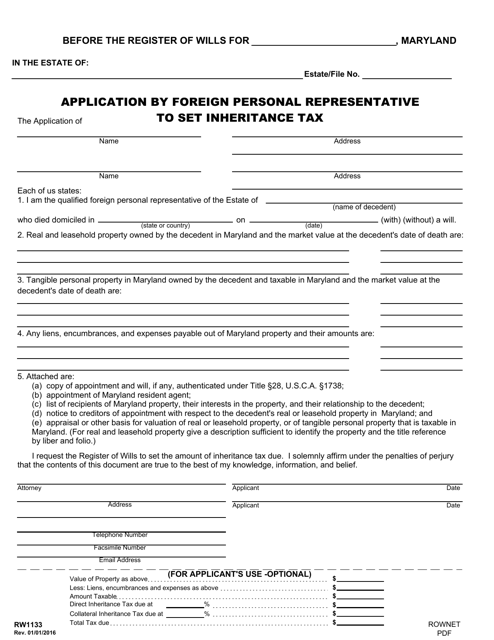

This form is used for foreign personal representatives to apply to set inheritance tax in Maryland.

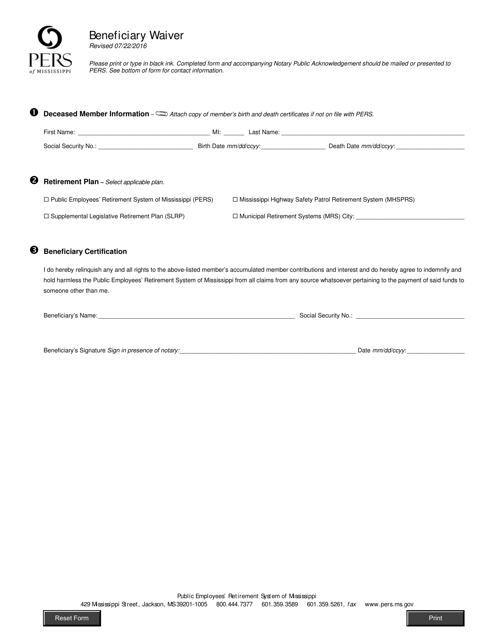

This document is used in Mississippi for a beneficiary to waive their rights or claims to certain benefits or assets.

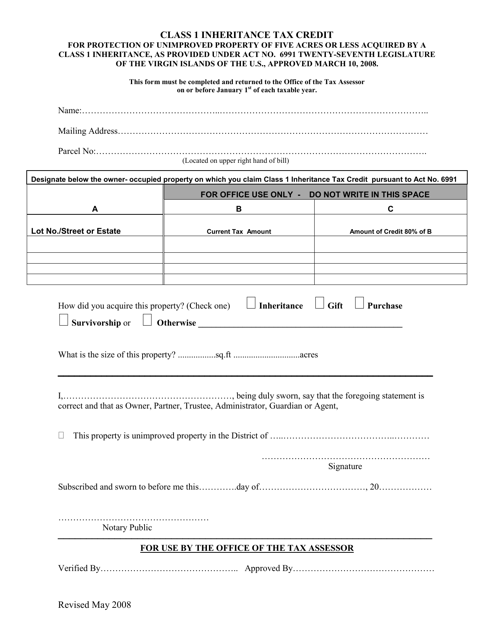

This document allows residents of the Virgin Islands to apply for a tax credit related to inheritance.

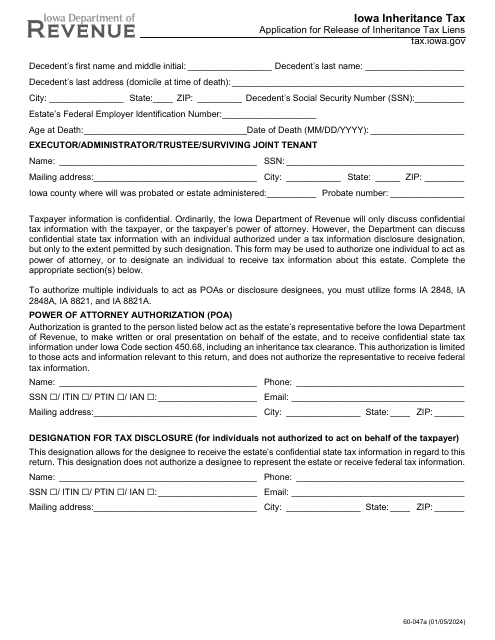

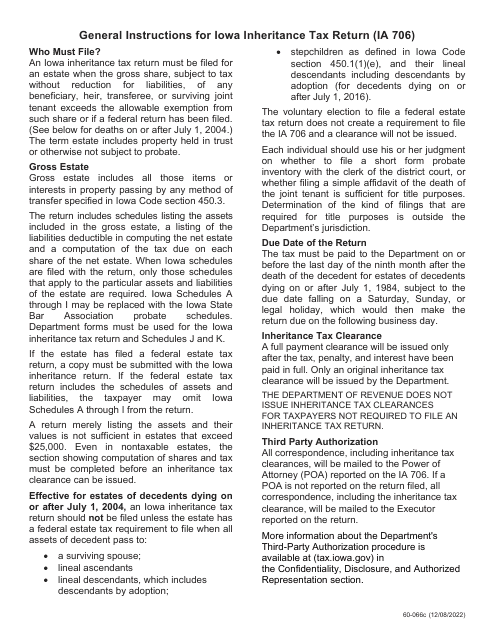

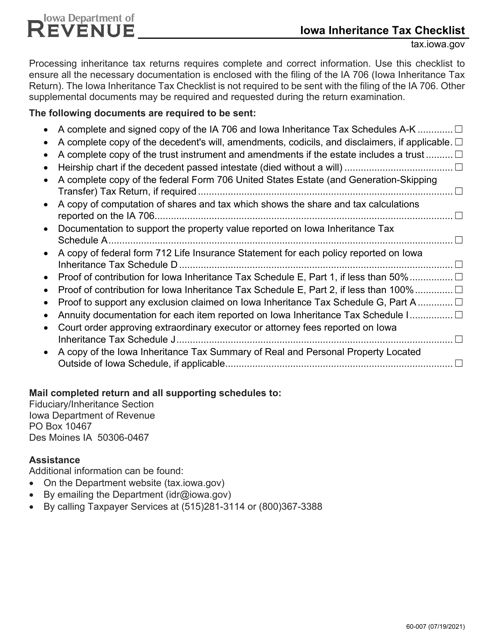

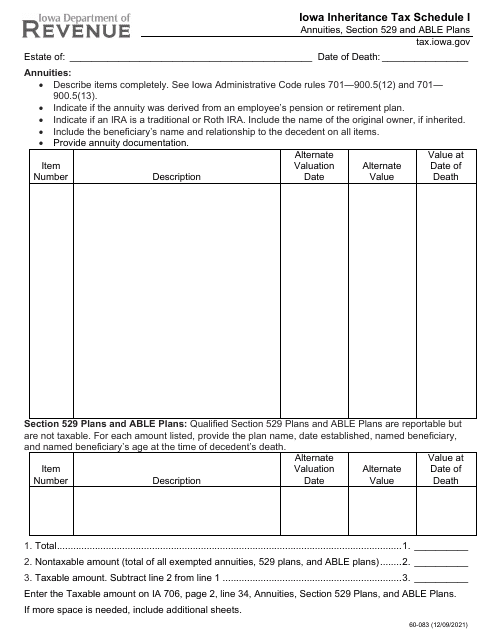

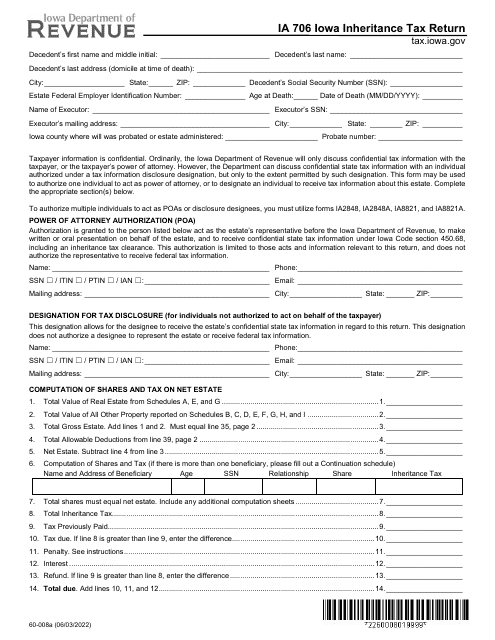

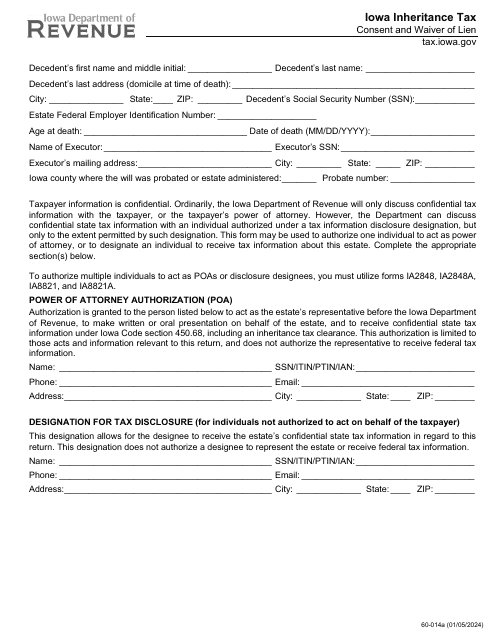

This form is used for completing an inheritance tax checklist in the state of Iowa. It is a necessary document for individuals who are responsible for filing an inheritance tax return.

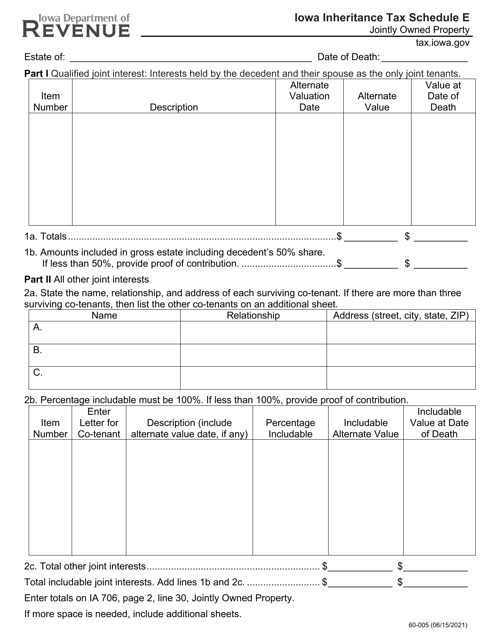

This form is used for reporting and calculating the Iowa Inheritance Tax on jointly owned property in the state of Iowa. It provides a schedule specifically for this purpose.

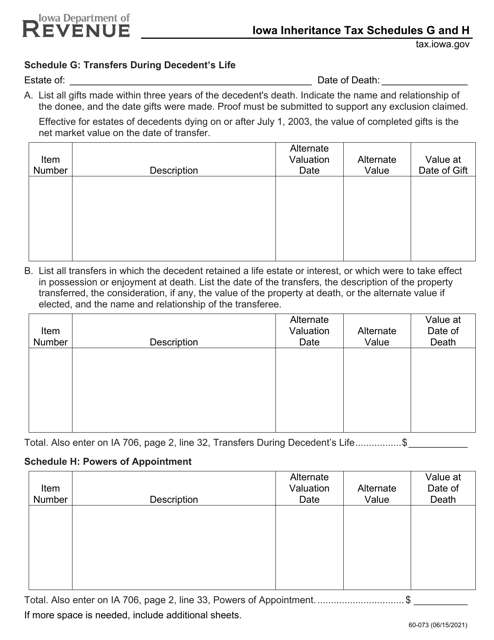

This form is used for reporting and calculating inheritance tax in the state of Iowa. It is specifically for Schedule G and H of Form 60-073.

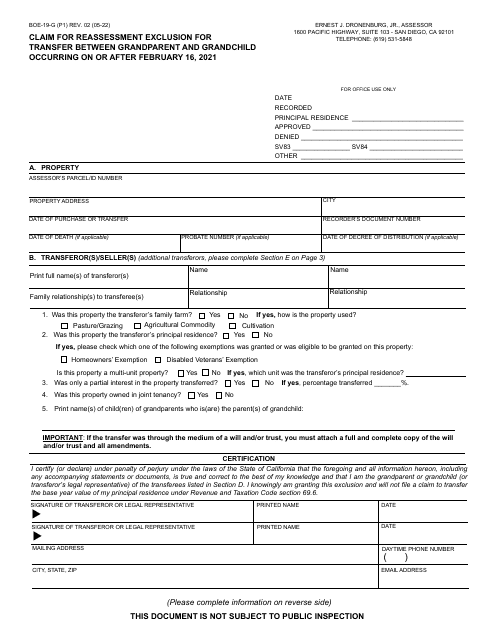

This form is used for claiming a reassessment exclusion for property transfers between a grandparent and grandchild in San Diego County, California. It allows for a potential exclusion from property tax reassessment.

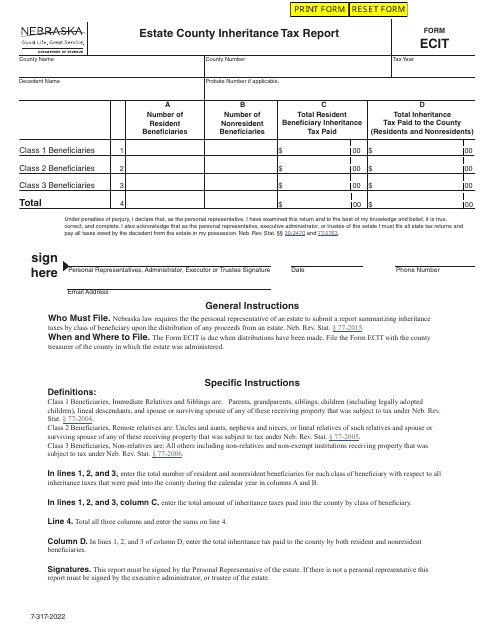

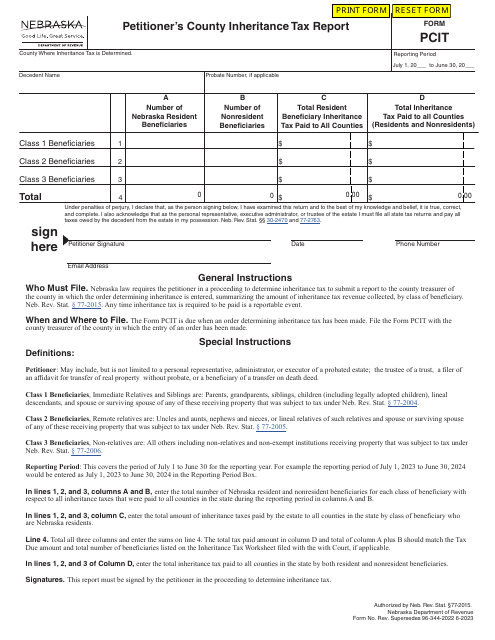

This form is used for reporting inheritance tax in Nebraska for estates in the county.

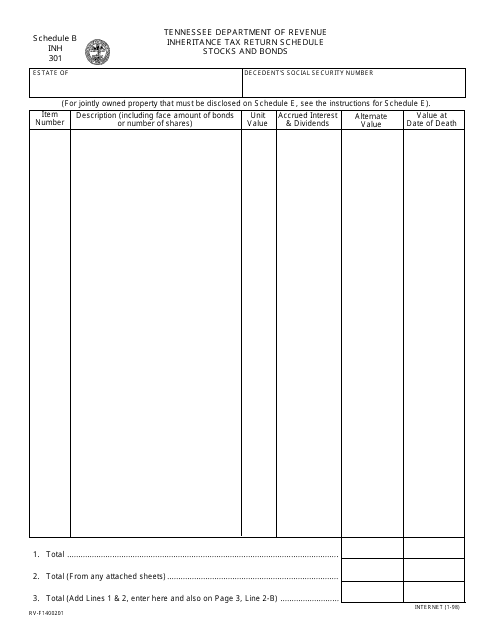

This form is used for reporting stocks and bonds on the Tennessee Inheritance Tax Return.

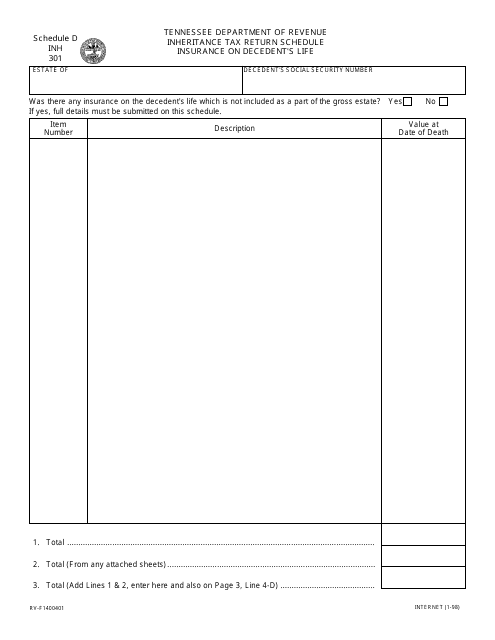

This form is used for filing the Schedule D Inheritance Tax Return for insurance on the decedent's life in Tennessee.

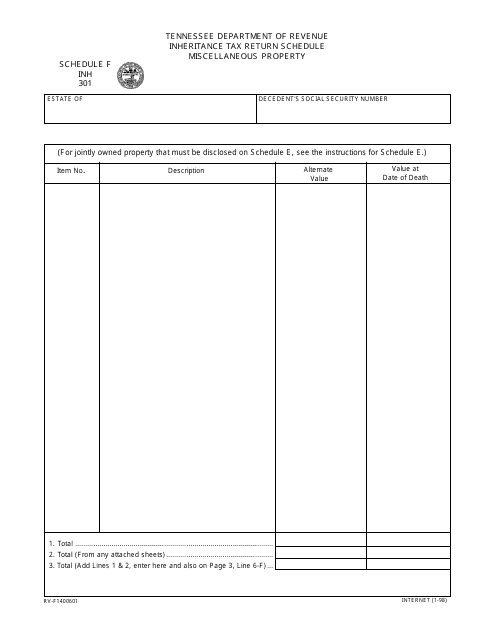

This Form is used for reporting miscellaneous property for inheritance tax purposes in Tennessee.

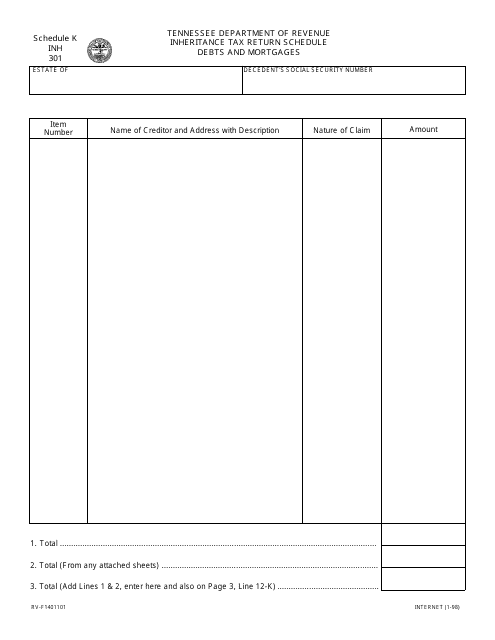

This document is used for reporting and calculating inheritance tax in Tennessee, specifically for listing debts and mortgages related to the inherited assets.