Business Retention Templates

Welcome to our Business Retention Documents webpage. This collection of documents is designed to assist businesses in retaining their operations, optimizing their performance, and ensuring their long-term success.

Our Business Retention Documents cover a wide range of topics related to business retention, including tax credits, relocation incentives, and strategies for improving business sustainability. These documents provide valuable information and resources that can help businesses navigate the complex landscape of regulations and requirements.

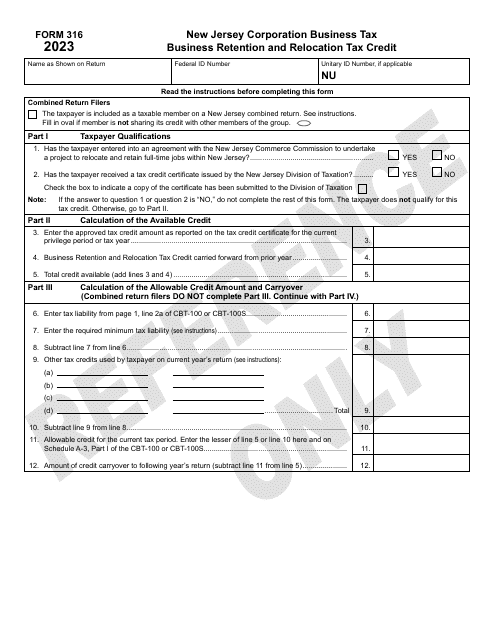

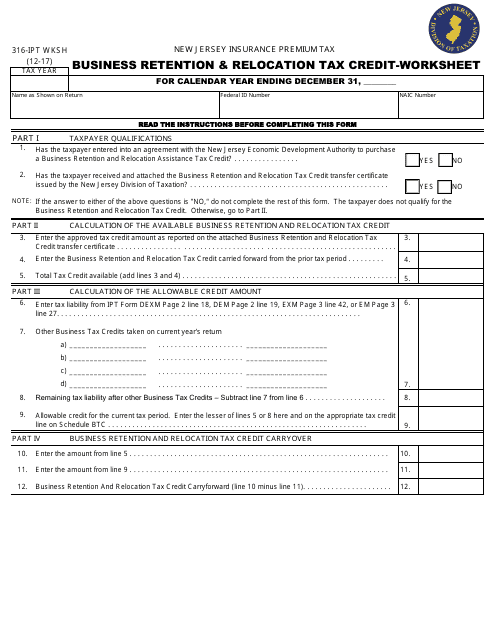

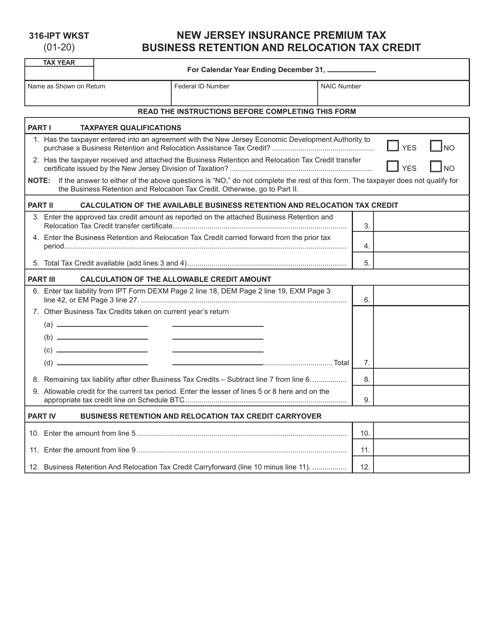

Whether you are a small local business or a large multinational corporation, our Business Retention Documents are here to support you. Our collection includes various forms and guides that can aid in the application process for tax credits and relocation assistance. These documents are tailored to meet the specific needs and requirements of different states and regions, such as the Form 316 Business Retention and Relocation Tax Credit in New Jersey.

By accessing our Business Retention Documents, businesses can gain a competitive edge by maximizing their financial incentives and taking advantage of opportunities for growth and expansion. Our resources can help businesses make informed decisions, mitigate risks, and identify strategies to increase their profitability and sustainability.

Browse through our collection of Business Retention Documents today and discover the valuable information that can benefit your business. Whether you are looking for tax credits, relocation assistance, or guidance on how to retain your business in a competitive market, our comprehensive resources are here to assist you.

Note: This text is a generic description of business retention documents. If you need more specific information to create the desired SEO text, please provide additional details.

Documents:

8

This form is used for calculating the Business Retention & Relocation Tax Credit in New Jersey.

This form is used for applying for the Business Retention and Relocation Tax Credit in the state of New Jersey.