Heirs at Law Templates

Are you in the process of settling an estate? Do you need legal documents that relate to the distribution of assets and property to the rightful beneficiaries? Look no further. Our collection of documents, also known as heirs at law or heir-at-law documents, provides all the necessary forms and instructions you need.

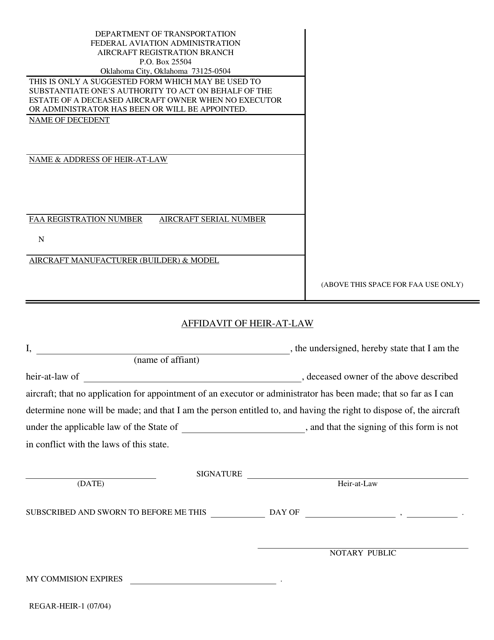

Whether you're a surviving spouse, legatee, or an heir at law, these documents cater to your specific needs. With forms such as the Notice to Surviving Spouse, Legatees, Heirs at Law, and Return of Notice and the Affidavit of Heir-At-Law, you have the tools to ensure a smooth estate settlement process.

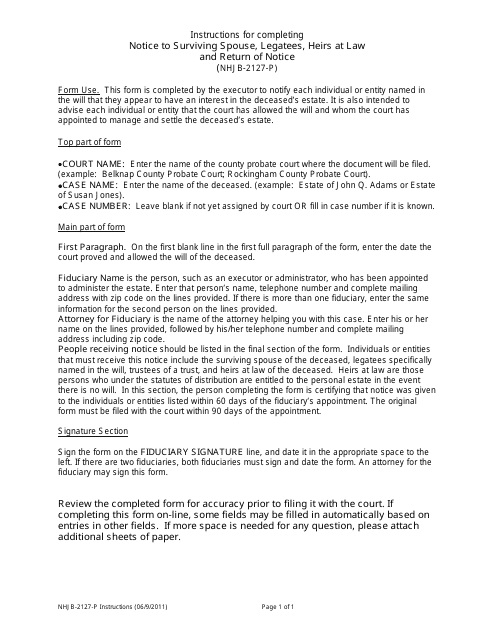

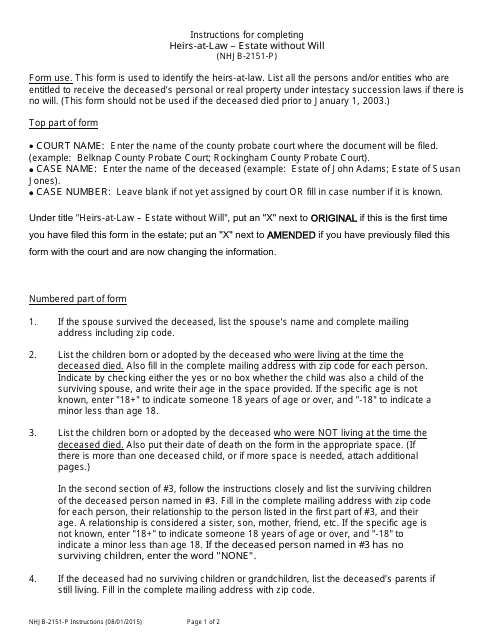

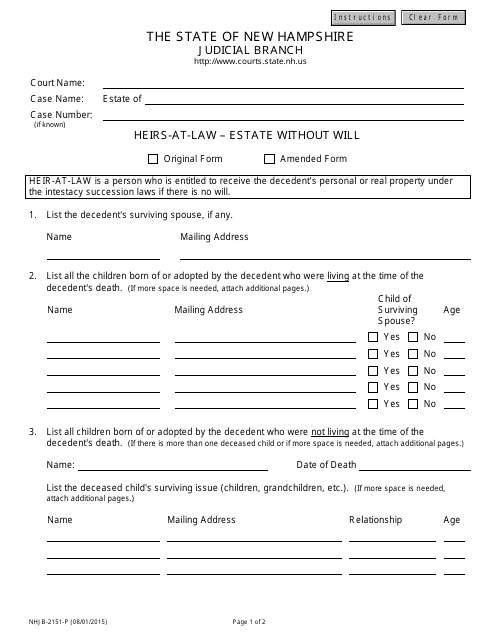

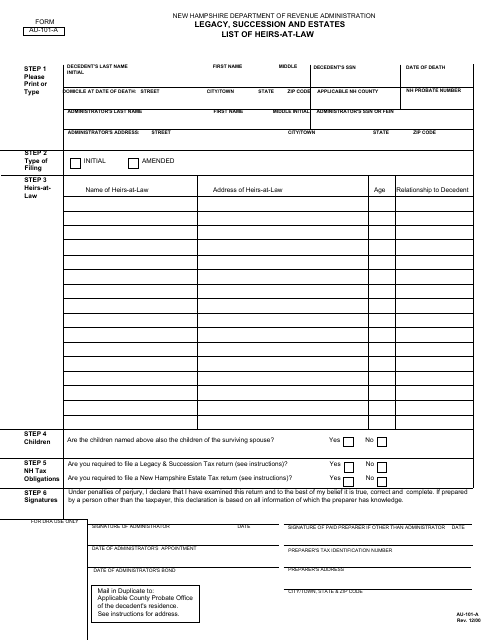

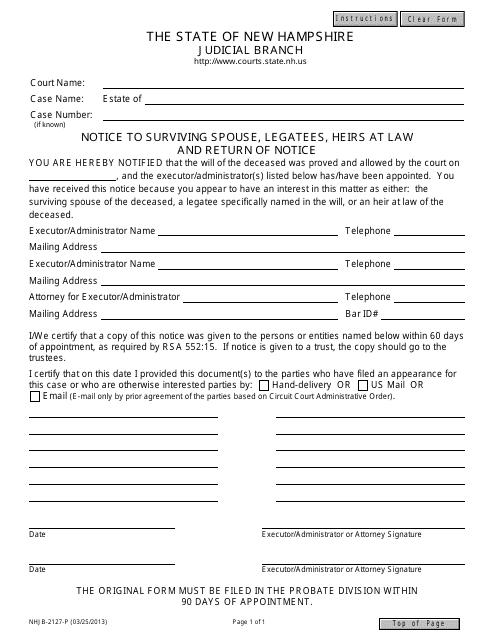

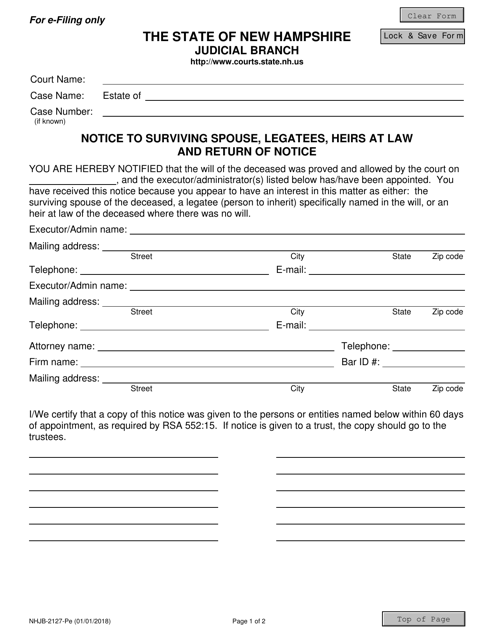

Our documents are tailored to the legal requirements of various regions, including New Hampshire. For example, the Form NHJB-2127-P is specifically designed for notifying surviving spouses, legatees, and heirs at law in New Hampshire. Similarly, the Form NHJB-2151-P caters to estates without a will, while the Form AU-101-A provides a comprehensive list of heirs-at-law in the state.

We understand that legal matters can be complex and overwhelming, which is why our documents are accompanied by detailed instructions. These instructions guide you through each step of the process, ensuring that you complete the forms accurately and efficiently.

Don't let the complexity of estate settlements deter you. Trust our heirs at law documents to simplify the process and provide the necessary legal framework for distributing assets and property. Whether you're a surviving spouse, a legatee, or an heir at law, our collection has everything you need to navigate the estate settlement process smoothly.

Note: We provide documents specifically designed for New Hampshire, but similar forms may be available for other regions as well. Please consult with a legal professional to ensure compliance with local regulations and requirements.

Documents:

7

This Form is used for providing notice to surviving spouse, legatees, and heirs at law, and for the return of notice in New Hampshire.

This form is used for providing instructions on how to complete Form NHJB-2151-P for heirs-at-law in the state of New Hampshire when dealing with an estate without a will.

This form is used for determining the heirs-at-law when there is no will in an estate in New Hampshire.

This form is used for creating a list of heirs-at-law in cases of legacy, succession, and estates in the state of New Hampshire.

This Form is used for providing notice to surviving spouse, legatees, and heirs at law about the probate proceedings in the state of New Hampshire. It also includes a return of notice for record-keeping purposes.

This form is used for notifying the surviving spouse, legatees, and heirs at law about the probate proceeding in New Hampshire. It also includes a return of notice section.

This form is used for declaring one's status as an heir-at-law in order to claim inheritance rights.