Tax Accounting Templates

Tax Accounting Services for Individuals and Businesses

Welcome to our comprehensive tax accounting services. Whether you're an individual looking for assistance with your personal taxes or a business in need of expert tax advice and accounting, we are here to help. With years of experience and a team of highly skilled professionals, we provide top-notch tax accounting services that ensure compliance with the ever-changing tax laws and regulations.

Our tax accounting services cover a wide range of needs, including:

-

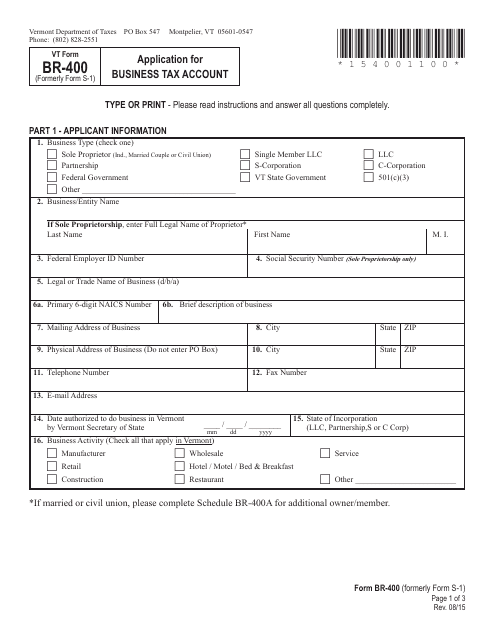

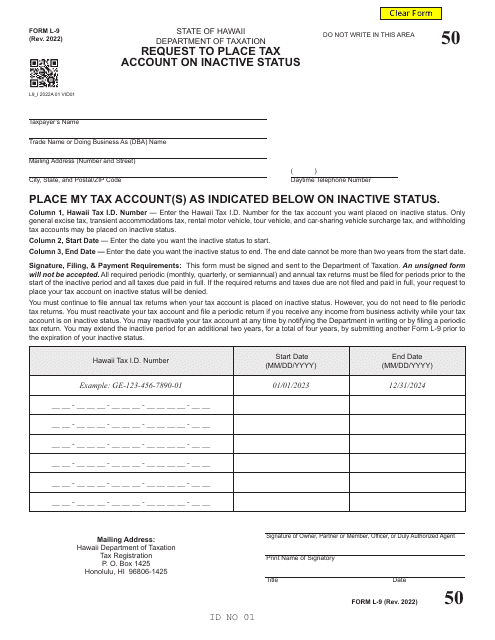

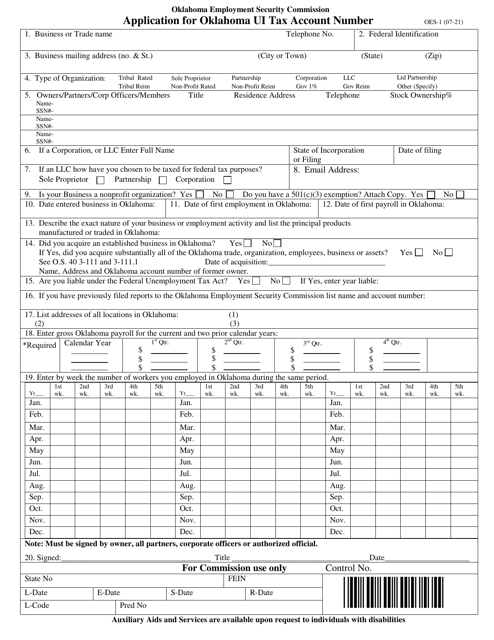

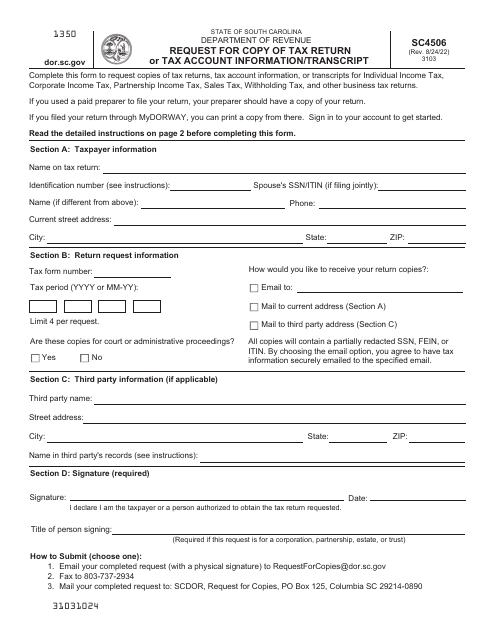

Tax Account Registration and Updates: We assist businesses with the registration process for tax accounts in various states across the country. Our team will ensure that all necessary forms and applications, such as the VT Form BR-400 Application for Business Tax Account in Vermont and the Form OES-1 Application for Oklahoma UI Tax Account Number, are completed accurately and submitted on time.

-

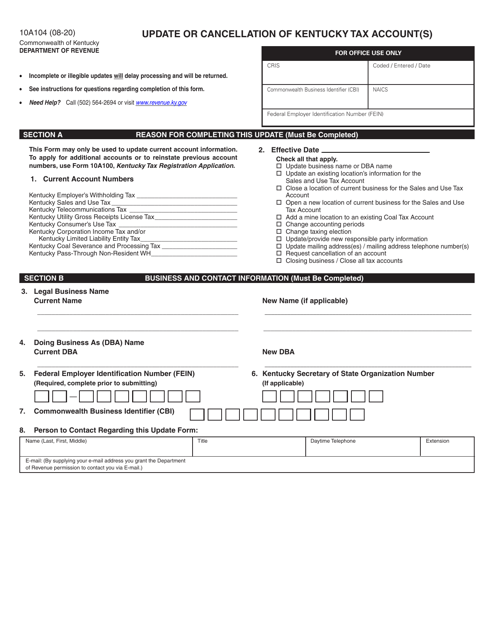

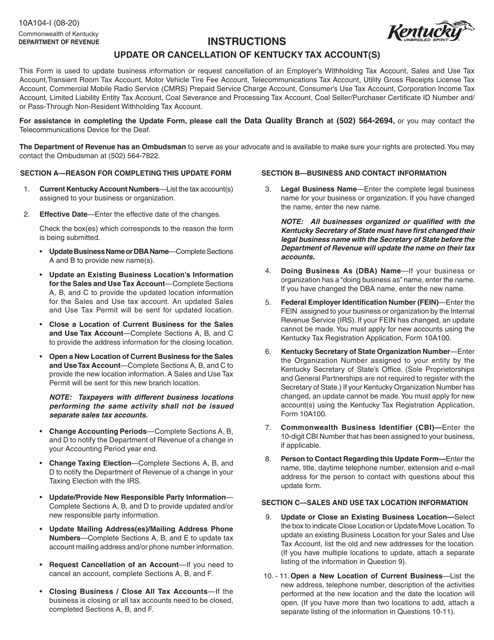

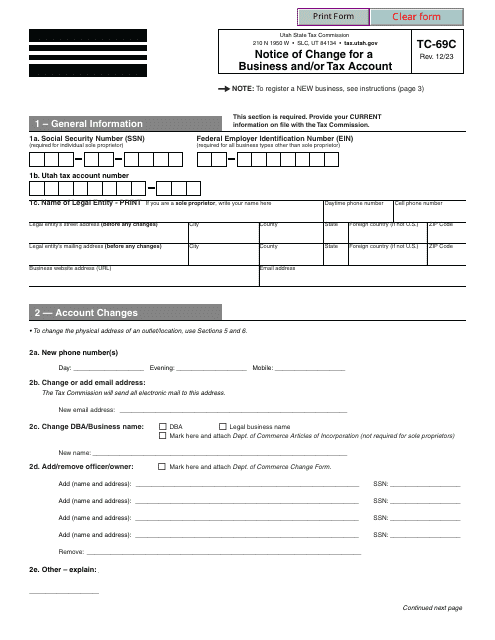

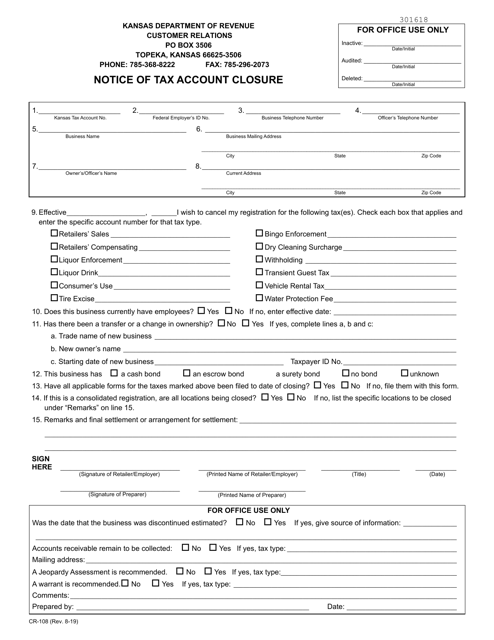

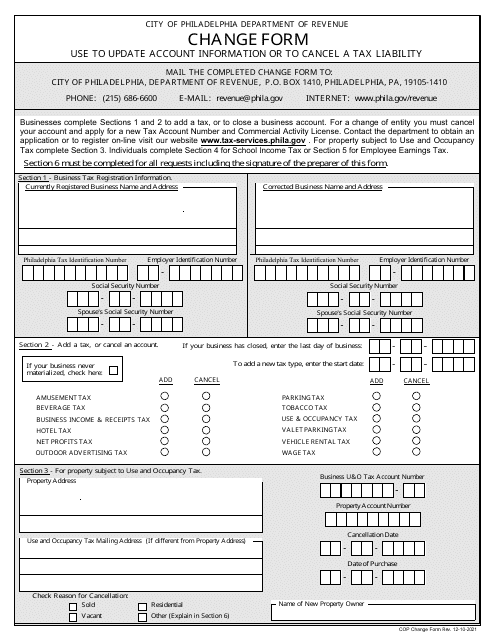

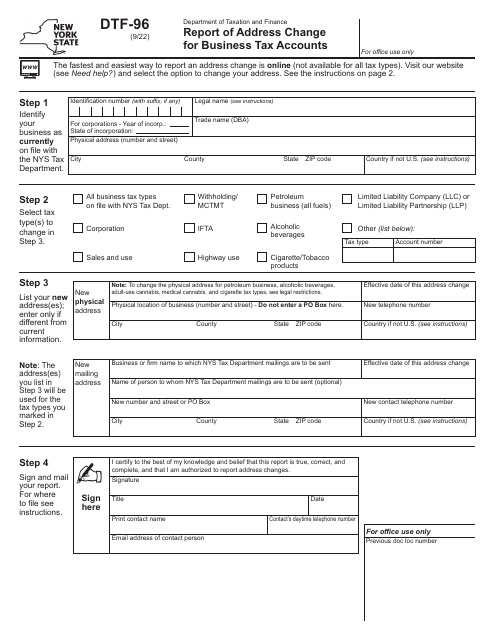

Tax Account Cancellation and Changes: If you need to cancel or make changes to your tax account, we can handle the process for you. We are well-versed in the specific requirements for updating or canceling tax accounts, as outlined in documents like the Instructions for Form 10A104 Update or Cancellation of Kentucky Tax Accounts in Kentucky and the Form TC-69C Notice of Change for a Business and/or Tax Account in Utah.

-

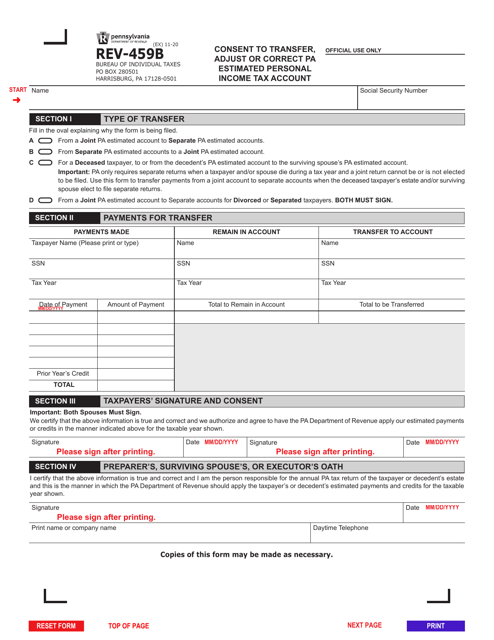

Personal Tax Accounting: Our tax experts are equipped to handle all aspects of individual tax accounting. We can assist you in preparing and filing your personal tax returns to ensure you take advantage of all available deductions and credits. Our goal is to maximize your refund or minimize your tax liability.

-

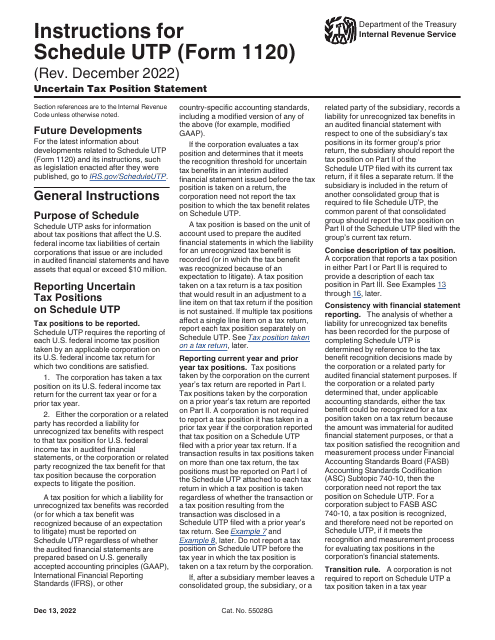

Business Tax Accounting: For businesses of all sizes, our tax accounting services are designed to streamline tax processes and optimize financial outcomes. We offer comprehensive tax planning, compliance, and consulting services to help you meet your tax obligations while making smart financial decisions for your organization's growth and success.

At Templateroller.com, we understand the complexities of tax accounting. Our team stays up-to-date with the latest tax laws and regulations to provide you with accurate and reliable services. Trust us to handle your tax accounting needs, allowing you to focus on what you do best – running your business or managing your personal finances.

Contact us today to learn more about how our tax accounting services can benefit you. Let us take the stress out of tax compliance and help you achieve your financial goals with ease.

Documents:

27

This Form is used to apply for a business tax account in Vermont.

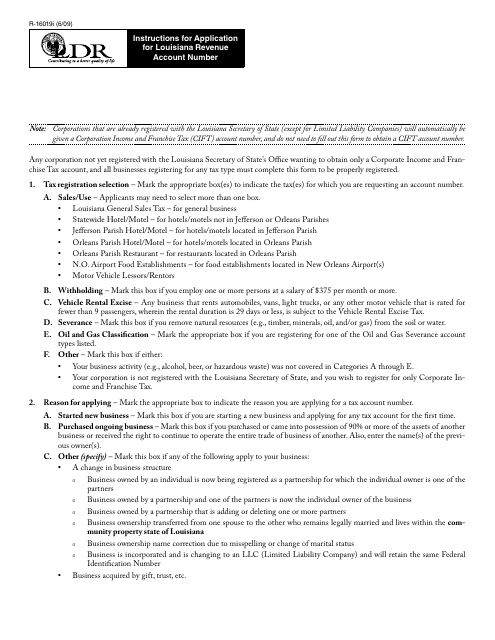

This document is used for applying for a Louisiana Revenue Account Number in Louisiana. It provides instructions on filling out Form R-16019.

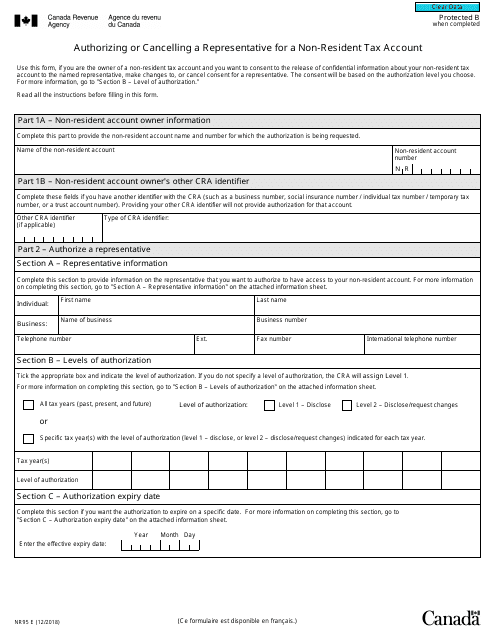

This form is used for authorizing or cancelling a representative for a non-resident tax account in Canada.

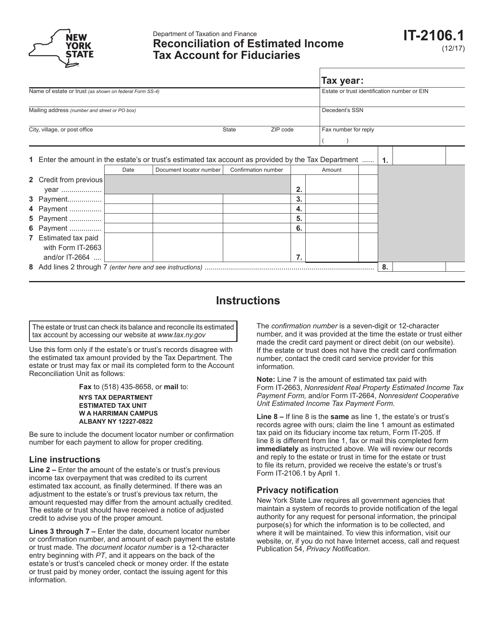

This form is used for reconciling the estimated income tax account for fiduciaries in the state of New York.

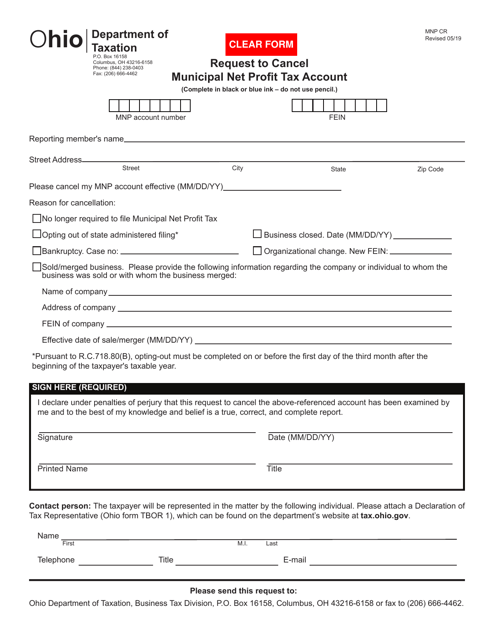

This form is used for requesting the cancellation of a Municipal Net Profit Tax Account in Ohio.

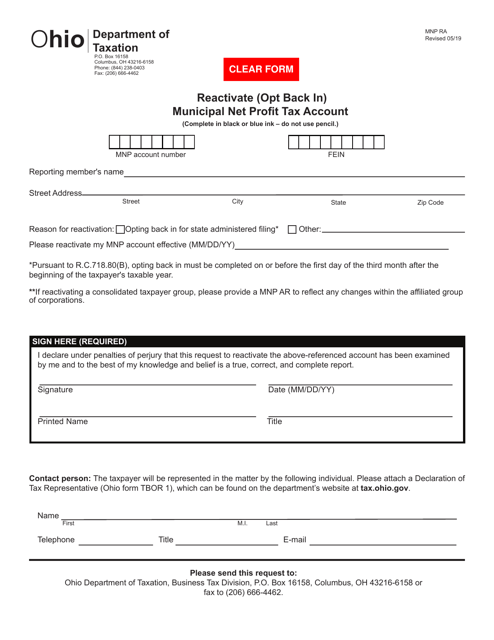

This form is used to reactivate a municipal net profit tax account in Ohio for those who have opted out and now wish to opt back in.

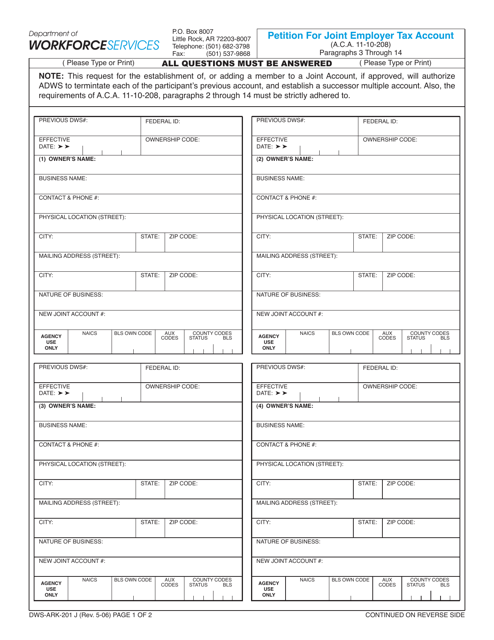

This Form is used for filing a petition to request a joint employer tax account in the state of Arkansas.

This Form is used for applying for an Oklahoma UI Tax Account Number in Oklahoma.

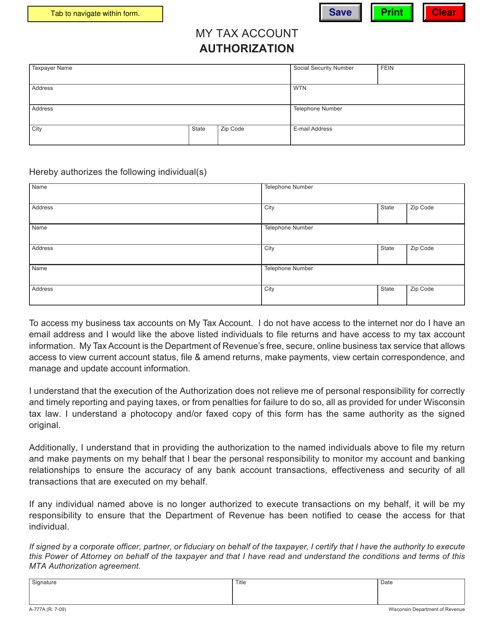

This form is used for authorizing someone to access and manage your tax account in the state of Wisconsin.

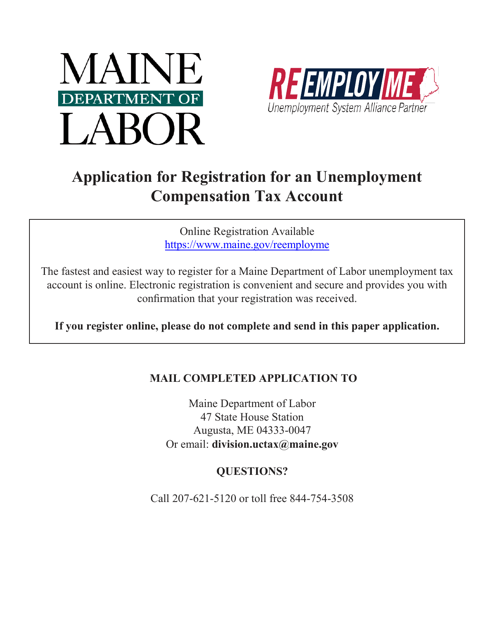

This form is used for registering a tax account for unemployment compensation in the state of Maine.

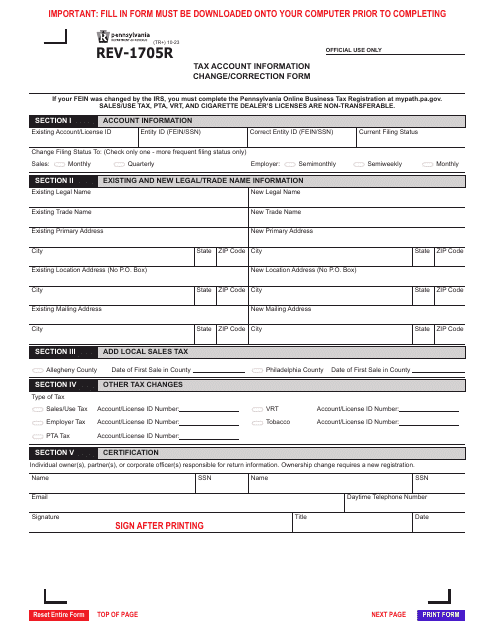

This form is used for changing tax account information with the City of Philadelphia, Pennsylvania.

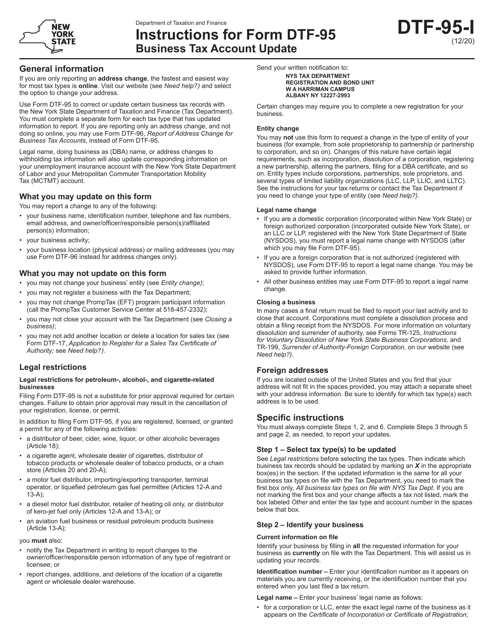

This form is used by businesses in New York to notify the Department of Taxation and Finance about changes in their physical or mailing address. It aids businesses to ensure their tax information is accurately updated.