Imputed Underpayment Templates

Are you facing imputed underpayment tax issues? Our website is your one-stop resource for all information related to imputed underpayment, also known as imputed underpayments. Imputed underpayment refers to the amount of tax that is calculated by the Internal Revenue Service (IRS) for partnerships and certain other entities.

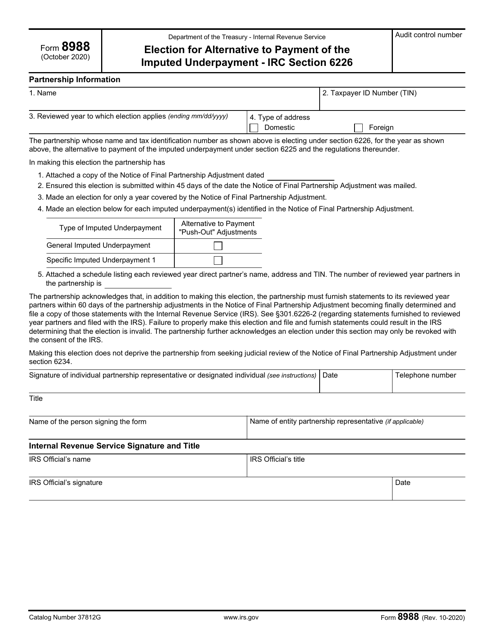

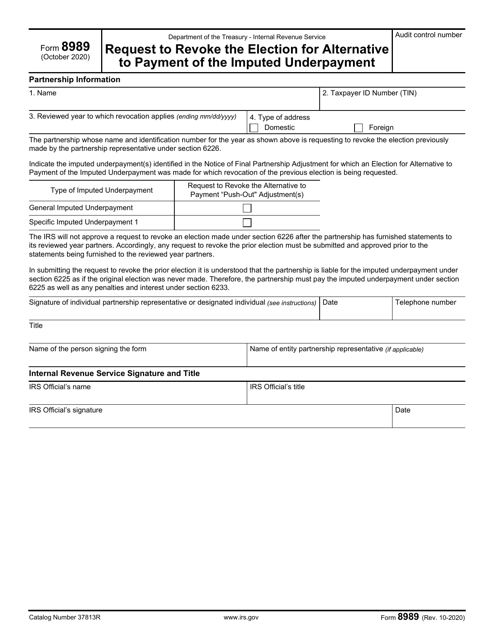

Understanding and navigating the complexities of imputed underpayments can be challenging, but our website is designed to provide you with comprehensive guidance. Whether you need information on IRS Form 8988 Election for Alternative to Payment of the Imputed Underpayment or IRS Form 8989 Request to Revoke the Election, we have you covered.

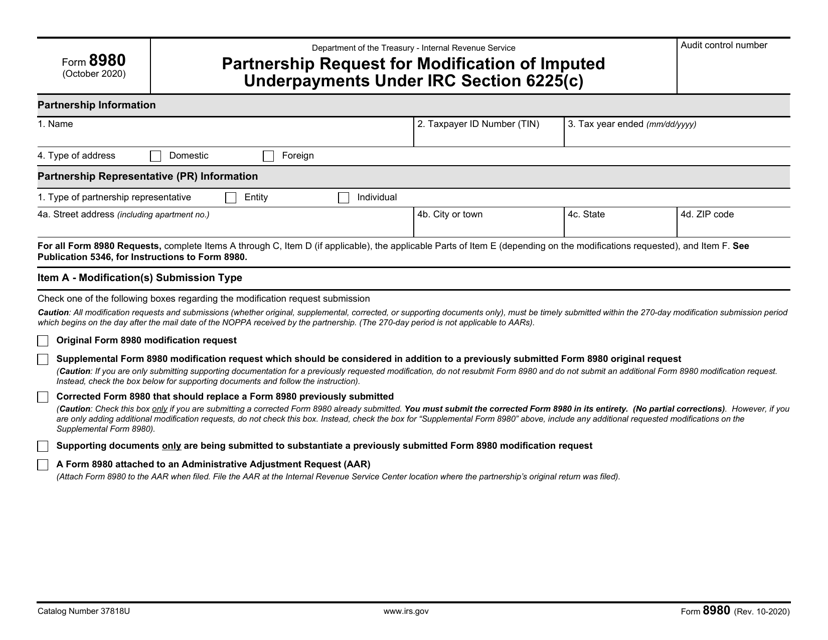

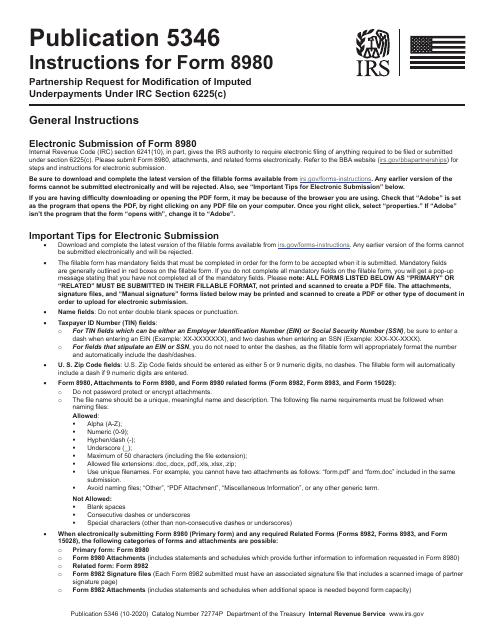

We also offer valuable insights into IRS Form 8980 Partnership Request for Modification of Imputed Underpayments Under IRC Section 6225(C). Our easy-to-understand instructions for IRS Form 8980 will help you request modifications to the imputed underpayment calculations for your partnership.

Imputed underpayments can have significant financial implications and can be a source of stress for individuals and businesses alike. That's why we have compiled a wealth of resources to assist you in navigating this complex tax topic. From explanations of the imputed underpayment calculation process to tips for maximizing your tax savings, our website is a valuable tool for anyone dealing with imputed underpayments.

Whether you're researching imputed underpayments for personal knowledge or seeking specific guidance for your tax situation, our website will provide you with the information you need. Trust our expertise and dedication to keeping you informed and empowered in dealing with imputed underpayments.

Documents:

7

This form is used for partnership to request modification of imputed underpayments under IRC Section 6225(C).