Tire Fee Templates

Are you looking for information on tire fees? Look no further! Tire fees, also known as tire disposal fees or tire tax, are charges imposed on the sale or disposal of tires in certain jurisdictions. These fees are intended to promote responsible tire management, including recycling and proper disposal, to protect the environment and public health.

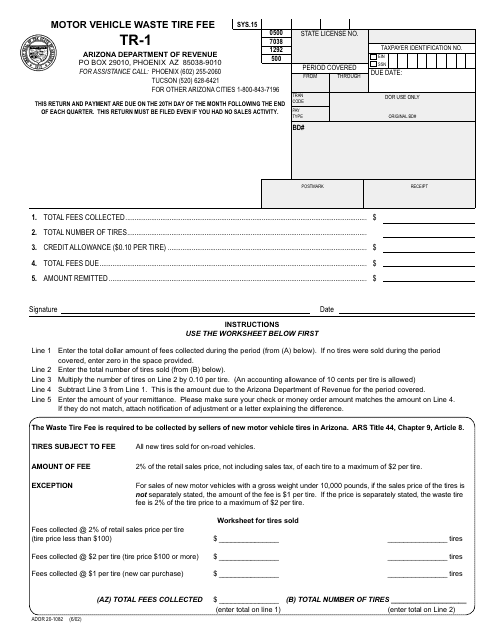

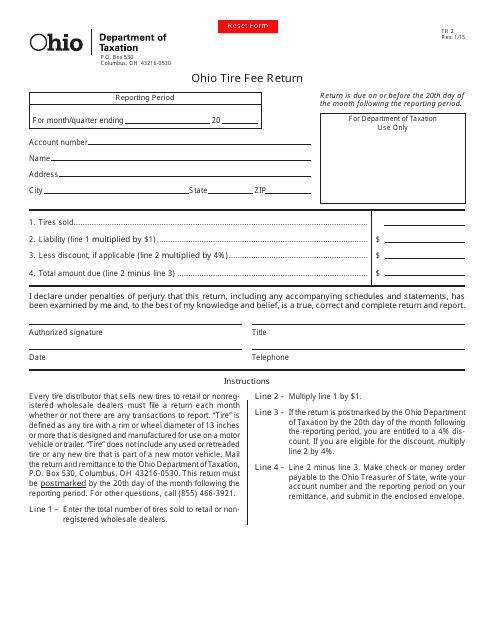

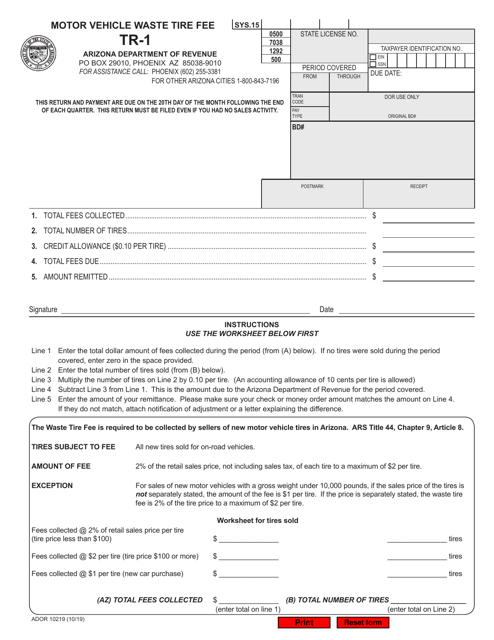

If you live in Arizona, you may be familiar with Form ADOR20-1082 (TR-1) Motor VehicleWaste Tire Fee. This form is used to report and remit the tire fee collected from the sale of motor vehicle tires in Arizona. Similarly, Ohio has Form TR2 Ohio Tire Fee Return, which serves the same purpose for tire retailers in Ohio.

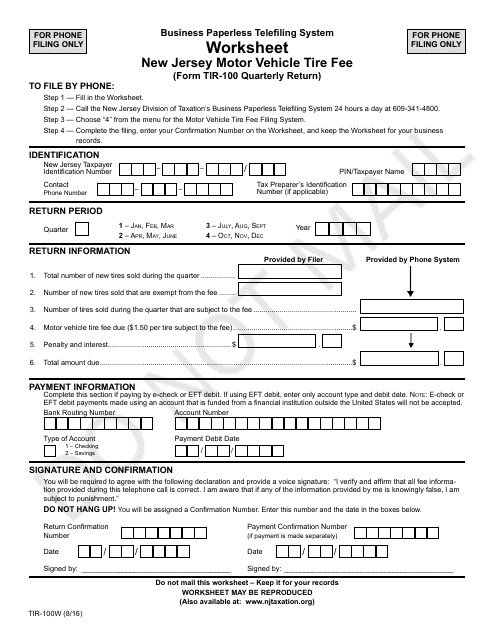

In New Jersey, the tire fee is calculated using Form TIR-100W New Jersey Motor Vehicle Tire Fee Worksheet. This worksheet helps businesses determine the amount of tire fee due based on the number of tires sold or imported into the state.

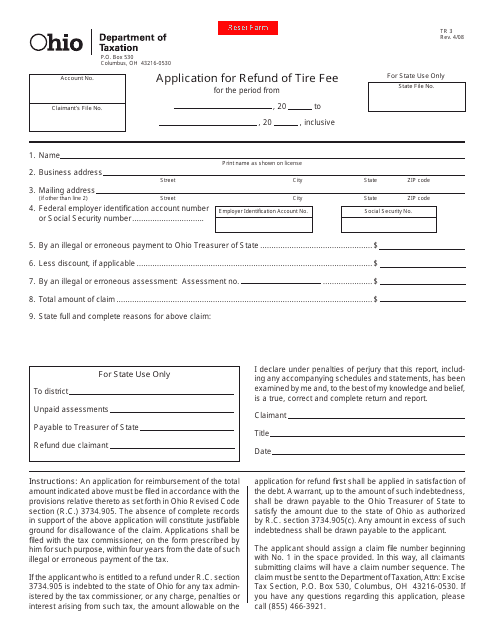

Sometimes, you may find yourself eligible for a refund on tire fees. In Ohio, for instance, you can apply for a refund using Form TR3 Application for Refund of Tire Fee. This form allows individuals or businesses to request a refund for any tire fee overpaid or for tires that were exported out of the state.

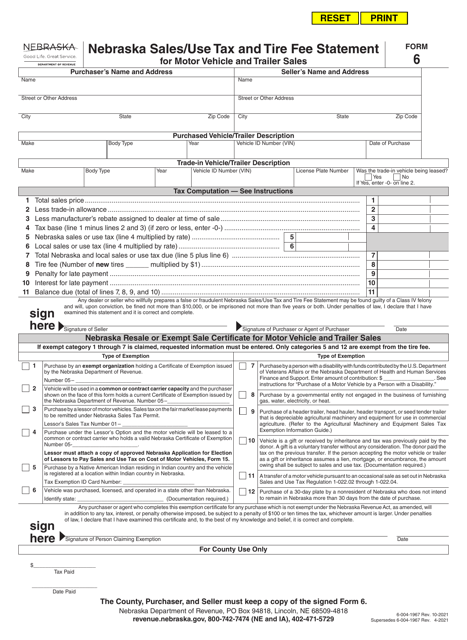

For businesses in Nebraska involved in motor vehicle and trailer sales, it is crucial to file Form 6 Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales. This form helps businesses report their sales, use tax, and tire fees accurately.

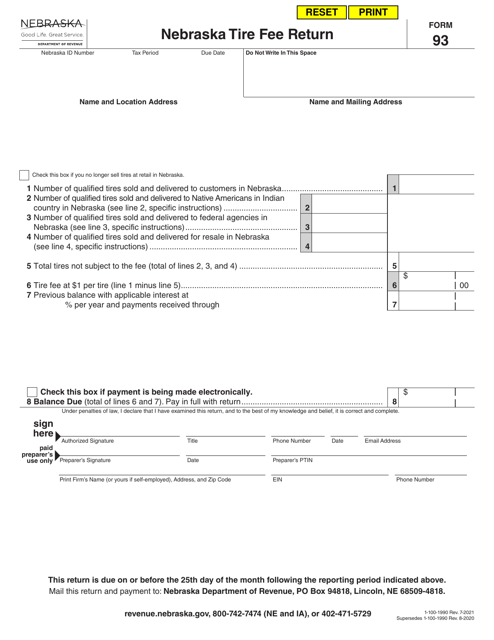

Understanding and complying with tire fees can be complex. It is important to have the necessary knowledge and resources to meet your obligations. Whether you're a tire retailer, a consumer, or an environmental advocate, staying informed about tire fees is essential. We provide information and resources on tire fees in various regions, so you can stay up to date with the latest regulations and requirements.

Please note that the specific forms mentioned above are just a few examples, and tire fee regulations may vary by jurisdiction. It is always recommended to consult the relevant authorities or seek professional advice for accurate and up-to-date information regarding tire fees in your area.

Documents:

13

This form is used for reporting and paying the Motor Vehicle Waste Tire Fee in Arizona. It helps businesses and individuals comply with state regulations and contribute to tire recycling efforts.

This Form is used for reporting and paying the New Jersey Motor Vehicle Tire Fee, which is required for anyone selling new tires in the state of New Jersey.

This Form is used for submitting the Ohio Tire Fee Return in Ohio. The Ohio Tire Fee is a tax imposed on the sale of new tires in the state.

This Form is used for calculating the motor vehicle tire fee in New Jersey. It serves as a worksheet to help individuals determine the appropriate fee based on the number of tires they are purchasing.

This form is used for applying for a refund of the tire fee in Ohio.

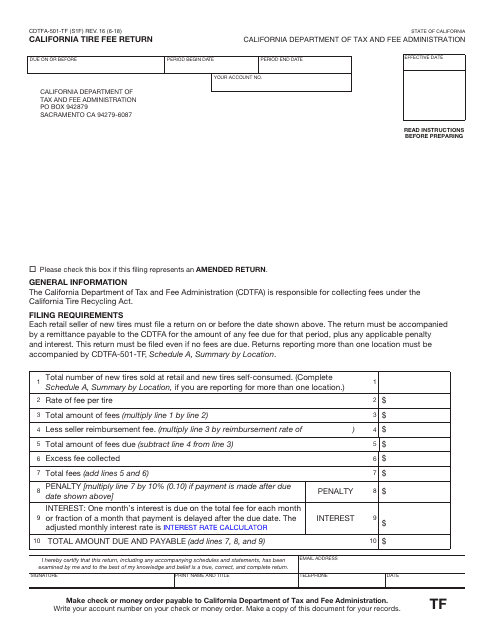

This form is used for submitting the California Tire Fee Return to the California Department of Tax and Fee Administration. It is required for businesses that sell or manufacture tires in California to report and remit the tire fees collected from customers.

This form is used for reporting and calculating the tire recycling fee owed by businesses or individuals in the state of Oklahoma.

This Form is used for the Motor Vehicle Waste Tire Fee in Arizona.