Itemized Statement Templates

An itemized statement, also known as an itemized statement of compensation or an itemized statement of earnings, is a detailed document that provides a breakdown of various components related to finances, earnings, or expenses. These statements are typically used for reporting purposes, tax filings, or to provide a transparent account of financial transactions. They play a crucial role in various fields such as tax compliance, worker's compensation, and labor regulations.

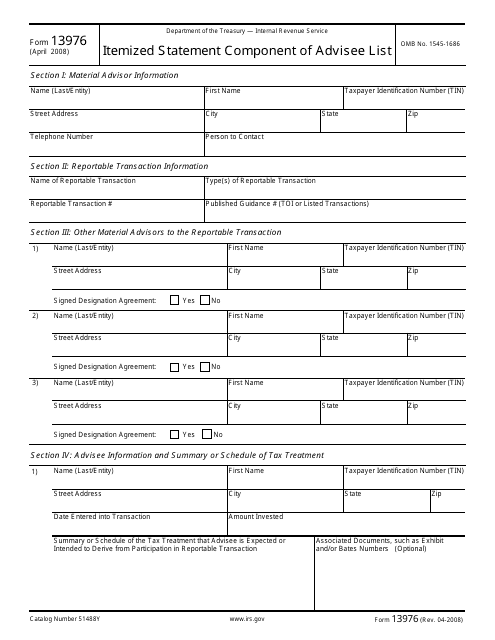

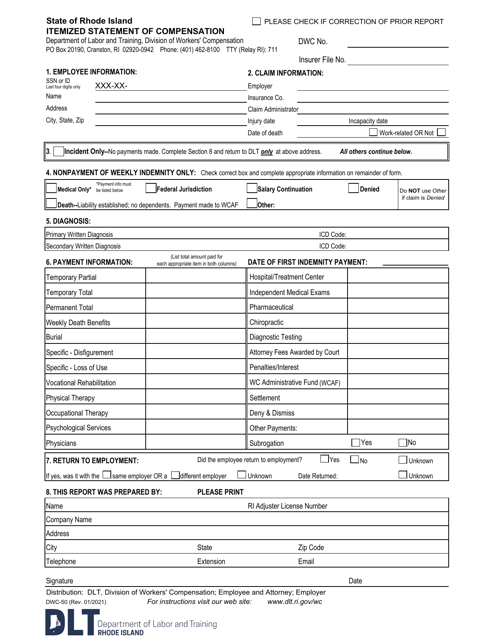

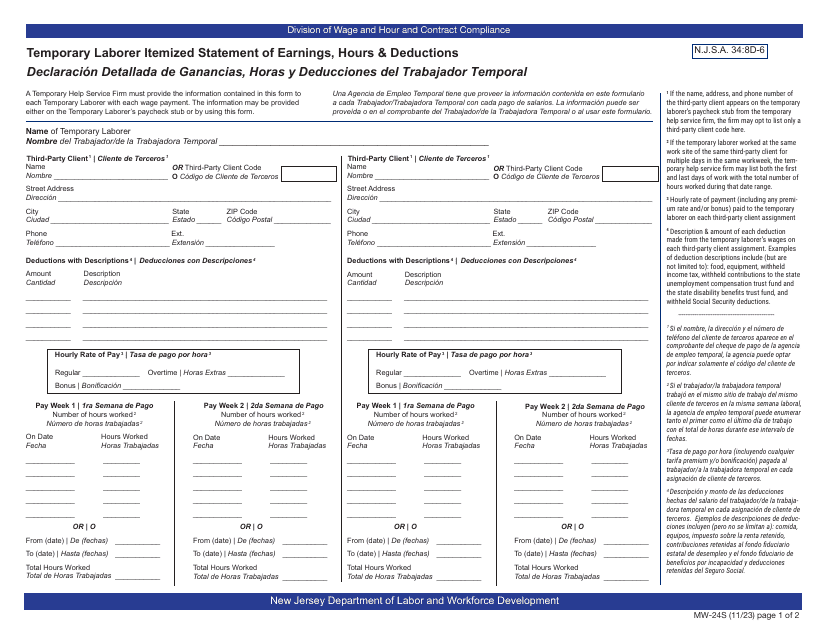

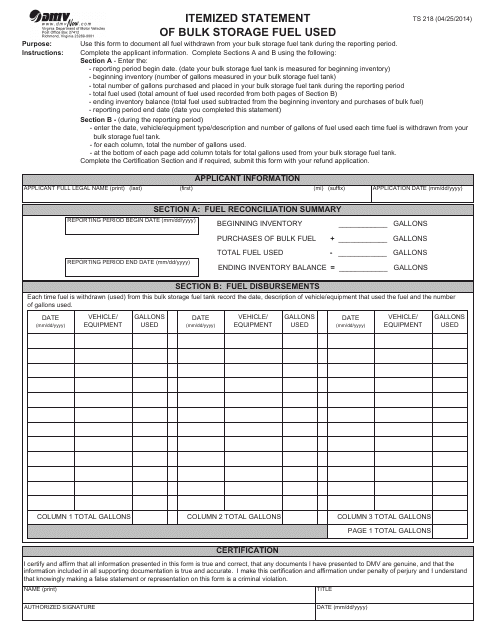

Whether it's the IRS Form 13976 Itemized Statement Component of Advisee List or Form DWC-50 Itemized Statement of Compensation in Rhode Island, these documents are designed to ensure accuracy, accountability, and compliance. The Form MW-24S Temporary Laborer Itemized Statement of Earnings, Hours & Deductions in New Jersey (English/Spanish) and the Form TS218 Itemized Statement of Bulk StorageFuel Use in Virginia are other examples of itemized statements that serve specific purposes within their respective jurisdictions.

Itemized statements serve as a valuable tool for individuals, businesses, and organizations to maintain financial records, track income and expenses, and adhere to legal obligations. By providing a comprehensive breakdown of financial details, these statements help streamline financial processes, facilitate audits, and ensure transparency and compliance.

If you or your organization requires an itemized statement for tax purposes, financial reporting, or any other regulatory obligations, ensure accuracy and compliance by utilizing the appropriate form or template specifically designed for your jurisdiction and requirements.

Documents:

5